Show notes – Predictions for 2022 and a look in the rear-view mirror at 2021 (Ep.137)

In this week’s episode Dave, Cate and Pete take you through a review of their predictions made for 2021 and make their predictions for 2022

Show notes – Top capital cities of 2021, will the stellar rate of growth continue in 2022, is interest in regions here to stay, how rents and vacancy rates continue to entice investors, the outlook for unemployment and inflation and more – Market update (Ep.136)

In this week’s episode Dave, Cate and Pete take you through the latest property and economic data for the month of December.

Show notes – The L to P of property success (Ep.135)

In this week’s episode Dave, Cate and Pete take you through the next section of the property alphabet – L to P! “LMI” what is it and how to reduce it, critical “Mortgage” strategies, “Negative” gearing and making it work for you, effectively using “Offset” accounts, “Positive” gearing and stage of life

Show notes – Behavioural economics 101 – Tackling the biases that impact our property and investment decisions (Ep.134)

In this week’s episode Dave, Cate and Pete take you through a number of cognitive biases that are likely to impact your financial decision making!

Why your mortgage repayment strategy is critical to wealth creation

How much time did you invest in determining whether you will make interest only or principal and interest repayments on your mortgages?

If you are like most people, the answer is just a few minutes and the conversation is usually limited to paying off extra if you have a home loan, and possibly paying interest only for investment debt so that you can claim the interest as a tax deduction.

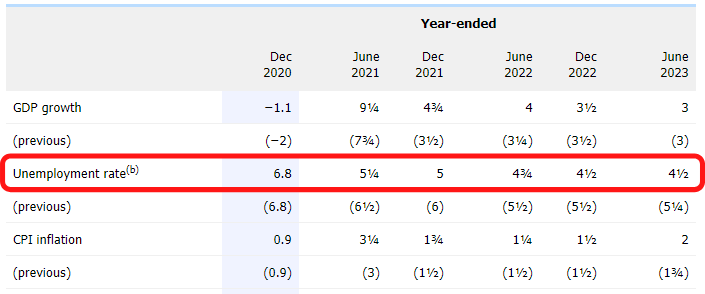

Economics 101 – How inflation, wage growth and unemployment drive RBA rate movement

The RBA have consistently communicated since mid-2020 that rates will remain low until inflation hits the target band and remains there for a sustainable period. So, let’s do a quick 101 education session to connect the dots on what the RBA are saying and why!