Formerly the “Property Planner, Buyer and Professor” podcast

Listen and subscribe

Android

Android

Highlight Segments

2.55 – Mike quizzes Dave and Cate about Brisbane overtaking Melbourne’s median prices and explores whether the data is reliable

7.28 – Cate opens a conversation about what’s happening in the regions

10.47 – Mike ponders the inflation data and he asks his co-hosts when they think interest rates will fall

16.38 – Rents…. is the worst yet to come?

24.50 – Distressed listings figures have The Trio intrigued… what is Melbourne telling us?

28.30 – Teaser from next week’s episode…

28.50 – Westpac Consumer Sentiment Index…. what’s good? and what’s not?

39.35 – What’s on steroids? Personal loans!

45.10 – Gold nuggets!

Show notes

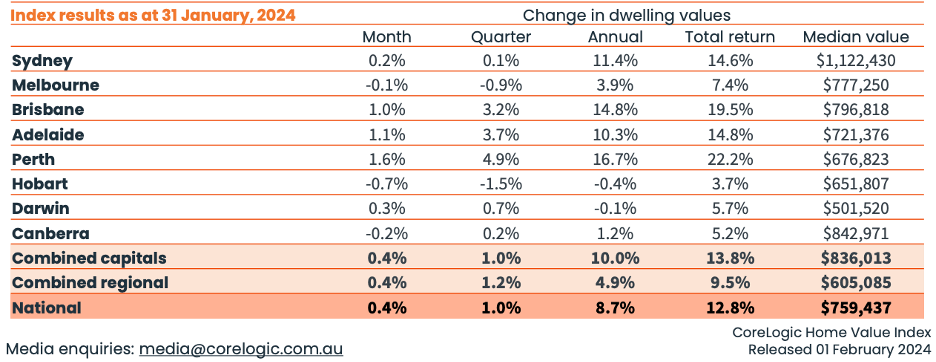

1. Home Value Index Results

The January 2024 data is out, and the capital city league ladder has been changing. But are houses and unit imbalances across capitals skewing the data? Dave explains..

What’s happening with the regions? The quarterly data shows that regions have outpaced the capitals. Are we seeing a recovery in some of the regions that suffered during 2023 with the reverse-COVID exodus?

Mike dares to broach the inflation data and asks his co-hosts when they think interest rates will fall. Dave suggests August/September this year, whereas Cate won’t be surprised if it’s even in 2025. Time will tell!

“Data does let us down like that”, says Cate and she shares some another example of stock segmentation and purchaser incentives skewing data.

Source: CoreLogic

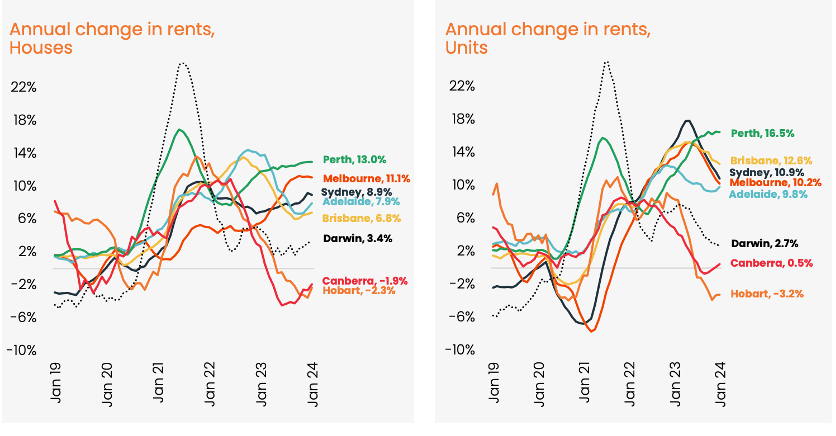

2. Rents

The national rental index recorded it’s strongest monthly rise since April. Could things get worse before they get better? Cate shares her concern about the rate of investor sales and anecdotal evidence from agents’ reporting. Cate predicts that rental hikes will eclipse 10% nationally. She also talks about the challenges being tougher for families, as opposed to singles and couples.

Was the December rental figure a data blip, or has the rental demand started to ease? Cate demystifies things for our listeners.

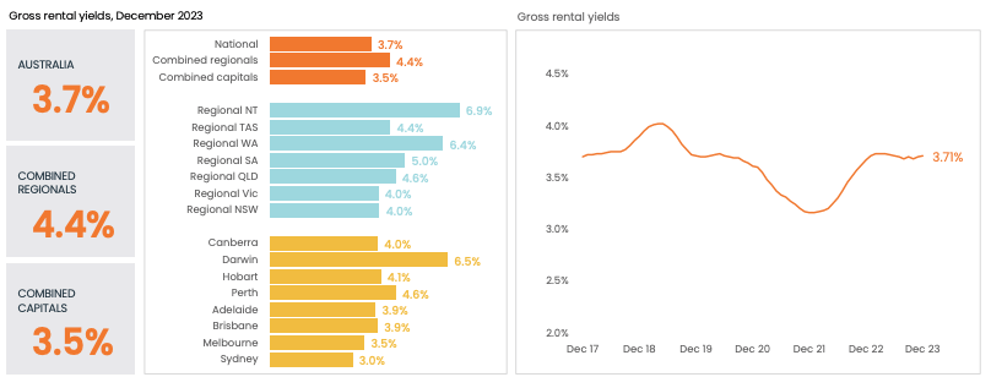

Gross rental yields have ticked up to new levels, but as Dave explains, “that’s what they used to look like!” Like many other property-related cycles, rental yield, too is cyclic.

Source: CoreLogic

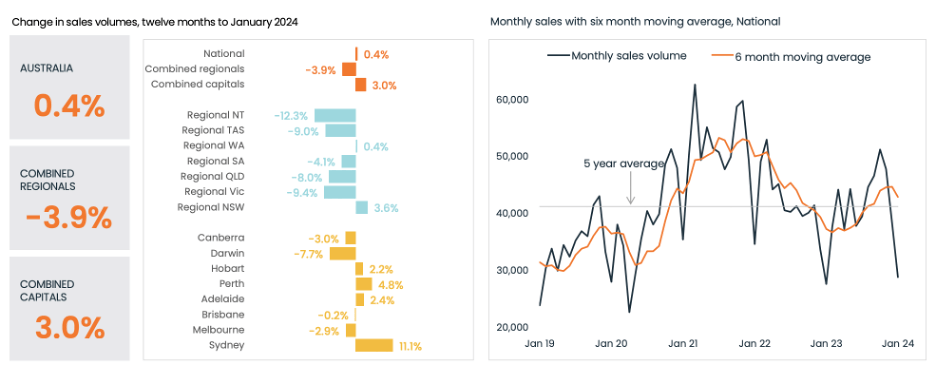

3. Sales volumes

We have sales volumes to thank for our 2023 year holding up as it did, but now that sales numbers have increased, will the supply and demand ratio threaten capital growth? It seems not. Buyer appetite is strong and sentiment has ticked up somewhat.

Source: CoreLogic

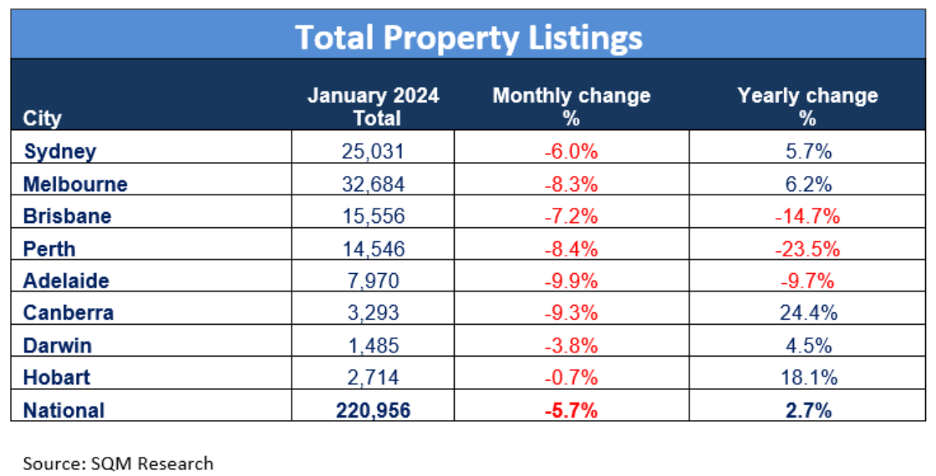

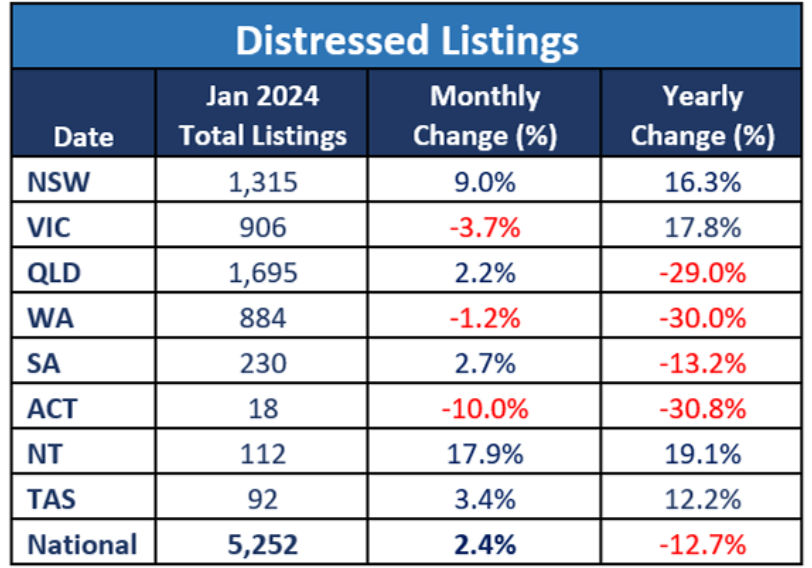

4. Listings

The stock availability, (or lack thereof) has a direct correlation with capital growth.

Yet the distressed listings have The Trio intrigued. Is Victoria’s data point a green shoot or an anomaly? It’s one to watch….

Source: SQM Research

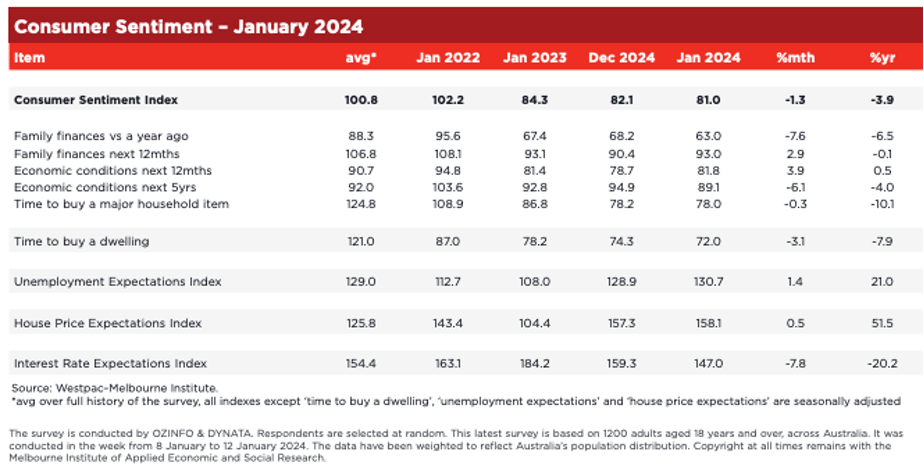

5. Consumer sentiment

The Westpac Consumer Sentiment data provided some good discussion; what a difference the surprise inflation figures made! But which measure still has Cate worried?

Source: Westpac Melbourne Institute

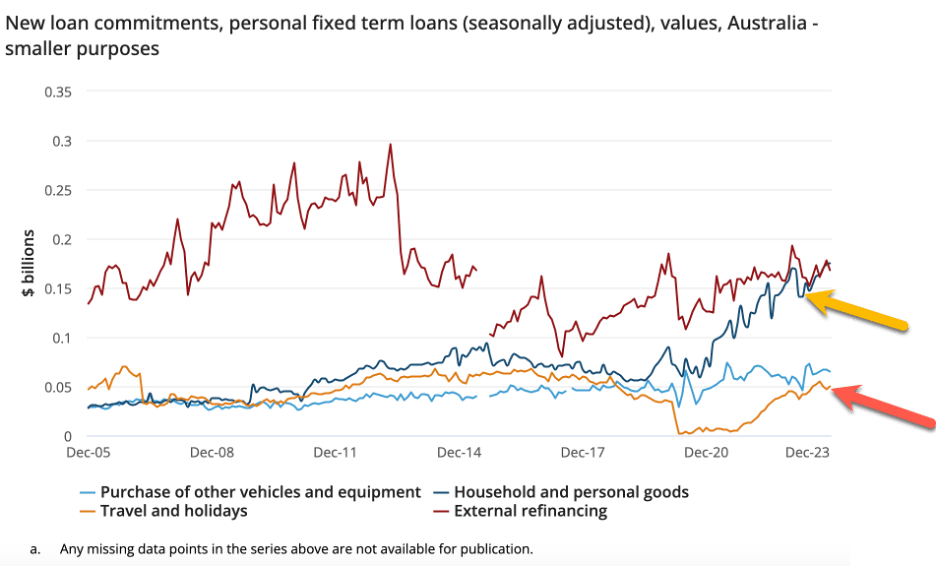

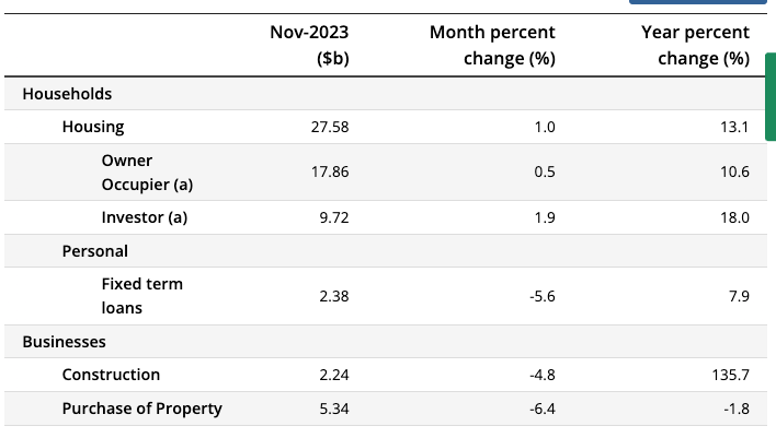

6. New Loan Commitments

Cate draws attention to the unsecured lending figures and holds concerns about some of the items that people are financing on high-interest credit.

Source: ABS

Dave explains how the consumer sentiment index is determined with 50+ sub-groups of people assessed. It’s an interesting peek behind the curtain!

Investor activity is up and it has been steadily increasing. Despite the investor-led sales, talk of increased rents and the potential for strong capital growth surges are exciting a cohort of investors.

Source: ABS

The three year bonds show that we could see rates drop in the near-term, yet the ten year bonds suggest that rates could sit at similar levels to where they currently are now.

Source: investing.com

Gold Nuggets

Cate Bakos’s gold nugget: Stop spending on discretionary stuff! And better yet, stop using unsecured debt to do it. We need to bring down inflation.

Dave Johnston’s gold nugget: An interesting fact… House values have continued rising at a faster rate relative to units. House and unit median values are at their greatest differential ever.

Mike Mortlock’s gold nugget: Don’t make it a holiday, make it a toy, and make it second hand…. AND use cash!

Resources

Ep. 6 – What determines your property strategy?

Ep. 10 – Why your approach and assessment is paramount to property success

Ep. 12 – Property Cycle Management

Ep. 18 – When to hold and when to fold

Ep. 60 – Why established properties out-perform