In this week’s episode, Dave, Cate and Pete take you through:

- Value growth continues to lose steam

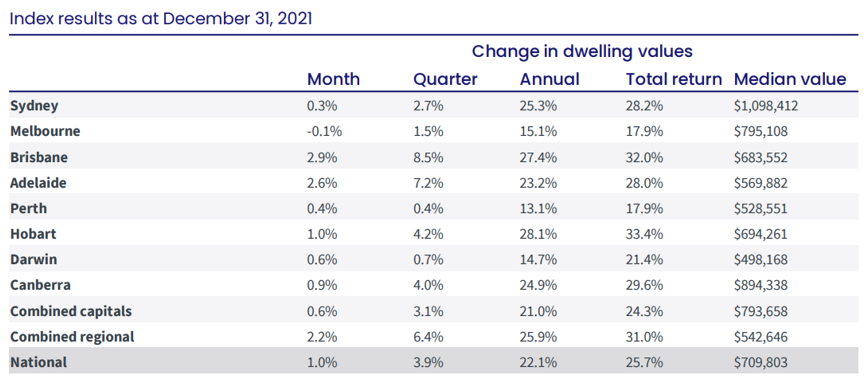

Values increased nationally 1% over December, which is the lowest level of monthly growth since January 2021. The trio share a sneak peak of some of their predictions for 2022.

Source – CoreLogic 4 Jan 2022

- A look at our capital cities

Brisbane and Adelaide were the outperformers for the final month, and each have been gaining pace since October. While Melbourne had a slightly negative month, Sydney growth reduced from prior months to 0.3%, proving again that December can be one of the best times to buy in our two biggest cities.

- How regions have performed

For 2 years in a row, regions have outperformed capital cities, reaching a whopping 25.9% growth over 2021. But is this trend here to stay? The trio share their insights.

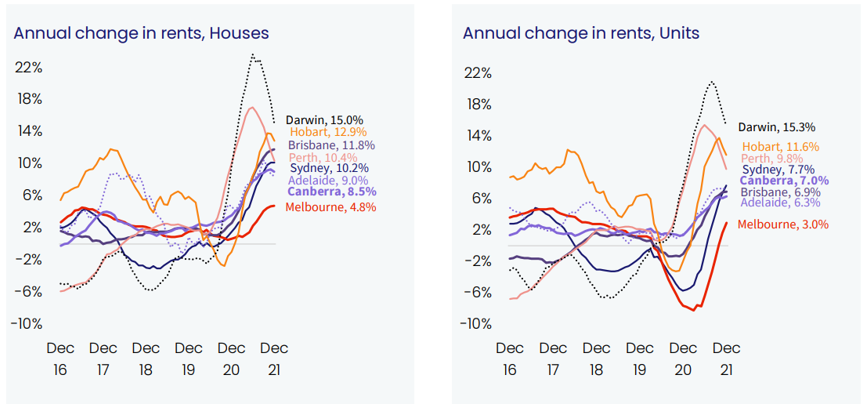

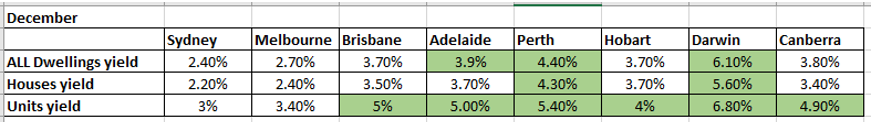

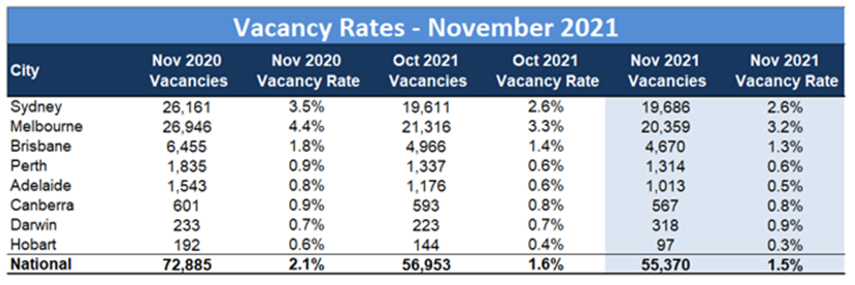

- Rental markets

With vacancy rates continuing to tighten, rental markets in just about every city (metro and regional) will become increasingly competitive. This will place pressure on governments to address rental stock shortage, although investor activity may provide some respite as investor numbers have been steadily increasing over 2021.

Source – CoreLogic 4 Jan 2022

Source – CoreLogic 4 Jan 2022

Source – SQM Research 14 Dec 2021

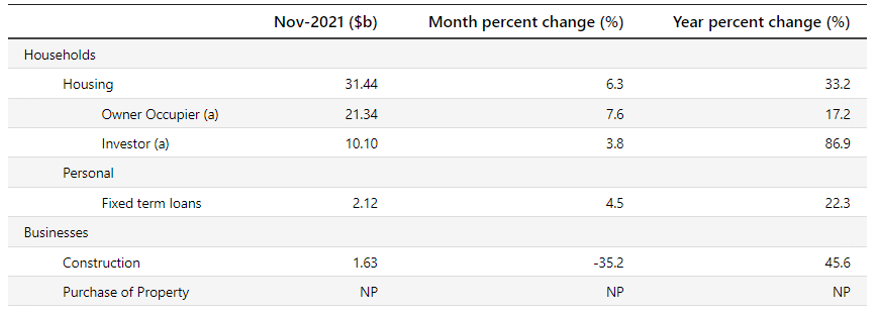

- Investors gain foothold in the market

Investor lending is now up to 32.1% in November, climbing steadily from 29.11% in July. With an election looming, it will be interesting to see what policies the incumbent government proposes to walk the tight rope between supporting mum and dad investors and championing for first home buyers. The trio watch this space with keen interest.

Source – ABS 14 Jan 2022

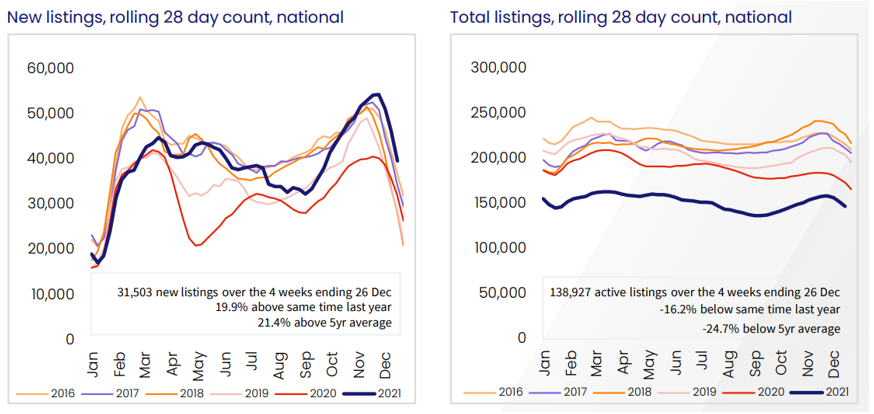

- New listings flood the market

New stock on the market was the highest since 2016, however the total listings in December were still significantly lower than the five-year average. This indicates that buyers are still heavily active in the market, snapping up new and old stock. Will these competitive conditions continue 2022?

Source – CoreLogic 4 Jan 2022

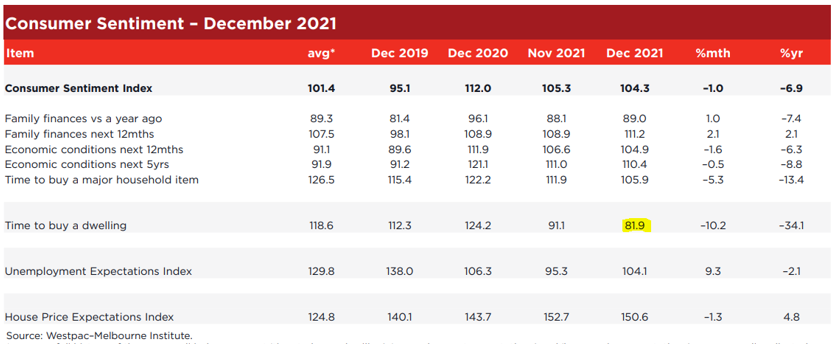

- Consumer sentiment on purchasing a property continue to languish?

The ‘Time to Buy a Dwelling Index’ shows consumer sentiment dropping to the lowest point at 81.9 over December. However, the house price expectations index is up at 150, indicating that the majority of Australians are optimistic about property prices increasing. This general trend reflects the current state of play, that it’s a bad time to purchase a home because prices are soaring. However, buyers will need to harness their reluctance to compete hard, and balance this with the fear of a market outpacing them.

Source – Westpac Melbourne Institute 15 Dec 2021

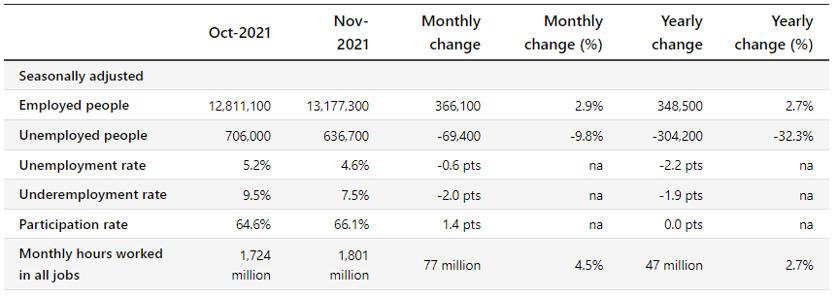

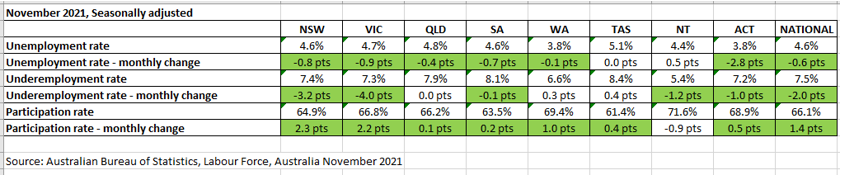

- Unemployment improves but is inflation here to stay?

The unemployment rate has decreased back to 4.6%, back in line with September after increasing to 5.2% in October and is expected to keep reducing. Will the Australian story follow the US, (which is now down to 3.9% unemployment with inflation hitting 5.5%) or is our inflation transitory? The trio discuss the early signs of expected US rate increases and how this could impact the property market.

Source – ABS 16 Dec 2022

Source – ABS 16 Dec 2022

Resources

- Has the market peaked?

- Interest rate speculation

- How to develop your own property plan – start with the end in mind (#4)

- Interpreting data to uncover an outstanding property and location– and how to sort the gold from the lies, damn lies and statistics! (#8)

- Time in the market vs Timing the market (#19)

- How many properties do you need to retire wealthy? (#27)

- What determines your property strategy (#6)

- Why the family home is often the biggest piece of the investment puzzle (#22)

- The great debate! Capital Growth v Cash flow – which investment strategy is superior? (#56)

- Preparing for auction #2 (#98)

- The winner’s curse and how to avoid it (#94)

- The Seven secret steps to buying a house (#93)

- Property Planning your next purchase – critical considerations and why modelling financial outcomes is vital to success (#92)

- Goal setting fundamentals for property success (#82)

- Why your Mortgage Strategy is more important than your interest rate! (#9)

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Gold nuggets

Cate Bakos – The Property Buyer’s Golden nugget: when it comes to data, being informed is so valuable. Remember that monthly data is influenced by all kinds of things. Holiday seasons and Christmas is a case and point, always keep an eye on quarterly and annual data.

David Johnston – The Property Planner’s Golden nugget: the trend is your friend. The monthly data, look at it in the bigger picture of the trend, whether 3 months, 6 months or 12 months and then you start to see the broader perspective.