Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

- What is underquoting? Sometimes known as ‘bait pricing’, underquoting is the practice applied by agents knowingly advertising the price of a property for sale on the market at a price lower than the true value of the home, (or worse still, at an advertised price that is lower than the vendor’s asking price). The Property Buyer sheds light on why this practice occurs in Victoria, (and other states).

- What is the danger to the buyer of underquoting. Buyers will waste money and time carrying out due diligence and building inspections on a property, only to find out that the property is not within their actual budget and out of reach. Buyers who have been in the market long enough and those who have been burnt enough times will start to cotton on that the quoted range is not representative of the realistic price that the property will go for. So now, there is an expectation that a property will sell for more than the quoted range.

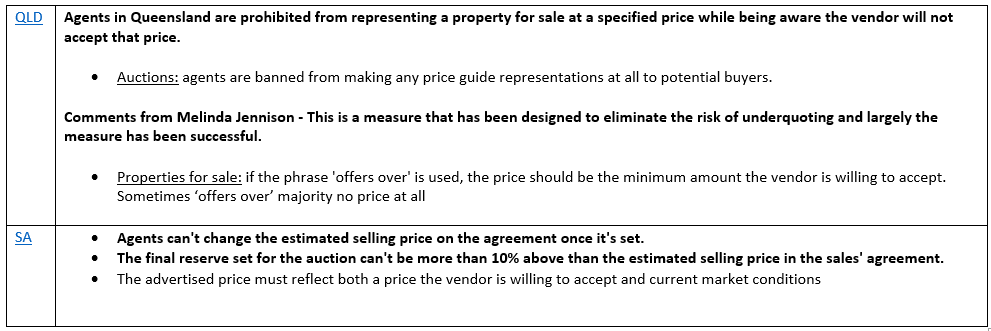

- How Queensland has tackled this issue. Agents in the Sunshine state are prohibited from representing a property for sale at a specified price while being aware the vendor will not accept that price. In addition, if a property is going to auction, agents are banned from making any price guide representations at all. While this does effectively deal with the problem of underquoting, it does raise other challenges for buyers. In this case, buyers must carry out the hard task of working out for themselves what a property is worth, when many are not experts in property. Is it better to have no guidance at all on price?… or some (mis)guidance that’s inaccurate? The trio ponder this question.

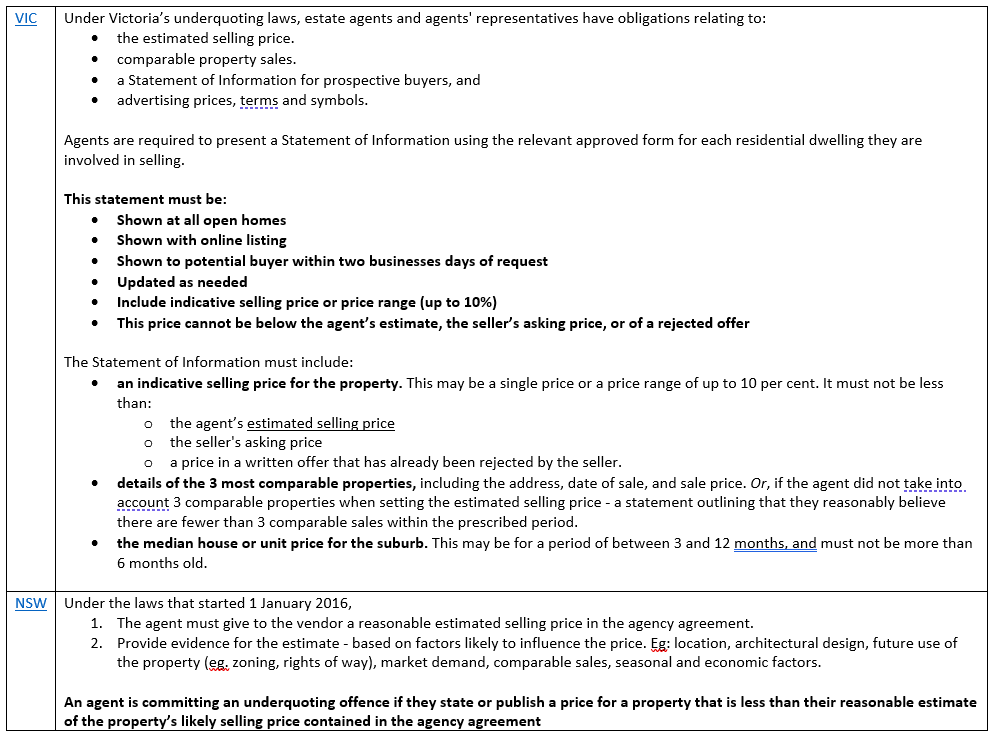

- How Victoria’s underquoting regime misses the mark. The Property Buyer explains the ‘Statement of Information’ that Victorian agents are required to display at all open homes and online listings, and more importantly, how agents are able to avoid accurate price representations despite their obligations.

- Striking the right balance. The trio discuss the different underquoting regimes in each state and the ideal outcome for underquoting laws. There are two sides to the coin and the solution must take into account both the vendor’s and buyer’s point of view.

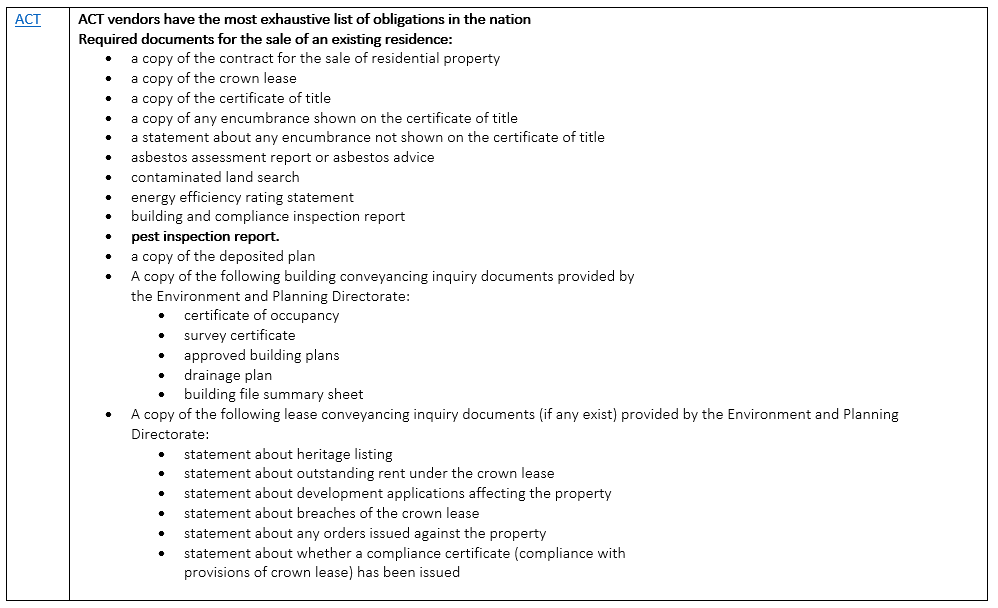

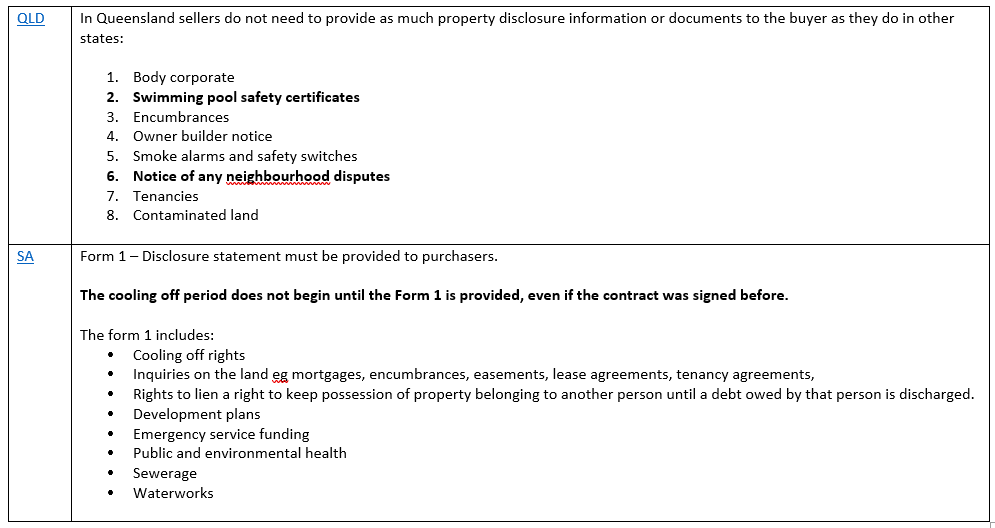

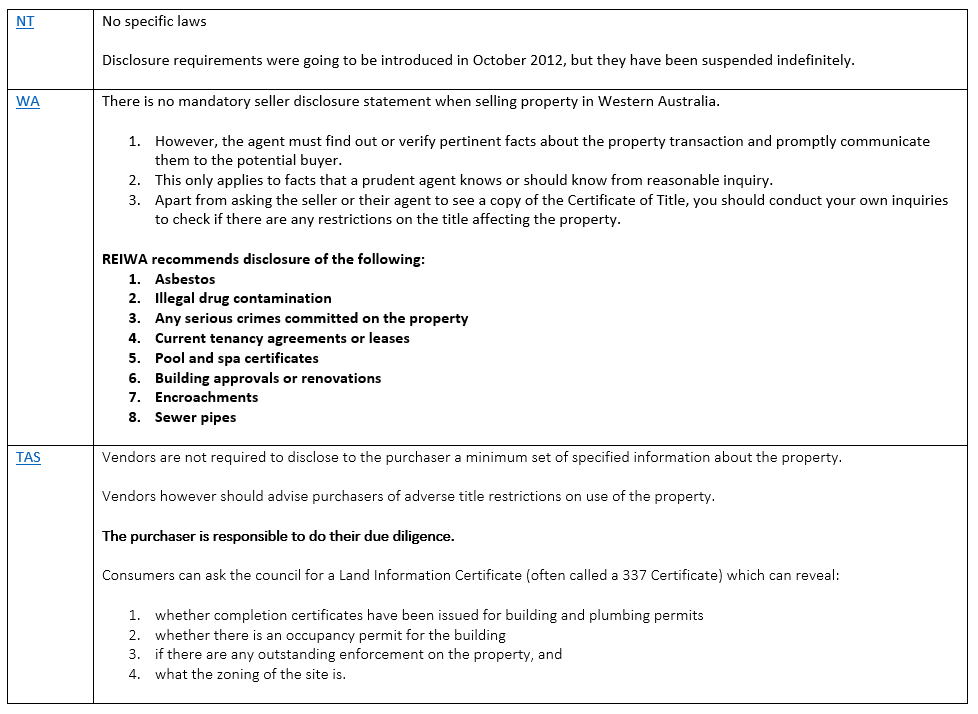

- Vendor disclosure obligations. Be careful not to get stung! Some states place no obligations on the vendor to disclose certain details about the property and the purchaser is required to complete all the due diligence and searches. The trio walk through the disclosure obligations, and in particular they circle in on WA and NT’s disclosure legislation.

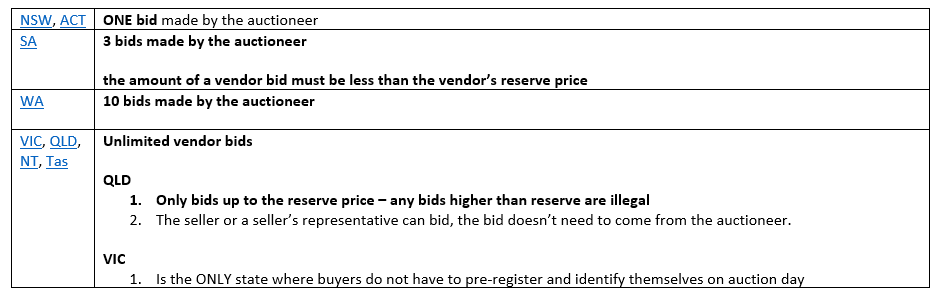

- Vendor bids. The trio outline the differences between each state of vendor bids, why they are used by the auctioneer and when they shouldn’t be used.

- Auctions vs private sales. While auctions are most prevalent in NSW and Vic, they remain in the minority for other states. The trio discuss when is a property more likely to go to auction vs private sale.

Resources

- Why we don’t rely on verbal offers

- Gazumped?

- Bidding tactics 101 (Ep.20)

- Congenial negotiation tactics and how to apply them in the right situation (Ep.29)

- Preparing for auction: Part #1 – Appraising, budget setting, due diligence, reserves, low-ball offers & auction twists (Ep.73)

- Setting yourself up to purchase with confidence and why getting your pre-approval in place is more critical than ever (Ep.78)

- Preparing for auction: Part #2 – Cooling off period, finance approval, negotiating terms and auction quote ranges (Ep.98)

- Property Cycle Management – why now is always the best time to buy if it suits your personal economy and you have a long-term property plan (Ep.12)

- TIME IN the market v TIMING the market (Ep.19)

- How will your mortgages serve you in the long run?

- Five mortgage strategies that can grow your wealth

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Show notes

What is underquoting?

- Sometimes known as ‘bait pricing’, underquoting is the practice of knowingly advertising the price of a property for sale on the market as lower than the true value of the home.

- Passing off properties as ‘bargains’ means that potential buyers spend their time researching that property, potentially investing money in property inspections for that home and then either putting in a private bid or attending the auction for the property only to be very quickly left out of the running as the true value of the home is reflected in the bidding.

- The challenges in Victoria

- Victorian real estate agents have a reputation for underquoting, is that deserved? Yes. There are so many fabulous real estate agents out there. It can give a campaign an advantage over another one. There is a difficult process that agents have to deal with and consumer affairs has no idea how to police it – many shades of grey.

- What is the disadvantage of NOT underquoting – two properties, same street, going to auction at the same time. Assuming they are identical and it’s worth $1,000,000.

- People will waste money on due diligence and building and pest inspections only to find out that the property is out of reach. But if you get burnt enough times, you start to cotton on that the quoted range is not the price that the property will go for.

- If the honest agent quotes the property at $950,000 to $1,050,000 – the people looking at that property will assume that the vendor is chasing $1.2M.

Federal legislation that applies to all states and territories

- Australian Consumer Law makes price misrepresentation illegal for all goods and services in every state and territory.

- It is unlawful for real estate agents to:

- intentionally mislead you

- lead you to a wrong conclusion or impression

- give you a false impression

- leave out or hide important information (e.g. in fine-print disclaimers)

- make false or inaccurate claims.

- It makes no difference whether the agent intended to mislead or deceive you—it is how you perceived the conduct that matters

- To reduce the chances of misleading you, real estate agents must take care to:

- Disclose all information relevant to the price of the property

- Advertise the selling price based on a reasonable market appraisal or the price the seller has indicated they are likely to accept

- Not make false claims about the price of the property

- Not advertise or under quote a property at a price significantly less than the selling price to attract interest in the property

- Not make false claims about the location, characteristics or use that can be made of the land.

- False claims about price:

- A real estate agent might make false claims about the price by:

- advertising a property as ‘passed in’ at a price higher than what was actually bid at an auction

- claiming that the vendor has already rejected offers more than the buyer is willing to pay, when no such offers have been made and/or rejected

- advertising a property at a price that is less than a previously rejected offer unless the seller is now prepared to accept a lower offer.

- According to the Australian Consumer Law, if an agent cannot provide reasons for advertising a property at a certain price, they can face a fine of up to $500,000 for an individual or $10 million for a company.

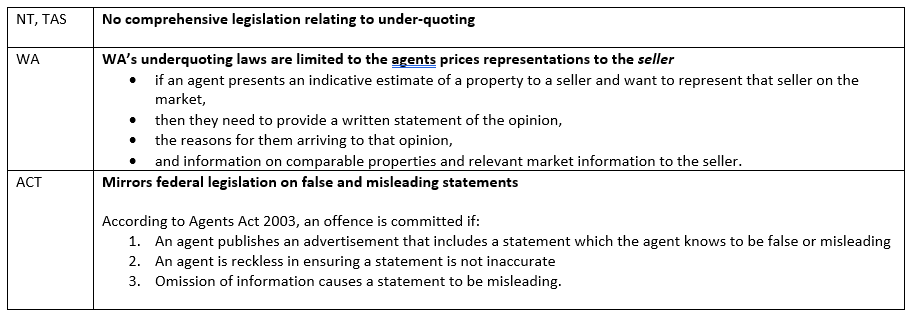

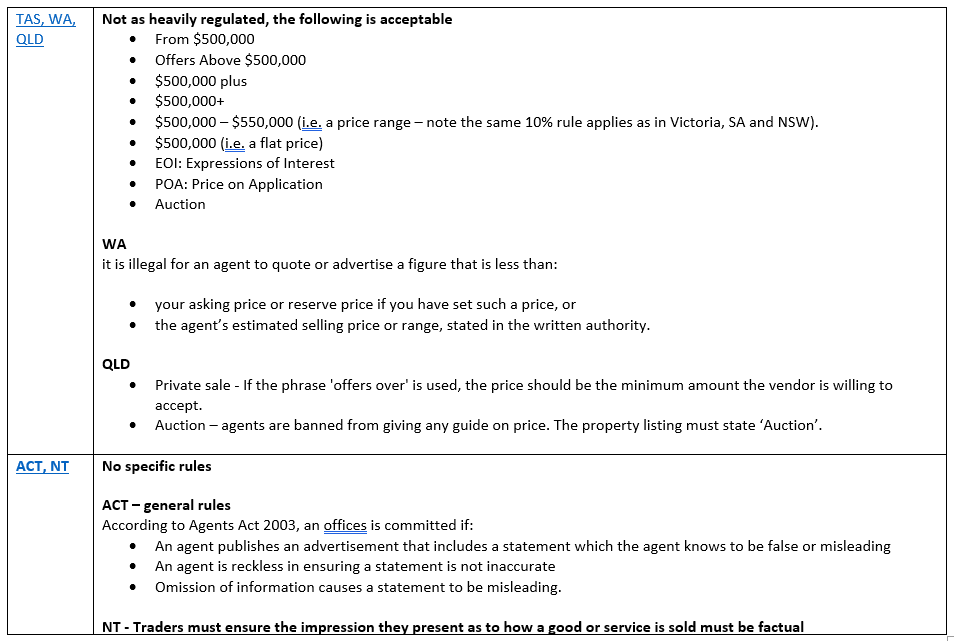

The following states rely heavily on federal legislation

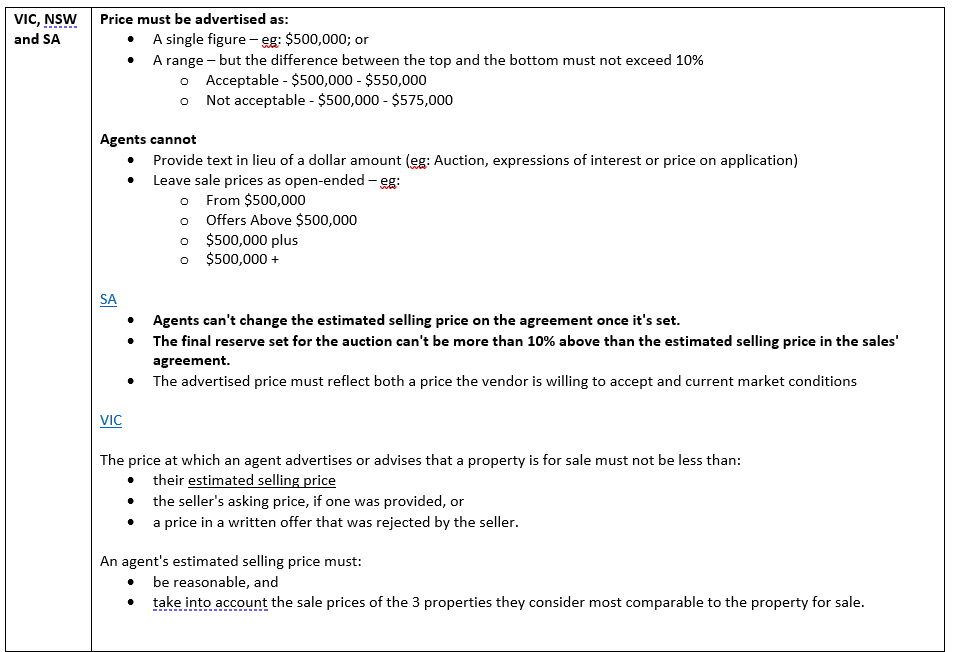

The following states have their own underquoting regimes

Quoted price rules – estimated selling price

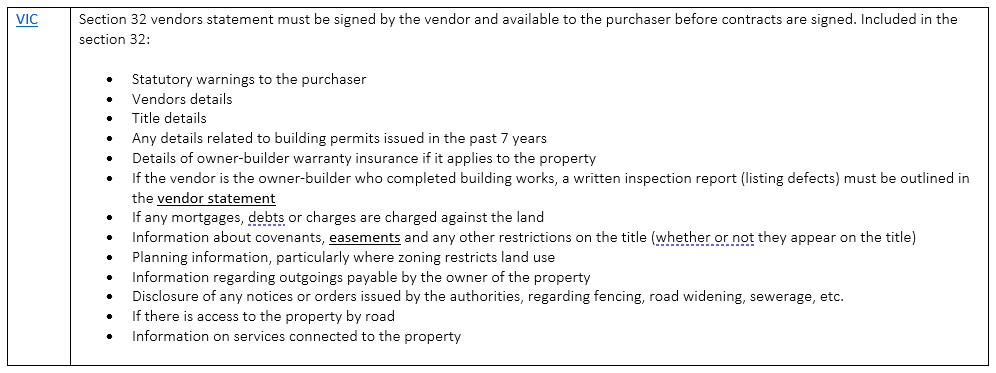

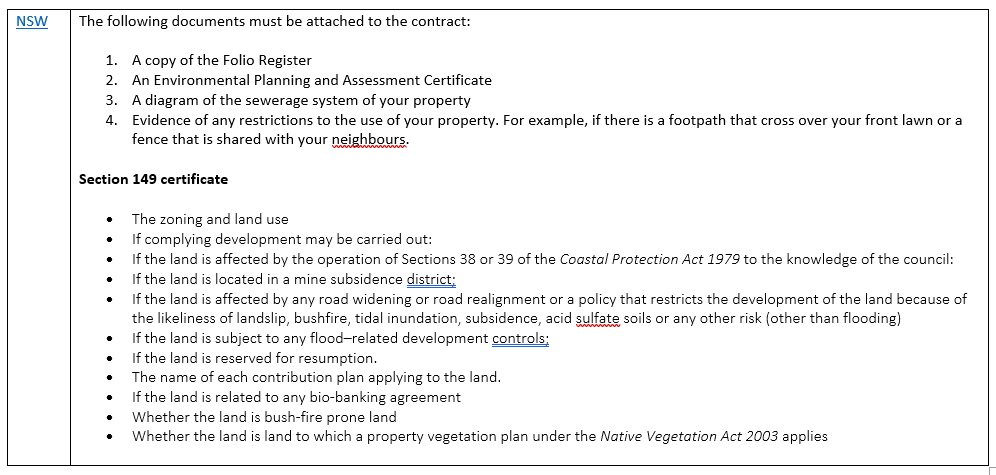

Vendor disclosure obligations

States with no disclosure obligations:

Vendor bids

- A vendor bid is made on behalf of the seller if the seller is not satisfied with the amount of the last bid.

- Vendor bids are allowed in ALL states and each state requires

- The auctioneer to announce at the beginning of the auction that vendor bids will be allowed.

- The auctioneer to announce when they have made a bid on behalf of the vendor, buy saying ‘vendor bid’ or something similar.

Gold Nuggets

David Johnston – The Property Planner’s Golden nugget: message to our law makers and legislators, it will be a vote winner if you simplify our property selling laws. Make it connected to the quote must be what the vendor is willing to sell for and get rid of all of the rest of the red tape. To the buyers, you need to take comparable sales tracking seriously to truly know where the market is at.

Cate Bakos – The Property Buyer’s Golden nugget: message to purchasers who are still looking to buy. When we hit Christmas day, there will be some low hanging fruit and stock that’s left over. But still do your due diligence and make sure you buy a great property, don’t just pick the lowest hanging fruit because it’s easy to buy.

Market update

- Proposed land tax changes in Queensland. In a surprise move, the Queensland government has put forward in their mid-year budget update plans to change the calculation of land tax so that an investor’s entire investment portfolio is taken into account, (not only the land owned in Queensland). The trio discuss the probable impacts for demand for Queensland property, property values and also rents. Not to mention the potential that other states will possibly follow suit.

- Regionals outstripping the capitals in unit growth. When looking at property growth over the last 12 months, units in combined capitals have increased by 12.6%, while units in combined regions have increased a whopping 23.1%. The trio discuss the possible reasons behind this perplexing bit of data.

- Auction volumes still strong despite Christmas only days away. Last weekend (ending Sunday 19th) was the second busiest auction week, (in terms of stock volumes) since CoreLogic began tracking in 2008. The week beforehand was the biggest stock volume week on record and we are now in the fourth consecutive week where more than 4,000 capital city homes have gone under the hammer. What it means is that supply and demand ratios are slightly closer to equilibrium, and in contrast to the difficult buying conditions that have been a hallmark of 2021, it’s now a (comparatively) great time to buy, with more properties for sale than ever before and many buyers giving up the search and packing up for Christmas already. Keep your eyes open over January, as there is likely to be more stock hanging around than normal as clearance rates have eased somewhat for the short term.