Android

Android

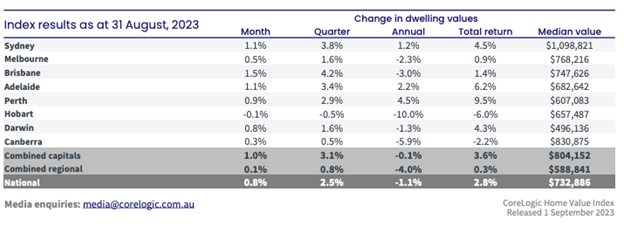

1. August home value insights

As our residential Australian property market ticks over to a ten trillion dollar value, Cate shares the August stats with our listeners and points out that the market is doing more than just demonstrating a recovery. The market is now moving reasonably solidly, and even Hobart’s rate of contraction has slowed. While Dave is reluctant to call the bottom of the market for Hobart, he does point out the home value index, particularly for Sydney. Although he touches on the volatility of Sydney’s performance over recent years.

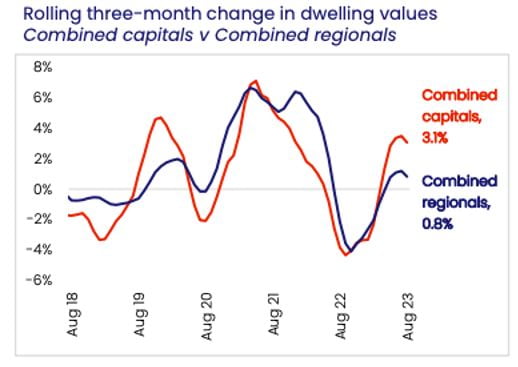

2. Capitals vs Regions – growing divide

Dave highlights the sheer weight of some of our regions such as the Gold Coast and the Sunshine Coast, however he maintains that we have an increasing disparity between capitals and regions.

Mike asks Cate about the mass exodus from city to regions, and whether there has been a reversal, but Cate clarifies her answer. “A regional city is very different to a coastal holiday hotspot.” Tune in to hear more…

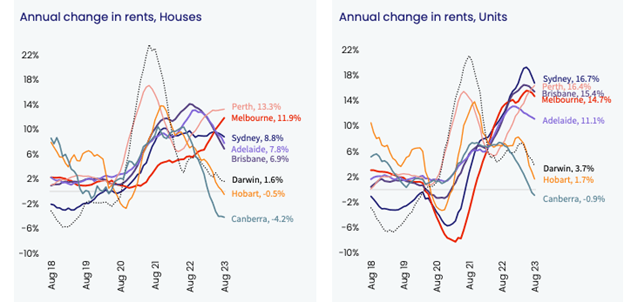

3. Rents continue to rise

Mike notes the crazy pace of change for unit rents, but Cate highlights the trajectory of Melbourne house rental growth and ponders the relationship between some of the tough reforms and taxes facing the southern city.

Mike asks “How are rents still going so strong in Perth?” and Cate has a theory that links to Wage Price Growth. See our ABS chart to illustrate this.

Source: CoreLogic

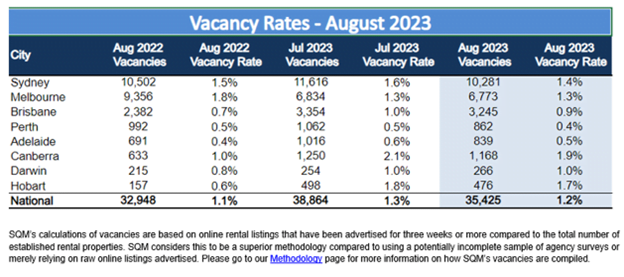

4. Vacancies remain tight

Moving on from the perks and perils of WA, the Trio turn their gaze to the rental vacancy rates. Mike ponders whether the vacancy rate has stabilised, but as Cate suggests, it can’t get much lower.

Source: SQM research

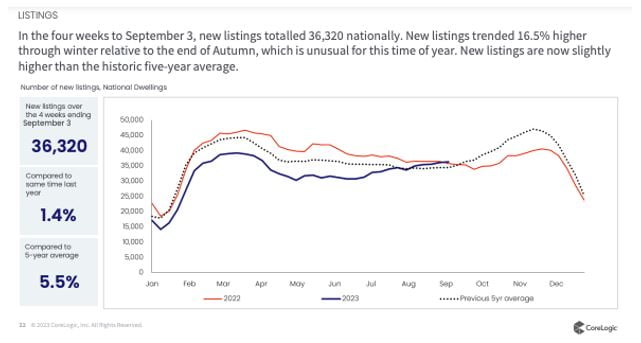

5. Listings flying off the shelves

Cate shares the reality from the coal face in relation to listing volumes. “As quick as they can supply them, the buyers are grabbing them.”

Dave considers the impact of higher migration rates on the supply and demand ratio also.

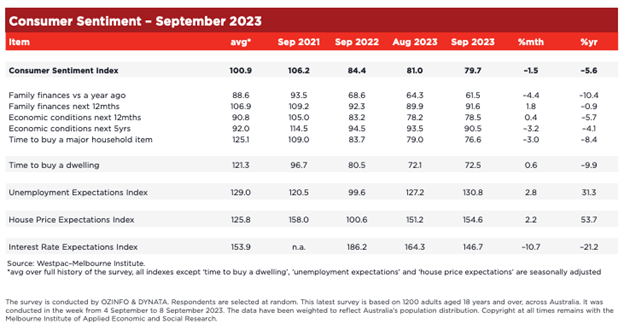

6. Sentiment Snapshot and the mortgage cliff

Family finance vs a year ago… a huge change for September. Things have tightened considerably and Cate debates whether the mortgage cliff has had effect, or whether ‘talk’ of the mortgage cliff itself is impacting sentiment. And finally, the major household item figures are declining in response to higher interest rates.

Source: Westpac Melbourne Insitutue

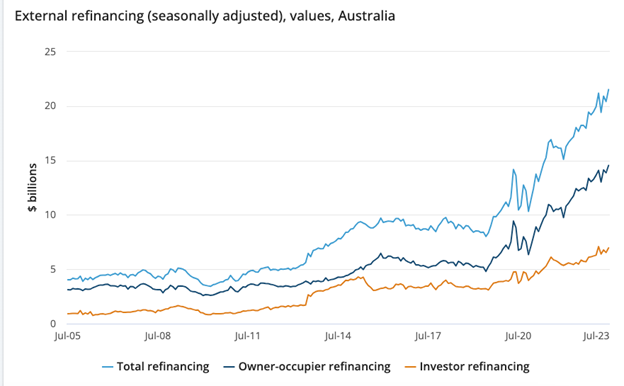

8. Refinances at record highs while construction languishes

Dave reports on the lending figures for August. Refinances hit a record high, once more and construction continues to tumble, demonstrating that we just aren’t building new dwellings at enough pace. Dave note unsecured lending to find holidays is up, and this is not habit that we want to encourage. Mike shares a great saying that one of our industry friends, Pete Wargent voiced.

“Spend less than you earn and invest the difference.”

Gold Nuggets

Dave Johnston’s gold nugget: Time in the market versus timing the market… Dave shares what investors should be basing their decisions on.

Cate Bakos’s gold nugget: Buyer sentiment, stock levels, and upgrading/downsizing… should people buy first and sell second, or vice-versa?

Resources

- Ep. 4 – How to develop your own property plan

- Ep. 9 – why mortgage strategy is more important than your interest rate

- Ep. 19 – time in the market vs timing the market

- Ep. 52 – Dissecting 10 years of Core Logic data – capital cities & regional areas

- Eps. 217, 219, 220 – And check out our inflation and interest rates trilogy