Property Plan

Get clarity on your long term property pathway, next purchase, existing portfolio, and how to achieve your retirement goals, using Australia’s only Property Planning platform.

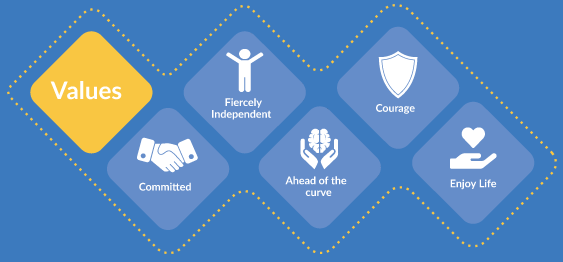

As a time-poor professional, you are looking for fiercely independent and sophisticated property and mortgage service tailored to you, where you can be in the drivers seat today and for your tomorrow.

Would you like to have ongoing access to Australia’s first Property Planning platform tool that allows you to map out your future property decisions based on your current financial situation to create a pathway to achieving your financial goals?

Do you feel like you should be planning for your biggest property and financial decisions in a structured manner that you can update and evolve real time as your life evolves?

Would you like to understand the implications of holding or selling as part of future property decisions?

Do you want to set long term goals and reverse engineer a plan to meet your goals, and be able to map out different pathways to allow you to contrast and compare?

Do you want education and advice that is tailored to you from the company that invented Property Planning and has been providing tailored advice since 2004?

Do you want clarify on your Next Purchase to determine whether your next property decision should be a home or investment?

Every decision you make should

maximise your lifestyle or wealth,

whilst minimising risk

Think of a Property Plan this way – imagine what ‘financial planning’ could be if no investment, insurance or superannuation products were sold. Now imagine that property was the core asset included in the advice and you were in the driver’s seat, with ongoing access to tailor and update your Property Plan via the only software tool of it’s kind in the country.

Why You Must Have a Property Plan to Succeed with Property Investing

Check out this insightful article by our Founder and Managing Director David Johnston on the Five ways property buyers set themselves up to fail and how to avoid these pitfalls, published by the Real Estate Buyers Agents Association of Australia (REBAA).

As Australia’s only national body representing exclusive buyer’s agents, REBAA is here to empower buyers with expert advice and advocacy to make smarter property decisions.

The Property Plan Experience

Full ongoing access to Australian first and only Property Planning tool to build out and evolve your own Property Plan.

Up to three planning and strategy meetings.

Property Selection tools and materials to be educated on how to approach buying like an a-grade buyers agent.

Five education hand-books, including content from our former University Endorsed education course, and a Future Home Framework to help you methodically work through what you want from your next home.

Sit down for a personalised Property Planning conversation where we can do a screen share and show you how the Property Planning platform works and how you can build your own platform.

3 Steps to your unique Property Plan

Plan – Understanding You

Strategy – the right pathway for you

Select – the right property for you

1. PLAN – Understanding You

2. STRATEGY – The right pathway

3. SELECT – The right property

Plan – Understanding You

We put you in control of your own Property Plan using our Property Planning platform which you can update and evolve over your lifetime.

We ask you the right questions covering your risk appetite, values, goals, lifestyle and financial aspirations.

You will be empowered to think about what is right for your next property decision in the context of your long-term plans.

Learn how to navigate and use the Property Planning platform for yourself.

Build out multiple pathways through to retirement enabling you to contrast and compare the financial outcomes.

Use the algorithm to show you a pathway to achieving your retirement goals.

Assess your existing property portfolio.

Get clear on your Money Management habits, or lack thereof!

Consider your preferred investment property pathway.

Ask any questions you like of your Property Planner to assist with developing your Property Plan and using the platform.

It makes sense to seek specialist independent advice for accumulating your largest financial asset.

Strategy – The right pathway for you

Failing to plan properly for your long-term home can be one of the most expensive mistakes you can make.

We help you understand and consider the many layers that go into making a great property decision.

Your Strategy will enable you to be clear on your next property decision in the context of your long term property pathway. This includes being clear on:

Your long term property pathway

Whether your next decision is a home (lifestyle) or investment property

Holding or selling any existing properties

Money goals

Mortgage strategy

Money management system

Price range

Asset type

Answer the most important questions!

Based on your price range and strategy:

- what should the financial return be?

- What should the macro location be?

- What should the asset type be?

- Do you have land tax considerations?

- What is your diversification strategy?

Missing a step or two can have huge consequences and lead to property mistakes costing hundreds of thousands, and even millions in opportunity cost over your lifetime.

That’s where we can help!

Missing a step or two can have huge consequences and lead to property mistakes costing hundreds of thousands, and even millions in opportunity cost over your lifetime.

That’s where we can help!

Select – the right property for you

Learn the secrets of A-Grade buyer’s agents!

Select and purchase property with confidence and expert knowledge.

The right strategy for your next property decision could be anywhere in Australia.

Work with the only team that doesn’t have location bias, because we do not have buyers agents in-house, but we have the expertise because we pioneered buyers advocacy from 2004 to 2011.

If you want to purchase yourself, we can introduce you to an expert buyers agent anywhere in the country.

Answer the most important questions!

- Have you ever wondered how buyer’s agents do it?

- Are you concerned about making a mistake when you select your property?

- Have you ever thought it’s a rushed decision – you have 1-2 viewings of a property before going to an auction, not really knowing what it’s worth and spending more money than you actually have – all while hoping to get it right?

Sit down for a personalised Property Planning conversation where we can do a screen share and show you how the Property Planning platform works and how you can build your own platform.

Read David’s articles written for Domain.com.au & Australian Financial Review

Why isn’t there a Property Planning industry?

That was the question David asked himself and others in the early 2000’s.

The property industry is unregulated, so the quickest and easiest path to make money is through selling property.

There is a whole industry – the financial planning industry – dedicated to financial, investment and insurance products, yet no Property Planning industry.

Why short-term investing in property has long-term consequences

How data can help property investors identify gentrification before it happens

What our clients think about us

“The whole process from my first contact, to receiving the completed plans this week has been fantastic and I feel much more confident in my decisions now. You have both helped me increase my knowledge and view of property investment to levels I never would have thought possible six months ago! So again thank you!”

Andrew, Hawthorn VIC

“They have helped us to better understand and properly set up our money management, and are helping us to establish the best pathway for a family home and investment property”

Esteban, Mascot NSW

“Our property plan has been invaluable – it has helped us clearly understand our property goals and provide a road map to get there. We now feel that we have the right strategic financing in place and we have a much better understanding of where we are going. David is a true professional who takes the time to truly understand every aspect of your personal situation and provides excellent advice in a concise manner. We would have no hesitation recommending this service to our friends or family!”

Mark and Renee, Mitcham VIC

“David Johnston and the Property Planning Australia team have been fantastic. They have helped us with our longer term property planning and helped us developed an informed strategy for our next property decision. Plus they made our home loan application simple and easy.

Their ongoing service and support we received was another added extra and they offer more than a traditional Mortgage Broker would. I would highly recommend using their services.”

Charlie, O’Connor ACT

“PPA have been really professional and certainly helped us with our mortgages and property portfolio. We are a lot clearer about where we are heading in the future and how to achieve our future plans”

Lorraine, Warradale SA

“As a young couple ready to take the first steps to buying our first home we feel like we couldn’t be in better hands. No question is too big or too small and they’re always willing to have a chat and re-explain things, at no point did I feel embarrassed about ‘not getting it.’ I didn’t know the first thing about property before working with David and his team. Buying my first home is a big step in my life and I’m glad I have David in my corner. Would highly recommend!”

Rachel, Flemington VIC

“I have had the immense pleasure

of being on the receiving end of Property Planning’s amazing services. I would highly recommend the team here from many years of being a client. Thank you”

Steve, Bronte NSW

“I have been really happy with all the services provided by Property Planning and everyone that I have been in contact with have been of great help. If I come across anyone that could use your service I will definitely recommend Property Planning to them.”

Michelle, Thornbury VIC

Read our latest comprehensive resources by visiting our resources page now. Our team of experts are here to help you learn more about Property Planning.