Our Lecturers and Guarantee

by Property Planning | Oct 17, 2017 | Property Planning Australia

Our Guarantee The Property Planning Australia Education courses do not receive any commissions or fees from any real estate business, financial institute or property developers, and it does not sell any products or services other than education. We maintain our...

Course Dates and Enrolment

by Property Planning | Oct 17, 2017 | Property Planning Australia

Course Dates Location Melbourne Saturday 21st & Sunday 22nd May 2016 Please contact us on 03 9819 4088 or Click here to enrol or enquire about availability and price Sydney Dates to be confirmed for second half of the year Please contact us on 02 9017 2332...

Fundamental Property Investment Course

by Property Planning | Oct 17, 2017 | Property Planning Australia

Our education courses are designed to provide you with the independent knowledge from experienced lecturers that you need to make your property investment decisions. Course Content. Course Structure. Independence of lecturers. No selling of any kind. Breadth of...

Industry Leaders

by Property Planning | Oct 17, 2017 | Property Planning Australia

We're among the industry's best! Over the years Property Planning Australia have received regular recognition and awards from the industry's peak body the MFAA and various leading financial media. This reflects our approach to providing genuinely tailored advice based...

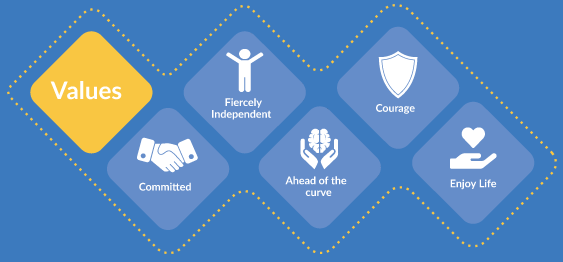

Why We Are Unique

by Property Planning | Oct 17, 2017 | Property Planning Australia

Property Planning Australia is a young, dynamic and progressive company that is evolving with both our client’s needs and the rapidly changing market place we work in. We do not believe a property investment is better than share market investment or visa versa. We...

Who is Property Planning Australia?

by Property Planning | Oct 17, 2017 | Property Planning Australia

Property Planning Australia is an independently owned and operated financial services company with a focus on independent property advice and genuine fee for service investment advice. We are a group of professional and experienced advisors who have a vision to change...

Property Investment Course

by Property Planning | Oct 17, 2017 | Property Planning Australia

University Endorsed Property Education Education is a key to making informed decisions and ultimately investment success. That's why Property Planning Australia has created Australia's only university endorsed property investment course. Property Planning Australia...

Commercial Loans and Leasing

by Property Planning | Oct 17, 2017 | Property Planning Australia

Property Planning Australia's strategic approach and personalised service don't stop at home loans. We can also assist you with: business and commercial loans car loans personal loans business equipment leasing No matter how complex your situation and requirements, we...

Credit Problems?

by Property Planning | Oct 17, 2017 | Property Planning Australia

We'll find a specialised loan solution In a perfect world, all borrowers would be created equal - but who said the world was perfect?! Not everyone has a steady income and a sound credit history - but that doesn't mean you should miss out on obtaining a home loan. If...

Self-Employed

by Property Planning | Oct 17, 2017 | Property Planning Australia

We'll find a specialised loan solution When you’re self employed, it can be frustrating trying to find a lender who truly understands your financial situation. With access to more than 30 lenders ranging from boutique providers to the Big Four banks, Property Planning...