The Property Planner’s Monthly Market Update: June 2025

Welcome to the Property Planner’s Monthly Market Update, your comprehensive resource for the latest insights and trends in the property and economic landscape!

Show notes – How Long Does It Take to Double Your Property’s Value? – Busting the Myth & How Interest Rates, Supply & Market Fragmentation Changed the Game (Ep. 316)

Is the property cycle broken? The Trio unpack what’s driving today’s property values in a changing market.

REVEALED – Credit Cards: The Hidden Anchor on Your Borrowing Capacity

Boost your borrowing capacity today, learn how credit card limits affect your ability to borrow more for your dream home or investment.

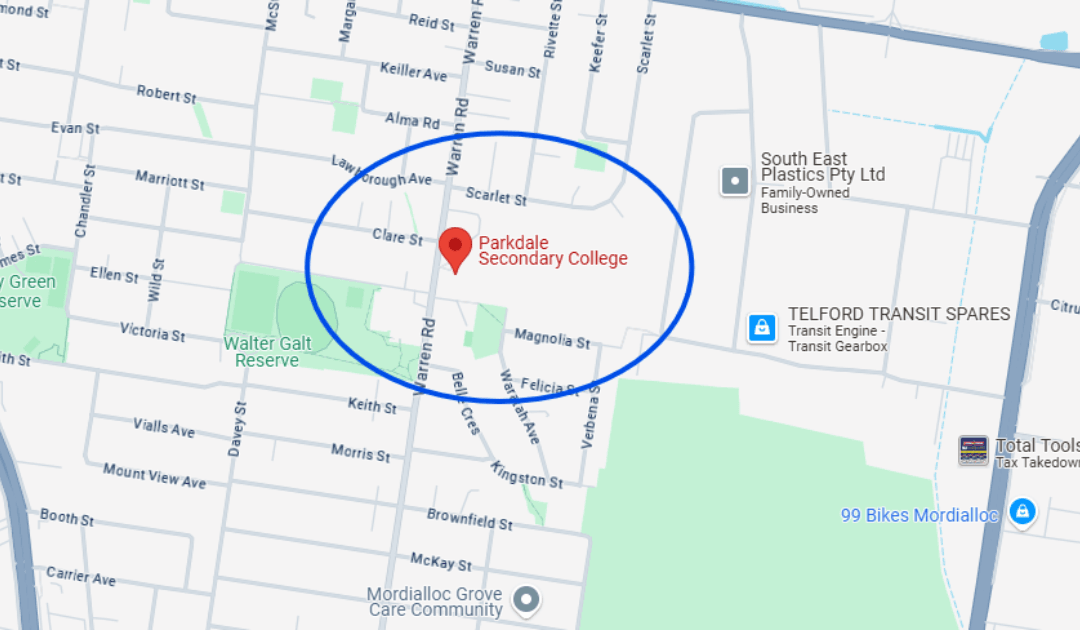

Show notes – The Family Home Puzzle – Balancing Budget, Space, School Zones & Selling Properties to Upgrade (Ep. 315)

Join the Property Trio as they explore strategies for navigating school zone challenges when buying your next family home.

Debt Consolidation: Smart Strategy or Long-Term Trap?

Discover how debt consolidation can improve cash flow and borrowing power, and learn how to minimise interest costs in our latest blog.

Show notes – Market Update May 25 – Darwin Powers On, Melbourne Recovery Continues, All Capitals Rising, Listings & Investor Trends Signal Shift (Ep.314)

In this week’s episode Dave, Cate and Mike take you through the latest property and economic developments in the month of May 2025