Formerly the “Property Planner, Buyer and Professor” podcast

Listen and subscribe

Android

Android

Highlight Segments

0.54 – Mike treats us to some Frank Sinatra, but he forgets we are recording one more Christmas special

1.39 – Market update commences

13.45 – Cate talks through the historical declines and how our most recent decline compares to others

9.39 – VIC regional recovery? Maybe… tune in to hear what Dave and Cate have to say about anecdotal evidence and data

17.45 – How is the data capturing investor-led sales? Cate delves into this new technology

22.47 – Teaser from next week’s episode… Artificial intelligence

31.46 – Has the Melbourne pendulum swung? Cate talks about the coal face experience and how this signals market conditions. Did the November rate increase bite? Or is it Christmas?

50.36 – Gold nuggets!

Show notes

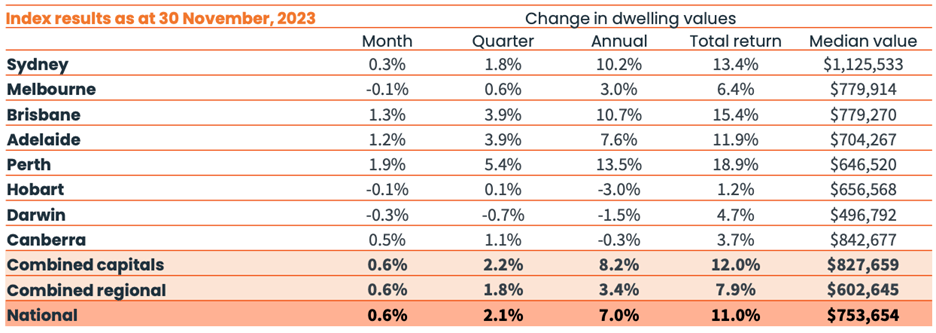

1. Home Value Index Results

We’ve reached a new peak in Australian house prices, with combined capitals hitting record highs. Cate and Mike discuss the market’s volatility and the significant declines experienced in recent years.

Source: CoreLogic

2. Median Prices – Melbourne vs Brisbane

Dave takes a deep dive into the nuances of median prices, particularly in Melbourne and Brisbane. He explains why median prices can be misleading and gives a comparative analysis of house and unit prices in both cities.

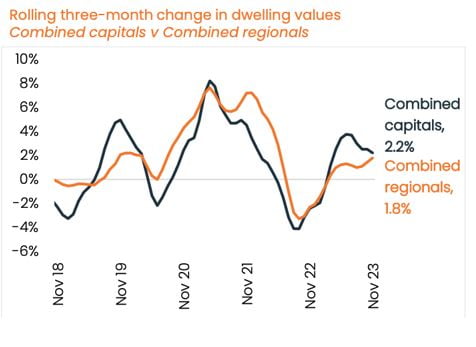

- Capitals vs. Regional Markets

Cate shares insights from her experiences in Victorian regional markets like Geelong and Ballarat, comparing them to capital cities. The trio also debates the impact of wage growth on the capital city versus regional property debate.

- Work From Home Impact

The team reflects on the quote, “If you want a job, work from home. If you want a career, come back to the office,” discussing its implications on the Australian property market. Dave examines unemployment trends and makes future predictions.

- Policy Discussions

The trio addresses Brisbane’s proposed changes to land tax and debates the potential for more housing policies. They discuss the impact of investor sales on housing rents and supply.

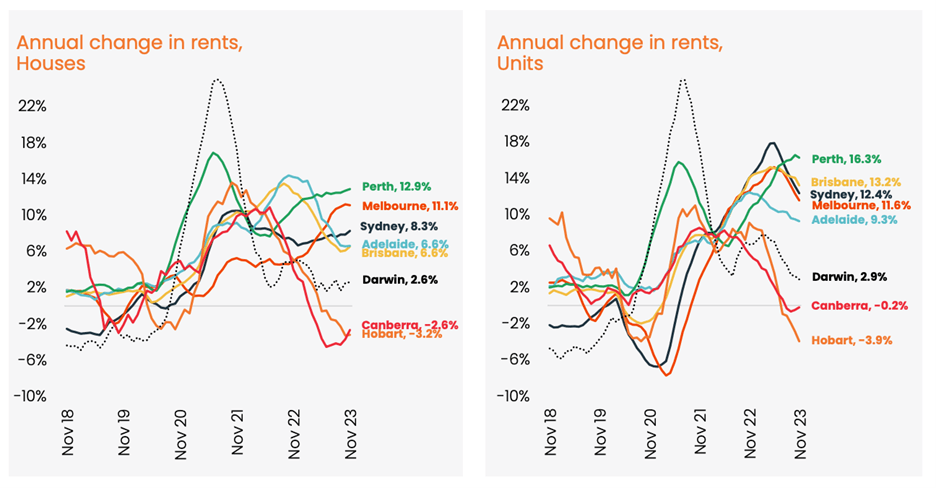

- Rental Market Trends

Despite a slowdown in growth, rental markets remain strong. The team discusses the recent increase in rents compared to property values and the implications for net yields.

Source: CoreLogic

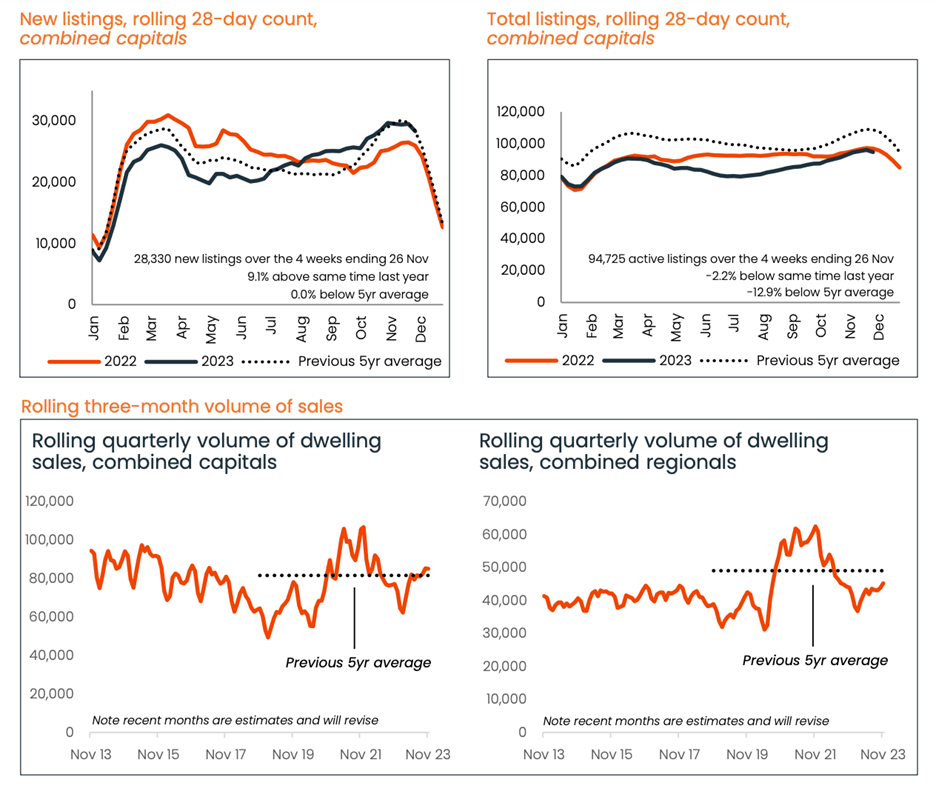

- New Listings and Buyer Demand

Cate shares insights on new listings, buyer demand, and the impact of recent cash rate increases. She also touches on the unique characteristics of the December market.

Source: CoreLogic

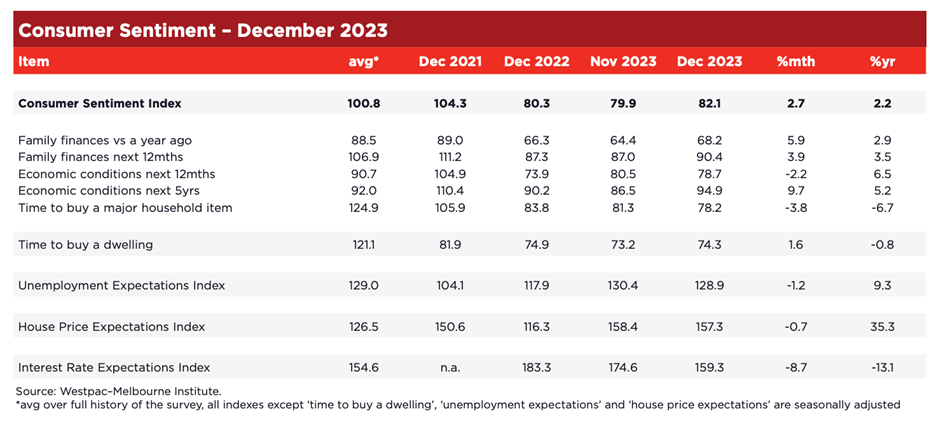

- Consumer Sentiment

Mike leads a discussion on the Westpac Consumer Sentiment Index, exploring shifts in market timing and economic outlook. They also cover the rise in personal, unsecured loans.

Source: Westpac Melbourne Institute

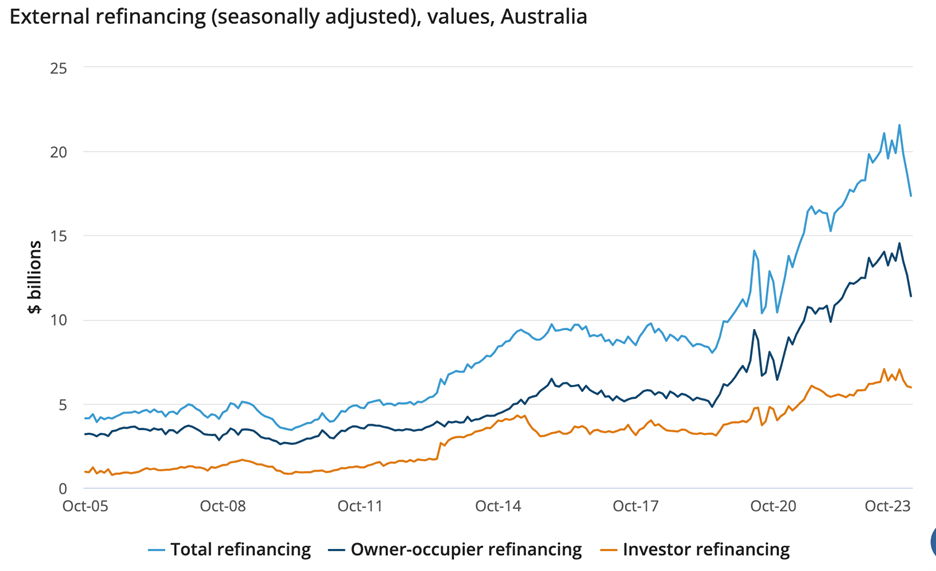

- Lending Landscape

Dave provides an update on loan approvals and refinancing trends, noting a significant decrease since May 2022.

Source: ABS

- Investor Interest in Melbourne

The episode concludes with a focus on the Sydney-Melbourne price disparity and why Sydney investors are increasingly interested in the Melbourne market.

Gold Nuggets

Cate Bakos’s gold nugget: For all of those budding purchasers who are focusing on 2024 as their year… take advantage of the buying conditions in the early part of the year. Agents are talking about increased listing volumes and the supply/demand ratio may favour buyers.

Dave Johnston’s gold nugget: Dave emphasis the attractive conditions that buyers could face in Melbourne, Sydney and Darwin in the early months of 2024.

Resources

Ep. 6 – What determines your property strategy?

Ep. 10 – Why your approach and assessment is paramount to property success

Ep. 12 – Property Cycle Management

Ep. 18 – When to hold and when to fold

Ep. 60 – Why established properties out-perform