Listen and subscribe

Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

- A look in the rear view mirror at the first half of 2022. The trio revisit the predictions they made at the beginning of the year. Were they on the money or did they miss the mark? Tune in to find out!

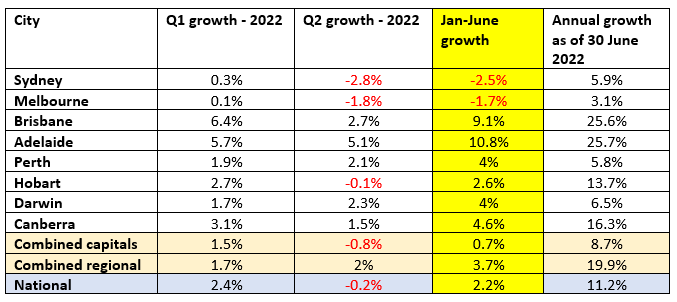

- What will the property market do in 2022? What capital growth rates can we expect around the nation this year? The trio review their predictions and lay their predictions down for the rest of 2022.

- Which capital cities will be the top performers? The trio look into the crystal ball, pour over the data and explain which capitals are expected to top the charts this year. But remember, property is not an asset class that lends itself to short-term investing. The important thing is to plan and strategise for the long-term.

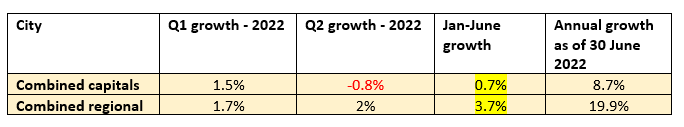

- How will regional locations fare? Regional locations have again outperformed capital cities in the first half of 2022. But will that continue?

- Will investors jump back into the market. Investors have shown strong increases in activity over 2021 but only a slight increase in the first 5 months of 2022. Is this trend likely to continue? The trio share their insights.

- Will APRA intervene in the property market? The RBA has done all the heavy lifting with increasing interest rates, meaning that APRA hasn’t had to intervene to temper the market. But will the government search for ways to intervene to keep rental prices lower and tempt first home buyers back into the market?

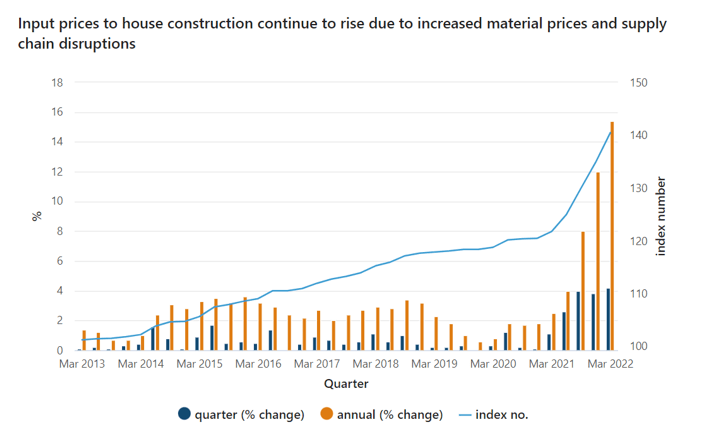

- Developers and building. Residential construction costs continue to climb and builders are flat out with projects, exacerbated by labour shortages, materials shortage and supply chain delays. How long will costs continue to remain high and what impact will this have on the property market?

- The outlook for interest rates? The trio share their predictions for future cash rate rises by the RBA and at what point they each think will the rate rises end.

- Rental market forecasts. Rents have continued to climb and vacancy rates have tightened. The trio discuss the outlook for rental markets for the rest of 2022.

- Sales volumes. After a record breaking year in 2021, sales volumes have lost pace and have trended back towards the five-year average. What does the future have in store? Tune in to find out!

- Risks which could impact the property market. The trio discuss potential risks on the horizon which could impact the property market this year.

- Where is inflation heading? When will inflation peak and what will cause the slow down? The trio discuss and lay their predictions down.

Resources

- Buying at the bottom of the market cycle

- Why Property Values won’t plummet – Cate’s Sunday blog

- #19: Time in the market vs timing the market

- #137: Predictions for 2022 and a look in the rear-view mirror at 2021

- Ep#155: Plotting Australian property market movements from 1970 to now – the impacts of recessions, inflation, financial deregulation, population growth, unemployment rates and analysing what could disrupt the drivers of price increases?

- #158: How interest rate cycles have impacted the property market since 1990 when the RBA first started targeting the cash rate and some predictions on what will happen this time

- #160: Top tips for purchasing in a cooling market – Listener question!

- Understanding your lifestyle goals and strategy

- Four critical mortgage offset strategies

- Five mortgage strategies that can grow your wealth

- How will your mortgages serve you in the long run?

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

1. What will the market do?

Pete – PREDICTION – The market will continue to slow and nationally, property prices will be lower at the end of the year compared to the beginning of the year.

Dave – PREDICTION – Continue to reverse trajectory and because Syd and Melb are the two largest cities the overall Oz market will finish around neutral or in slight negative territory for the year between 0 and 5 per cent.

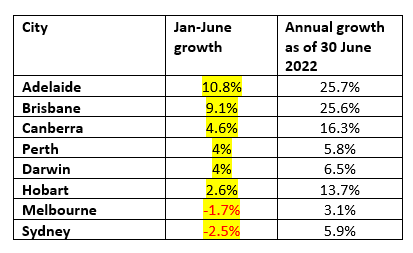

2. Capital city top performers

Pete – PREDICTION – TOP FOUR – Adelaide, Brisbane, Hobart, Regional Areas.

Cate – PREDICTION – Melbourne is going to spring back – I really do think it will play catch up when the international borders reopen and students come back. My rationale relates to the sheer buyer demand. Even in the face of high listing volumes and lots of social distractions in December 2021, Melbourne still only came off 0.1%, which I think is miraculous. Melbourne will be in the top 3 or the top 2. Also –

- Hobart – love affair is still there, no stock and vacancy rates

- Brisbane – every reason to keep performing

- Canberra – what-ever happens in May with the election could get things along or dampen

Dave – PREDICTION – Brisbane momentum will continue to hold on to top spot for 2022, Adelaide has solid momentum, Perth. (subject to Perth borders opening from Feb as has been decided and staying open all year) and highly sought-after coastal areas around the country. But I think once all beachside locations peak, we will see a long flat period of minimal and or negative growth for many years. Hobart continues to have stock shortage, I’ll share that with listeners and socials soon, I did think Melbourne was going to recover and it’s a buying opportunity, but it may play out over more than 1 year. Melbourne’s median value has dropped below Canberra, significantly lower than Sydney historically, I think the stigma of shut downs and also the desire to escape the potential for future covid lockdowns, that not as many will come to Melbourne from interstate in the next 12 months, but it will rebound over time. I’m also worried about stigma from Perth and having borders shut all the time.

Dave – PREDICTION – Per predictions at the start of the year, Bris and Adelaide with Perth a smoky for third.

3. Regional locations

Pete – PREDICTION – Regional areas will outperfrom capital cities again, 3 years in a row – covid-19 and wfh exodus. Not any country town, they have to be within reasonable distance of capital city, lifestyle attributes.

Cate – PREDICTION – Ratio between houses and units, not a severe ratio in regions but was in metro – for metro the gap will close, units will come back.

Regional growth will continue in the significant regional cities, not tiny ones, populations less than 20,000 for a regional town particularly more than 90 mins away from capital city or hub I am really nervous about

Rate of holiday house take up will slow down as international borders open up.

Dave – PREDICTION – Fairly even, the gap could continue to close but not saying that with any confidence. Double whammy of demand with exodus and also the well off in capital cities desire for buying holiday getaways is still there.

Cate – PREDICTION – Anything beyond a 90 min commute will come off. That’s my prediction. Major regions will continue to hold firm

Pete – PREDICTION – lifestyle locations (i.e. sea and tree change areas close to the capital cities) will continue to outperform capital cities in 2022

Dave – PREDICTION – Will begin a multi year hiatus of flat growth that will only recover after the capital cities have moved first.

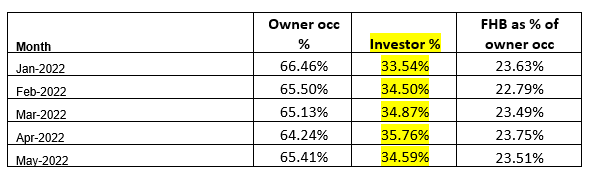

4. Investor numbers

Pete – PREDICTION – Assuming APRA doesn’t place restrictions on investment, investor numbers will continue to increase but not at the same rate as 2021.

Cate – PREDICTION – investor numbers to increase unless the regulator toys with credit policy and restricts it again, but I think they know that it’s a dangerous thing to do in the face of really tight vacancy rates.

Cate – PREDICTION – I think we’ll see some policy to target investors to entice them to be a part of an initiative to offer affordable housing.

Dave – PREDICTION – Yes, continue to increase and this to become a political issue, lots of articles written about it, some kind of policy intervention during the year to slow down – whether it’s APRA broadly making it harder to borrow or something specifically to target investors.

Updated predictions 2022

Cate – PREDICTION – Will continue to increase

Pete – PREDICTION – Continue to increase as yields increase. Yields are increasing mainly due to significant rent increases.

Dave – PREDICTION – Stay broadly level, maybe slight rise.

5. APRA intervention in the property market

Pete – PREDICTION – No

Cate – PREDICTION – Not in 2022. If we have a record runaway market, I predict they’ll do something more aggressive in 2023

Dave – PREDICTION – Yes, especially if rates stay at the same level all year – either APRA restrict lending to some degree OR new government policy designed to increase supply, assist first time buyers OR restrict investor numbers. The media is too powerful nowadays and there will be promises made. The policies that come out will be dependent on which party wins the election.

Updated predictions 2022

Cate – PREDICTION – nil

Pete – PREDICTION – no intervention from APRA as the RBA will continue to increase interest rates, therefore APRA doesn’t need to do anything

Dave – PREDICTION – Nil by APRA, but government will search for ways to intervene and throw money at first time buyers, and strive to find ways to increase supply of properties or fiscal support for renters.

6. Developers and building

Pete – PREDICTION – 2022 will continue to be a tough time to find a tradie or builder. Some builders will go under due to cashflow issues, brought on for supply (eg: if supply is hard to get, you can’t proceed with building, if you can’t do that, you won’t get progress payments)

Cate – PREDICTION – I think builders and materials will remain in tight supply. Renovation/build costs will continue to influence up-sizers to sell/buy as opposed to renovate. I also worry about developers and builders with fixed price contracts – I’m fearful we’ll see a few go under and this will exacerbate the builder shortage issue. We also have so many exciting infrastructure projects and investment going on in the country – I personally know that many in the building trade are opting out and swapping to contract work for the project managers of the successful incumbent infrastructure companies – continued issue which will be a hallmark of 2022 and it will see a lot of people choosing to sell and buy, as opposed to renovate and extend.

Dave – PREDICTION- Builders continue to be very expensive due to the overhang of the home builder continuing and supply chains not untangling as easily as many thought or hoped.

Updated predictions 2022

Cate – PREDICTION – More pain before things ease. I envisage another 12-18 months of pain

Pete – PREDICTION – more builders will continue to broke as labour and material shortages impact on cashflows.

Dave – PREDICTION – Costs will stay high for 12-18 months, and gradually activity will drop off a cliff because of this huge bottleneck period. Remembering the high costs have been caused by supply chains issues and rising commodities and the huge number because of government stimulus targeting renovations for the first time ever = recipe for disaster for some builders/developers.

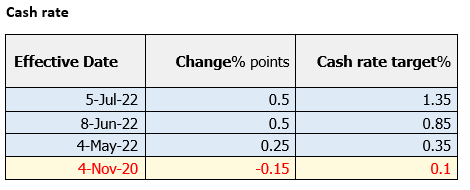

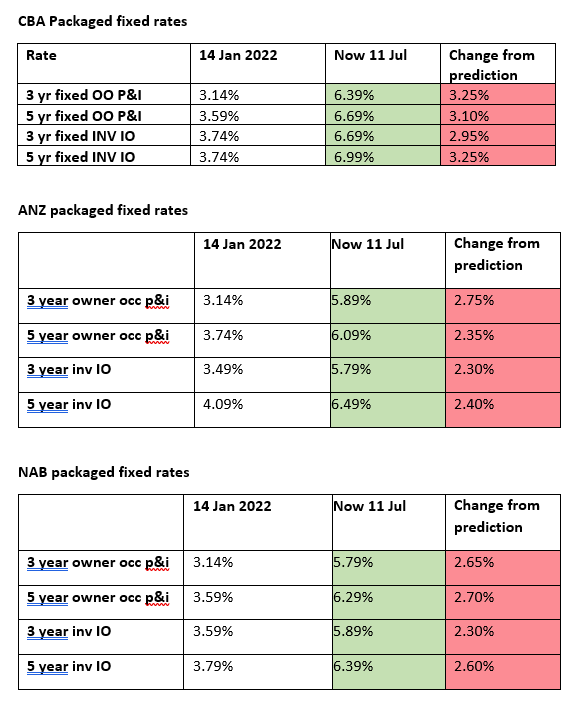

7. Interest rates

Pete – PREDICTION – The cash rate will remain the same

Cate – PREDICTION – No change in 2022 for cash rate unless US inflation becomes a consistent concern. If there is an increase it will be tiny, 0.25% is really big considering the cash rate is now 0.10%. Fixed rates to increase.

Dave – PREDICTION – Remain at the same level, or a rate rise of 0.25% in the second half of the year. RBA to announce the end of QE measure after the first RBA meeting – in Feb 2022.

Dave – PREDICTION – Fixed rates continue to increase further

Dave – PREDICTION – US will increase 3 or more times and that will put pressure on rate increases on countries like Australia and the Aussie $

Updated predictions 2022

Cate – PREDICTION – Likely they’ll oversteer it and we’ll see some cuts in 2023

Pete – PREDICTION – The cash rate will be closer to 2.5% by the end of the year.

Dave – PREDICTION – Unemployment dropping to 3.5% we might see around 2% to 2.5% by the end of the year, overcorrect, and be reducing rates in the second half of next year.

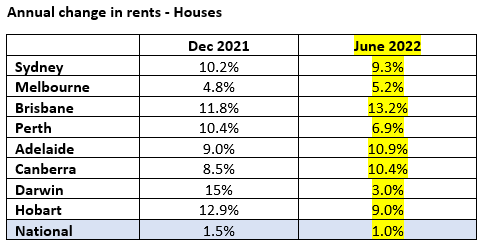

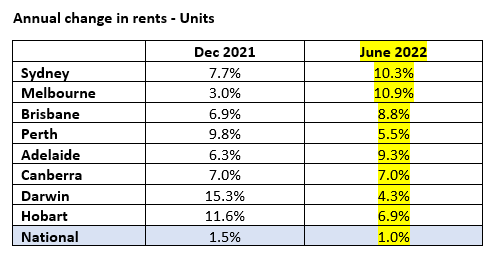

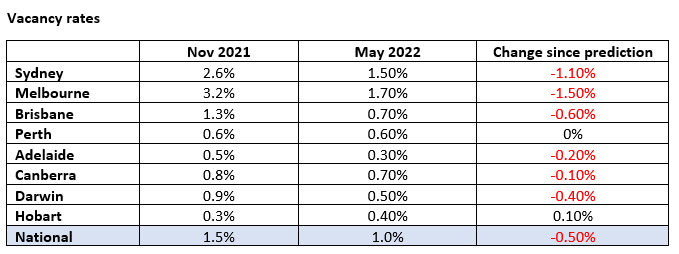

8. Rents/Vacancy rates

Pete – PREDICTION – Rents to continue to increase and vacancy rates to stay extremely low

Cate – PREDICTION – Higher rents and tighter vacancies EVERYWHERE and I feel Melbourne’s bounce back will shock us all.

Dave – PREDICTION – Rents increasing at a more stable pace, but above average. Increasing investor purchases will put downward pressure on this gradually over the year and policy intervention, but the return of international migration and overseas students to more historical numbers will offset this.

Vacancy rates remaining very low which will also be partly due to the lag time of new properties being finished due to slowdown in 2020 of new projects.

Updated predictions 2022

Cate – PREDICTION – I don’t see these easing at all. We have tough renter conditions for many years to come unfortunately

Pete – PREDICTION – rents to continue to increase and vacancy rates continue to decrease as more and more international students and overseas migrants come to Australia.

Dave – PREDICTION – Staying around the same level which is very low.

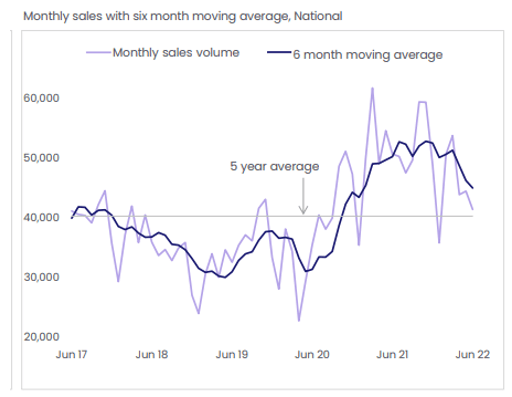

9. Sales volumes

Pete – PREDICTION – Remain high but it won’t be a record year like 2021

Cate – PREDICTION – Higher than previous 12 months, but I predict lower sales volumes. I think we’ll see greedy vendors trying it on, but not all will meet the market. Some of the smaller properties, anything that an upgrader is selling, we’ll see a fair few of those.

Dave – PREDICTION – Reduce, but stay above the average sales volumes from the last 3 to 5 years. 2021 was the highest on record, don’t think that’s going to happen again this year.

Updated predictions 2022

Cate – PREDICTION – Diminished but we’ll still see transactions. Stock could become an issue. Just not as many as the past two years.

Pete – PREDICTION – continue to decrease to below the five-year average

Dave – PREDICTION – Diminished – closer to the 5-year average.

10. Risks which could impact the market

Pete – PREDICTION – Tightening of lending

Cate – PREDICTION –

- Any silly stuff our politicians dream up to win votes,

- APRA tinkering with credit

- US hiking up interest rates

- Builders with fixed price contracts going into receivership

- Another nastier COVID strain than Delta

- Supply chain shocks with essentials and panic buying

Dave – PREDICTION –

- Inflation becoming endemic EG continuing for the first 6 months of the year, and maybe longer.

- New Covid strains and Covid still not becoming something we can live with easily and freely.

- Supply Chains not freeing up as easily as some believe they will.

- US increasing rates multiple times.

- Share market falling in the US and OZ.

- Oz increasing rates early.

- Russia invading Ukraine.

- APRA stepping in again or government placing restrictions on investors.

- Perth and Melbourne are on the nose due to the Government’s harsh approach to lockdown and closed borders causing trust issues for interstate migration.

- Property market moving into negative territory towards the end of the year.

I predict some of the above will occur:

- US rates rising multiple times in 2022. China asking US and others not to raise rates.

- Supply chain issues lingering for at least 6 months, if not all year.

- Inflation challenges lingering for at least 6 months, if not the entire year due to the supply chain issues and the amount of new money printed/QE as part of the unprecedented stimulus of 2020 and 2021 that may yet become a new historical lesson to learn for future economists and governments.

- Further measures to curb lending by APRA or to specifically target investors/help FTB’s by APRA or government.

Updated predictions 2022

Pete – PREDICTION – I think there will be less risks i.e unexpected events, in the second half of the year. Petrol prices are already falling

Dave – PREDICTION –

- Endemic inflation proving harder to reduce

- Continued de-coupling from supply chains from China meaning the cost of many goods rise maintaining inflation for longer

- Higher than expected rate rises

- Not getting enough new migrants to Australia to support the jobs crisis – one advertised job for everyone out of work

- The share and property market hit further lows

- China economy continues to underperform or worse, has some kind of financial crisis.

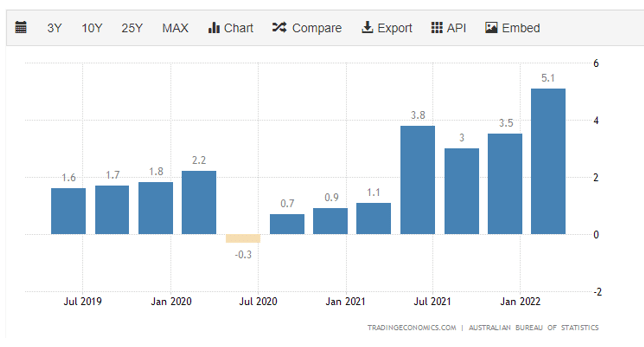

11. Inflation

Dave – PREDICTION – I think inflation will creep up higher than expected and last longer than we expected. Even though I think supply chains due to restriction around human movement and huge demand driven by stimulus are two core reasons. I think improving supply chains will take time and remains somewhat dependant on our ability to manage covid globally. And the amount of stimulus is simply unprecedented, therefore no one knows how it will play out. I think countries on the whole probably provided too much but we shall see. After supposedly not providing enough during the GFC.

Updated predictions 2022

Pete – PREDICTION – Will peak at 7% by the end of the year, rate of inflation will start to slow, influenced by significant increases in interest rates.

Dave – PREDICTION – It will still be an issue for the rest of the year. There is some hope that commodity prices have started to plateau. I think it will get close to other Western nations ahead of us, I would say it would hit the 7s and maybe 8s.

Gold Nuggets

Market Updates

- Pick your advisors wisely! Cate shares a recent experience of working as a Buyer’s Advocate for a friend. The moral of the story? When you’re working with a professional, if you know their work and you trust them, you can get a great outcome, because speed and swift decision making is everything.

- How will the unemployment rate impact rate rises? The latest figures from the ABS show that unemployment has dropped to 3.5%. This has caused quite the stir, with economists now expecting rates to rise by 0.50% next month, maybe even 0.75%. David cautions that the RBA shouldn’t move too hard too fast on rate increases, but it is looking increasingly unlikely that the RBA will move by 25 basis points only. It will be interesting to see what actually occurs next week…

- Rents playing catch up. Increasing rents have been the talk of the town, with rents recently going up significantly. Pete shares some interesting data which highlights that in the last 10 years, rents have not kept up with inflation despite the dramatic increases. How will this inform future policy decisions from the Minister for Housing? We will have to wait and see.