The RBA have consistently communicated since mid-2020 that rates will remain low until inflation hits the target band and remains there for a sustainable period. So, let’s do a quick 101 education session to connect the dots on what the RBA are saying and why!

The RBA have consistently communicated since mid-2020 that rates will remain low until inflation hits the target band and remains there for a sustainable period. So, let’s do a quick 101 education session to connect the dots on what the RBA are saying and why!

- Inflation – The target band for inflation is between 2% and 3%.

- Wage growth – For inflation to reach this level, the Reserve Bank believes we require wage growth to be at 3% to 4%.

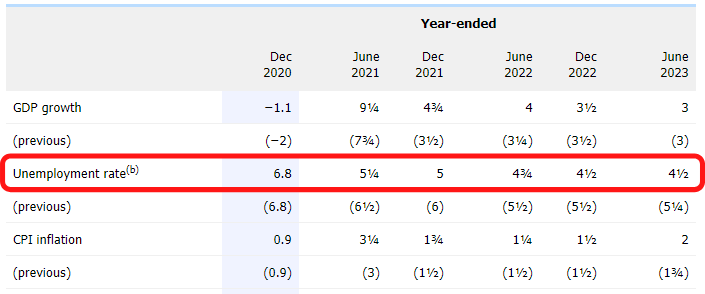

- Unemployment rate – It’s becoming increasingly evident that unemployment needs to drop down to the low 4%’s, or perhaps even the high 3%’s (currently 5.6%) for this kind of wage growth and inflation to occur.

This is unlikely to happen until 2023 or 2024 in the RBA and treasury’s view. And this is best case scenario, as unemployment has not been at 4% since August 2008 prior to the GFC, and wage growth is at record lows of 1.5%, and inflation has been under 3% for the last 9 years.

This is why the RBA central case is that interest rates will remain nailed to the floor until 2023 or 2024.

As you can see in the table, the current forecast from the RBA is for unemployment to reach below 5% by the end of next year and still be 4.5% mid 2023.