Listen and subscribe

Android

Android

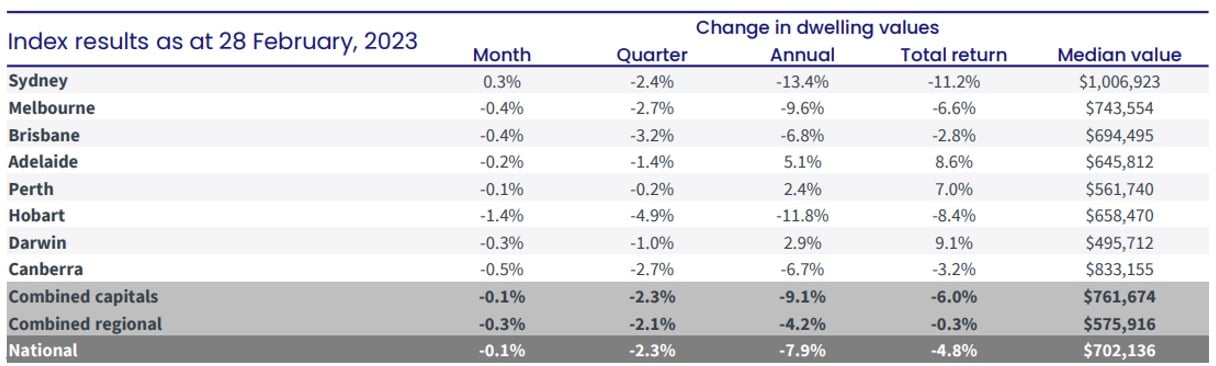

Source: CoreLogic

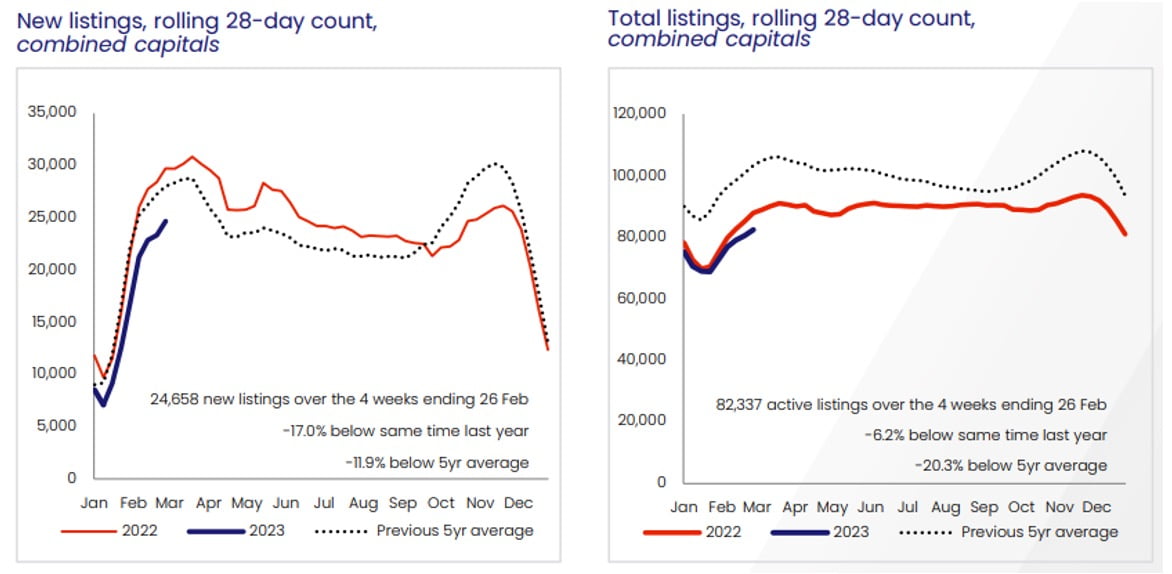

2. New listings and total listing figures are still substantially under the previous five year average, but the discrepancy is slightly smaller than last month.

Much like Cate and Dave’s point for February sales, it’s likely that the listing activity was lower than typical January/February periods due to agents and vendors taking advantage of a summer break.

Source: CoreLogic

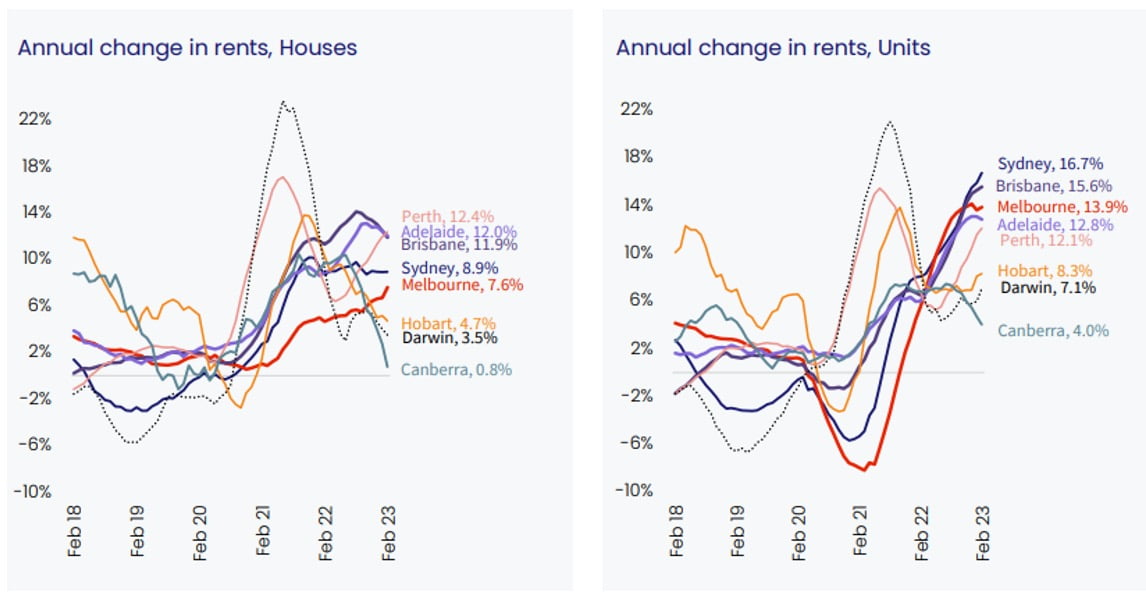

3. Unit rents are looking dire for renters in most cities, but what is going on with Canberra?

Dave has an ear to the ground with some of his family in our nation’s capital and his late night text to Pete and Cate shed some light;

“Cate and Pete,

So my cousins nailed in 20 seconds why Canberra property values are struggling.

1. Public service wages were frozen and

2. Lots of interstate people can work from home doing jobs based in Canberra

3. Cost of living is very high Canberra relative to it size. Number two behind Sydney. Rents are number two behind Sydney.

Properties are ‘too expensive’ in their words and vacancy rates are going up. Obviously prices flew during COVID as well to the point that Canberra’s house median went well past Melbourne’s, and as I’ve said this is historical very unusual.”

Source: CoreLogic

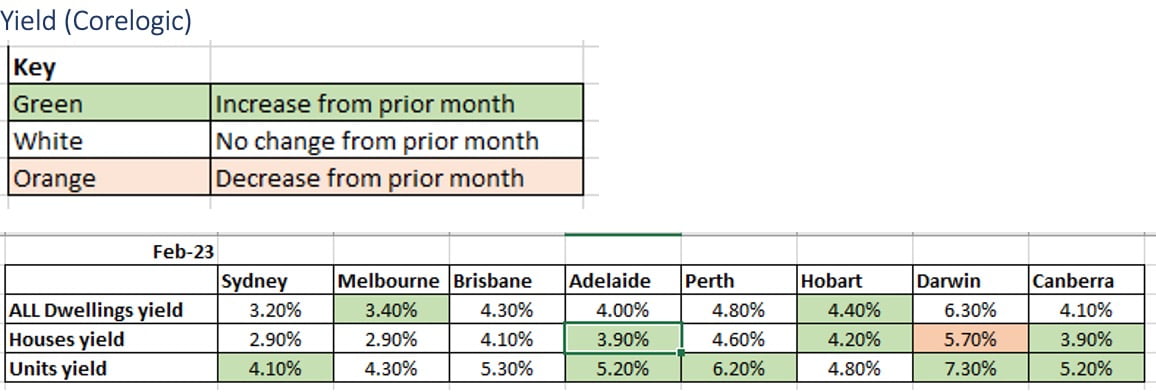

4. Tighter rental vacancy rates – as rents continue to climb, some of our capital cities (for both houses and units) are exhibiting further tightening rental yields.

Source: CoreLogic

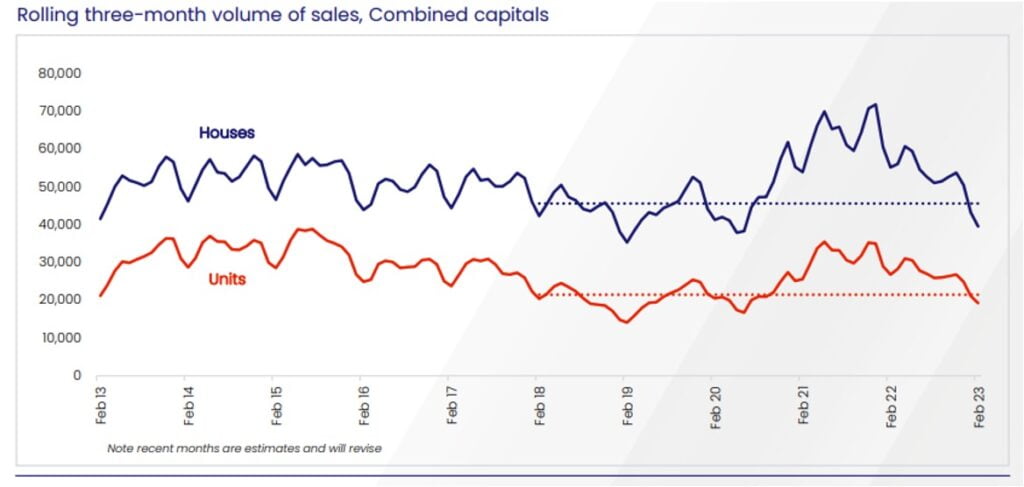

5. Sales activity is still low despite an expectation that our emerging autumn markets usually start to demonstrate a peak of activity at this time.

The volume of sales currently, when contrasted against the higher number of houses and increased population count within our capitals, presents quite a surprise. Pete discusses the decreased consumer sentiment and the correlation this has with listing and selling activity.

Cate highlights some of the historical downturns, specifically the 2019 trifecta of Banking Royal Commission, credit crunch and the threat of Labour Party tax reform at the time; unsurprisingly this period and the onset of COVID were the only other periods of low sales volumes over the past decade.

Source: CoreLogic

Source: CoreLogic6. Consumer sentiment has continued to wane, although the trio point out some interesting indices on the latest Westpac Consumer Sentiment chart.

Pete refers to current consumer sentiment at the start of the episode and makes a point that the sentiment levels today are among some of the lowest we’ve had in recent times, despite the fact that our interest rates are still comparatively low compared to historical rates. Dave aptly coins this period “the hangover period” following stimulus and COVID payments.

Cate raises a point about “time to buy a major household item” for the listeners, however. The reduction on this figure signals financial pain for consumers and suggests that the ‘YOLO’ since lockdowns is finally dissipating, and the RBA’s interest rate increases are affecting the hip pocket.

Source: Westpac Melbourne Institute

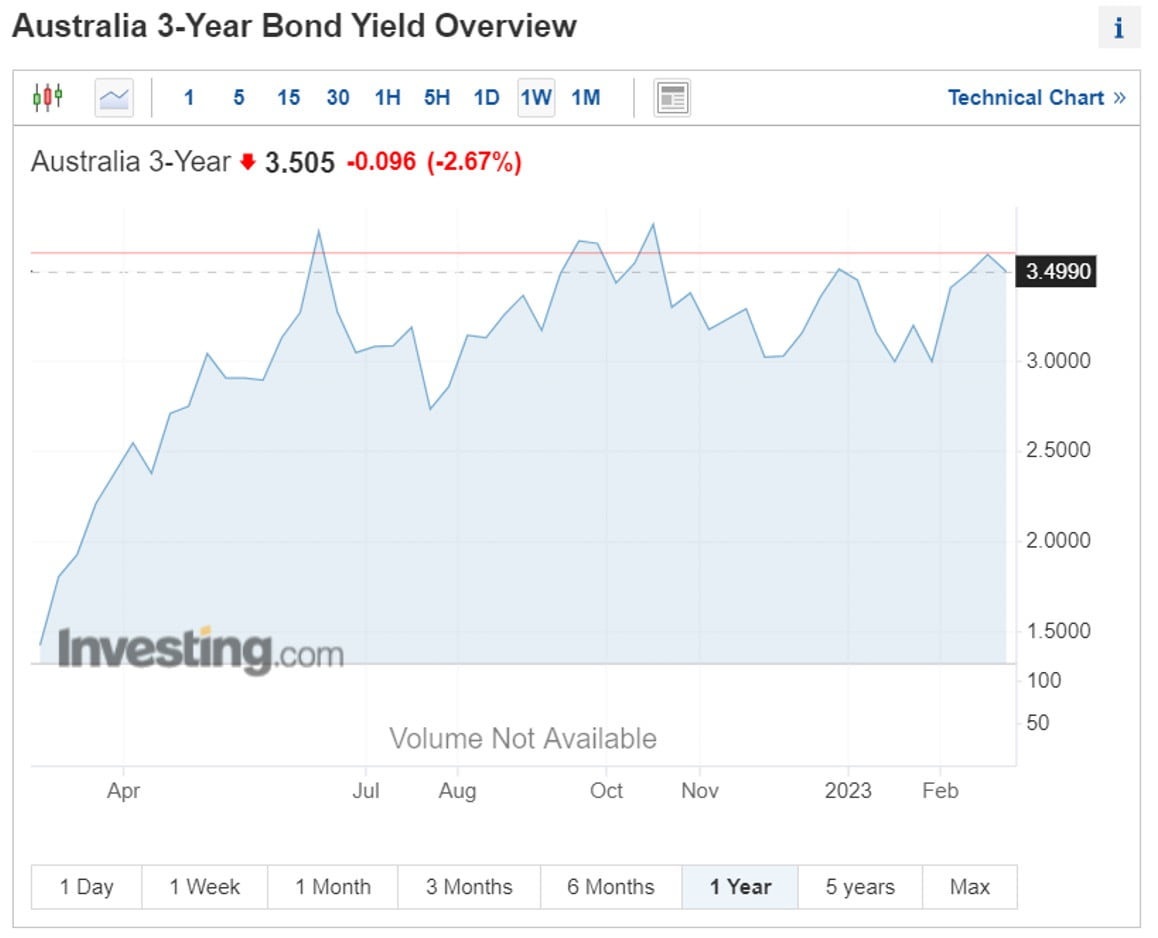

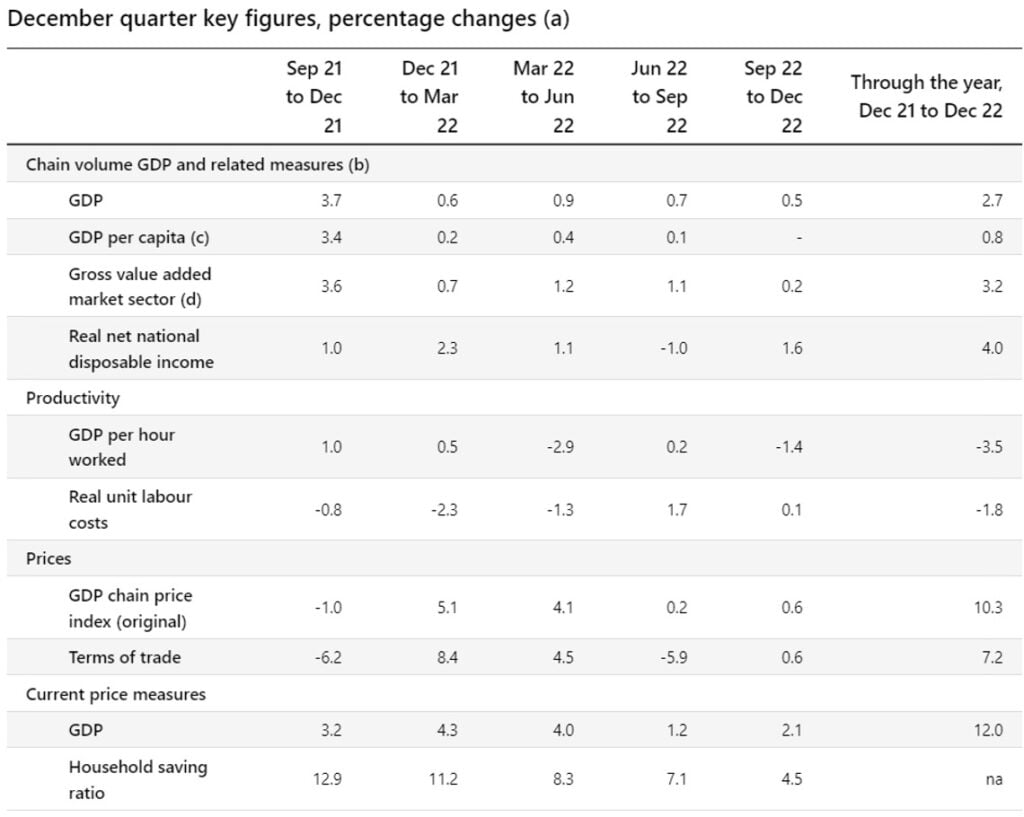

7. Our bond yields continue to tell us that interest rate equilibrium is getting closer, although money markets indicate that we may have more rate rises than earlier expected.

The three year bond yield is a little bit higher than last month’s and in light the economic drivers, Governor Lowe’s recent speech following the meeting is not entirely surprising.

Source: investing.com

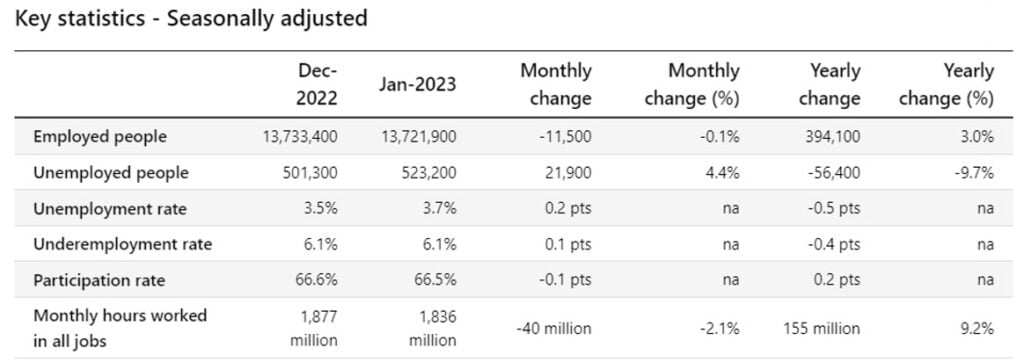

8. Unemployment continues to stay at historically low levels.

As Pete says, “Ahhh, but some good news!”

Gold Nuggets

Cate Bakos – The Property Buyer’s Golden nugget: Cate reminds listeners to factor in the impact of COVID on our markets, and in particular, the ongoing effects that have continued to shape our data.

David Johnston – The Property Planner’s Golden nugget: Dave has some sagely advice for the governments when tackling the number of available properties for sale. Without policy intervention and changes to stamp duty, he feels the issue is not likely to go away.

Resources

- Ep. 8 – Interpreting data to uncover an outstanding property and location – and how to sort the gold from the lies, damned lies and statistics!

- Ep. 12 – Property cycle management. Why now is always the best time to buy if it suits your personal economy and if you have a long term property plan

- Ep. 19 – Time in the market vs timing the market

- Ep. 155 – Plotting Australian property movements from 1970 to now

- Ep. 158 – How interest rate cycles have impacted the property market since 1990 when the RBA first started targeting the cash rate and some predictions on what will happen this time