Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

- What is cross collateralisation?Also known as cross securitisation, put simply, cross collateralisation is where you have a single loan secured by two or more properties. The Property Planner and Buyer unpack the myths that surround this loan structure strategy.

- Why do people think cross collateralisation should be avoided?The main reason why people are averse to cross collateralisation, is the belief that by having a single property providing security for a loan, you are protecting your other assets from the bank in the event of loan default and forced mortgagee (lender) sale. If the value of property is not enough to extinguish the debt on the loan, the lender may look to your other assets to cover the shortfall. While retaining individual loans for each security property may limit a lender’s ability to access your other assets, it is certainly not impossible and there are other legal means that lenders can use to access your other properties to recoup their losses.

- Beware of spruikers!A large proponent of not crossing securities are property spruikers who are selling properties under the guise of ‘free property advice’. This is because their aim is to convince people to buy multiple properties, with high loan to value ratios which are often poorer quality assets, with low prospects of capital growth. Brand new properties can often decline in value, so the spruiker is actually protecting themselves by advising against cross-collateralisation, and promoting assets are financed across multiple lenders.

- Using mortgage strategy to manage risk and why prevention is better than cure. We see protecting your assets from a lender as the absolute last line of defence in a worst-case scenario. As we always say, prevention is better than cure and there are many mortgage strategies that you can put in place to ensure that you manage risk effectively. The Property Planner talks you through the different strategies to protect your family and build your war chest.

- Is your property strategy conservative or aggressive?Your risk tolerance and risk profile are critical in determining what is the right risk management strategy for you and how aggressive your property accumulation strategy should be.

- Should you pick one lender or spread your loans across multiple lenders?The trio discuss the pros and cons of a single lender and multiple lender strategies. Generally speaking, if your property strategy is particularly aggressive or high risk, you may consider loans across different lenders to be appropriate for you.

- Business debt and non-property investments. How cross collateralisation can enable you to do some wonderful things. The Property Planner and Buyer explain the considerations when making decisions about business debt and non-property investments.

- Selecting the right strategy for you. In the end, there is no one size fits all approach. To make the right decision for you, you need to get tailored advice based on your goals and circumstances, and work out what your top risk management strategies will be.

- And of course, our ‘gold nuggets’

Market insights

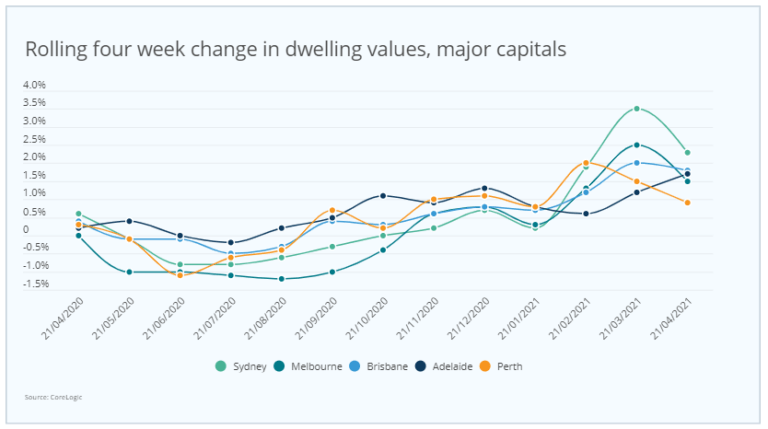

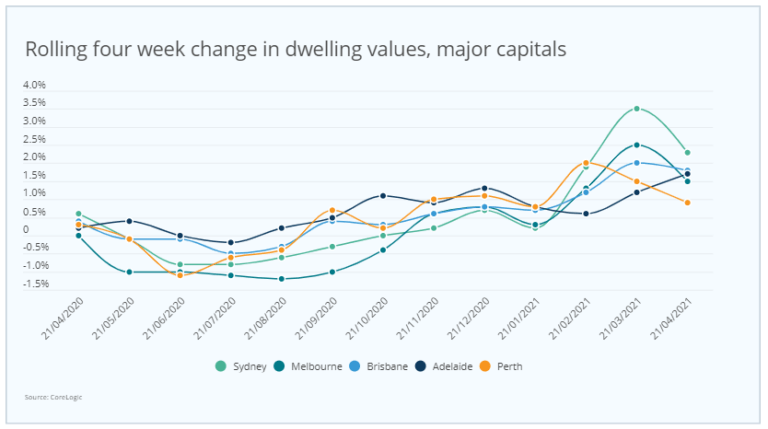

- Month on month growth reaches peak. Some say that the housing market is beginning to show some signs of slowing. Agents who have been so inundated with activity are starting to return to their usual practices of performing pre-auction calls to firm up bidders. This signals that some of the heat in the market might be subsiding. The trio believe that we’ll still continue to see positive growth, but not at the same rate of knots experienced over the last few months. The Property Buyer suggests that the velocity is decreasing despite the pace remaining positive.

- Positive market indicators. The latest unemployment figures released by the ABS for the month of March show unemployment lowering from 5.8% to 5.6%, which is great news. Iron Ore spot prices per tonne cracked $190, which is the highest price since 2011 and 1% off record highs in the mining boom years. This bodes well for the Government’s coffers and our federal budget returning to surplus over the coming years.

- Loan deferrals back on track. In more positive news, only 0.5% of the million loans deferred due to Covid are still frozen. Many people who were hanging their hat on waiting for properties to flood the market because of forced sales have missed out on opportunities. Like we always say, there is no time like the present to purchase property, provided that you are making decisions based on your own personal economy. Timing the market is incredibly difficult, even for the property experts.

- Houses outperform units. Latest figures from CoreLogic reveal that for all capital cities (bar Melbourne), houses have performed units over the last year. That has been the case for many decades, but accentuated further through Covid where people were looking for bigger dwellings. We expect rental yield and capital growth for units to slow down even further.

Resources:

- Mortgage Strategy 101 – Ep 5. Risk Management

- Why your approach and assessment of risk is paramount to property success! (Ep.10)

- Mortgage Strategy 101 – Ep 4. Optimise Investment Deductions

- Mortgage Strategy 101 – Ep 9. – Maximising your tax deductions by using a redraw facility

- Optimising tax deductions – top mortgage and loan strategy tips

- Mortgage Strategy 101 – Ep 6. Offset Optimisation

- Offset accounts – God’s gift to mortgage strategy! (Ep.40)

- All things property tax – how to understand your deductions at tax time (Ep.44)

- Why you need to plan for your future home when buying an investment property

- How to turn your first home into an investment property when upgrading

- How to avert mistakes if you want to rent out your former home

- Why short-term investing has long-term consequences

- Diversification 101 – How and why to plan for diversification within your property portfolio (Ep.43)

- How will your mortgages serve you in the long run?

- Five mortgage strategies that can grow your wealth

- How mortgage strategy shapes your ability to hold property, and grow your wealth for decades into the future! (Ep.24)

- Why your Mortgage Strategy is more important than your interest rate! (Ep. 9)

- Mortgage Strategy 101 – Ep 12. How to keep property as you accumulate!

- Mortgage Strategy 101 – Ep 8. How to keep a stepping stone home when you upgrade

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Show notes:

- What is cross collateralisation

- Essentially you secure one loan against more than one property.

- A lot of myth around never cross collateralisation, but it’s not always the right thing to do

- You can manage risk when you cross collateralise

- You can get a second loan and two loans against the one property – but what we’re talking about is multiple properties against one loan.

- Throw all of your properties in the one bucket, with that one lender –

- Benefit of not-cross collateralising – it’s harder if you fall short of being able to keep a property, that the bank can sell up all of them.

- The benefit of cross collateralising is that you can have individual loans for each property – you could have two loans for each investment property, which can be cumbersome.

- Especially when spread out over many lenders.

- Why do people think cross collateralisation should be avoided?

- Worst case scenario, the bank won’t come after your other properties to recoup their losses if you’ve sold a property and it cannot fully extinguish the debt relating to that property.

- What you’re planning for is if the bank has to force sell you up and there’s no equity in that property to cover all the debt, then it’s harder, but not impossible for the bank to access your other assets.

- Fear of losing a degree of control if all of your assets are tied up with the one bank.

- Having all of your eggs in the one basket or giving all of your love to one lender.

- If you own multiple properties and your LVR is 80% and you have significant buffer of savings and redraw – you can be less concerned about cross collateralising and having a simple loan structure, one loan per property.

- Managing your risks through other ways

- Having LVR at 80% means that when you go to sell the property, the value would need to have dropped by 20% in order to not cover the debts relating to that property. Unless you have bought off the plan or have a dud investment, this is unlikely to occur and the proceeds from sale should be able to cover the remaining debt.

- Plus your redraw and savings in place means that you are giving yourself buffer time to be able to make decisions, without your hand being forced.

- Prevention is better than cure.

- Not being too tight on your borrowing capacity either.

- If you have these things in place, you buy yourself time to make your own decisions. Even when you do sell, the remaining properties, plus your savings and equity should be able to manage through this process.

- It’s a pretty rare occasion for banks to sell the property.

- As the years go on, the property value goes up, your LVR increases, there is less chance that there will be a shortfall.

- 22 years the Property Planner has been in the game and we’ve never had a client who’s had to force a sale. Many who cross collateralise with multi property strategies

- The fear of losing the home is fairly ubiquitous.

- But this fear has been peddled by spruikers a lot of the time. Spruikers being people who make money from selling property, trying to get them to buy multiple properties, with high LVR and often these businesses are connected to mortgage businesses as well. People who are professing to be free buyers agents or investment advisers, they’re flogging assets off a stock list – they are not looking at individual clients position and tailoring an approach. It’s a one size fits all approach and large commissions on offer for these salespeople. A lot of people unfortunately follow this advise – tax deductions, over inflated projections.

- In house mortgage and legal team – protecting themselves, not you. They know that these properties tend to value lower at settlement, not the same level of capital growth. But they want you to borrow high LVR, paying LMI across multiple properties.

- One reason to go with multiple lenders can be because it helps borrowing capacity – mainstream lender vs 2nd tier non-bank lender who doesn’t need to meet the same restrictions and regulations as banks.

- Generally speaking, we aim and most of our clients who own multiple properties, we strive for the second property onwards to be at 80% or lower. We’re a conservative business, by the time you’re on your third property, unless your risk profile is super aggressive, you probably should be striving to be under 80%. If you’re not at this stage, perhaps you should look at your property strategy, because you may not be purchasing quality assets or your money management could improve.

- By the time you own 3 to 5 properties, you should have good equity built up, gross LVR at 70% or below, really strong financial position – and so the fear of managing the worst-case scenario of not cross collateralising property is less of a risk.

- Prevention is better than cure. In the end we are talking about a risk management strategy. And you can manager your risk through savings, redraw, lower LVR, having a strong borrowing capacity.

- Strategy and level of aggression –

- One lender or multiple lenders

- The reality is that the law allows a lender to come after you if there is a shortfall on a forced sale, whether your loans are cross collateralised or not. And whether they hold that property as security or it’s with another lender.

- Not cross collateralising is not the panacea to protect your assets, it just makes it a little bit harder.

- One lender pros:

- One loan for each individual property and purpose.

- No mixed debt, or mixed purpose.

- Simpler to track your lending

- Simpler at tax time

- Can owe more debt than the value of the property to maximise deductions, while keeping it as a single loan.

- Fewer lenders, less online banking to navigate and statements

- Fewer loans, fewer savings/offset accounts.

- Higher total debt with one lender = better interest rates because you are more valuable to the lender.

- Only one set of banking and lender’s fees.

- Only one discharge fee when you sell a property V multiple discharge fees for each individual loan that is discharged.

- The ability to access the combined equity across all properties in one simple loan to access funds

- Only one lender to apply to for each loan. Multiple lenders can mean undertaking multiple loan applications and separate loan increases across various lenders which can be costly, time-consuming and make banking confusing.

- Multiple lender pros:

- Selling a property when crossed with another will require valuations on remaining property. If there is other security involved, they will need to ensure the remaining security can support remaining loan. This is when more questions can be raised around ability to service debt is rental income is lost. With any policy, any changes, there is always the blanket line, ‘subject to assessor/bank discretion’.

- If it is crossed, may require a whole new application and assessment of current financial position. Generally speaking, if you were to simply discharge a mortgage and pay ‘all’ associated debt, then there will be no assessment and no valuation required. All the lender cares about is the loan they provided has been paid, hence they release the relevant security.

- More products to select from

- Borrowing capacity may be enhanced when you use multiple lenders.

- You can keep ownership separate.

- If you have a high-risk investment strategy as in high LVR and speculative assets, using multiple lenders may have some benefits. Some examples include:

- owning properties unlikely to provide capital growth

- stretching your affordability and have limited monthly surplus cash flow

- if you have limited cash savings reserves

- if you have an LVR, above 80%, especially if combined with the points above.

- Lenders will generally attempt to mortgage as many properties as possible, even when a property(s) may not be required to be mortgaged given your overall equity. This should only be a concern when dealing directly with lenders as we will always strive to provide lenders with only the level of security they require. If you can maintain the title of a property without having to mortgage, then we would suggest you do so on most occasions. This is a very strong form of risk management.

- Business debt and other investments outside of property

- Crossing can enable you to do some wonderful things with business debt, but once things are up and running, you may want to then remove your property.

- Working out the right strategy for you

- There is no one size fits all, you need to go through your own circumstances, work out what are your risk management strategies and make the right decisions for you. Too often, people don’t have the right information in order to make the best decision.

David Johnston- The Property Planner’s Golden nugget: Your strategic mortgage broker should be able to talk you through the pros and cons of cross collateralising vs not, and the different ways you can manage your risk so you can make a decision that’s right for you. Make sure you’re really clear on the purpose of the debt in each loan and how much of the debt relates to what assets. This is open of the reasons why you want to keep each debt separate for simplification. The more assets and more loans, the more complex it becomes. Most people have at least one mistake which is costing them money on their mortgage structure.

Peter Koulizos – The Property Professor’s Golden nugget: you need to go and seek advice from a number of professionals, before you work out whether cross collateralisation is right for you. Speak to your strategic mortgage broker, speak to your accountant, there are a number of people that need to be involved in this decision.