Maximizing Investment Potential: Unlock Investment Benefits by Borrowing Up to 106%

Here’s a key strategy for investment borrowing on how to maximise your tax deductions and preserve your savings!

Show notes – Integrating Property Plans with Financial Plans: Tips & Tricks for Self-Employed, Single Parents & Schemes to Get on the Property Ladder (Ep. 254)

The Trio tackle two listeners questions – What to do if your financial planner is anti-property and how to get into property ownership when borrowing capacity is stacked against you!

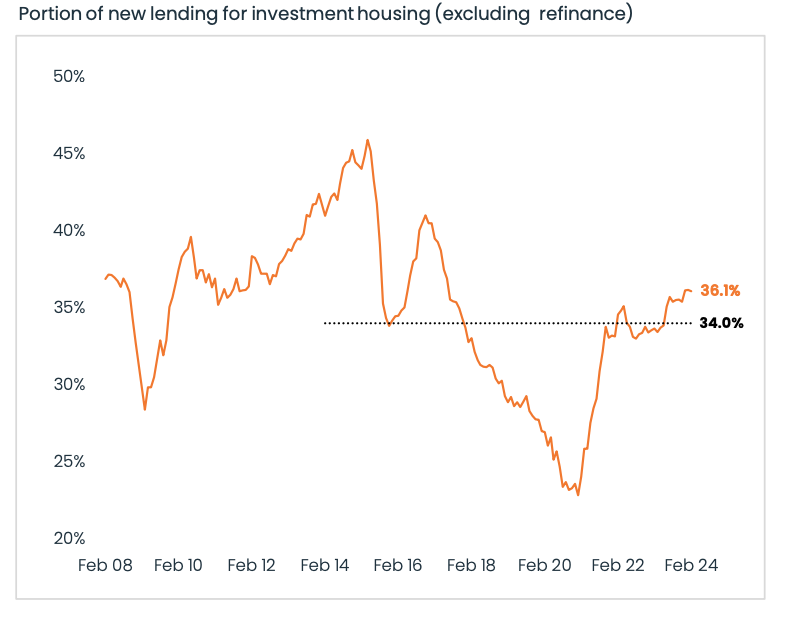

Show notes – Market Update Mar 24 – Migration Trends Driving Values, Taking Stock of Perth, Melbournians Think it’s a Better Time to Buy & Rate Cuts Delayed (Ep.253)

In this week’s episode Dave, Cate and Mike take you through the latest property and economic developments in the month of March 2024

Building Wealth Through Property: Strategic Mortgage Insights

Thinking about investing in property? Here’s a key piece of advice to maximise wealth creation through effective mortgage strategy.

Show notes – The Owner-Occupier vs. Investor Dilemma – Navigating Purchase Strategy, Affordability, Asset Selection & Loan Approval (Ep. 252)

Sally is about to purchase her first home and she has great questions for the Trio about her strategy, options and next steps.

Show notes – Rental Revolution Revealed – Unit Rents Gain Ground on Houses, a Temporary Surge or Lasting Trend? (Ep. 251)

Median rental growth for units have eclipsed that of houses, but why? The Trio unpack their theories