Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

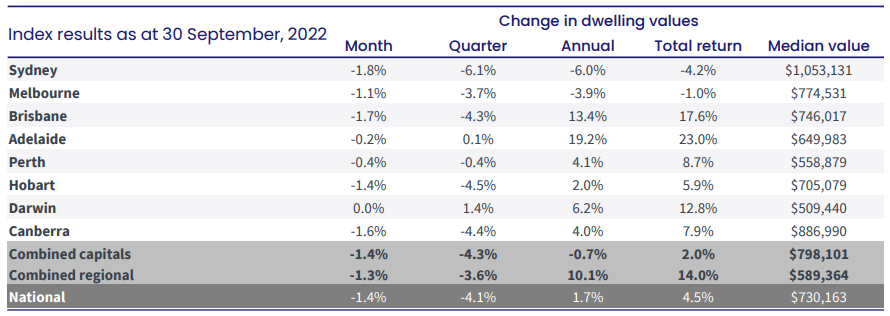

1 Property market falls decelerate over September

For the first month, the rate of price decline has decelerated, which may be an early sign that the market has passed through the worst of monthly falls. Other early indicators are auction clearance rates picking up and stock levels remaining low. With the RBA putting the breaks on rate increases, the trio discuss what’s likely on the horizon.

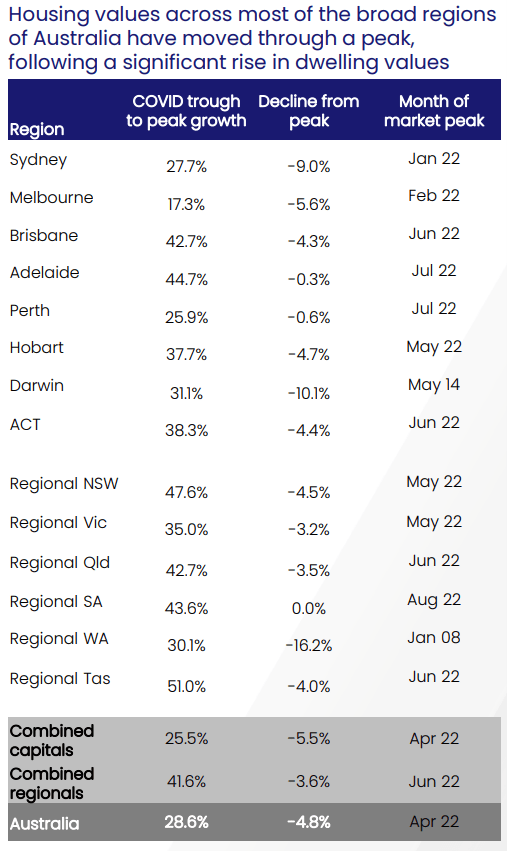

2. Peak to trough decline

The current peak to trough decline nationally sits at -4.8% since the peak of April 2022. The trio discuss the peak to trough falls for the capital cities and state regions. Note that regional WA is still below it’s peak 14 years ago, a good reminder to be sceptical of property spruikers and do your research prior to entering any investment decisions.

3 Brisbane land tax has been repealed, but has the damage already been done?

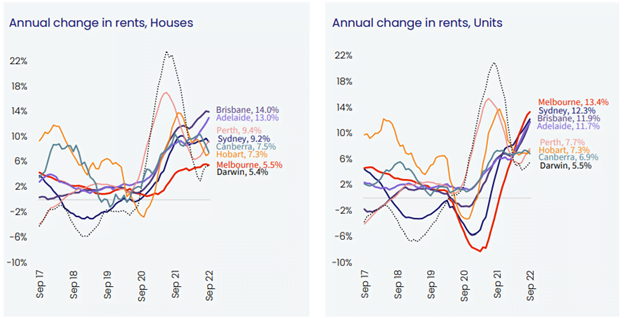

Rents for houses in Brisbane are up 14% over the year and vacancy rates are sitting at a low of 0.7%. On a positive move, the land tax proposal was scrapped, (thanks to our friends at PIPA, PICA and REIQ). However, Brisbane has already sustained some pain, with many investors selling up or in the throws of doing so.

Comments from CoreLogic:

- The national rental index increased by 0.6% in September, the lowest monthly rise in rents since December 2021.

- At the national level, rental growth moved through a peak in May 2022 with a 1.0% rise; since that time, the monthly pace of rental growth has been easing.

- The slowdown in rental growth is a little surprising given rental vacancy rates remain so low and overseas migration is ramping up, although there has been a subtle uptick in vacancy rates across some regions.

- Since the onset of COVID, capital city rents have risen 16.5% and regional rents are up 25.1%.

- It’s likely renters will be progressively seeking rental options across the medium to high density sector, where renting is cheaper, or maximising the number of people in the tenancy in an effort to spread higher rental costs across a larger household,”

4 Where is the big picture on housing?

The trio discuss government and regulator decisions that have made it harder for landlords and investors. Without the big picture of understanding and deciding what is an appropriate mix of ownership between owner occupiers and investors, and how many investors should be private investors, the approach to housing reform is like throwing darts blindfolded. In positive news, the rate of increase in rents was the lowest it’s been in 10 months, which signals that rental growth is tapering.

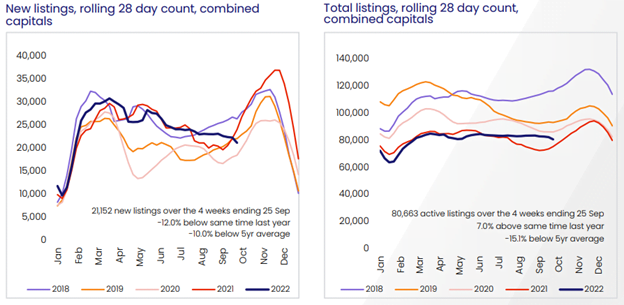

5 Listings languish

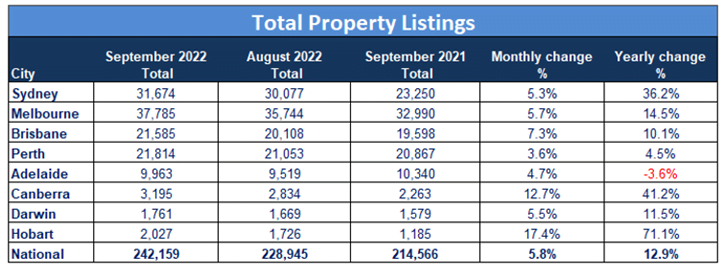

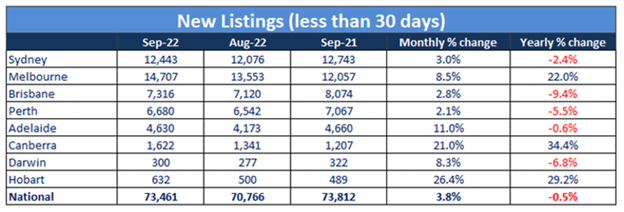

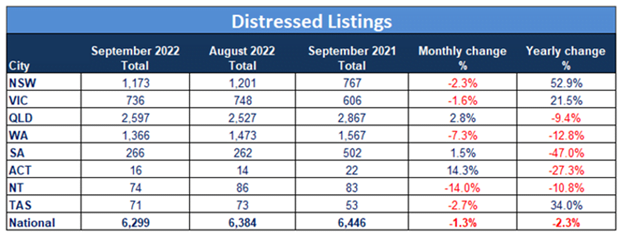

Spring is typically the time of the year that an increase in stock occurs, but the level of listings has actually dropped and is close to the 5 year average. With interest rates on the rise and prices declining, vendors are holding off thinking that now is not a good time to sell. Hobart and Canberra are bucking the trend, with listings at 71% and 41% higher than this time last year. The trio discuss what this means for value growth and dive into distressed listings.

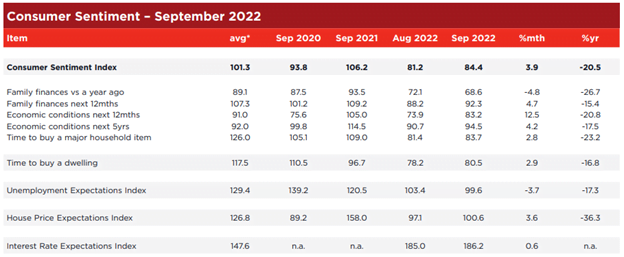

6 House price expectations turns around

In an interesting turn of events, the house price expectations index has ticked over 100, after dropping below 100 for the first time since September 2020 last month. Victoria and Western Australia are most positive, with readings of 108 and 106 respectively. This should improve further due to the RBA slowing down cash rate rises and is another positive green shoot in the month of September.

7 Investors continue to bow out while first home buyers jump in

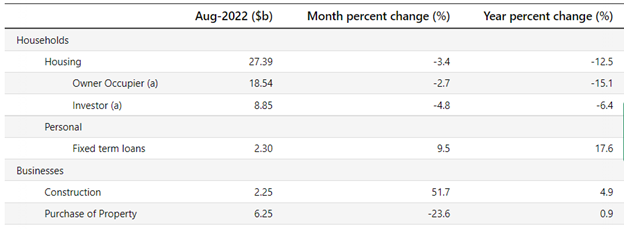

Over the month of August, investor lending fell by 4.8%, while owner occupiers remained resilient. First home buyers increased by 7%. Personal loans also increased by 9.5%, which is a concern that people are funding something that they don’t have the money for. David shares what bond markets are saying about where the cash rate is likely to end up too.

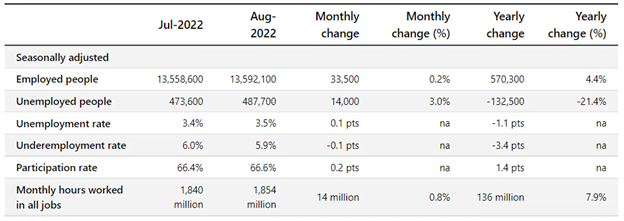

8 Unemployment remains steady

The trio discuss the unemployment rate and what is on the horizon with new migrants and the scrapping of mandatory isolation for Covid-19.

Gold Nuggets

David Johnston – The Property Planner’s Golden nugget: I’ve made suggestions to our listeners that the back end of this year will be the best time to buy, the signals that we’re getting from the market is continuing to suggest that. Early movers and bargain hunters are likely to be jumping back into the market, we’ve seen resilience in clearance rates, rate of deceleration reducing, green shoots in sentiment that suggests that the back end of this year will be the best time to buy.

Cate Bakos – The Property Buyer’s Golden nugget: land tax is a different tax to the other ones we experience. If you are buying someone else’s investment property, you may have a portion of land tax that you need to pay out, which is paid by the calendar year. So if you purchase in December, there will be no land tax bill, but there may be if you purchase in January.

Resources

- 12 Reasons why now is the best time in history to refinance!

- All things property tax – how to understand your deductions at tax time (Ep.55)

- Bad credit behaviour – what doesit mean andhow can it be solved before it’s too late? (Ep.65)

- Setting yourself up to purchase with confidence and why getting your pre-approval in place is more critical than ever (Ep. 78)

- Optimising tax deductions – Top mortgage and loan strategy tips (Ep.87)

- Understanding my land tax (Ep.108)

- How to increase your borrowing power – Learn how investors, first home buyers and upgraders increase capacity (Ep.116)

- How much can I borrow? How borrowing capacity can be impacted, massaged and manipulated (without breaking the rules of course!) (Ep.115)

- Why your Mortgage Strategy is more important than your interest rate! (Ep. 9)

- Five mortgage strategies that can grow your wealth

- Mortgage Strategy 101 – Ep 5. Risk Management

- Why your approach and assessment of risk is paramount to property success! (Ep.10)

- Mortgage Strategy 101 – Ep 4. Optimise Investment Deductions

- Mortgage Strategy 101 – Ep 9. – Maximising your tax deductions by using a redraw facility

- Optimising tax deductions – top mortgage and loan strategy tips

- Mortgage Strategy 101 – Ep 6. Offset Optimisation

- No mortgage strategy – #4 of the top 7 Critical Mistakes (Ep.34)

- All things property tax – how to understand your deductions at tax time (Ep.44)

- Why you need to plan for your future home when buying an investment property

- How to turn your first home into an investment property when upgrading

- How to avert mistakes if you want to rent out your former home

- Why short-term investing has long-term consequences

- Diversification 101 – How and why to plan for diversification within your property portfolio (Ep.43)

- How will your mortgages serve you in the long run?

- Mortgage Strategy 101 – Ep 12. How to keep property as you accumulate!

- Mortgage Strategy 101 – Ep 8. How to keep a stepping stone home when you upgrade

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.