Android

Android

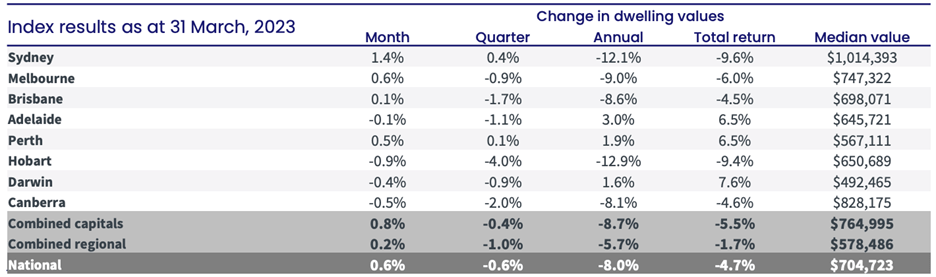

Dave and Cate are both confident that our market strength is sustainable, however Mike chimes in with some context around the quantum of the rebound for the month of March. Cate makes a point about the impact of buyer confidence, (and acceptance) of the rate increases, particularly now that it’s evident the rate increases are easing, inflationary pressures are reducing and skilled migrant arrival numbers are climbing.

“It’s refinancing gold rush times at the moment”, says Mike. “I think double digit growth isn’t out of the question.”

The Trio crack straight into the data as follows.

Source: CoreLogic

Source: CoreLogic2. Peaks to troughs

The sea change/tree change movement is obvious in this following table, but the March uptick signals a recovery in the regions also. Despite the fact that many of our cities are plagued by low stock supply, we have this to thank for placing a floor under price falls.

Cate touches on the elasticity she’s seeing, however when it comes to Lockdown Escapees returning to the city.

Source: CoreLogic

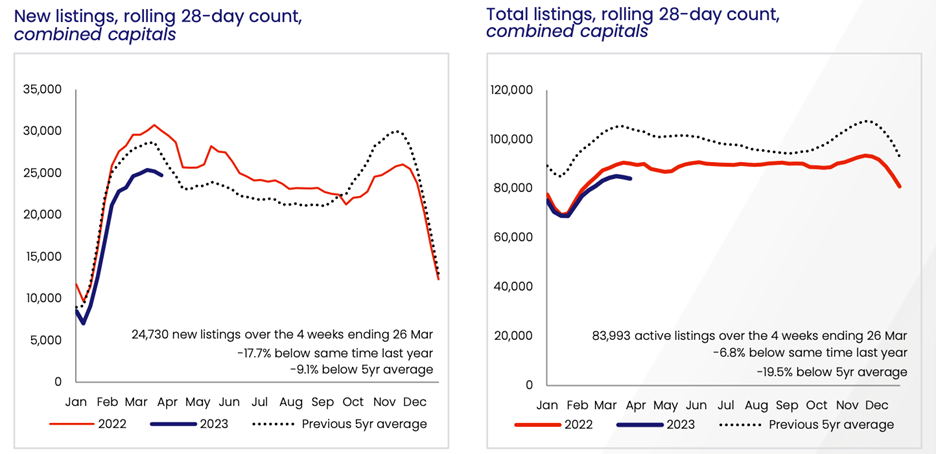

3. Sales volumes are down

Dave shares an interesting thought; the number of sales as a function of total dwellings are diminishing. From stamp duty avoidance to low confidence, and also taking into account the insufficient options for prospective vendors to choose from, our market forces are not conducive to vendor listing activity. Dave predicts a listing rebound in the Spring months of 2023.

Source: CoreLogic

4. Dave confirms the high demand (and activity) for refinancing is evident in the data and at his coalface

5. Rents… Mike shares a scary news item

Mike read about a rental provider advertising a tent inside his living room for rent.

Looking at the rate of change for rents, almost every capital city except for Canberra is exhibiting frightening rates of rental growth. Brisbane is an interesting case to ponder, particularly following the repealed land tax changes and the impact it had on investors.

Mike quotes one of our Property Professor’s pieces of wisdom dating back to August last year. “Rents have grown at only half the rate of inflation for the past decade. With inflation at over 25% for the decade, and yet the property rental growth average sitting at 11%, the trio ponder the concept that rents are just playing catch up

Source: CoreLogic

Source: CoreLogic6. Consumer sentiment on the rebound?

During the discussion, Mike draws attention to the relationship between bond yields and sentiment, and questions whether the consumer sentiment figures are truly indicative of a recovery. Cate proposes that the combination of a “YOLO” mentality and increased savings during lockdown may have postponed the desired effects of the RBA’s rate hikes. It should be noted that an updated Westpac Consumer Sentiment chart for April has been obtained to compare with the previous chart discussed in March on the show.

Source: Westpac Melbourne Institute

Gold Nuggets

Cate Bakos – The Property Buyer’s Golden nugget: For any upgraders who are feeling disconcerted by the lack of housing options to pursue, they should consider a long, (or flexible) settlement period to give themselves time to shop.

David Johnston – The Property Planner’s Golden nugget: Dave feels that late last year was indeed the best time to buy and he notes the markets are broadly in recovery mode now, and Mike agrees with him.

Resources

- Episode 10 – Why your approach and assessment of risk is paramount to property success!

- Episode 12 – Property Cycle Management – why now is always the best time to buy if it suits your personal economy and you have a long-term property plan

- Episode 19 – TIME IN the market v TIMING the market

- Episode 31 – Get rich quick schemes – No.1 of the top 7 Critical Mistakes

- Episode 158 – How interest rate cycles have impacted the property market since 1990 when the RBA first started targeting the cash rate and some predictions on what will happen this time