Listen and subscribe

In this week’s episode, Dave, Cate and Pete take you through:

- Brisbane and Adelaide show no signs of slowing. The trio discuss the home value index results for January, with Brisbane and Adelaide continuing the trend of above 2% monthly growth, while other capitals are slowing down. January tends to be a distorted month as many agents and vendors shut up shop for the holidays. We await the February results to get a better gauge on the market.

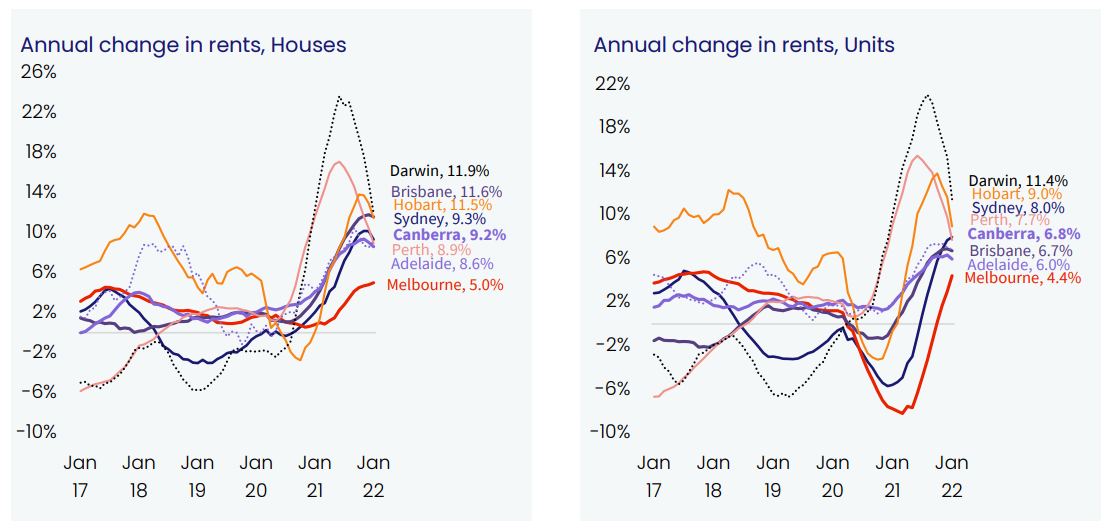

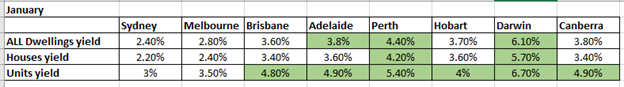

- Rental conditions easing. Rents have been flying along for the last year, although the quarterly pace of growth has been easing from 3.2% increases in March 2021 quarter to 2% over the three months ending in January 2022. Unsurprisingly, Sydney and Melbourne remain the only capitals in which rental yields are averaged at below 3%. Cate shares some insights on why available rental stock listings in the Melbourne CBD market have plummeted over the last 9 months.

Source – CoreLogic 1 Feb 2022

Source – CoreLogic 1 Feb 2022

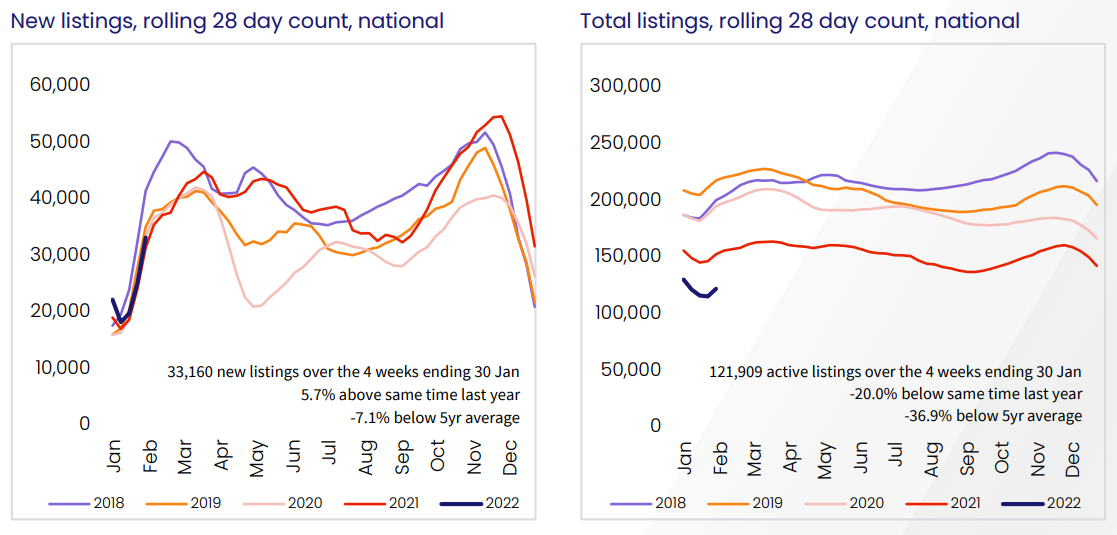

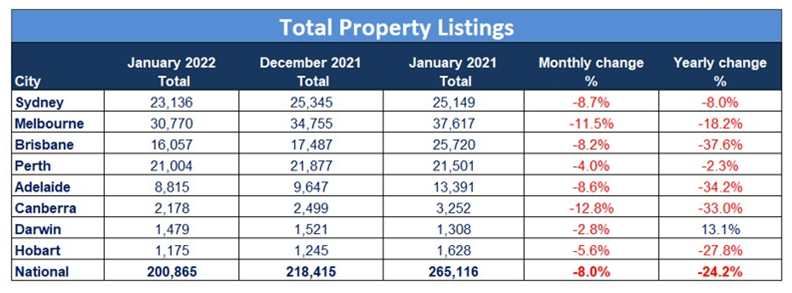

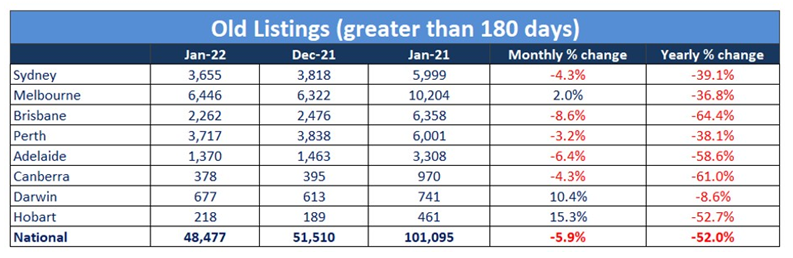

- Listings and the correlation between property growth rates. The trio discuss the level of old listings, new listings and total listings and how this has a direct correlation with value growth in our capital cities.

Source – CoreLogic 1 Feb 2022

Source – SQM Research 1 Feb 2022

Source – SQM Research 1 Feb 2022

Source – SQM Research 1 Feb 2022

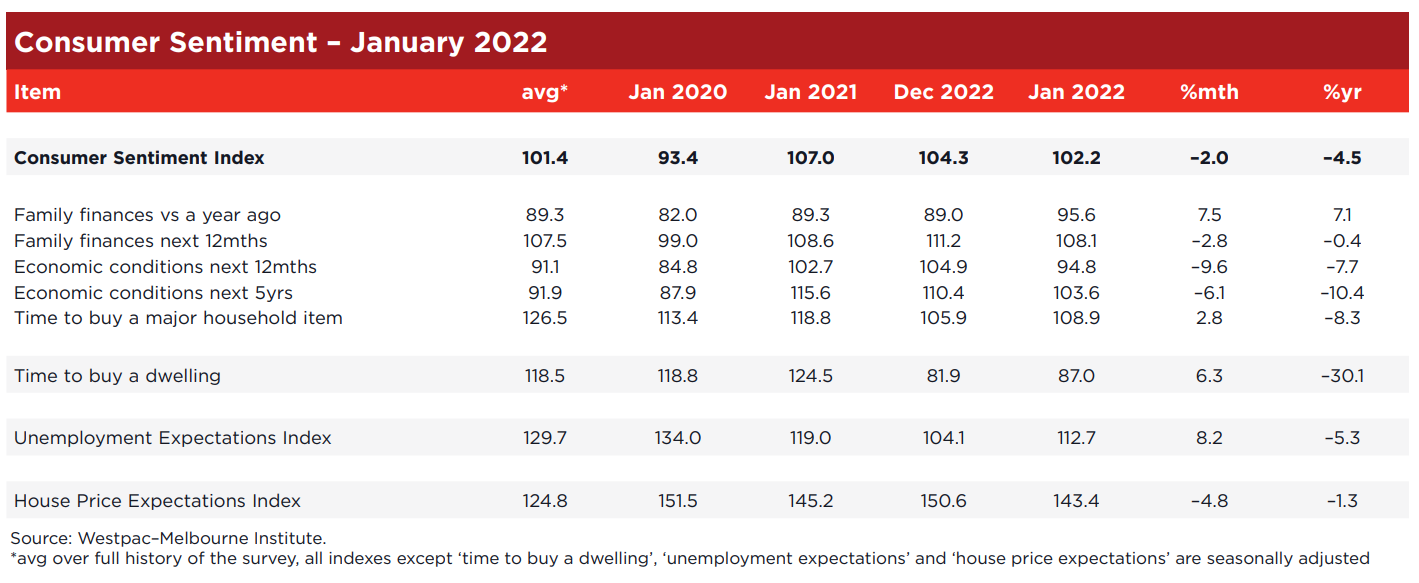

- Consumer sentiment. Consumer sentiment continues to remain negative when considering whether now is a good time to buy a dwelling. However the house price expectations index fell below 150 points for the first time since January 2021. While expectations on the East Coast dropped, house price expectations took a big upwards swing in Western Australia. The trio discuss the potential drivers of this shift in sentiment.

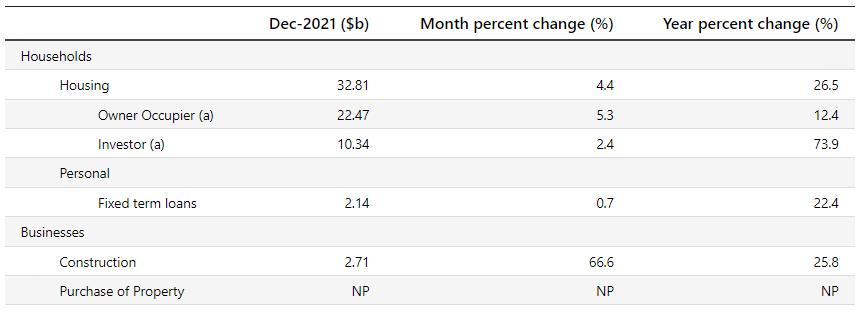

- Lending indicators. While 2021 was largely the year of the returning investor, lending indicators for December show an increase in owner occupiers greater than that of the measured increase in investors. The trio discuss whether this is an early indicator of the turning of the tide.

Source – ABS 1 Feb 2022

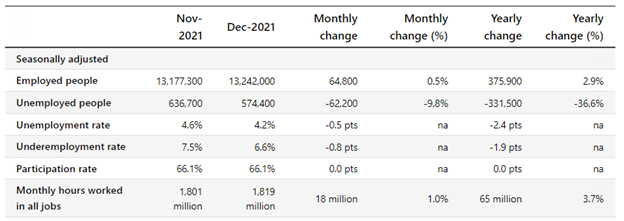

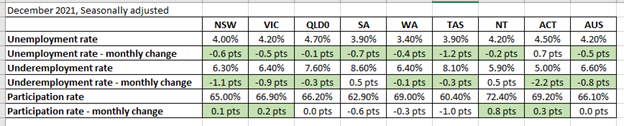

- Unemployment drops again. Kudos to South Australia for achieving the lowest unemployment rate ever recorded at 3.9%. However, the trio note that being one of the smaller states in terms of per capita, the data can be more volatile. Nationally unemployment decreased from 4.6% to 4.3%, which is a good news story for the government heading into an election.

Source – ABS 20 Jan 2022

Source – ABS 20 Jan 2022

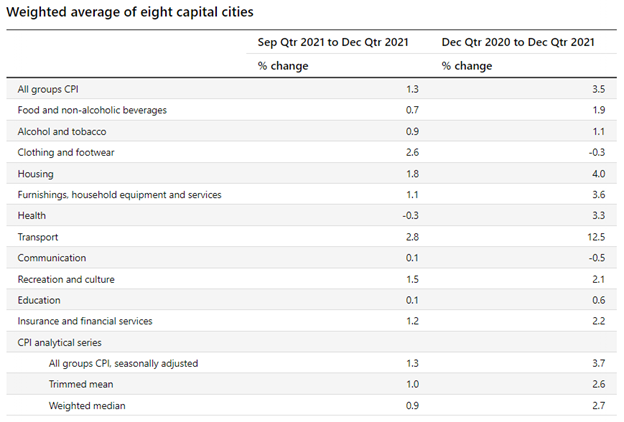

- RBA announcement. Governor Lowe has softened his stance on cash rate increases, saying now that it could be ‘plausible’ for cash rates to rise this year. While inflation certainly has picked up, it’s too early to conclude that inflation is sustainably within the target band to increase the cash rate and wages growth remains an issue. Most economists expect that any rate rises on the horizon will not come before August.

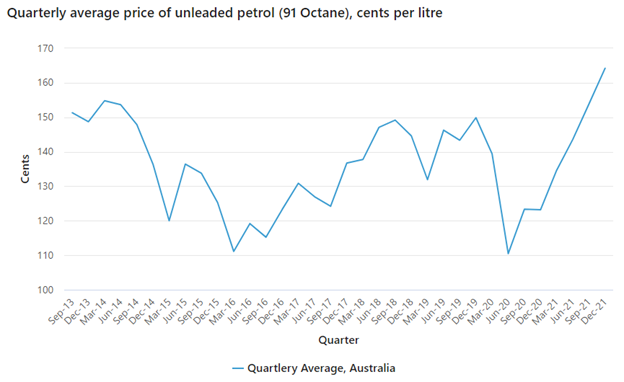

- Inflation. The latest data from the ABS shows CPI has increased 1.3% over the December quarter and 3.5% over the year. However, when making monetary policy decisions, the RBA looks at the trimmed mean, which excludes any outliers that can skew the data, which has increased to 2.6%, the highest since June 2014. The trio discuss the contributing factors driving inflation.

Source – ABS 25 Jan 2022

Source – ABS 25 Jan 2022

- Will the election announcement have an impact on property prices? The trio discuss the forthcoming federal election and whether we’ll see a slow-down in market activity and property price growth in the lead up.

Resources

- Interpreting data to uncover an outstanding property and location– and how to sort the gold from the lies, damn lies and statistics! (#8)

- Property Cycle Management – why now is always the best time to buy if it suits your personal economy and you have a long-term property plan (#12)

- How supply and demand dictate market movements – Part #1 Macro-economic forces – state of the economy, government assistance, tax, super, the wealth effect, availability of finance, market sentiment and more! (#119)

- How supply and demand dictate market movements – Part #2 Locational drivers – Streetscapes, schools, transport, prestige, shops, CBD access, recreation, entertainment and more! (#120)

- How supply and demand dictate market movements – Part #3 Locational drivers – Superstar cities, population paradox, NIMBYism, zoning, development, yields, vacancy rates, heritage overlays, regionals and more! (#121)

- How to develop your own property plan – start with the end in mind (#4)

- Time in the market vs Timing the market (#19)

- How many properties do you need to retire wealthy? (#27)

- What determines your property strategy (#6)

- Why the family home is often the biggest piece of the investment puzzle (#22)

- The great debate! Capital Growth v Cash flow – which investment strategy is superior? (#56)

- Preparing for auction #2 (#98)

- The winner’s curse and how to avoid it (#94)

- The Seven secret steps to buying a house (#93)

- Property Planning your next purchase – critical considerations and why modelling financial outcomes is vital to success (#92)

- Goal setting fundamentals for property success (#82)

- Why your Mortgage Strategy is more important than your interest rate! (#9)

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Gold nuggets

David Johnston – The Property Planner’s Golden nugget: power of compound growth, the most powerful force known to man some would say. It took almost 100 years for the value of land in NSW to surpass $1trillion in total value from 1916 to 2014. It only took another 7 years to get to $2 trillion. Great illustration of the power of compound growth and for investing for the long-term.

Cate Bakos – The Property Buyer’s Golden nugget: for anyone who is out there looking for a property is to understand competition levels. And we’ve been talking about listings, supply and demand, you’ve got a few things you can use to get insight. Get out there and see how many people are strolling through the door and asking for contract, ask the agent how many contracts they’ve given out on this property. Get onto portals and see what the supply and demand is in contrast to the average supply and demand – do it from your desk, see which suburbs are running particularly hot. Don’t make any decisions based on supply and demand, but knowledge is power.

Peter Koulizos announcement: developed a course at Adelaide Uni called ‘introduction of proeprty and valuation. It is compulsory part of the Masters degree, but it is non-award, which means anyone can enroll, you don’t need an undergraduate degree to do it. You can study it online if you wish – Google Adelaide University Prop-7005