Got a question for the trio?

Episode Highlights

2.00 – Mike introduces this week’s listener question

6.55 – Mike asks Dave if Ben can have his cake and eat it to, and Dave has an important question for Ben.

10.37 – “Dave, what stages of life do you typically see your clients facing these conundrums?”

15.05 – Cate’s simple solution sounds too good to be true, but can it be done? And what are Ben’s challenges. Dave weighs in with a detailed solution – it requires some intensive concentration though!

20.37 – Sneak peek into next week’s episode – our 2024 predictions

30.40 – Mike explores the impact of offset against principal and interest loans

35.40. – And our gold nuggets!

Show notes

This week’s episode features a great listener question from Ben.

“Offset account question I am grappling with. I am nearing retirement and have three investment properties in NE Melbourne, two of which are IO and fully offset. Third is IO and partially offset. I have a PPOR P&I loan with and offset account set up.

I continually go round the conundrum of whether to park my funds offset against investment IO loans or the PPOR P&I loan. I fully understand the extra cash flow I get by not paying interest on the IO loans, and effectively have the rent as income (taxable).

And offsetting P&I PPOR actually makes no difference to my P&L unless I do something downstream – sell or refinance. Any thoughts?”

Cate offers the layman’s view on Ben’s predicament.

My first question would be: “Do you have enough savings to 100% offset your home loan?”

- If the answer is yes, it’s pretty simple, he should do that because the home loan after tax assuming he is earning more than $18,201 after tax deductions per annum is better off being 100% offset.

- I suspect it is possible based on experience given we know he is approaching retirement, has fully offset two investment loans and has another investment loan partially offset.

What stages of life do you typically see clients having a similar conundrum, and what events can initiate this conundrum?

We actually see this quite a lot and with people in all stages of life, once they have debt on an investment and the home, because it often comes down to a lack of understanding the implications of putting the funds against the home loan or the investment loan.

Ben does have options, but some of these options won’t be as easy to roll out one he officially stops working, because refinancing may require his employment income for servicing. Dave and Cate, let’s assume this is the case. Ben has the following options to consider:

Refinance his PPOR to IO. This would then let him adjust his minimum repayments with offset activity. How easy is this? what are the challenges?

- Some lenders won’t allow IO for PPOR

- Can he 100% offset his home loan?

- At what stage does the offset sit at the same net position as the loan?

And how does this then relate to a new buffer in redraw?

However, a perceived problem with this is likely to be that offsetting a P&I loan doesn’t actually reduce your repayment, but for an I/O it does, therefore he doesn’t think there is any cash flow benefit.

The next area of confusion is that people struggle to mentally conceptualise many aspects of how offsets, redraws, etc work.

In this case even if he can’t change the repayment from P&I to interest only (due to his age and inability to refinance), the bank or many mortgage brokers will have told him this, and therefore he needs to keep making the high P&I repayment.

However, if he is 100% offset and making P&I repayments, his net position doesn’t actually change, only his buffer. But many bankers and brokers won’t think of this, and therefore will not explain it.

It works like this – if his home loan balance is $500,000, and he puts $500,000 in offset, and his minimum monthly P&I repayment is $3,000, what happens is he is charged zero interest, and each month his home loan will come down to $497,000, and his offset will reduce to $497,000 (where the repayment is coming from) and zero interest will be charged.

Because of this, the home loan will be paid off a lot faster and he will also be building up a buffer in redraw because he is making principal repayments over the required amount (the full repayment is principal), that will partially cancel out the reduction in his offset balance. As you can see, this is a little complex, but not that complex that almost everyone can understand this IF you are smart enough as a broker or banker to be alert to this which most aren’t.

Another option Ben has is to refinance his PPOR and reset his debt balance. This will reduce his minimum P&I repayment, but it will extinguish the flexibility of his funds on hand, as he places the savings down as principle. Dave, what are the pro’s and cons of this?

- Higher interest payments over the long term

- Loss of deductions if he wants to change the PPOR over to an IP if this is in the plan

- Loss of flexibility with the savings if he does have other acquisition plans

- Higher immediate positive cashflow

- Less tax on his rental earnings given some of the capital is against his house as opposed to his third IP

And the obvious option, which isn’t really pleasing to Ben at present is to keep paying down his P&I repayments at the standard repayment rate, and enjoy the idea of paying less interest over the life of the loan. It’s a case of delayed gratification. But sometimes we can’t afford to delay gratification. I often see investors making cashflow decisions that don’t make the most financial sense, long term. Pressures like we discussed earlier in the show can contribute to cashflow preservation decisions.

The overarching important message relates to the fact that Ben should be offsetting his PPOR first and foremost. Can you talk our listeners through this?

Mostly we find where people go wrong, is that they take a more simplistic approach on face value, where they either look at the numbers behind the cash flow vs tax benefits, but more commonly is that they only take a look at the interest rate.

People can see that the rate they are paying on the home loan is lower than the rate they are paying on the investment loan – so they automatically think they should pay off the investment loan or offset the investment loan first because, just focusing on the interest rate, it appears to be the more expensive debt.

But appearances can be misleading, and we actually recommend (if monthly cash flow is not an issue), to offset the home loan or pay down the home loan first.

Ultimately, this is because the interest expense on the investment loan is claimable against your taxable income and therefore the true cost of the interest isn’t the interest rate, it is the interest rate LESS the tax deduction (which is determined by your tax bracket.)

Taxable income brakets

$18,201 – $45,000 19c

$45,001 – $120,000 $5,092 plus 32.5c

$120,001 – $180,000 $29,467 plus 37c

$180,001 and over $51,667 plus 45c for each

Most people earn between $45,000 and $120,000 and are paying 32.5C in the dollar on tax. Once you understand that there are no tax deductions to be had on the home loan, even if the home loan is on a lower interest rate, you can intellectualise why you are better off 100% offsetting your home loan debt

This is because investment loan rates minus your 32.5% tax deduction, or even a 19% tax deduction if you earn between $18k and $45k will almost always ensure that the effective cost or the end cost on your home loan, is higher than the investment loan.

Let’s do the maths!

If your home loan rate is let’s say 6.7%, and your investment loan is let’s say 7%, which are two reasonably common rates today, the difference is about 30 basis points or 0.30% in this example.

On face value, what you are paying on the investment loan is higher than the home loan

But by factoring in your tax deductions if you are earning between $45,000 and $120,000pa of 32.5% – Because you can claim the interest on the investment loan as a tax deduction – the effective interest rate on your investment loan is more like 4.7% because the interest deduction reduces your taxable income, and therefore the tax payable on that amount of interest by 32.5%.

Even if your taxable income is only between $18,000 and $45,000, it still reduces by 19%, making the effective rate that you pay is reduced from close to 7% to around 5.6% V 6.7% on the home loan.

It’s can be difficult to comprehend this concept just listening, without seeing the numbers in front of you so, we will include in our show notes a link to a video I’ve done in our Mortgage Strategy Series – episode 9 – where I walk you through, with a live example on the whiteboard, why it’s recommended to offset the home loan first and explain the effective interest rate that you pay on your investment loan, after factoring in tax deductions.

In simple terms, reduce the interest rate on the investment loan by the tax rate you pay on your income to estimate the true interest cost that you are paying.

Let’s talk about the benefit of offset for P&I loans. We are familiar with the direct impact offset has on IO loans, because the interest is calculated daily, and it is palpable because it represents the entire repayment. And this minimum repayment varies as the net debt balance varies.

But when we have a P&I loan with an offset account, the direct cashflow impact is not palpable at all, because our P&I repayments are predetermined and consistent.

What we can see when we look behind the curtain though is positive. Our loans are repaid sooner with every offset dollar working for us.

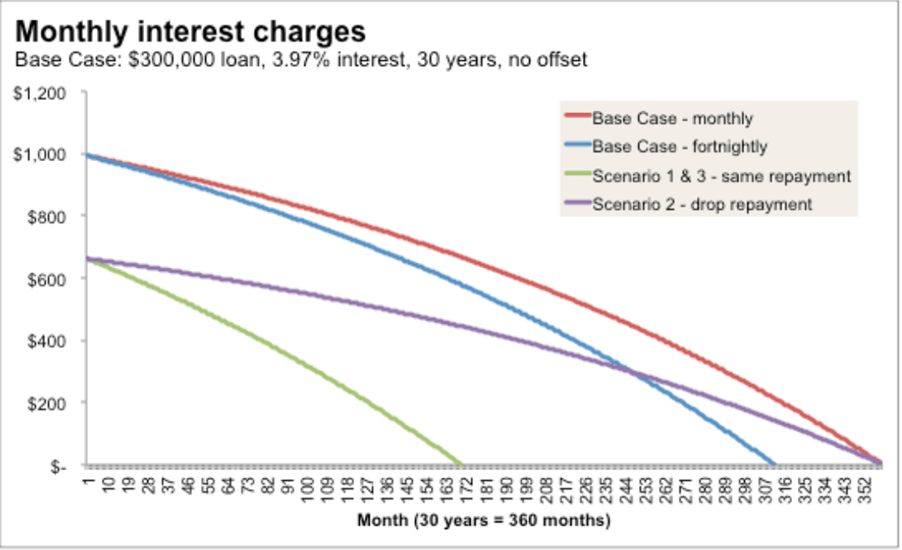

Cate dug up this chart from Money School (which I’ll share in the show notes). Dave, can you share some of the figures in this chart for our listeners about the reduced loan time horizon?

To help you get your head around what happens with the interest, here’s a chart showing a few different scenarios:

Base case (red line):

- $300,000 loan

- 3.97% interest

- 30 year term

- $1,427.06 repayment per month

Pay off a bit more (blue line, Method 1)

- Change to $714 per fortnight repayments

Pay off $100k and keep same repayments OR put $100k in offset (green line, Method 2 part 1 and Method 3)

- Repayments remain $714 per fortnight

Pay off $100k and drop to minimum repayment (purple line, Method 2 part 2)

- Repayments drop to $951 per month

It’s a great point. Fortnightly payments or weekly make precisely zero difference if you have all 100% savings offsetting because in effect you are making a daily payment. This is something that SMB’s will explain to some clients who don’t realise this.

Gold Nuggets

Dave Johnston’s gold nugget – If Ben can’t refinance and can’t go to IO, Dave highlights the important points for Ben to consider. Sometimes going backwards from a cashflow perspective isn’t always the worst case scenario. Looking forward, doing the maths and not losing sight of the bigger picture is important.

Cate Bakos’s gold nugget – Visibility is everything. If Ben has a dashboard and can get a sense of timeframes, he will get a better sense of perspective. His overall portfolio will likely hold him in good stead, but in the meantime he could do a stocktake of his current discretionary spending, and conduct a health check on his current home loans.

Mike Mortlock’s gold nugget – There is no simple answer, but there are a number of ways that he can do this. Knowing what the banks will allow is important too.

Resources:

Ep. 9 – Why your mortgage strategy is more important than your interest rate?

Ep. 48 – Offset accounts – God’s gift to Mortgage Strategy!

Ep. 55 – All things property tax – how to understand your deductions at tax time

Ep. 207 – All things property tax – how to understand your deductions at tax time