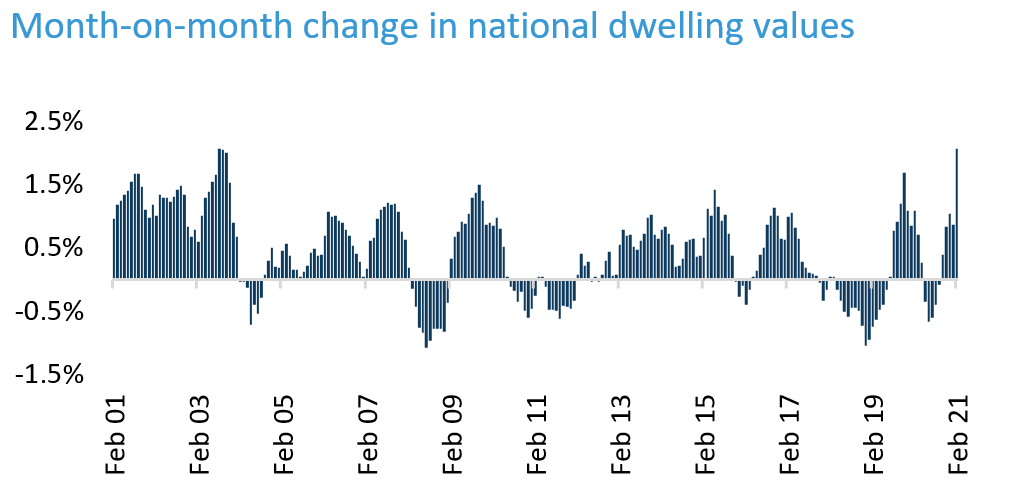

In September 2020 we led the way by predicting that prices would increase by 10% in 2021. Many banks and economists didn’t forecast 10% rises until last month. We now believe that we’ll see growth of 15%, subject to rates staying low and no intervention from APRA. We make this prediction following the release of ABS data for quarter 4 of 2020, along with year-to-date CoreLogic data, which is reflecting what we’re seeing on the ground in the property market since late 2020. Privately, we’ve communicated since late 2020 that prices could set new records, with one key insight being our friends in NZ recording 20% annual growth, as shared in market update #18 of the Property Planner, Buyer and Professor podcast ‘The early trajectory for 2021’. The RBA is adamant rates will stay low until inflation consistently reaches 2-3%. Requiring unemployment in the 4’s or even 3’s (currently 5.8%) and wages growth above 4%pa (currently anemic at 1.4%). The RBA continue quantitative easing by buying Aussie bonds targeting 3 and 5 year maturities, keeping fixed mortgage rates low to support low variable rates with the cash rate at 0.1%. Overall, we expect a similar pattern to 2003 where capital cities values rose 18.1% Listen to Market Update #18 “The early trajectory for 2021” Check out the ABS data If you’d like to discuss your property plans or mortgage strategy, please get in touch with us here.

In September 2020 we led the way by predicting that prices would increase by 10% in 2021. Many banks and economists didn’t forecast 10% rises until last month. We now believe that we’ll see growth of 15%, subject to rates staying low and no intervention from APRA. We make this prediction following the release of ABS data for quarter 4 of 2020, along with year-to-date CoreLogic data, which is reflecting what we’re seeing on the ground in the property market since late 2020. Privately, we’ve communicated since late 2020 that prices could set new records, with one key insight being our friends in NZ recording 20% annual growth, as shared in market update #18 of the Property Planner, Buyer and Professor podcast ‘The early trajectory for 2021’. The RBA is adamant rates will stay low until inflation consistently reaches 2-3%. Requiring unemployment in the 4’s or even 3’s (currently 5.8%) and wages growth above 4%pa (currently anemic at 1.4%). The RBA continue quantitative easing by buying Aussie bonds targeting 3 and 5 year maturities, keeping fixed mortgage rates low to support low variable rates with the cash rate at 0.1%. Overall, we expect a similar pattern to 2003 where capital cities values rose 18.1% Listen to Market Update #18 “The early trajectory for 2021” Check out the ABS data If you’d like to discuss your property plans or mortgage strategy, please get in touch with us here.