Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

- Access to public transport and shops. Access to public transport is a key driver for demand and is increasingly important in larger cities. Access to shops is another key driver, although retail trade analysis shows that the larger the shopping centre, the further people are willing to travel to reach there. What we see now is that the desire to be close to shopping centres has been replaced with a desire to access local shops and nice cafes. Being within walking distance to your transport hub or local shopping precinct is a major draw card.

- Quality schools. Proximity to quality schools, particularly prestigious public schools where the perception is that your child will get a private school education at public school prices, is a major driver for many parents when picking a location. This greatly increases demand for properties that are within the zone of a public school or properties within 30 minutes commute of private schools. The Property Buyer shares a tip to do a cost benefit analysis, as many parents will pay extra to get in the zone of a public school, but maybe you’d be better off paying the private school fees and saving on the elevated purchase costs?

- How close is too close? Being nearby to great amenities and services can greatly impact the desirability of a location, but being too close can be problematic. Train lines, rubbish tips, industrial areas, petrol stations and shopping precincts are just a few of the things that you need to be mindful of being too close to. Think about the noise, the people and the smells. Is the property too close for comfort?

- Proximity to the CBD, are we at the beginning of a new era? The CBD apartment market has been one of the worst hit during covid, but will we see a permanent exodus from the CBD? The trio discuss the elements which still make the CBD or living close to the CBD an attractive prospect. Although the office market may never be the same post-covid, the CBD is still a hub for transport, shopping, sports, social gatherings and a number of prestigious private schools.

- Recreation, sports, leisure and the outdoors. Access to sporting fields, clubs, pools, parks and the outdoors play a big part in determining the desirability of a location. Arguably they are appreciated now more than ever because of covid lockdowns. When it comes to the great outdoors, the biggest impact will be proximity to the beach, where it will be more expensive but also have higher prospects for capital growth.

- Prestige of the area. A name and post code can make a lot of difference. Prestige is something that matters more to some than others, but it is a real thing. It’s the same reason why some people drive a Mercedes and others are happy to drive a Nissan. The Property Professor shares the example of Angwin Avenue in Adelaide, which divides the suburbs of Prospect and Blair Athol. The Prospect side of the street is valued higher, and it’s all because of the post code.

- Visual aspects, geography and climate. The Property Professor compares two regions in Adelaide, both 40km away from the city, but with very different price tags. What sets these locations apart? It comes down to the views, geography and climate. As a general rule, if your location is closer to sea level, there is greater risk of flooding, and the higher you are, the more chance you’ll get a nice view.

- Looking for a beautiful streetscape. The trio discuss the four elements that make a desirable streetscape, with the reminder that the best approach is to buy on the best street. Counterintuitively, a lot of people look for sub-division capability to drive capital growth in the future, however in a few years time, your beautiful street may not be so beautiful anymore. It could be lined with new townhouses in a higher density area.

- Conducting your reconnaissance missions. When scoping out whether a street is classed as A-Grade or B-Grade, one valuable hint is for buyers to get there at school pick up time or at peak hour and see what’s happening. Do people park on this street because it’s within walking distance of the nearest shopping precinct or train station? Is it a cut through street between two main roads that receives a lot of commuting traffic? This all goes into what makes an A-Grade street and translates into a huge difference to capital growth performance.

Resources

- Capital growth – what increases property value (Ep.89)

- The population paradox – why more people doesn’t always mean higher prices

- Why established properties outperform (Ep. 48)

- Why Sydney and Melbourne outperform (Ep. 39)

- Dissecting 10 years of CoreLogic data (Ep.42)

- Land to asset ratio

- Why the land-to-asset ratio of a property can determine its future price growth

- How data can help property investors identify gentrification before it happens

- Melbourne suburbs set to transform in the next few years

- Interpreting data to uncover an outstanding property and location– and how to sort the gold from the lies, damn lies and statistics! (Ep. 8)

- How to develop your own Property Plan – start with the end in mind! (Ep.4)

- How age and stage of life can impact your property plan and selection (Ep.13)

- Why the family home is often the biggest piece of the investment puzzle (Ep.21)

- How many properties do you need to retire wealthy? (Ep.27)

- Starting without a plan and end goal – No.3 of the top 7 Critical Mistakes (Ep.33)

- Property v shares – how to strike the right balance in your investment portfolio (Ep. 79)

- Property planning and your next purchase – critical considerations and why modelling financial outcomes is vital to success (Ep.92)

- How will your mortgages serve you in the long run?

- Five mortgage strategies that can grow your wealth

- How mortgage strategy shapes your ability to hold property, and grow your wealth for decades into the future! (Ep.24)

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Show notes

- Proximity to amenities and services

- Public transport – the larger the city, the more important it is. Being within walking distance.

- Proximity and quality of schools – perception is that their child will get a private school education at public school price. Don’t want to pay the school fees, but will pay extra to get in the zone. Do cost benefit analysis – will it be cheaper to just pay the private school fees?

- Proximity and quality of shopping – retail trade analysis, the larger the shopping centre, the further people are willing to travel from to reach there. Shops replaced with local shops and cafes – can you get the coffee, get your beer and buy the paper? When was the last time that you walked to the shops for your groceries, most people drive to basic shopping. The suburbs that were around major shopping precincts had better long-term prospects. Properties very close drop in value, the noise and the people

- You can be too close to things – train lines, rubbish tips, industrial areas, petrol stations.

- Carparking, licenced and then you have noise of people drinking, dumpster bins

- CBD – are we at the beginning of a new era?

- People living near the city, close to public transport, then with the advent of car, freeways, highways suburbia exploded

- Will we see an exodus from the CBD?

- Office workers, won’t see as many back in the CBD when covid is over.

- It is still a transport hub

- Prestige private schools are also in or near the CBD

- The major shopping hub is also still the CBD

- So for a number of reasons, it’s still attractive

- Pubs, sporting events, essential meeting point for people – hive of activity

- If we proportionately need less commercial space for people to work from, there will be more people working from home more days of the week. More of that commercial space could become residential.

- If there’s less people in the CBD, that will attract more people to the CBD, because it won’t be as packed.

- Recreation, sports, leisure

- Kids to be able to spend their time outdoors, play sports, access to good sporting fields, clubs, basketball stadiums. Play a big part whether for children or for themselves.

- People have appreciated the outdoors or sports or recreation even more because of being locked inside.

- Outdoors

- The biggest impact you’ll get is being close to the beach, it will be a lot more expensive, but it also has a big prospect for capital growth. Then would be the foothills – greenery or hiking trails, Ovals, Small parks, or dog friendly parks.

- Prestige of the area

- Part of Burwood got rezone to Camberwell, Prospect or Blair Athol

- This is not a completely different location, we’re talking left or right hand side of the street.

- Prestige of an area matters more to some people than others, but it’s a real thing

- Everyone has some level of being house proud

- Same reason why some people drive a mercedes and some drive a nissan. Our social status could definitely influence that.

- Sometimes it has an impact on dryzones in town as well.

- Visual aspects, geography and climate

- McClaren Vale or Galler in Adelaide, same distance from the city. It’s cooler and more moderate in McClaren Vale, in Galler it is hotter in the summer time. More rolling hills, perfectly flat. Quite different

- The east was built out first, you look at the geography, the oldest and most beautiful houses were built on the hills and looked over the bay. But this has certainly had a significant impact on where the better streets and locations are occurring.

- If you’re lower down, more chance of flooding, higher up, more chance of view.

- Still has an impact because we could lose site of it sometimes while going through the

- Streetscape

- Generally look for:

- Wide

- Treelined

- House set back from front boundary

- Lined with other appealing houses – buy the worst house in the best street.

- If you’re going for a subdividable block, you’re working with what the council allows. So if you’re purchasing a property in a street that has had a few subdivisions, in a few years time, it may not be a beautfil street anymore, it could be lined with all new houses. Turns into a higher density area.

- Could it be better to pick a property where you can’t subdivide?

- That is what eliminates a street from being a-grade.

- Get there at school pick up time or peak hour, it could be a cut-through street. Kids can ride bikes, kick a footy and not have to move the wheely bin for the stumps too often also feeds into what an a-grade street looks like.

- Which street you buy in can make a huge difference to capital growth.

Gold Nuggets

David Johnston – The Property Planner’s Golden nugget: A b-grade street may have many of the attributed of an a-grade street, but there may be some subtleties that you can pick up on. Could be busier, sprinkling of units or townhouse developments, sharing of some amenities, cut through traffic for schools or parking for local commercial area or precinct, could be too close to local amenities. Being under the flight path is another thing you need to consider.

Peter Koulizos – The Property Professor’s Golden nugget: consider the outdoors, if you’re looking for a home and your family loves hiking, then by all means, consider a home at the foothills, around the bush, near a national park. If you’re an investor purely looking to make money, then it would be near the beach.

Weekly Market Update

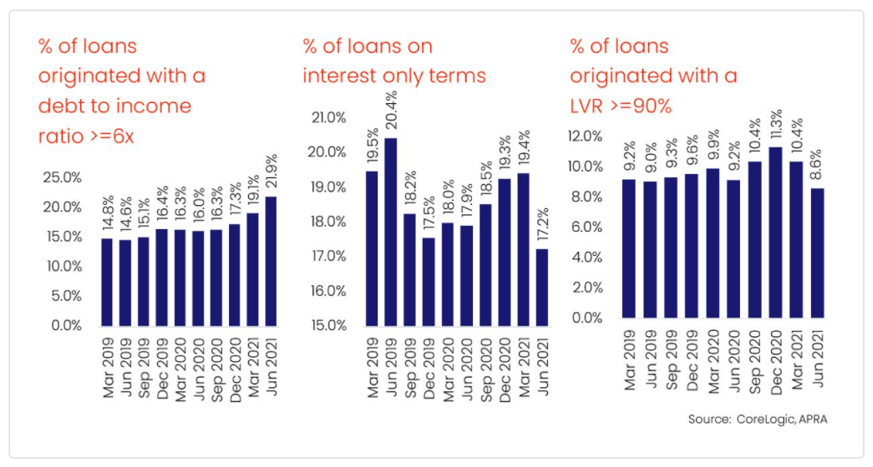

- APRA concerned over high debt-to-income lending, but no intervention for now. Outstanding housing credit hit $1.9 trillion in June, which is 4.7% higher than 12 months ago. Compared with how the property market has moved in the last year, it doesn’t seem too high. However, the June quarter saw a rise of high debt-to-income lending which is now at 21.9%, up from 15% two years ago. At the same time, lending with high loan to value ratios fell and interest only loans are the least in number they’ve been in the last two years. This indicates that we may be borrowing more, but not leveraging as hard and APRA doesn’t believe lending standards are deteriorating.

- Latest ABS stats on capital city property prices. The ABS has released figures for the June quarter for the Residential Property Price Index, showing price increases of 6.7% over the last quarter for the combined capitals. This is the fastest rate of growth in any quarter since 2003. Over the last 12 months, values rose by 16.8%. Interestingly, capital city figures did not match CoreLogic’s analysis in all cases which highlights discrepancies between data houses and the challenges of relying on data from one source.

- The dangers of data delay. Each capital city is exhibiting enormous growth runs, despite the pandemic. In Melbourne and Canberra, our ability to trade has been so restricted, that the only purchasers left in the market are those who are willing to purchase sight unseen or do video walk throughs of a property. This is a perfect illustration of data lag, as this won’t flow through in the numbers until later.