Formerly the “Property Planner, Buyer and Professor” podcast

Listen and subscribe

Android

Android

Highlight Segments

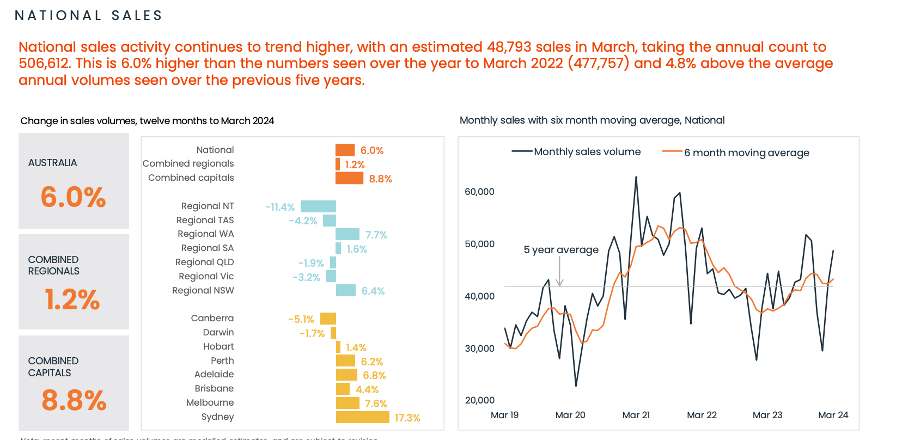

0.58 – Mike launches into the March market update – “Brisbane, Adelaide and Perth are the perennial favourites this quarter!”

7.22 – As Dave says, every city has had growth in the last 12 months. The combined capitals have delivered almost 10% growth in the last year, and very few would have predicted this.

15.51 – Cate puts the Perth discussion back on the table

20.13 – Teaser from next week’s episode…a great first home buyer listener question

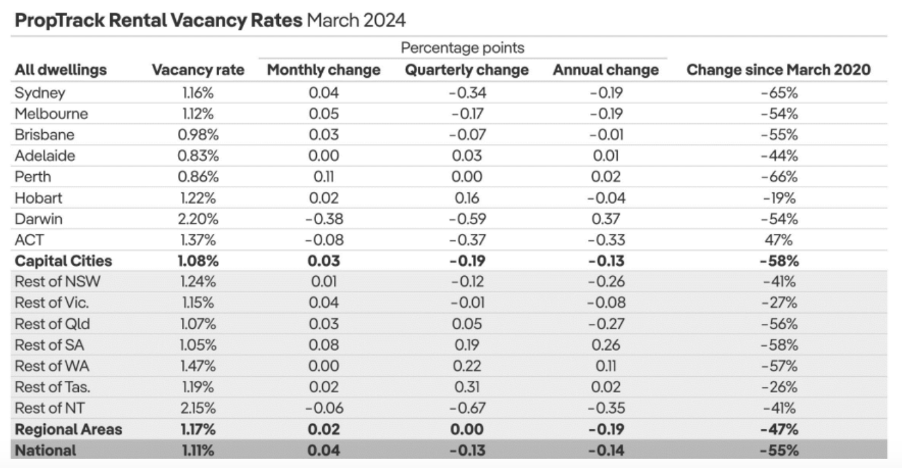

28.53 – National vacancy rates are around just one percent!

38.16 – The Westpac consumer sentiment index has just come out… but what’s changed since last month?

47.45 – Gold nuggets!

Show notes

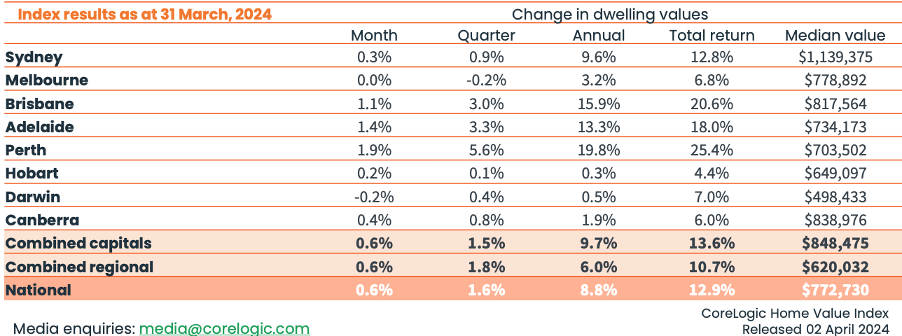

1. Home Value Index Results

The March 2024 data is out, and Cate concedes she got it wrong with her March data predictions. She’s considered the reasons why, and Cate sheds light on a possible reason for this, and it relates to bias.

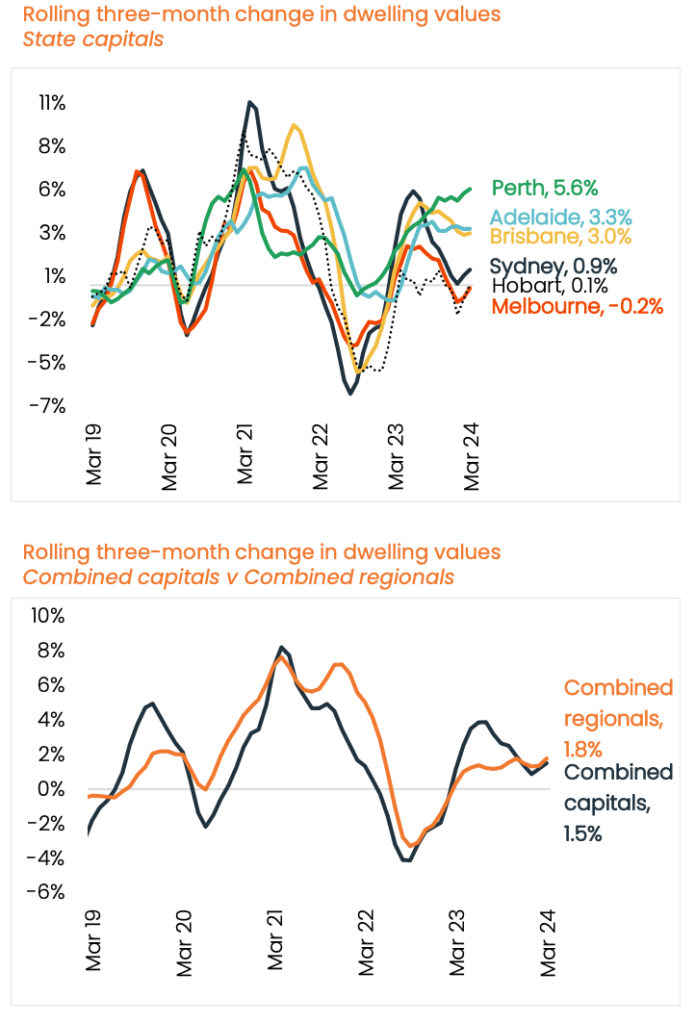

Dave overviews the last twelve months of growth, and he points out that the last year has delivered almost 10% growth for the combined capitals; something very few would have predicted.

Source: CoreLogic

Cate sheds light on some of the enquiry she’s getting, and some of the reasons why investors are turning away from ultra-hot markets. Perth is one example of a hot market, and the Trio explore how much steam remains in the Perth market.

Cate recalls a great article from Pete Koulizos in the recent PIPA Newsletter… he believes that Adelaide will continue to perform. Tune in to hear more…

Source: CoreLogic

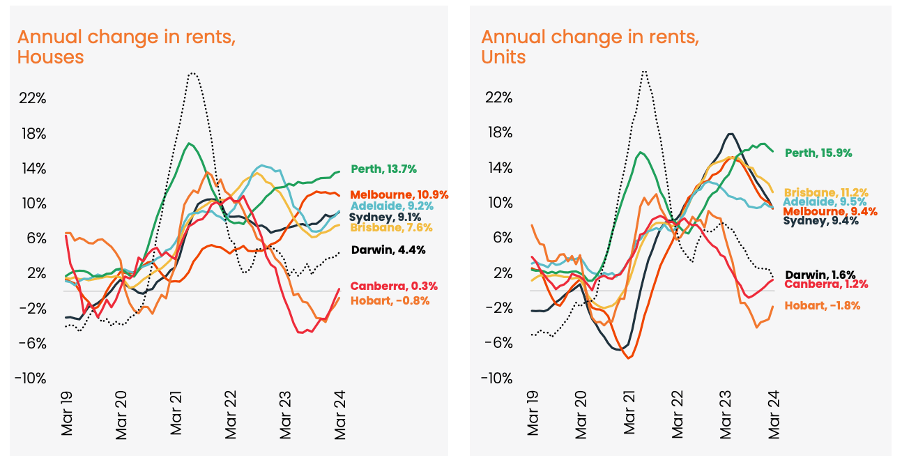

2. Rents

Mike segues into rental performance. Median rents as a function of income highlight the expensive cities for tenants. Cate’s insights into house versus unit rents is interesting also.

Is there a correlation between increased land tax and increasing house rents? Mike explores…

Mike dares to broach the question Perth’s climbing rents and tight vacancy rates; surely this signals that Perth is not at the top of the cycle.

Source: CoreLogic

4. Listings

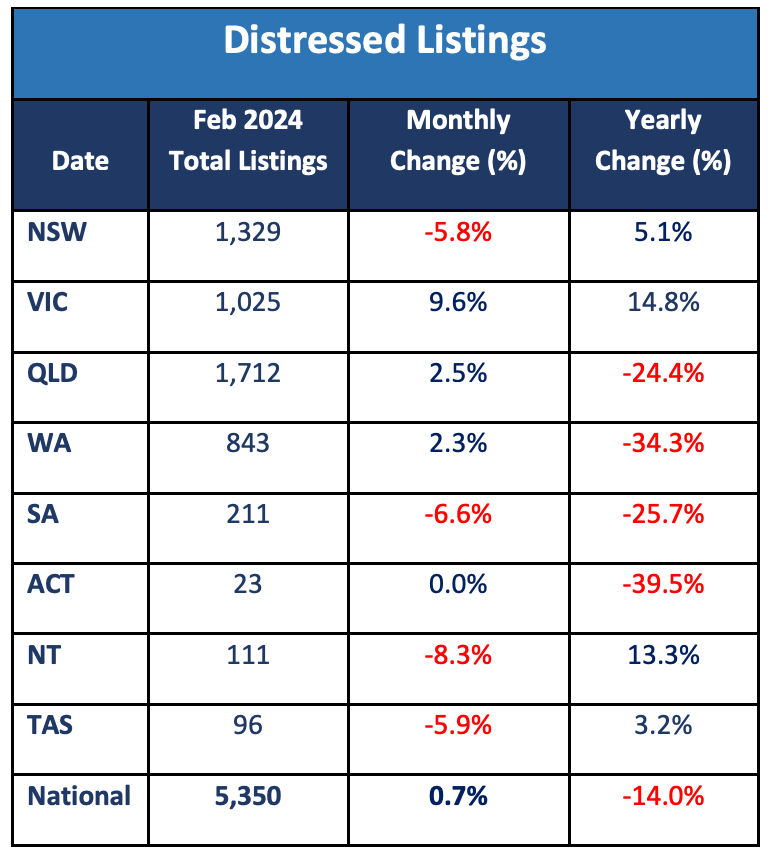

Distressed listings are showing an uptick in a few states, however. Are any jungle drums beating in Victoria? Cate delves into the data and asks the hard questions, although Dave wonders if distressed listings paint a picture of the overall health of a given market. Is there a correlation?

Source: SQM Research

5. Consumer Sentiment

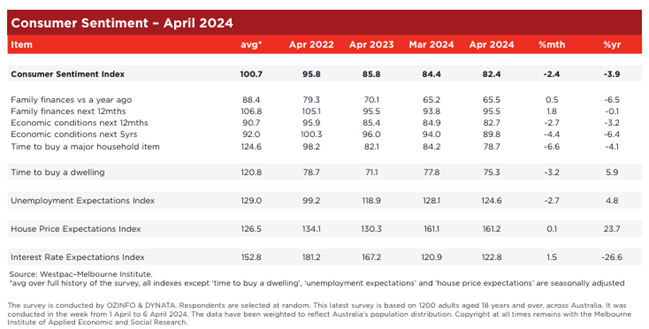

The Westpac consumer sentiment index isn’t showing a dramatically different outlook since last month, but at a state level the indices aren’t all aligned. Dave hints at the cities that are showing a more optimistic outlook.

6. Lending market

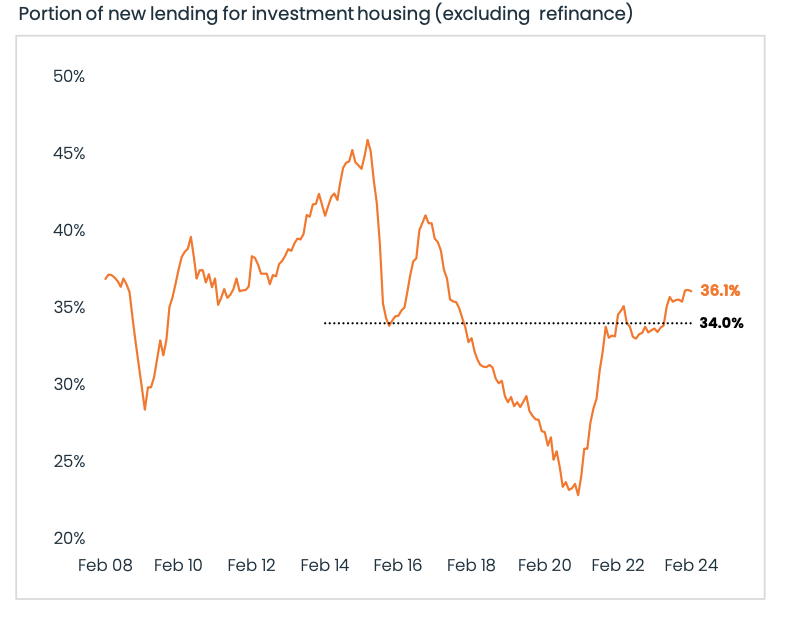

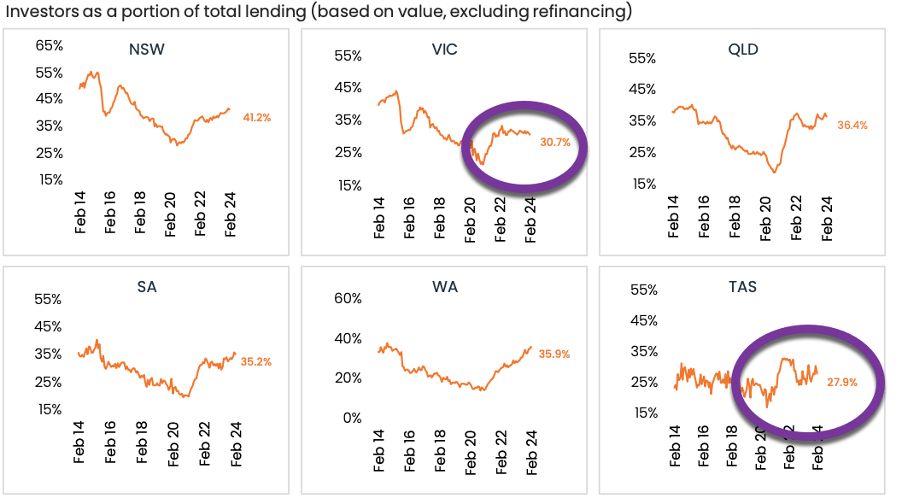

Investment lending has increased despite headwinds such as interest rates, additional taxes and onerous rental reforms.

Source: CoreLogic

This state breakdown of investment activity is intriguing, particularly the disparity between Vic/Tas and the other, hotter states.

Source: CoreLogic

Gold Nuggets

Cate Bakos’s gold nugget: Cate considers how we interpret data, and how bias can be introduced.

Dave Johnston’s gold nugget: “in order to avoid FOMO, understand the right price point for yourself. Work out your strategy and match up the property location and type to your strategy. Look at the long term when you’re making your property decision.

Mike Mortlock’s gold nugget: “You can’t buy the data, you can only buy the property.”

Resources

Ep. 6 – What determines your property strategy?

Ep. 10 – Why your approach and assessment is paramount to property success

Ep. 12 – Property Cycle Management

Ep. 18 – When to hold and when to fold

Ep. 60 – Why established properties out-perform