Formerly the “Property Planner, Buyer and Professor” podcast

Listen and subscribe

Android

Android

Highlight Segments

0.59 – The Trio chat about the recent income tax changes for Stage 3 on 1 July 2024

5.10 – Mike introduces the December market update

11.02 – Mike quizzes Cate about the state of the regions

6.00 – Cate talks through the historical declines and how our most recent decline compares to others

14.35 – Mike’s press release unpacked!

23.14 – Teaser from next week’s episode… Listener question: do we retire our debt or invest?

31.52 – Westpac Consumer Sentiment Index

43.50 – Gold nuggets!

Show notes

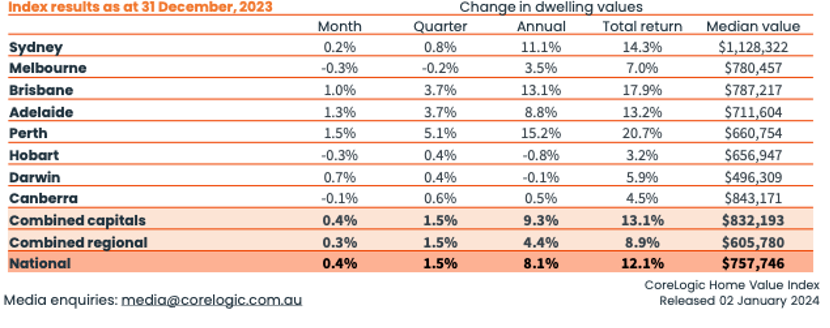

1. Home Value Index Results

The December data is out, albeit in parts after the Core Logic team put out a thinner report over the break. Dave points out that December represented the smallest gain in property growth and he ponders whether the most recent interest rate increase triggered a slowdown at year end.

Dave also draws our attention to the ‘tale of two cities’, and the two-speed property economy between the mining states and the non-mining states.

Cate questions the relationship between listing activity and growth rates. Is there a correlation? And are we back to the good ol’ days when it comes to the summer break and the property industry shutdown?

What’s happening with the regions? Dave and Cate shed light on some of the elastic behaviours in certain regions.

Source: CoreLogic

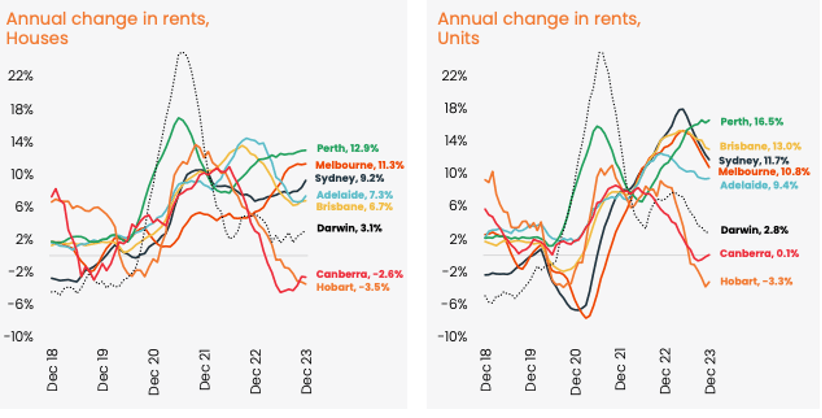

2. Rents

Mike shares his press release story about the national rental crisis with the listeners… tune in to hear more.

Was the December rental figure a data blip, or has the rental demand started to ease? Cate demystifies things for our listeners.

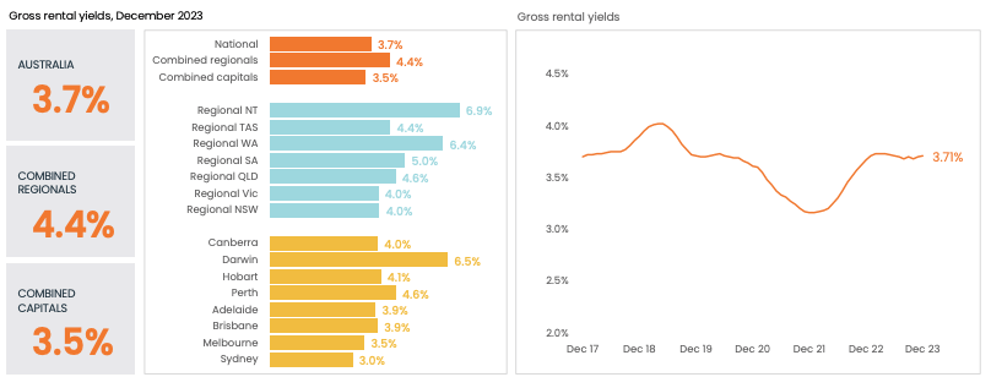

Gross rental yields have ticked up to new levels, but as Dave explains, “that’s what they used to look like!” Like many other property-related cycles, rental yield, too is cyclic.

Source: CoreLogic

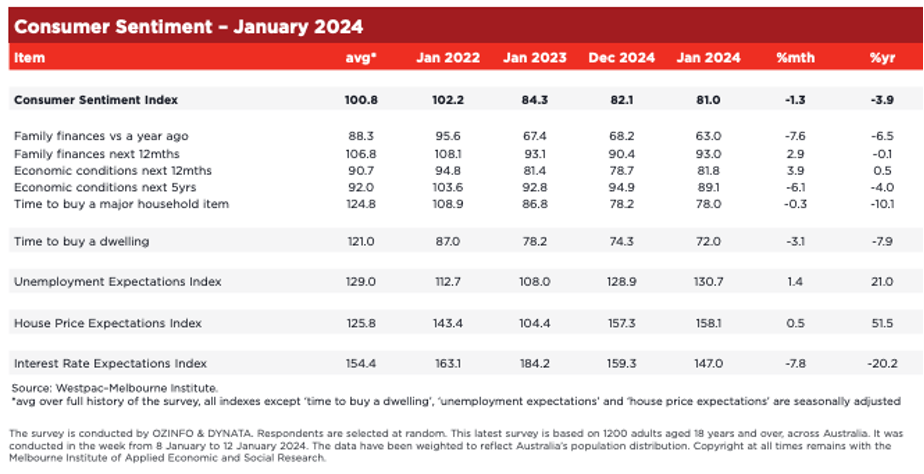

3. Consumer sentiment

Are we expecting a busy listing period over the coming months? Cate shares some coal face intel and some insights into buyer activity currently.

What is the Westpac Consumer Sentiment Index telling us? Have the interest rate increases finally bitten hard? And what direction does the Trio think rate movements will take over the coming months/year?

Source: Westpac Melbourne Institute

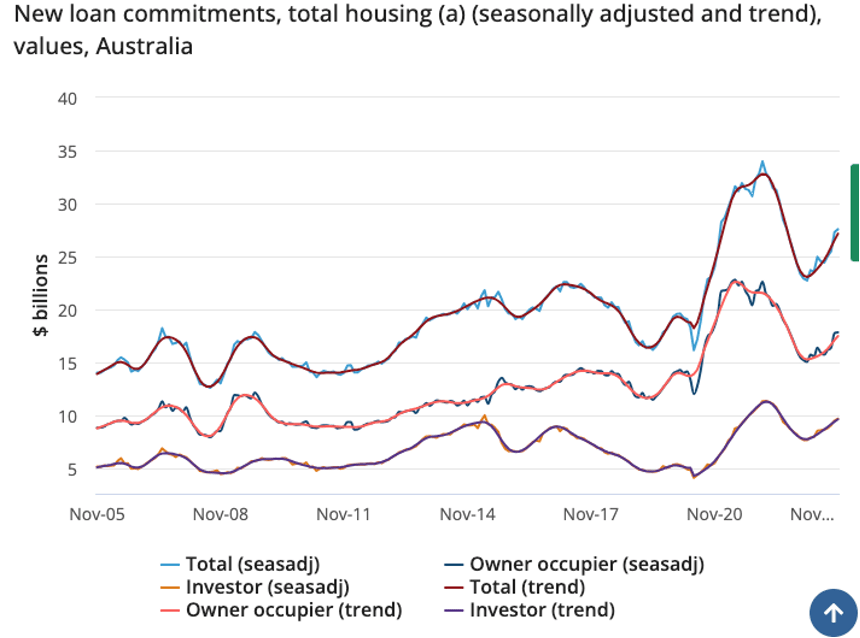

4. New Loan Commitments

And Mike asks Dave for some business insights into borrower activity; it’s an intriguing overview and it ties in with the data.

Source: ABS

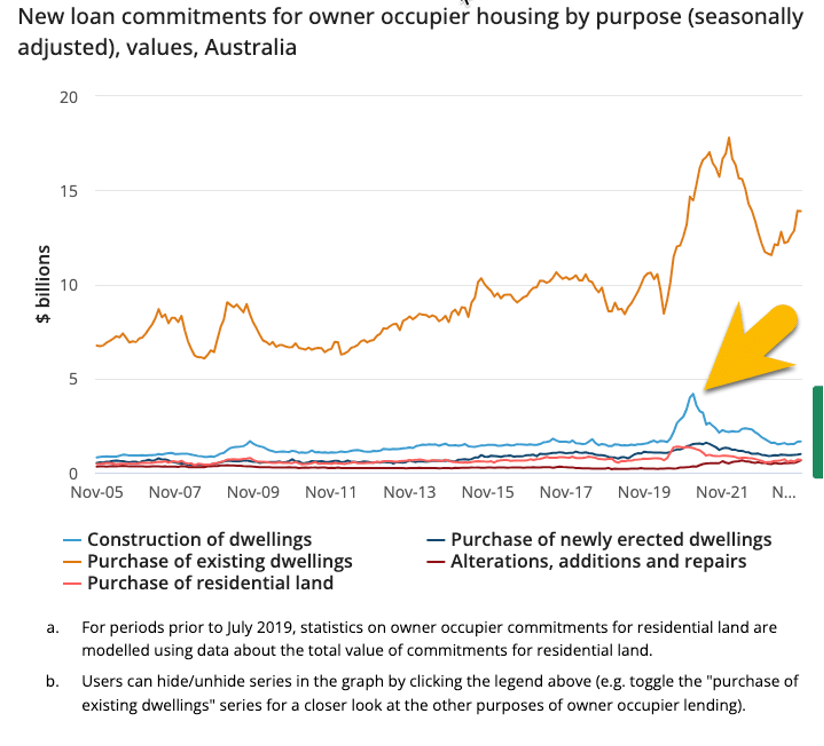

Lastly, Cate draws attention to the construction challenges being faced now.

Source: ABS

Gold Nuggets

Cate Bakos’s gold nugget: For all those people who are planning on purchasing sub-median priced property in early 2024, stay close to the agents as ex-rental stock emerges

Dave Johnston’s gold nugget: Dave emphasis the need to make your own personal decisions based on your own economy.

Resources

Ep. 6 – What determines your property strategy?

Ep. 10 – Why your approach and assessment is paramount to property success

Ep. 12 – Property Cycle Management

Ep. 18 – When to hold and when to fold

Ep. 60 – Why established properties out-perform