Got a question for the trio?

Episode Highlights

3.10 – Cate opens the discussion about “The mortgage cliff”

6.30 – Dave explains what the mortgage cliff actually means

9.31 – Cate offers a pub comparison to fixed rate lending during COVID

12.55 – Mike shares some light reading on an RBA hypothesis

14.00 – Cate defines negative equity and what can cause it

18.36 – Dave falls prey to one of Mike’s easter eggs

21.58 – Teaser for next week’s show – Alison reaches back out to us about buying in beachside Mentone

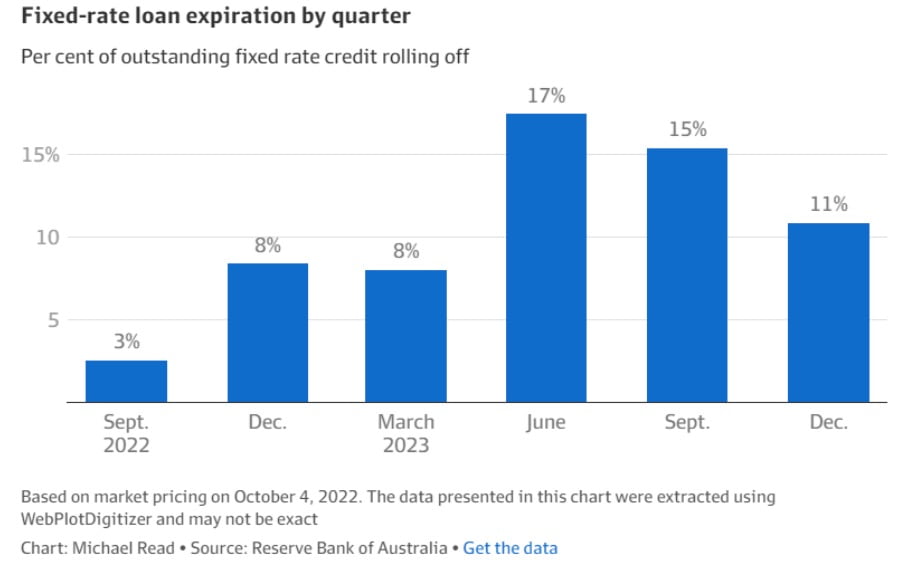

27.13 – Mike distills some data in relation to fixed rate loan expiry

28.00 – Mike references the graph in our show notes

35.01 – And our gold nuggets!

Show notes

In this riveting episode of Property Trio, we venture deep into the realm of mortgages to explore the looming question: Is the “mortgage cliff” a genuine concern or simply media hype?

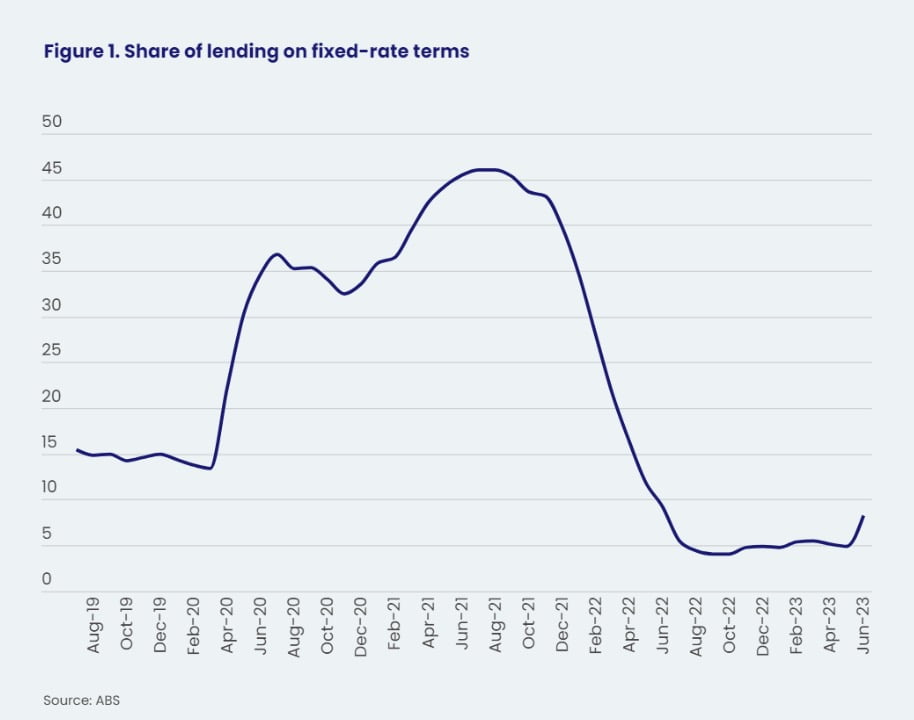

Dave kicks off the episode by likening the hysteria surrounding the mortgage cliff to the Y2K bug, raising questions about the influence of fear in these scenarios. He clarifies what the fixed rate cliff really means for borrowers—many of whom face a jump in holding costs as exceptionally cheap loans adjust to today’s variable rates. The Trio takes it upon themselves to dig into the hard data, debunking or confirming the claims made about this financial precipice.

Cate ponders why more people didn’t fix during the pandemic and finds a good bar-tab comparison.

Mike brings up the headline “Millions on Mortgage Cliff” and questions the scale of the issue, while also sharing insights from an academic paper on the strong correlation between negative equity and loan arrears. The discussion delves into multiple facets of mortgage stress, delinquencies, and timelines, aiming to provide our audience with a comprehensive understanding.

Moving on to regulatory interventions, Cate and Dave consider the impact of potential changes, like high LVR loans and credit reduction. Dave highlights how lending practices have evolved across different global economies, bringing a unique perspective to the table.

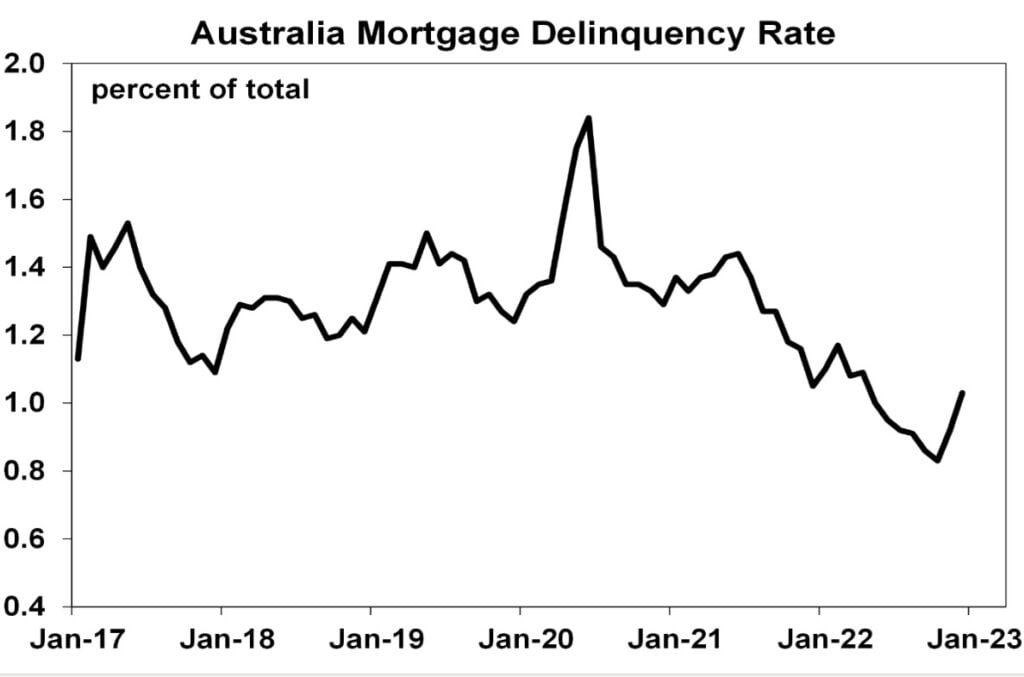

Mike spices things up with some audio tricks, but the conversation soon refocuses when Dave delves into real stats about mortgage arrears. It turns out that soaring property values and tightened credit controls have acted as a protective barrier against widespread loan defaults.

On the topic of refinancing, Dave reveals startling numbers: external refinancing has surged by a whopping 21% in the last year. Cate questions Mike about some eyebrow-raising stats concerning fixed-rate loans nearing their expiry date, offering listeners a balanced view on the situation.

Cate also empathizes with first-time home buyers caught unprepared for rising interest rates, reminding us all that a 2% interest rate was never meant to last forever.

In a nutshell, Dave wraps up with an insightful commentary on the role of ASIC and non-bank lenders in the current landscape.

Gold Nuggets

Mike Mortlock’s gold nugget: While some new variable rate mortgage holders will be feeling some pain, spending is moderating and Mike holds hope that the ‘mortgage cliff’ is a bit of a beat up. He believes that rate cuts are likely to be around the corner. “It’s not a cliff… that’s my summary.’

Dave Johnston’s gold nugget: Dave also feels that it’s not a cliff either. It will likely have a ‘slow tail’ and there will be some pain, but not so much in the owner occupier residential market.

Cate Bakos’s gold nugget: Overall, there will be a mortgage cliff for some individuals, but Cate doesn’t think that there will be advantageous buying conditions as a result. We have to consider the other forcefields; new arrivals (skilled migrants), a rapid increase in rents, and we also have to consider the impact of inflation on property values, and lastly; confidence from high employment.