Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

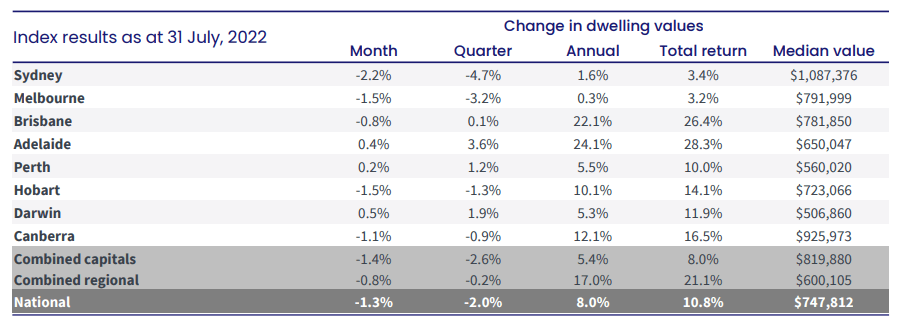

- The latest home value index results

The housing market is now in its third month of decline, nationally dropping by 1.3%, which is comparable to the onset of the GFC in 2008 and downturn in the early 1980s. Sydney is now showing the sharpest value falls in almost 30 years, while Brisbane moves into negative territory for the first time since August 2020.

- Median values are not all what they seem

David shares some interesting facts about capital city housing markets, which means that listeners should be cautious when looking at median dwelling values between capital cities. It’s much more reliable to look at the median value for houses and units separately, but even then, the data can be skewed. The trio explain why.

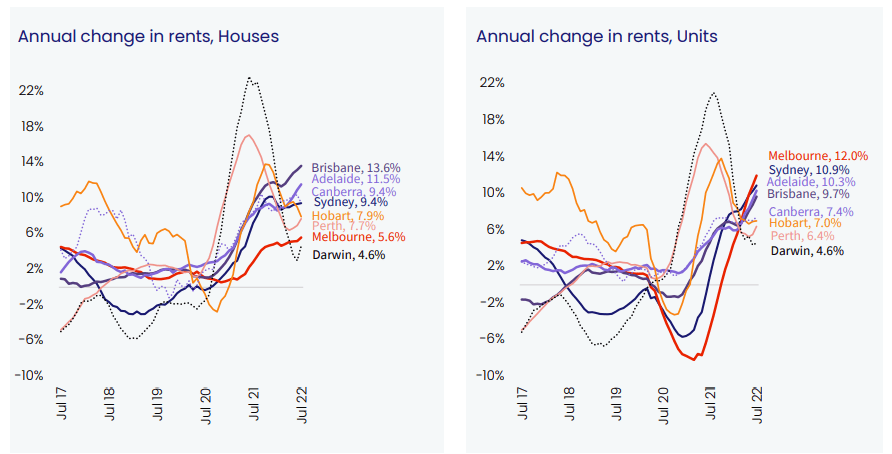

- Rental markets remain extremely tight

Historically, capital growth and rental growth would stay relatively aligned. However, the property boom in 2021 has meant that capital growth has significantly outstripped rental growth and is now going through a period of correction. Rents are likely to continue to run for some period of time, while our property values are still exhibiting a decrease, which in turn, is increasing rental yields.

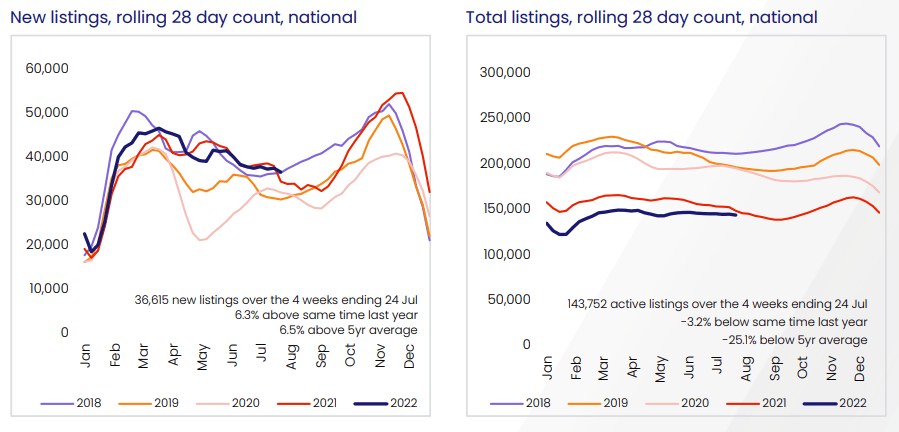

- Distressed listings on the rise

Vendors in distress have increased in seven out of eight states over July. Over the year, the biggest change can be seen in Hobart with a 50% increase in distressed listings, however they are rising from a very low base.

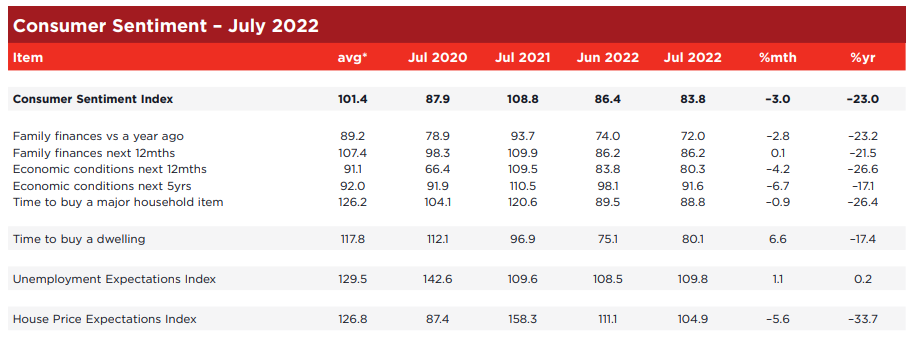

- Consumer sentiment continues to dive, but is now the best time to buy a dwelling?

The trio discuss the latest consumer sentiment data, which as expected is reducing towards 100 for ‘house price expectations’ and is expected to go below 100 in the next month or so. However, the time to buy a dwelling index is showing the early signs of an upswing as home values become more affordable.

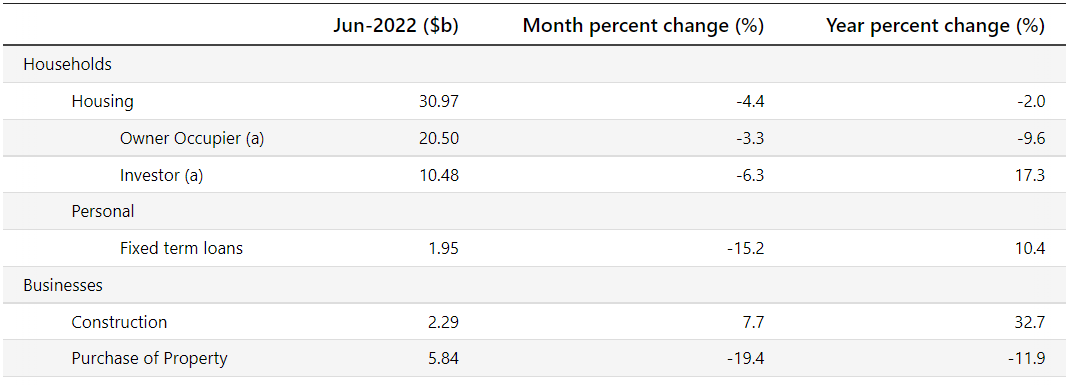

- Lending falls at the fastest rate since May 2020

Total lending fell by 4.4% over June, with first home buyers taking the biggest hit, declining by 10%, the largest decline in 3.5 years. Owner occupiers remained the most resilient, falling by only 3.3%. In other news, certain banks have lowered their 3 and 4 year fixed offerings, as bond yields have peaked and now show a decline, indicating that the expectations for where the equilibrium cash rate will sit has reduced.

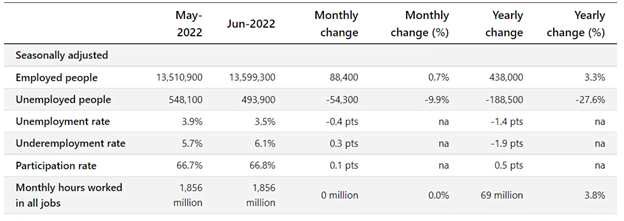

- Unemployment reduces again

The jobless rate has reduced to 3.5%, as businesses desperately look for new employees. There is a growing push to enable retirees to return to work without impacting their pension entitlements to alleviate the pressure … watch this space. Turning the tap on for immigration is also expected to have an impact. In June, the largest amount of student visa applications ever on record was processed.

- Are we done with 0.5% monthly rate increases?

As the cash rate moves towards 2%, we’d hope that as the rate reaches closer to equilibrium, the RBA will slow down on the magnitude of rate increases so as not to over-steer. The trio are hopeful that the we’ve had the last 50 basis point increase, but only time will tell. David shares the news from New Zealand, which was the first nation to increase the cash rate in October 2021 and NZ’s cash rate currently sits at 2.50%.

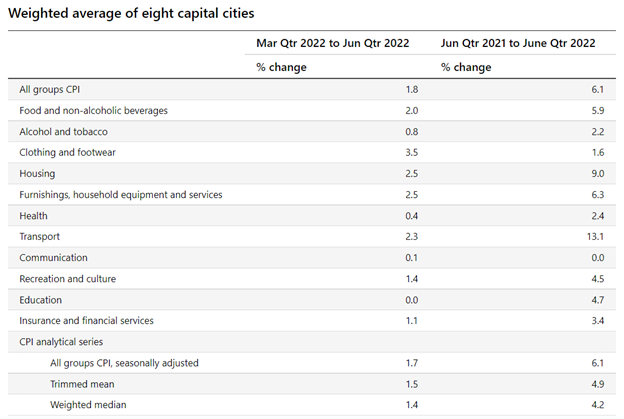

- Inflation surprises on the upside

The latest inflation figures from the ABS show annual inflation rose by 6.1% over the last 12 months, slightly lower than expected. The trimmed mean for annual inflation, which excludes large price rises and falls, increased to 4.9%

Resources

- Interpreting data to uncover an outstanding property and location– and how to sort the gold from the lies, damn lies and statistics! (#8)

- Property Cycle Management – why now is always the best time to buy if it suits your personal economy and you have a long-term property plan (#12)

- Market update – Recovery lessons from recent recessions, the great depression, GFC & Spanish Flu – the market forecast (#46)

- Market update – 2020, that’s a wrap! Who were the property outperformers, the under-achievers and why the market remained resilient (#83)

- Predictions for 2022 and a look in the rear-view mirror at 2021 (#137)

- Why your Mortgage Strategy is more important than your interest rate! (#9)

- Mortgage Strategy 101 – YouTube video series.

Gold Nuggets

Cate Bakos, the Property Buyer’s gold nugget – for all people who are sitting there waiting for the bell to ring, we’re used to the idea of increasing interest rates, unlike the shock of a pandemic or federal election. The rate tightening is happening each month, when is opportunity at it’s greatest? Think it’s now, but look around and ask how could the conditions improve and what will trigger an improvement? How long have buyers got? A few months, but probably not a year.

David Johnston, the Property Planner’s gold nugget – the best buying opportunity will be in spring, what will happen is a rate movement in September, October, November, they generally don’t make a move in December or January. When we’ll have two more quarters of data, the housing market will be showing numbers that impact expenditure and household wealth effect. Sentiment will change because we’ll have a number of months with no rate changes. So spring this year will be the best time to buy.