Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

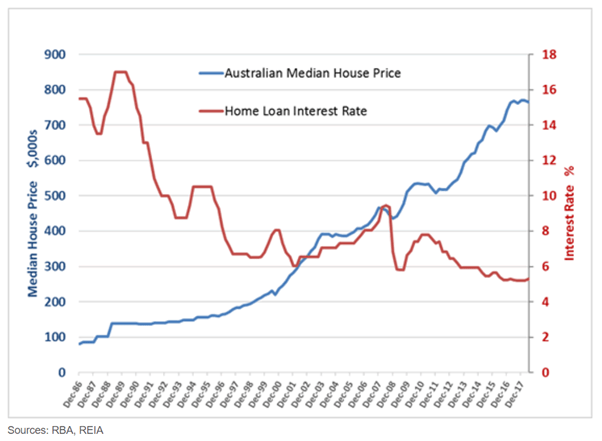

- Do interest rate movements impact the property market? In this episode, the trio sink their teeth into data going back to 1990 to answer the question whether increases or decreases in interest rates have an impact on the property market.

- Floating the Aussie dollar and targeting the cash rate. David sets the scene with a brief history of why the Australian dollar was floated in 1983 and the benefits this brought to our economy. Seven years later in 1990, the RBA started targeting the cash rate of overnight loans between the banks, which has a powerful influence on other rates in our economy, ie: mortgages.

- Cash rate cycles since 1990. Since the RBA began targeting the cash rate, Australian’s have lived through five rate lowering cycles, four increasing cycles and we’ve just started rate increasing cycle five. What can be gleaned from history to inform the future? The trio unpack each cycle and most importantly, what happened to property values and the broader economy.

- Property predictions. Dave and Pete stick their neck out and make predictions for the property market: how low will values drop and how long will the current rate increasing cycle last?

Resources

- After recording, the RBA Governor speaks on interest rates

- Why Property Values won’t plummet – Cate’s Sunday blog

- Ep#9 – Why mortgage strategy is more important than your interest rate

- Ep#12 – Property Cycle Management – why now is always the best time to buy if it suits your personal economy and you have a long-term property plan

- Ep#46 – Market update – Recovery lessons from recent recessions, the great depression, GFC & Spanish Flu.

- Ep#97 – Listener questions – What will drive capital growth after interest rates rise?

- Ep#155 – Plotting Australian property market movements from 1970 to now – the impacts of recessions, inflation, financial deregulation, population growth, unemployment rates and analysing what could disrupt the drivers of price increases?

- Understanding your lifestyle goals and strategy

- Four critical mortgage offset strategies

- Five mortgage strategies that can grow your wealth

- How will your mortgages serve you in the long run?

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Show notes

- Floating the Australian dollar and targeting the cash rate.

- In 1983, the Australian dollar was floated, to give more control over money supply. Wanted to target the growth of money supply, the policy was called money targeting. Meet all requests to exchange foreign currency, that meant that the supply of Australia’s

- prior to the float there was significant volatility in domestic monetary conditions.

- 7 years later, Australia RBA started targeting the cash rate – that is the rate charged on overnight loans between the banks. It has a powerful influence on other rates and forms the basis for other interest rates.

- What it means is that we can drive the rate that most people pay on their loans, this allows the reserve bank to influence economic conditions, rather than them being at the whim of international conditions and economies.

- It allows us to have more control over our own economy. The same goes with floating the dollar, it’s a live market and the governemnt and RBA can make different decisions to influence the currencies rate of conversion, which can help or hinder our exports, imports and it can support the broader economy.

- RBA started setting the cash rate target in January 1990

- Over recent decades, the Reserve Bank has targeted the cash rate, which is the rate charged on overnight loans between commercial banks. It has a powerful influence on other interest rates and forms the base on which the structure of interest rates in the economy is built.

- NZ was the first country to announce interest rate targets in 1990 and other nations soon followed

- NZ was also the first to target inflation in 1990 with Australia following in 1993

- Interest rate movements from peaks to troughs:

- There is less volatility in interest rates than there is in property markets.

- Since 1990, we’ve had an average cash rate of 4.70%, but since 1993, the average cash rate has been 4.05%

Graphs

Inflation:

Rate lowering cycle #1

Reduction – Jan 1990 – 17-17.5% (peak) to Jul 1993 – 4.75% (low) – 1 year 6 months

Rate movements #: 15

Total change: -12.75%

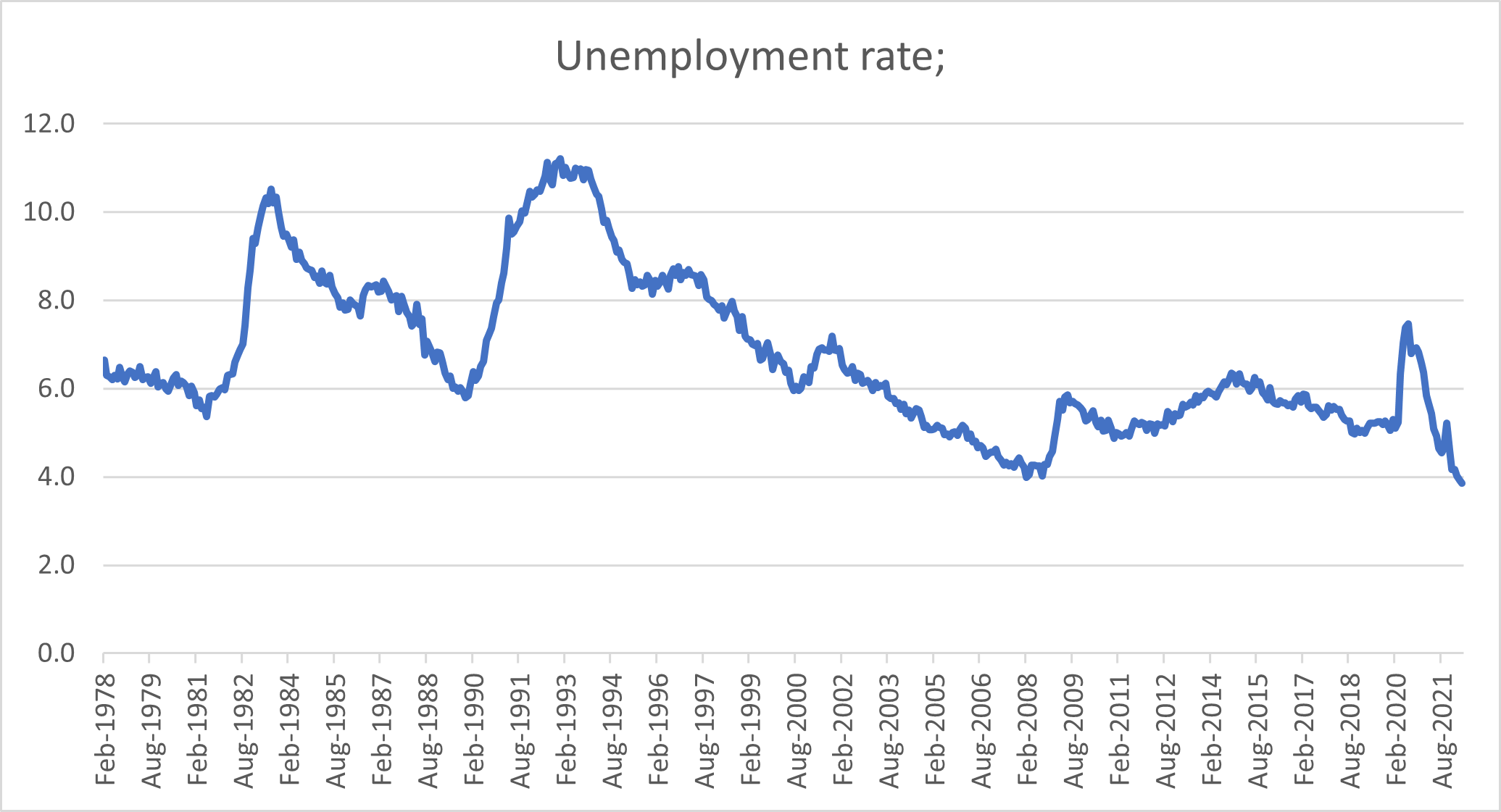

Unemployment

- Unemployment rate Jan 1990 – 6.1%

- Unemployment rate Jul 1993 – 10.9%

Inflation

- Ave inflation over 1993 calendar year – 1.75%

Stayed at the bottom until Jul 1994 – 1 year

Unemployment

- Unemployment rate Jul 1994 – 9.6%

Inflation

- Ave inflation over 1994 calendar year – 1.97%

Total time frame from beginning reduction to beginning increase – 2 years 6 months

% rate change – 72% lower

Recession – 1990 to 1991

Median values increased from ~140K to $150K from 1990 to 1994 – 2% annual growth

Comments

- The rate lowering felt like Christmas had come.

- This recession was arguably the worst, unemployment was at almost 11%

- Inflation was close to 2%.

- There is a lot of fear mongering about rates going up and prices coming down, over the last 30 years, what has actually happened. History gives you an insight into what is likely to happen in the future.

- The property market only grew by 2% annual growth.

- In 1990 unemployment was 6.1%, but in 1993 it was 10.9%

- There is more than just interest rates at play.

- You would have heaps more disposable income, as long as you didn’t fix.

Rate tightening cycle #1

Increase – Aug 1994 – 4.75% (low) to Dec 1994 – 7.5% (peak) – 5 months

Rate movements #: 3

Total change: 2.75%

Unemployment

- Unemployment rate Aug 1994 – 9.4%

- Unemployment rate Dec 1994 – 8.9%

Inflation

- Ave inflation over 1994 calendar year – 1.97%

Stayed at the top until Jul 1996 – 1 year 7 months

Unemployment

- Unemployment rate Jul 1996 – 8.6%

Inflation

- Ave inflation over 1995 calendar year – 4.58%

- Ave inflation over 1996 calendar year – 2.65%

Total time frame from beginning increase to beginning reduction – 2 years 6 months

% rate change – 58% higher

Median values increased from ~150K to $160K from 1994 to 1995 – 7% annual growth

Comments

- High unemployment, volatile interest rate movement, but property prices increased by 7% annual growth.

Rate lowering cycle #2

Reduction – Jul 1996 – 7.5% (peak) to Dec 1998 – 4.75% (low) – 2 years 5 months

Rate movements #: 6

Total change: – 2.75%

Unemployment

- Unemployment rate Jul 1996 – 8.6%

- Unemployment rate Dec 1998 – 7.2%

Inflation

- Ave inflation over 1996 calendar year – 2.65%

- Ave inflation over 1997 calendar year – 0.23%

- Ave inflation over 1998 calendar year – 0.86%

Stayed at the bottom until October 1999 – 10 months

Unemployment

- Unemployment rate Oct 1999 – 6.8%

Inflation

- Ave inflation over 1998 calendar year – 1.41%

Total time frame from beginning reduction to beginning increase – 3 years 3 months

% rate change – 37% lower

Median values increased from ~170K to $210K from 1996 to 1999 – 7% annual growth

Comments

- Generally speaking, you would see rises in asset values, but the property market over this period grew by 7% annual growth.

- So far, there is no correlation between property values and interest rate movements

Rate tightening cycle #2

Increase – Nov 1999 – 4.75% (low) to Aug 2000 – 6.25% (peak) – 9 months

Rate movements #: 5

Total change: 1.5%

Unemployment

- Unemployment rate Nov 1999 – 6.4%

- Unemployment rate Aug 2000 – 6.1%

Inflation

- Ave inflation over 1999 calendar year – 1.41%

- Ave inflation over 2000 calendar year – 4.46%

Stayed at the top until Jan 2001 – 5 months

Unemployment

- Unemployment rate Jan 2001 – 6.1%

Inflation

- Ave inflation over 2000 calendar year – 4.46%

- Ave inflation over 2001 calendar year – 4.41%

Total time frame from beginning increase to beginning reduction – 1 year 2 months

% rate change – 32% higher

Median values increased from ~210K to $290K from 1999 to 2001 – 18% annual growth

Comments

- Higher interest rate environment, we’re increasing interest rates and trying to tackle inflation

- Mid 1999, GST was announced to come in – the market stagnates. What is going to happen when the GST comes in, will property prices be 10% more?

- First Home Owner’s grant of $7,000 and double if you were buying something new.

- Property prices went off – annualised growth rate for property was 18%.

- If there is one major correlator with property values, I would suggest that it’s got to do with government stimulus.

- Low doc loans and no doc loans – no longer, the amount of compliance a mortgage broker has to go through now is significant.

Rate lowering cycle #3

Reduction Feb 2001 – 6.25% (high) to Dec 2001 – 4.25% (low) – 11 months

Rate movements #: 6

Total change: -2%

Unemployment

- Unemployment rate Feb 2001 – 6.5%

- Unemployment rate Dec 2001 – 6.9%

Inflation

- Ave inflation over 2001 calendar year – 4.41%

Stayed at the bottom until Apr 2002 – 4 months

Unemployment

- Unemployment rate Apr 2002 – 6.3%

Inflation

- Ave inflation over 2002 calendar year – 3.05%

Total time frame from beginning reduction to beginning increase – 1 year 3 months

% rate change – 32% lower

Median values increased from ~210K to $340K from 2001 to 2002 – 28% annual growth

Comments

- Scratching our heads at why rates were lowered when there was a higher unemployment rate and inflation.

Rate tightening cycle #3

Increase May 2002 – 4.25% (low) to Mar 2008 – 7.25% (peak) – 5 years 10 months

Rate movements #: 12

Total change: 3%

Unemployment

- Unemployment rate May 2002 – 6.4%

- Unemployment rate Mar 2008 – 4.1%

Inflation

- Ave inflation over 2002 calendar year – 3.05%

- Ave inflation over 2003 calendar year – 2.76%

- Ave inflation over 2004 calendar year – 2.28%

- Ave inflation over 2005 calendar year – 2.72%

- Ave inflation over 2006 calendar year – 3.52%

- Ave inflation over 2007 calendar year – 2.36%

- Ave inflation over 2008 calendar year – 4.35%

Stayed at the top until Aug 2008 – 5 months

Unemployment

- Unemployment rate Aug 2008 – 4.0%

Inflation

- Ave inflation over 2008 calendar year – 4.35%

Total time frame from beginning increase to beginning reduction – 6 years 3 months

% rate change – 70% higher

Median values increased from ~320K to $520K from 2002 to 2009 – 7.2% annual growth

Comments

- The cash rate is at 0.85%, this period started at 4.25% and was going up for 6 years – it was a strong economy, but it was just normal. Unemployment was coming down, close to where it is now. Inflation bounced around, but was starting to build.

- What happened to property prices – they grew on average by 7.2%. Despite rates going up over 6 months.

- History tells us that rates increasing didn’t really impact the property market.

Rate lowering cycle #4

Reduction – Sep 2008 – 7.25% (high) to Apr 2009 – 3% (low) – 8 months

Rate movements #: 6

Total change: -4.25%

Unemployment

- Unemployment rate Sep 2008 – 4.3%

- Unemployment rate Apr 2009 – 5.5%

Inflation

- Ave inflation over 2008 calendar year – 4.35%

- Ave inflation over 2009 calendar year – 1.77%

Stayed at the bottom until Sep 2009 – 5 months

Unemployment

- Unemployment rate Sep 2009 – 5.7%

Inflation

- Ave inflation over 2009 calendar year – 1.77%

Total time frame from beginning reduction to beginning increase – 1 year 1 month

% rate change – 59% lower

Median values increased from ~450K to $530K from 2008 to 2010 – 8% annual growth

Comments

- Closest correlation was when covid hit, in terms of concern for the economy.

- People were really concerned about what was going to happen to the economy, but property values grew at 8% compound growth over 2 years.

- Government stimulus again.

- But things stabilised quickly. There was speculation that property prices would drop by 40%, but they actually went up by 8% annualised.

- Overseas economists don’t understand the Aussie dream of owning your own home. We may give up other things, but we won’t give up the dream of owning our own home.

Rate tightening cycle #4

Increase Oct 2009 – 3.75% (low) to Nov 2010 – 4.75% (peak) – 1 year 2 months

Rate movements #: 7

Total change: 1.75%

Unemployment

- Unemployment rate Oct 2009 – 5.6%

- Unemployment rate Nov 2010 – 5.1%

Inflation

- Ave inflation over 2009 calendar year – 1.77%

- Ave inflation over 2010 calendar year – 2.86%

Stayed at the top until Oct 2011 – 11 months

Unemployment

- Unemployment rate Oct 2011 – 5.2%

Inflation

- Ave inflation over 2011 calendar year – 3.33%

Total time frame from beginning increase to beginning reduction – 2 years 1 month

% rate change – 27% higher

Median values decreased from ~530K to $520K from 2010 to 2012 – negative 1% annual growth

Rate lowering cycle #5

Reduction from Nov 2011 – 4.75% (high) to Nov 2020 – 0.1% (low) – 9 years 1 month

Rate movements #: 18

Total change: -4.65%

Unemployment

- Unemployment rate Nov 2011 – 5.2%

- Unemployment rate Nov 2020 – 6.8%

Inflation

- Ave inflation over 2011 calendar year – 3.33%

- Ave inflation over 2012 calendar year – 1.71%

- Ave inflation over 2013 calendar year – 2.48%

- Ave inflation over 2014 calendar year – 2.49%

- Ave inflation over 2015 calendar year – 1.49%

- Ave inflation over 2016 calendar year – 1.28%

- Ave inflation over 2017 calendar year – 2.0%

- Ave inflation over 2018 calendar year – 1.93%

- Ave inflation over 2019 calendar year – 1.59%

- Ave inflation over 2020 calendar year – 0.89%

Stayed at the bottom until Apr 2022 – 1 year 5 months

Unemployment

- Unemployment rate Oct 2009 – 3.9%

Inflation

- Ave inflation over 2020 calendar year – 0.89%

- Ave inflation over 2021 calendar year – 2.82%

- Ave inflation over 2022 calendar year – 3.94% (estimate)

Total time frame from beginning reduction to beginning increase – 10 years 6 months

% rate change – 98% lower

Recession – Q1 and Q2 2020

Average values increased from $486,900 to $920,100K from Dec 2011 to Dec 2021 – 6.7% annual growth

Comments

- The reason why the fear exists and why it’s noisier, because the young people who are looking to get in for the first time, or people who have only owned property who have never seen rates go up.

- This is the biggest cohort than ever before.

- Sentiment does impact real outcomes, which is why it gets measured so much.

- The reality is that we’ve seen positive price movement far more than the negative.

- If rates are going up, it means the economy is strong – most things in the economy are going well and that’s why rates are going up.

- Average values increased from $486,900 to $920,100K from Dec 2011 to Dec 2021 – 6.7% annual growth. A little bit softer than previous years, when interest rates were trending down.

- It challenges the notion that falling interest rates give rise to property price growth.

- What comes to light is that things average out over the longer-term.

- Shocks are the things that have a dire impact or a dramatic impact, when things are more stable, people behave very differently.

- The old saying – this too shall pass. Month’s can seem like a long time when you’re living through it, but looking back over the last 30 years, it’s just a drop in the ocean and things average out over time.

The booms are bigger than the busts

In the last 34 years, the three largest annual increases in capital city house prices were:

- 1988 – 32.9%

- 2002 – 18.4%

- 2003 – 19.3%

In the last 34 years, capital city house prices have fallen on three occasions:

- 2008 – 4.1%

- 2011 – 4.4%

- 2018 – 5.5%

Gold Nuggets

David Johnston – The Property Planner’s Golden nugget: – if we look at the history of lowering cycles, on 14.6 years lowering / 5 cycles = 2.92 ave years of rates lowering. 8.16 years increasing / 4 cycles = 2.04 ave years of rates increasing

The takeaways are that property prices are not significantly affected over the period of time of rate tightening cycles, there are many different factors which push and pull on values. I’d be very surprised if we see an overall reduction in values by more than 10%. There’s all the vested interests that step in, the proeprty market is critical to the australian economy. We do want to bring down inflation, but they want do it at a significant cost to Australian’s back pocket and wealth. The period of time we’re looking at. Rates will start being reduced int eh second half of next year – prediction by economists.

Peter Koulizos – The Property Professor’s Golden nugget: – Will property prices drop by 15% to 25%, I don’t think so. They haven’t dropped that significantly, so why would they now? The economy is strong, low unemployment and still low interest rates. I don’t think all capitals will drop in value – Brisbane and Adelaide have gone up almost 30%, they will have to drop significantly to get to negative levels.

Market Updates

- Comparing the history of Australia’s property market downturns and increases. Pete shares a sneak peak of data that he has collated detailing the extent of Australia’s three strongest years of property value growth and declines. Without giving too much away, prices are likely to drop, but there is no need to panic.

- What are the capital growth drivers when interest rates increase? Cate shares her Sunday blog detailing the drivers of capital growth when interest rates are on the rise and predictions for the property market. Check out our show notes to read the blog!

- NSW stamp duty abolition in limbo. David shares news from NSW, where the State Government is looking to abolish stamp duty and transition to land tax. Plans will be announced in the State budget next week, however the Federal Treasurer has confirmed that there are unlikely to be any handouts for tax reform. Watch this space…