Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

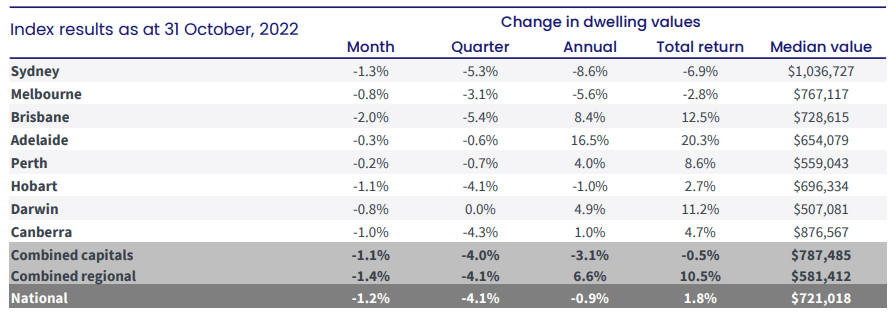

- Positive signs as home value index results show rate of decline slows

Dwelling values’ rate of decline is slowing in all cities except Brisbane, although Dave hints that the pain and fallout from the proposed stamp duty changes is likely to dissipate somewhat. Regions are also now losing value at a slightly higher pace than the combined capitals, although the differential is merely incremental at this stage. Property values have only just hit negative territory over the last twelve months nationally, in fact less than one per cent, and the trio marvel that this is not quite what the media is portraying. Cate makes the point that median is something that listeners all need to understand. Some factors can influence certain price-points to sell more than others and recognising that median represents a mid-point is essential when distilling the data. Is there an elastic change to follow for the COVID-fuelled locations? Time will tell, but the trio acknowledge that the work-from-home phenomenon during COVID has shaped the way many of us now work. Will these work related, structural changes remain though? Only time will tell.

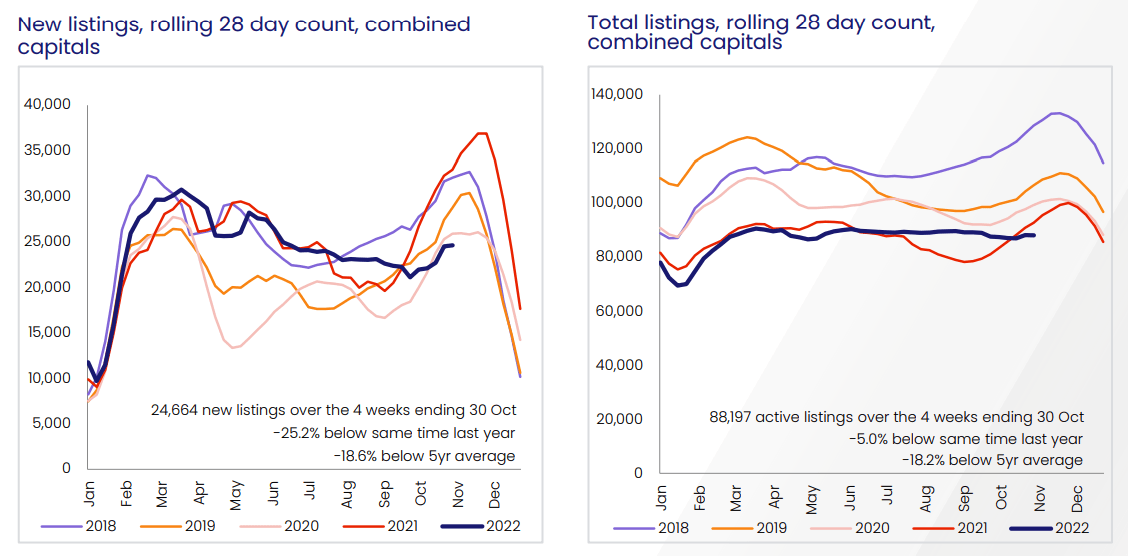

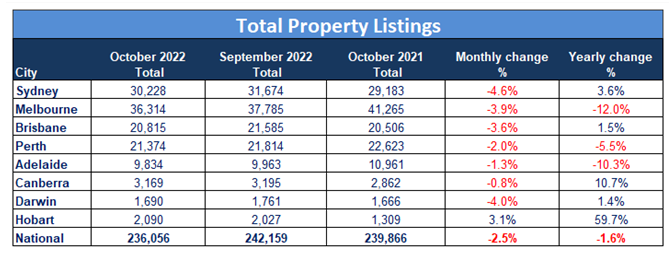

2. Spring listings still slow, bucking typical seasonal trends

Cate leads listeners through the listing figures and points out that all listings and new listings are very low, and the spring market expectations for the typical wave of new listings have not been met. The classic “chicken and egg” issue applies as vendors who may have considered selling are looking at their buying options and holding back in fear of not finding a replacement home. To the point raised earlier about construction levels, (and costs) being impacted negatively, the disparity between listed renovated houses and renovation projects is now problematic. Much of the current and new listings aren’t necessarily what most buyers want. Will the combination of low stock levels and a healthy amount of buyer interest lead to some price growth in the short term? And if so, could this bring more vendors back to the market? The trio ponder what early 2023 could look like for stock levels.

3. What’s the correlation between dwelling sales and consumer confidence?

Pete sheds light on the relationship between the number of dwelling sales and consumer confidence with the aid of a great chart from Tim Lawless, and notes that for 2022, our sales numbers are well below the five year average.

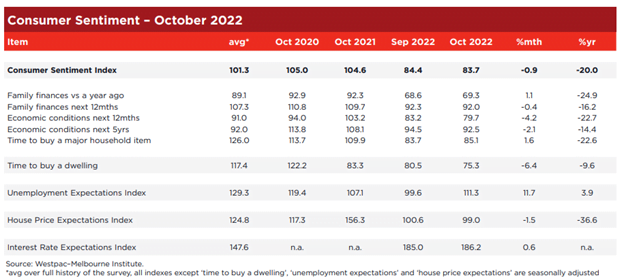

4. How job security is impacting consumer sentiment

Looking over the Westpac sentiment index, Dave takes listeners through some of the interesting changes, and some of the items that are flatlining somewhat. Job security is a noteworthy point, illustrating that the discomfort around rising interest rates and the cost of living is offset somewhat by our perception of a reasonably positive employment outlook.

5. How savings and YOLO factor into inflation

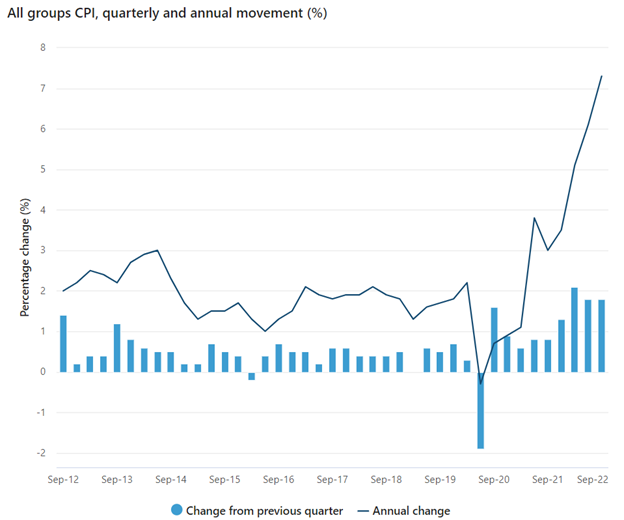

Dave’s insights into our capacity to save during lockdown, contrasted with our zest now for YOLO (you only live once) hints at part of the problem we’re now facing in relation to the inflationary pressures.

6. RBA revises inflation cap

With the recent RBA revision of the inflation cap, the trio ponder what the impact could be, however they all acknowledge the difficulties we currently face with higher fuel and food costs and the ongoing supply chain woes we face globally. Housing inflation is leading the pack, yet these essential elements are not optional when it comes to spending.

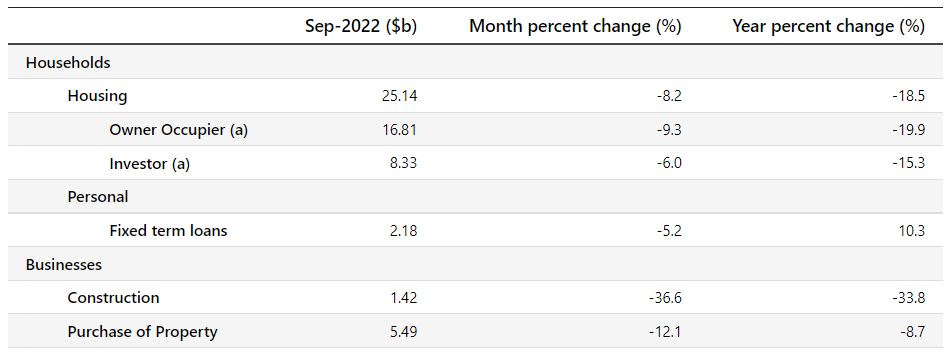

7. New lending continues downward trend, however personal loans on the rise

While lending figures are pointing towards a decrease in new finance commitments, Cate points out that personal debt and unsecured finance is increasing, signalling some potential pain points.

8. What does the bond yield say about where interest rates will end up?

Dave covers where bond yields are currently headed and gives us some optimism that the yields are not moving quite as much as previous months. The three year bond yield currently sits at circa 3.5%, and the ten year bond yield at circa 3.85% support the slowing rate of increase and Dave feels that peak inflation is not too far away. Based on a cash rate of 2.85% currently, it’s likely that an equilibrium rate of somewhere between 3.5% and 4% is on the cards. Cate considers the plight of the Christmas traders if an increase is applied by the RBA in December, and wonders whether it could be the rate increase that really bites. One to watch…

Gold Nuggets

David Johnston – The Property Planner’s Golden nugget: Dave’s gold nugget hinges around his sense that the property market is becoming a leading indicator, and he shares some great examples of how buyers can be savvy when it comes to taking advantage of the conditions we’re navigating.

Cate Bakos – The Property Buyer’s Golden nugget: Cate’s gold nugget relates to the buyers out there who could apply market segmentation to the options out there, and she suggests how some of these segments could be bought advantageously, namely first home buyer stock and land-banking sites. Both of these opportunities have presented as these two buyer contingents have reduced their appetite in the current environment

Resources

- All things property tax – how to understand your deductions at tax time (Ep.55)

- Bad credit behaviour – what doesit mean andhow can it be solved before it’s too late? (Ep.65)

- Setting yourself up to purchase with confidence and why getting your pre-approval in place is more critical than ever (Ep. 78)

- Optimising tax deductions – Top mortgage and loan strategy tips (Ep.87)

- Understanding my land tax (Ep.108)

- How to increase your borrowing power – Learn how investors, first home buyers and upgraders increase capacity (Ep.116)

- How much can I borrow? How borrowing capacity can be impacted, massaged and manipulated (without breaking the rules of course!) (Ep.115)

- Why your Mortgage Strategy is more important than your interest rate! (Ep. 9)

- Five mortgage strategies that can grow your wealth

- Mortgage Strategy 101 – Ep 5. Risk Management

- Why your approach and assessment of risk is paramount to property success! (Ep.10)

- Mortgage Strategy 101 – Ep 4. Optimise Investment Deductions

- Mortgage Strategy 101 – Ep 9. – Maximising your tax deductions by using a redraw facility

- Optimising tax deductions – top mortgage and loan strategy tips

- Mortgage Strategy 101 – Ep 6. Offset Optimisation

- No mortgage strategy – #4 of the top 7 Critical Mistakes (Ep.34)

- All things property tax – how to understand your deductions at tax time (Ep.44)

- Why you need to plan for your future home when buying an investment property

- How to turn your first home into an investment property when upgrading

- How to avert mistakes if you want to rent out your former home

- Why short-term investing has long-term consequences

- Diversification 101 – How and why to plan for diversification within your property portfolio (Ep.43)

- How will your mortgages serve you in the long run?

- Mortgage Strategy 101 – Ep 12. How to keep property as you accumulate!

- Mortgage Strategy 101 – Ep 8. How to keep a stepping stone home when you upgrade

- How our mortgage strategy helps us to hold properties

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.