Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

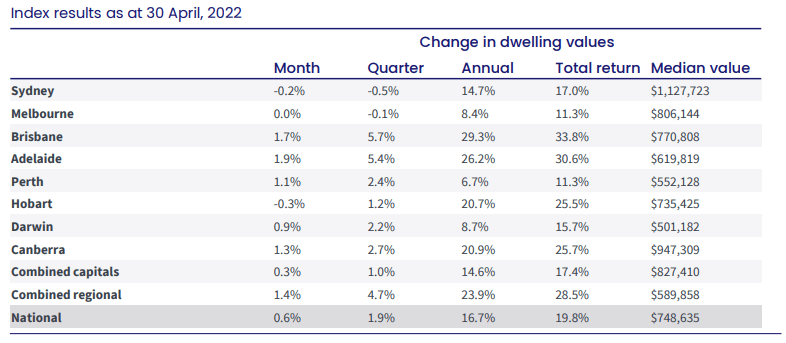

1. Adelaide top of the pops

For the first time in a long time Adelaide is the highest performing capital city for the quarter, topping the charts with 5.7% growth. Adelaide just surpasses Brisbane’s 5.6% recorded quarterly growth.

2. Capital city market cycles diverge

Due to governemnt stimulus during covid lockdowns, all capital cities were simultaneously growing in value. In a return to normality, capital city property growth trajectories have diverged, with cities now at different phases of the property cycle. Sydney is in slightly negative territory, Melbourne plateauing and Hobart now on a downward trend, the worst performing over the month of April. On the other end of the scale, Adelaide and Brisbane are still flying, while Perth has rebounded and is starting to rise.

3. Combined regions continue delivering strong growth

Regional areas have continued the run of solid growth, returning (a combined regions measure) of 1.4% value growth over April while capital cities combined only raised by 0.3%. Over the last 12 months, the regions have returned a whopping 28.5% total return. The trio discuss the peak rate of growth, working from home, migration trends and the insights that can be gleaned. But is this a permanent attraction by home buyers towards the regions?

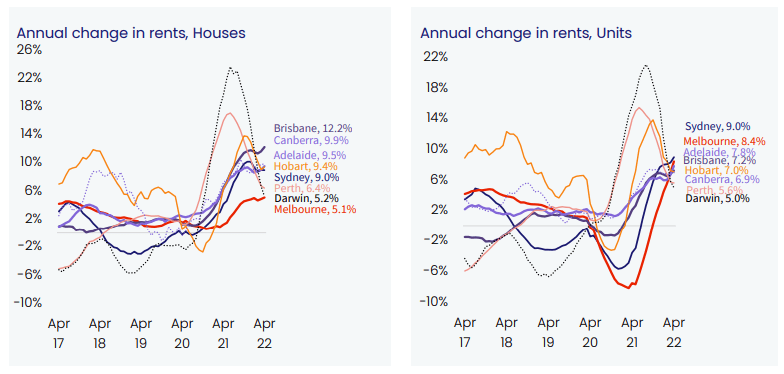

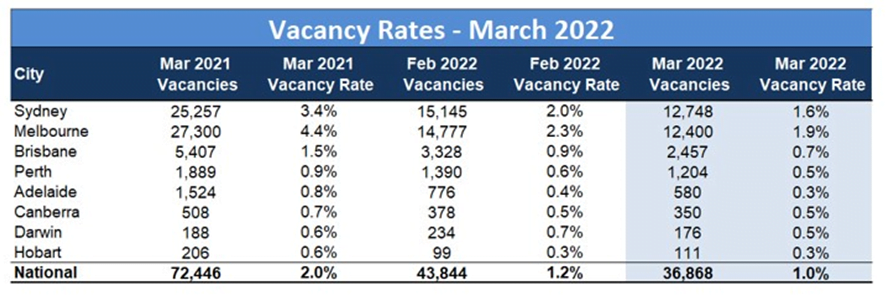

4. Rents and vacancy rates likely to entice investors back into the market

Nationally, vacancy rates have hit 1%, which represents a very tight rental market considering 2% is the norm. Even the poorest performing cities, Sydney and Melbourne, are below 2%, with all other capitals posting below 1%. This is good news for investors, because rental yields, (which have been at an all-time low for a while), are now expected to move back to historical norms.

5. Melbourne and Sydney unit market recovering

A year ago, the Sydney and Melbourne unit market hit rock bottom. In a stellar recovery, unit rents are up by 8% for Melbourne and 9% for Sydney over the last year. This is likely to lead to value growth for units, as investors catch wind of rising rentals, tight vacancy rates and higher rental yields, and jump on the bandwagon.

6. Interest rates rise but the sky is not falling

A deterrent for budding investors is the strong likelihood of rising interest rates over the next year. However, market conditions are still incredibly positive. Property values are up, rents are up and interest rates are still historically very low, even if they do rise by 1%. Don’t forget, lenders factor in rising interest rates and changing market conditions and they add in a buffer to their affordability assessment accordingly.

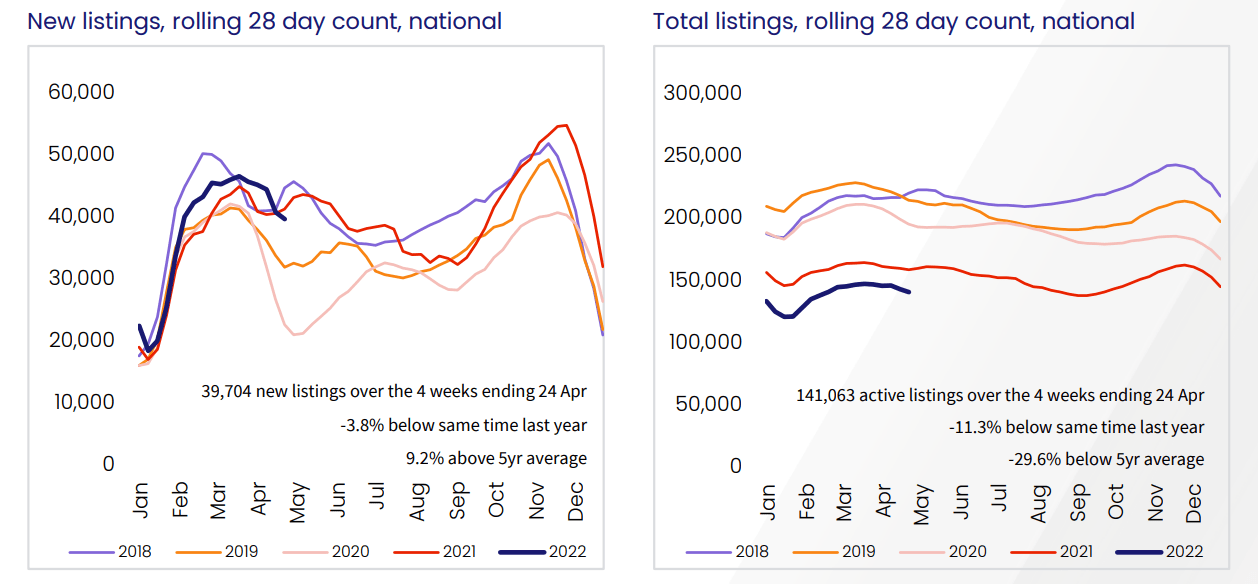

7. Listings drop, is the election to blame?

Nationally, listings volumes have dropped over the last 3 months. People do get nervous with a pending election, even though there are no big ticket property items on the agenda this time around. The trio will be watching this space closely to see what happens with listings post the election and how this imbalance will affect property values.

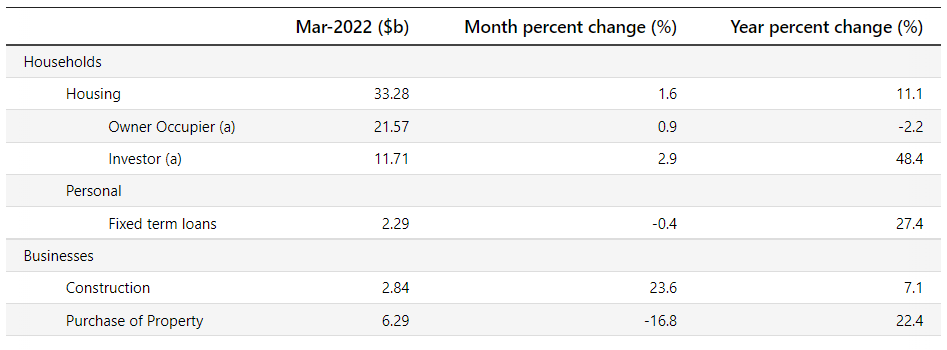

8. Key insights from lending indicators

The level of investors entering the market has started to plateau, while first home buyers are on a slight uptick. Comparing with historical figures, the level of investors and first-time buyers are in a balanced position. The trio discuss the private rental market and the key role it plays in housing those who are not able or not ready to purchase.

9. What does the 3 year bond yield say about where the cash rate is heading?

From 0.1% a year ago, the 3 year bond yield has flown to 3%. Regarding the cash rate, there is much debate about whether 1.5% or 2.5% will be the point of equilibrium in the economy. So, what do bond traders think about where rates are going and how challenging is this to pinpoint?

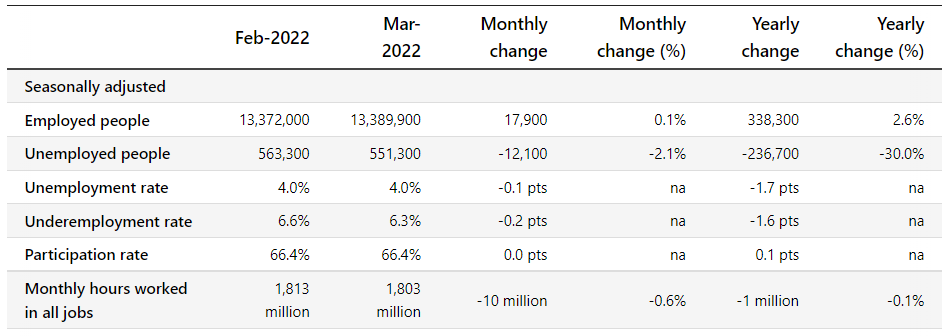

10. Unemployment at a significant long-term low

Although not receiving much attention in the election campaign, almost everyone who wants a job, has a job. The unemployment rate has been rounded at 4% and another reason why rates have increased. Rates go up when the economy is strong and people are spending, and the economy is strong because more people are in jobs than the nation has seen in a long time.

11. Inflation 101

Inflation is the talk of the town and the Property Planner gives our listeners a crash course in why prices are going up. Supply chain difficulties and the war in Ukraine are clear external factors that have caused soaring inflation. But to some extent, inflation has been exacerbated by our government and policy makers. The trio discuss how this has happened and the dangers of stagflation.

Resources

- Interpreting data to uncover an outstanding property and location– and how to sort the gold from the lies, damn lies and statistics! (#8)

- Property Cycle Management – why now is always the best time to buy if it suits your personal economy and you have a long-term property plan (#12)

- Market update – Recovery lessons from recent recessions, the great depression, GFC & Spanish Flu – the market forecast (#46)

- Market update – 2020, that’s a wrap! Who were the property outperformers, the under-achievers and why the market remained resilient (#83)

- Predictions for 2022 and a look in the rear-view mirror at 2021 (#137)

- Why your Mortgage Strategy is more important than your interest rate! (#9)

- Mortgage Strategy 101 – YouTube video series.

Gold Nuggets

David Johnston – The Property Planner’s Golden nugget: there is a bit of nervousness for some buyers. We know historically and we’ve done a great episode with a lot of great data on what’s happened when markets have retracted. But lets say if we get into a flat or retracting market, historically they’ve lasted 3 to 12 months. The worst one on record could last 12 to 24 months. We know that retracting markets are the best time to buy property. The average time frame for people to buy and settle is 1 to 90 or 60 days. Start searching – 30 to 90 days, then settlement another 30 to 90 days. Average time could be 9 months. People over analyse the short term and under analyse the long-term. If you’re thinking about buying property, the most important economy is your own economy and don’t over think it because there are some markets starting to plateau and there are talks of rate rises. If you’re in it for the long-term it’s generally the best time to buy.

Cate Bakos – The Property Buyer’s Golden nugget: my gold nugget relates to people’s emotions about getting into the property market, whether buying a home or buying an investment, clearly the cost of doing business is looking like it could increase, but we need to factor in all the moving parts. If investor you need to be looking at rents, and your maintenance costs, holding costs. If you’re an owner occupier, you need to look at how much you are prepared to pay with your mortgage rates, if there’s sensitivity there, you can think of fixing. Granted fixed rates have moved up. But the price movement shouldn’t put people of investing, just thinking of the metrics in how much they need to outlay and what they’re looking to achieve from their strategy.