Formerly the “Property Planner, Buyer and Professor” podcast

Android

Android

2. Unveiling Market Segments

Our discussion moves towards market segments, with a particular focus on the volatility of the top quartile of the market. We explore the historical trend of high-priced properties being the first to decline during downturns and rebound swiftly during recoveries.

We also shed light on an intriguing fact concerning cash purchases, which often go unnoticed amidst headlines about mortgage holders. Many buyers, such as down-sizers and inheritors of wealth, settle their purchases without the need for lending, adding an interesting dimension to the market dynamics.

Furthermore, we delve into the participation rates of first home buyers, uncovering the grants, opportunities, initiatives, and changes that provide them with greater benefits than in previous years. Dave shares a fascinating statistic, mentioning that the average assistance from the “Bank of Mum and Dad” now exceeds $50,000.

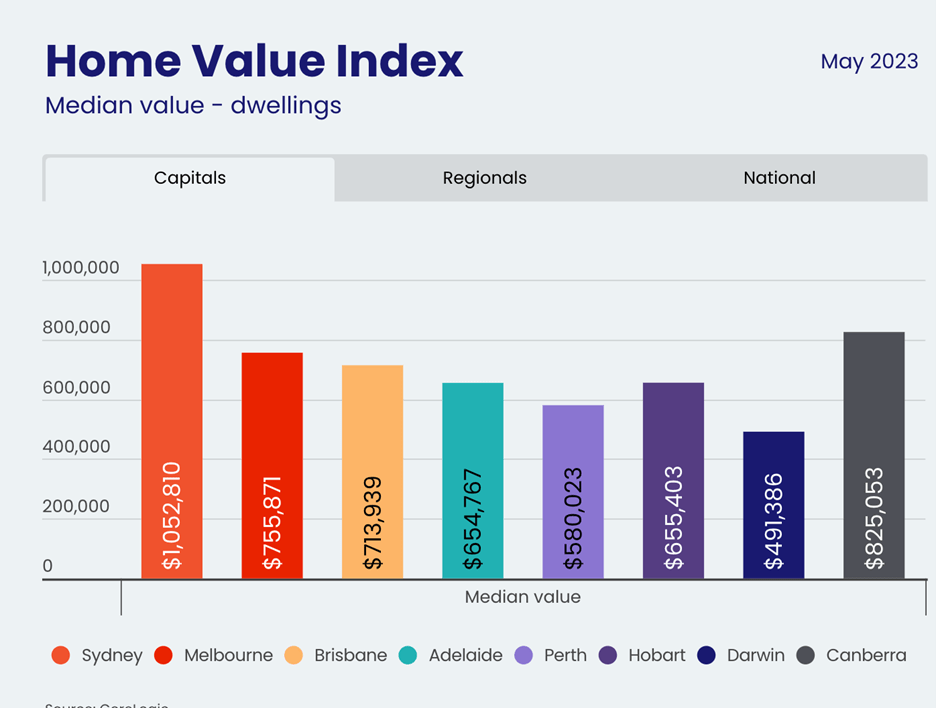

Distortions in data analysis are also brought to our attention. We explore how the ratio of units to houses can significantly impact median values, as exemplified by comparing cities like Melbourne and Brisbane. Additionally, an overrepresentation of sales from one market segment can create further distortions. Mike reminds us of the influence of initiatives that favor specific price points, emphasizing the need for deeper analysis when interpreting real estate data.

Source: CoreLogic

3. Rental movements

Shifting our focus to the rental market, Dave presents the latest trends in capital cities and regions. While rental pressure persists in cities, the regions are experiencing a slowdown. Dave highlights that only around 15% of new arrivals choose to settle in regional areas, with the majority heading towards the bustling capital cities.

We uncover an interesting disparity between rental increases for units and houses. Affordability emerges as a primary factor, with units being more cost-effective to rent.

Source: CoreLogic

4. Listings shortages

Moving on to listings, we note that they are currently below the five-year average. Mike raises a question about a slight uptick in May, but Cate attributes it to the avoidance of the Easter school holidays. Unfortunately, there seems to be no relief in sight for buyers as they continue to grapple with a shortage of available properties.

Source: CoreLogic

5. Consumer sentiment

Consumer sentiment plays a crucial role in shaping the real estate market. We explore the rise in house price expectations, indicating a widespread belief in future price increases. We dive into key changes in sentiment, including attitudes towards major household purchases, economic conditions over the next five years, and the timing of buying a dwelling. Surprisingly, despite the fast-paced nature of the current market, the consensus remains that it’s not an ideal time to purchase a property. People are cautiously pessimistic.

Source: Westpac Melbourne Institute

6. Lending Landscape

Dave’s pet subject… lending! “But we’re not lending anymore”, says Mike. Dave, our lending expert, shares insights into loan commitment figures, hinting at a potential turning point

The Trio consider whether investment loan figures include vacant or personal-use dwellings that aren’t housing tenants.

Source: ABS

7. Productivity

Productivity remains a key concern, and stagflation poses a threat to the economy if not improved. Dave details this risk for our listeners.

Gold Nuggets

Dave Johnston’s gold nugget: The breakdown of Goods and Services is an interesting dilemma. With services costs rising but goods settling down, our RBA has their work cut out for them.

Cate Bakos’s gold nugget: Freightos Baltic Index! This is a compelling chart when it comes to gauging the cost of freighting goods; a significant proportion of the overall cost for imported goods.

Mike Mortlock’s gold nugget: When will our spring selling season arrive? Or could listing activity remain low? Mike talks about the challenges buyers face while our supply and demand ratio sits at current levels.

Resources

- 10 – Why your approach and assessment of risk is paramount to property success!

- 12 – Property Cycle Management – why now is always the best time to buy if it suits your personal economy and you have a long-term property plan

- 19 – TIME IN the market v TIMING the market

- 110 – The Baby Boomer impact on real estate | Why rightsizing needs policy intervention to free up supply

- 158 – How interest rate cycles have impacted the property market since 1990 when the RBA first started targeting the cash rate and some predictions on what will happen this time