Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

- Land tax basics. Land tax is an annual cost that is determined on the total value of the land you own, (with the exception of a principle place of residence). Unlike Capital Gains Tax, Land Tax is a state tax, with differing thresholds, tiers, rates and methods of calculation between each state. Another layer of complexity are the differing rates and thresholds for owning property in trusts or in a company. As you acquire property, you need to be mindful of your ever-growing land tax bill, and this is often not factored into cash flow costs when people make property decisions. The trio also discuss and explain how land values are calculated for tax purposes.

- Tax on unimproved value. Each year the Valuer-General evaluates the ‘unimproved value’ of the property, meaning the land portion without the dwelling. Funnily enough, the only time you want a conservative estimate of value is on your land tax bill and council rates notice. If you disagree with an estimate, you normally have 30 to 90 days to challenge it, and if found in your favour, this could save you thousands of dollars. More often than not, the value that the government apportions for your land is not what the market would give you. Where this will hurt, is in a falling market. Although you’re more likely to be eligible for a re-assessment in this case.

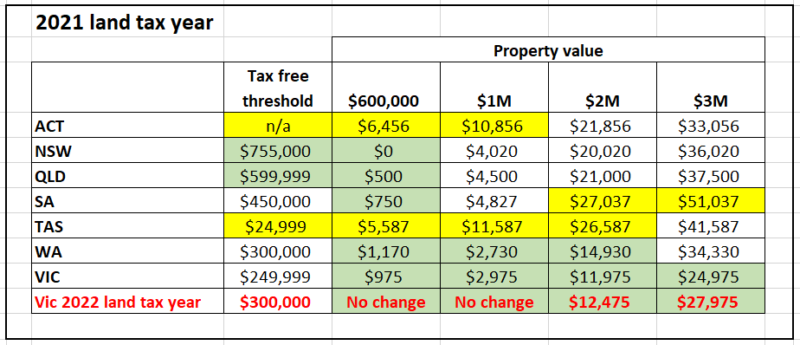

- The friendliest land tax states. The trio outline the differences in land tax for each state. Which states have the lowest tax-free threshold? And which states offer the friendliest environment for building a property portfolio. Before you purchase your next property, you should be broadly aware of the land value component, and you should try to determine many properties you will accumulate over your life-time in each state. Having a plan that factors in land tax, helps an investor provision for cash flow obligations.

- Tax decisions drive investment choices. Political, financial and economic discussion is often centred around tax and it’s implications. States may increase taxes, and this has potential to impact the level of investment, (both private and consumer-based investment), and in turn this can create a flow-on effect on unemployment, property value growth and wage growth.

- The pitfalls of land tax. The Property Buyer explains two of the ways that the operation of land tax can be unfair, particularly towards home buyers and absentee owners. If you’re purchasing a home or planning to live overseas for a period of time, ensure that you understand the potential land tax implications.

- Diversification. As well as land tax benefits, purchasing property in another state can provide you some much needed diversification in your property portfolio. This will mitigate the risks associated with property cycles and can also counter-balance the risk when one property market is going through a downturn or period of stagnation. Right now,we’re in an atypical situation where all markets are increasing at the same time, and while it’s extremely positive, it doesn’t happen often.

- Developing your property strategy. Land tax is important to understand and take into account, as your net income position and retirement nest egg can be greatly impacted by your decisions. If your cash flow is tight, a big land tax bill could send you over the edge of affordability. However, your decision shouldn’t be solely based on tax considerations alone. Tax is just one of the plethora of puzzle pieces and moving parts to understand before making a decision. The Property Planner takes you through some scenarios to better understand your cash flow and income position.

- The land tax bomb. The Property Professor goes through the last 10 years of property market data and illustrates how selecting the states with the low-tax environments may not be the best choice for capital growth. Depending on your strategy, it may pay in the long-term to purchase property in a state with higher land tax and foot the bill.

Resources

- Optimising tax deductions – top mortgage and loan strategy tips (Ep. 87)

- All things property tax – how to understand your deductions at tax time (Ep.55)

- Diversification 101 – How and why to plan for diversification within your property portfolio (Ep.53)

- Property planning and your next purchase – critical considerations and why modelling financial outcomes is vital to success (Ep.92)

- How to determine property value for your home (Ep.107)

- Offset accounts – God’s gift to mortgage strategy! (Ep.40)

- Cross collateralisation – myths busted, best loan structures, mortgagee sales and more (Ep.99)

- Why your Mortgage Strategy is more important than your interest rate! (Ep. 9)

- No mortgage strategy – #4 of the top 7 critical mistakes (Ep.34)

- Why your approach and assessment of risk is paramount to property success! (Ep.10)

- How will your mortgages serve you in the long run?

- Five mortgage strategies that can grow your wealth

- How mortgage strategy shapes your ability to hold property, and grow your wealth for decades into the future! (Ep.24)

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Land tax across the states

*Please note – there is no land tax in Northern Territory

Land tax scenarios

Scenario 1 – Unimproved land value $1M

Property value $1.5M x 3% rental yield = $45,000 rent / @ 4% = $60,000

- Land tax $3k to $5k in most states or around 5% to 10% of your rent.

- Except for ACT and Tas where it is 15% to a whopping 25%

Cost to rental income – Range 5% to 25% / 1$ paid out in $20 to 1 in $4

Scenario 2 – Unimproved land value $2M

Property value $3m x 3% yield = $90k rent / @ 4% = $120k

- Victoria is approx. 10% of income spent on land tax and this the lowest

- WA is 12% to 15% One is every 6 to 8 dollars goes towards land tax

- All states above $20k bill except the two above

- The rest of the stats are around 15% to 30% with SA and Tas paying $26k and $27k

Cost to rental income – Range 10% to 30% / 1 in $10 to 1 in $3.33

Scenario 3 – Unimproved land value $3M

Property value $4.5m x 3% yield = $135k rent / @ 4% $180k rent

- Victoria is 14% to 20% is the lowest Or $1 paid out of every $5 to $7 earnt

- SA most expensive is $1 out of $3 or $4 or even high $2’s.

- Other states – $1 out of $3 to $6

Summary

- Victoria is the most forgiving currently, but this can change anytime. I would be surprised if a Victoria government didn’t increase it to be more in line with other governments over time.

- SA is the most expensive at the top end.

- Some cities, such as Sydney and Melbourne, land value is much higher, so land tax grows more rapidly potentially whilst owning less properties.

- A higher land to asset ratio, although positive for capital growth appreciation, will mean more land tax is payable when owning the same value of property as someone with a lower land to asset ratio.

- The higher the land value, the more important the rental yield can become/less reliance you want to have on the rental yield. EG you are wealthy enough, that it isn’t so important to you.

Show notes

- Land tax is often not factored into cash flow cost when people are purchasing property.

- Once you start to own a certain number of properties, you always want to be aware of the land tax implications, as part of determining the next property purchase and location.

- Land tax basics – how is land value assessed?

- Every year, the Valuer-General evaluates/determines the ‘unimproved value’ (i.e. land value) of property.

- Land tax is an annual cost that is determined on the total value of the land you own.

- They are almost always conservative.

- As soon as you get that estimate, you only have 30 to 90 days normally to challenge it. That can certainly save you thousands, if the algorithm has over-estimated the value of your land.

- Uncertainty – the value of your land is constantly changing, the government charges can change, Victoria have just changed theirs. Victoria does theirs over the calendar year, some do it over the financial year.

- Before you purchase your next property, you can’t be completely certain on the land value, and you can’t know for certain how many properties you will accumulate over your life time.

- Having a plan that factors in land tax and helps mitigate that expense is certainly worthwhile.

- Tax decisions drive investment choices

- So much of the political, financial and economic discussion is about. State’s may increase taxes, but it will change the level of investment, which can impact unemployment, growth of property and growth of salaries.

- Land tax free thresholds:

- ACT you pay from Day dot, this is because they are trying to abolish stamp duty.

- NSW – $755,000 is the land tax free threshold – although NSW gets more expensive the more property you have, if you only have a small portfolio, it will be cheap.

- Because it is a tiered system, once you go above $2M, SA is the most expensive.

- The pitfalls of land tax

- In Victoria, need to reference if it is taking place in other states as well. If a first-time buyer purchases a property that has land tax obligations on it, they will pay the residual land tax bill, because that is how the legislation is worded.

- Absentee owner land tax rate – if you live outside of Australia, expats or travellers, there will be an absentee surcharge. It is 2% of the property’s value each year.

- How does land tax vary if you own it personally or in a trust?

- Land tax thresholds start at a lower level if you own it in a trust or a company. A lot of investors who have property in their own personal name have a higher level that land tax kicks in it.

- How are land values calculated for rating and taxing purposes?

- Curbside valuation, typically it’s an algorithm, could be a land value per square metre portioned to a particular suburb. We talked about valuing like a professional in the last episode, and we know how much you need to take into account to do this.

- It’s not a detailed valuation, it’s a blunt instrument.

- More often than not, the value that the government gives you for your land, is not what the market would give you. Where that will hurt is in a falling market. Then you’re more likely to want to look at the land assessment, it’s more likely that you’ll be eligible for a re-assessment.

- Your strategy has to take tax into account, but shouldn’t be hinging on the land tax benefit. If your cash flows are tight, this could tank you.

- It can make a big difference to your net income position at the end.

- Diversification helps you manage property cycle risk, we’re in an unusual situation where all states are increasing at the same time.

- The Property Professor’s land tax bomb

- NT – $0 land tax – BUT properties are worth less than they were 10 years ago.

- WA – low land tax environment, BUT property values are up 2% in 10 years.

- NSW – if you purchased a $1M property 5 years ago, it would be worth $1.78, even though you had to pay $40,000 in land tax annually over those 5 years.

- Diversification

- Land tax should also be a consideration for diversification. As land tax is a state-based tax, a strategy to minimise land tax could be to purchase in different states, cities and regional areas with the land value likely to be lower and rental yields usually higher.

- This diversification can also help you own property in locations that are running on different property cycles. (it is unusual for a cities and regional areas to be increasing in value at the same time as it is currently.)

- PPOR – Generally speaking, your Principle Place of Residence is exempt from land tax calculations

Gold Nuggets

David Johnston – The Property Planner’s Golden nugget: We’ve dedicated one out of a 108 episodes on land tax and we’ve just scratched the surface. It is a factor to consider into your portfolio plan, but it’s just a piece of the puzzle and you shouldn’t be making your property decisions based solely on land tax, but you want to understand the impact, in conjunction with the various other considerations, in the context of your property plan.

Cate Bakos – The Property Buyer’s Golden nugget: be aware of cash flow. The fastest way to be asset rich and cash flow poor, is to have properties with outgoings that you can’t manage. You are unfortunately forced to sell the property if you’re facing bills and demand notices. There are lots of reasons why a property could have a negative cash flow and land tax could be a contributor, if you’re not aware of it.

Weekly market insights

- Race to the finish – Vic stamp duty concession is over. The Victorian stamp duty concession for properties purchased under $1million ended on the 30th of June. This produced some last-minute scrambling for those trying to get the 25% discount for established property and 50% discount for new property. In Victoria, many auctions were brought forward and offers submitted, as the concession has greatly improved borrowing power for many, particularly first home buyers. This initiative was offered shortly after Melbourne’s long lockdowns in 2020 in an effort to stimulate the property market. Little did our bureaucrats know that our market didn’t really need external stimulus. Low interest rates would have been more than enough.

- Latest unemployment figures exceeds expectations. The ABS has recorded a drop in unemployment from 5.5% in April to 5.1% in May. Thankfully, Australia is one of only two nations that has more people employed now, than prior to when covid took hold. The lowest unemployment level reached in the last decade is 4.9% and we’re not far away! Interestingly, despite Victoria’s extended lock downs, the unemployment rate in Victoria is 4.8%, while NSW sits at 5%. South Australia has the highest unemployment rate at 5.8% and ACT, the lowest rate at 3.6%. No surprises here, as the public service is less affected by downturns. The trio discuss the reasons behind the stellar unemployment result.