Listen and subscribe

Android

Android

Cate reports of a very segmented market at present. It is the renovated properties that are getting buyer’s hearts pumping, and it’s not necessarily just the family homes either. Inner-ring properties are also performing well and Cate touched on two challenging auctions that she missed out on – both in high income areas.

Dave discusses an interesting observation within his business. With interest rates rising, and extra complexity of cashflow changes, he is finding that more people are investing in property plans. In tandem with this, his team’s refinancing demand is strong also. This is not so surprising, particularly when the trio consider the lending data in the past week’s market update episode.

Hello gang!

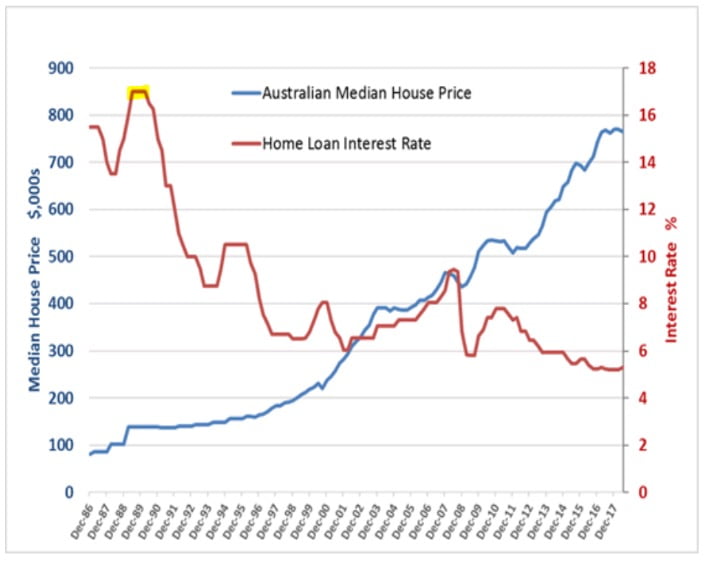

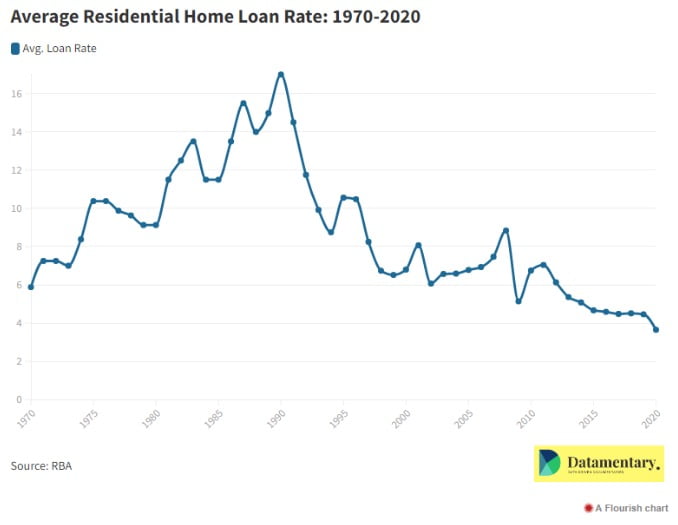

When you quote property appreciation estimates, you usually say something like 7%, based upon the historical average appreciation of the capital cities. That 7% has been made up of a number of factors:

- population growth

- increases in general wealth

- increase in dual income

- foreign investment

- government positive incentives (first homebuyer schemes)

- government mismanagement (not building enough housing, or a mismatch between where the housing is built and where people want to live)

- falling interest rates (since ~ 1990: 17% to 0%, then bouncing back up recently)

Most of the above criteria can be expected to maintain going forward…. except the last one. You will get variations in interest rates going forward, but you likely can’t get that huge tailwind from the drop from mid teens down again. So my question is:

- How much of the 7% return we have seen would be due to falling interest rates, and how should we alter our expectations of returns going forward?

Dave answers this compelling question with the aid of some charts. Looking at what happened prior to 1990 is a telling example of interest rate rises not necessarily correlating with price declines.

- Why do agents ask for personal details?

- How to buyers go about remaining anonymous? Cate shares some ideas for buyers to consider, but she warns those who use bogus names/numbers of the risk they take when the property is of interest.

- What are some of the reasons buyers like to remain anonymous? Cate sheds light on the typical motivations of buyers who feel uncomfortable about giving out their details

- And Pete asks Cate to share with the listeners some of her juiciest and most favourite undercover jobs she has tackled for buyers who have wanted to remain anonymous.

Gold Nuggets

Resources

#9: Why your mortgage strategy is more important than your interest rate?

#77: Understanding the real estate agent behaviours that buyers don’t like

#117: Understanding the real estate agent behaviours that buyers don’t like – Part 2