Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

1. Do cash rate rises slow down house prices?

The Property Professor shares his recent research covering the last 30 years of cash rate rises and the effect on property prices. Is there a correlation? Listen to find out and see the data here!

2. Housing growth consistent over the last 3 months

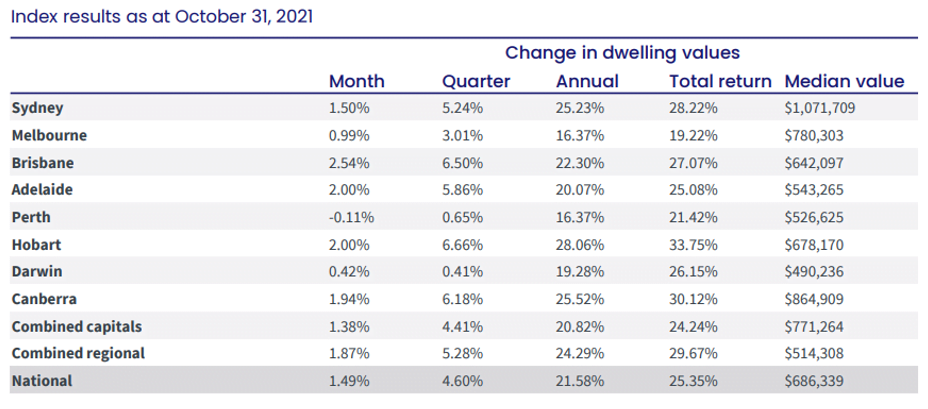

Nationally housing values increased a further 1.5% in October, which is in line with growth over September and August. Although slowing down from March’s peak, 1.5% monthly growth annualised is still a whopping 18%. For most capitals, growth has slowed down since March, except for Adelaide and Brisbane, which have both increased. This is possibly because median values are lower in these cities, while other capital cities become less affordable.

3. Brisbane takes the mantle for highest month on month growth, but Hobart is still going strong

Housing values grew 2.54% in Brisbane, while Hobart is coming down from extreme highs, posting a very strong 2%. Interestingly, property prices in Hobart are quite high relative to the rest of the nation, yet average incomes are 15% lower than national incomes. This points to money from the mainland being invested in Hobart and also indicates retirees and remote working sea-changers embracing the apple isle.

4. Regionals still outperforming capitals

Growth in our regions has consistently been higher than capitals, which is shown in annual, quarterly and monthly growth figures. This indicates there is a still a drive to escape to the regions, but we wish there was more data! Where is the money coming from? The Property Buyer shares her purchasing experiences in Geelong, where three quarters of buyers in the current market are Melbournian.

5. Holiday locations and the great escape

Interest in Queensland and key holiday destinations such as Noosa has continued burgeoning ahead. However, the trio warn that historically holidays locations have big runs of growth and then harsh corrections.

6. Will we see a rush of money to the property market?

The trio discuss the March peak rate of growth and at the time, we were feeling secure and believing covid was behind us. Then comes the delta strain and further lockdowns dampening growth. With vaccination rates picking up, boarders re-opening and holidays around the corner, it seems like we’re heading into another period of optimism that covid is in the rear view mirror.

7. Rental yields reducing as housing values soar

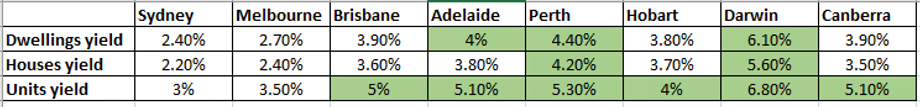

Melbourne unit rental growth, (which reached as low as negative 13%), have finally recovered and is now in positive territory. However, even though rental growth is increasing, this has not kept pace with housing values, so rental yield as a percentage of the value of the property is actually decreasing. The average yield for houses in Sydney and Melbourne is likely as low as it’s ever been, with rental yields at 2.20% and 2.40% respectively. This is one, (of many possible) indicators that the market is heated.

8. Listings on the rise but still at extremely low levels

Compared with the last 6 years, total listings in 2021 are the lowest in number. Old listings (properties that have been on the market for over 180 days) have halved year on year for most capital cities, as old stock is snapped up. Thankfully, new listings have seen an uptick over October with the end of Melbourne and Sydney lockdowns and vendor confidence in the spring market conditions increasing.

9. Consumer sentiment in the property market dips

The Westpac-Melbourne Institute ‘time to buy a dwelling index’ has fallen to 83.3 points, down from 96 points in September. This indicates many are feeling more apprehensive about now being a good time to purchase property. But this doesn’t mean that people will stop buying. Fear of missing out continues and it could be 6 months or so before we see the negative sentiment play out. On the other hand, the house price expectations index is at a whopping 156, showing that people think house prices are very high.

10. Investors on the rise

Lending indicators from the ABS show that owner occupied loans have fallen by 2.7%, while investors have increased 1.4%. This takes total investor lending to 31.74%, which has been creeping up consistently over the past few months. However, investor lending is still below 2015 levels, a point in time when APRA intervened and lending for investors reached 46%.

11. Inflation targets met, will interest rates rise sooner?

Inflation reached 2.1%, which is within the RBA’s target band of 2-3%. In the latest RBA meeting, the board has decided to cease targeting the 3-year bond yield, which essentially keeps 3 year fixed rates lower. This measure has come earlier than expected. The RBA has adjusted it’s position on maintaining a low cash rate until 2024, saying that it’s now plausible that the cash rate could increase in the back half of 2023. However, money markets and economists think it could be as early as the second half of 2022.

Resources

- Do cash rate rises slow down house prices?

- Cash rate and house price data

- How to develop your own property plan – start with the end in mind (#4)

- Interpreting data to uncover an outstanding property and location– and how to sort the gold from the lies, damn lies and statistics! (#8)

- Time in the market vs Timing the market (#19)

- How many properties do you need to retire wealthy? (#27)

- What determines your property strategy (#6)

- Why the family home is often the biggest piece of the investment puzzle (#22)

- The great debate! Capital Growth v Cash flow – which investment strategy is superior? (#56)

- Preparing for auction #2 (#98)

- The winner’s curse and how to avoid it (#94)

- The Seven secret steps to buying a house (#93)

- Property Planning your next purchase – critical considerations and why modelling financial outcomes is vital to success (#92)

- Goal setting fundamentals for property success (#82)

- Why your Mortgage Strategy is more important than your interest rate! (#9)

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Gold Nuggets

Cate Bakos – The Property Buyer’s Golden nugget: could a 1% increase create real issues in the property market? I think the overview Pete gave us in his analysis, but the cash rate rises were coming off a higher base. If we did have interest rate movements of 1%, if someone is paying 3% and rates increased by 1%, the rate has gone up by 33%, which is significant. How likely is it that we’ll have a solid interest rate movement or collection of short interest rate increases, I don’t think that’s likely.

David Johnston – The Property Planner’s Golden nugget: insight into why we look at the macro picture, other nations economies and geopolitical issues that can flow through to the Australian economy and ultimately, the property market and property prices. When will interest rates rise? That will be driven by inflation, but inflation hasn’t occurred for some time. So it’s a really interesting time to be watching this and looking at what’s causing inflation, is it long-lasting or temporary, is it off the back of limited supply of people being able to travel, the stimulus provided by countries around the world, one off factors due to covid pandemic that is causing this? What are other countries doing – lifting interest rates. What is the impact of supply of semi-conductors and how will that impact cars and inflation and ultimately interest rate rises.