Android

Android

The Trio deliberates on the challenges of targeting the new supply side of the equation, considering the long lead time and expensive building costs involved. Cate highlights the differences between this particular budget night and past ones.

Dave explores the obstacles faced by the government in the Build to Rent sector and sheds light on the proposed easing of the management trust withholding tax, explaining its impact on investment in the sector. Cate’s cautionary note about investing in this category, which involves controlled rents, provides an interesting perspective for pragmatic investors.

The Trio agrees that the First Home Buyer shared equity scheme is a commendable initiative. The scheme’s expansion to include individuals who have previously owned a home more than ten years prior, as well as the ability for siblings and friends to co-purchase, constitutes a significant change to an already impressive offering.

“It’s much harder these days to buy a property as a single”, says Dave, and this opportunity will make a positive difference for a lot of Australians, (including permanent residents) who are keen to get a foot on the property ladder. Cate particularly likes this initiative for several reasons, including the fact that it is less likely to segment the market and result in a dual speed rate of growth for first homebuyer stock vs all other stock.

The side impacts that could increase house prices in specific areas include parental leave changes, (as household incomes grow), and green energy infrastructure upgrades in our existing steel manufacturing locations.

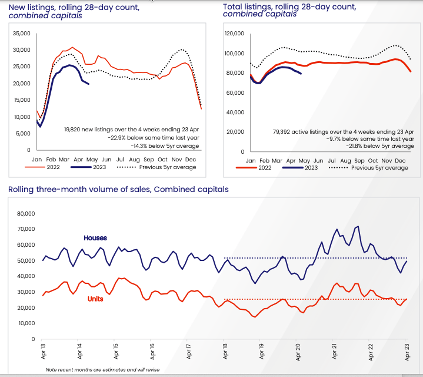

2. Listing volumes and the drivers that influence them

Currently, vendor participation is low, and buyers are pouncing onto ‘old stock’, which is in turn eroding ‘all stock’. Negative media sentiment and data lag are likely drivers of the current low listing rates. “Until vendors have confidence that the market isn’t horrible, vendors are going to sit on their hands”, says Cate. And she also shares her concerns about a particularly quiet winter; something that will be difficult for buyers, especially in the cooler climate cities.

Dave also comments about something important: listing activity is also low because owner tenure is extended. People are holding their properties for longer.

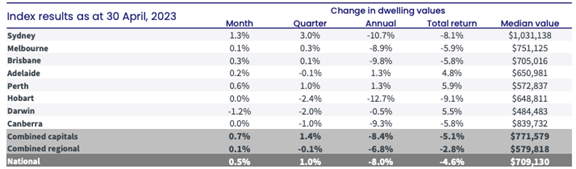

Source: CoreLogic

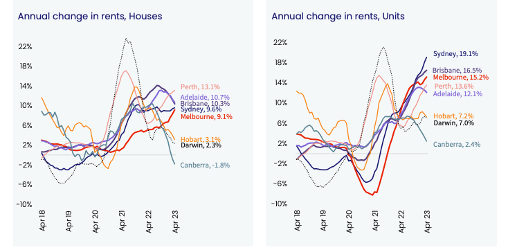

3. The annual change in rents for houses continues to challenge several markets, but the change in unit rents is quite shocking for tenants in the affected cities and regions.

But why is Tasmania lagging when compared to the other states? Mike asks Cate to explain and her answer may surprise listeners. And what is the story with Canberra? Dave eludes to the challenges associated with the public sector wage freezes, combined with the work from home acceptance.

Cate’s curious finding about eastern seaboard capital city top rental performers is intriguing…. we won’t spoil the surprise.

Source: CoreLogic

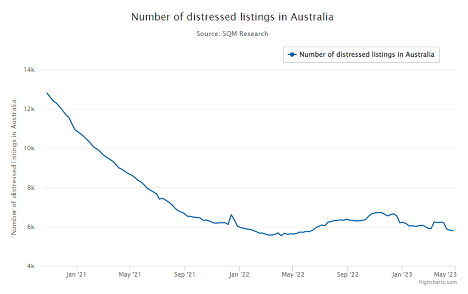

4. Distressed listings are not as ‘distressed’ as the media would have had us believe.

The charts are not showing that the impact of interest rate increases have dismantled home ownership like the headlines suggested they would.

5. The trio discuss the consumer sentiment index and the drivers and changes that are noteworthy forward indicators for the housing market

Source: Westpac Melbourne Institute

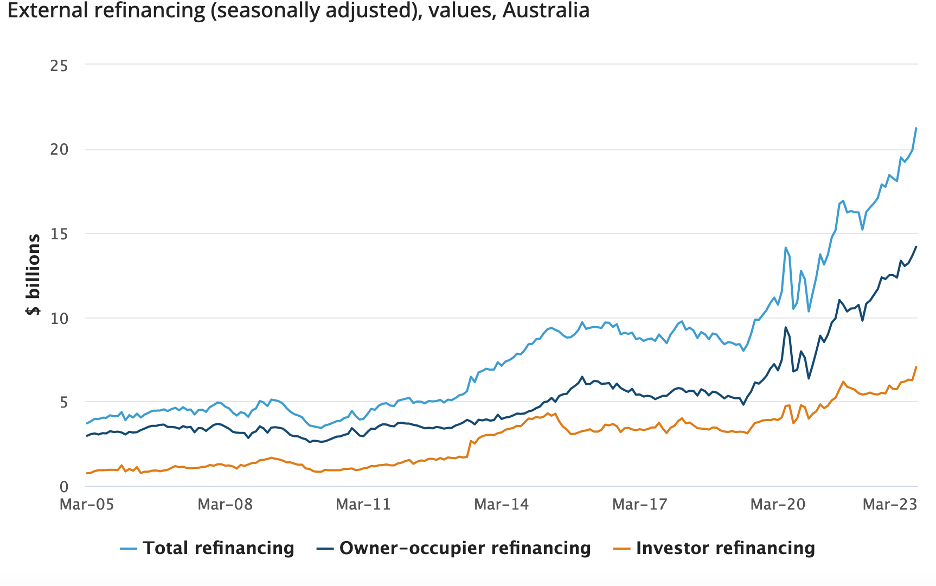

6. New loan commitments are interesting, and according to Mike, “the refinancing goldrush has become a hallmark of 2023”.

Dave discusses a rebound he’s seeing; both owner-occupier financing group and the investor financing groups have grown in size. First home buyers have grown by 15%; possibly amplified by the NSW stamp duty changes.

Source: ABS

Gold Nuggets

Dave Johnston’s gold nugget: the separation between unit rental growth and house rental growth is a great one to watch. We saw cyclical highs in the last quarter, and Dave is tracking the relative historical differential between unit and house rents with an educated hunch that we could see units turn a corner.

Cate Bakos’s gold nugget: Any prospective vendors who are wondering if/when it will be a good time to sell. Cate implores them to hit the pavement and to check out some auctions in their area. They may be pleasantly surprised.

Mike Mortlock’s gold nugget: Mike points out that we’ve seen the data starting to turn around, and he says it’s important to understand data lag. The best way to get a feel for the up-to-the-minute market conditions is to jump into the coal face and experience it in person.

Resources

- Episode 10 – Why your approach and assessment of risk is paramount to property success!

- Episode 12 – Property Cycle Management – why now is always the best time to buy if it suits your personal economy and you have a long-term property plan

- Episode 19 – TIME IN the market v TIMING the market

- Episode 31 – Get rich quick schemes – No.1 of the top 7 Critical Mistakes

- Episode 158 – How interest rate cycles have impacted the property market since 1990 when the RBA first started targeting the cash rate and some predictions on what will happen this time