Capital Gains Tax

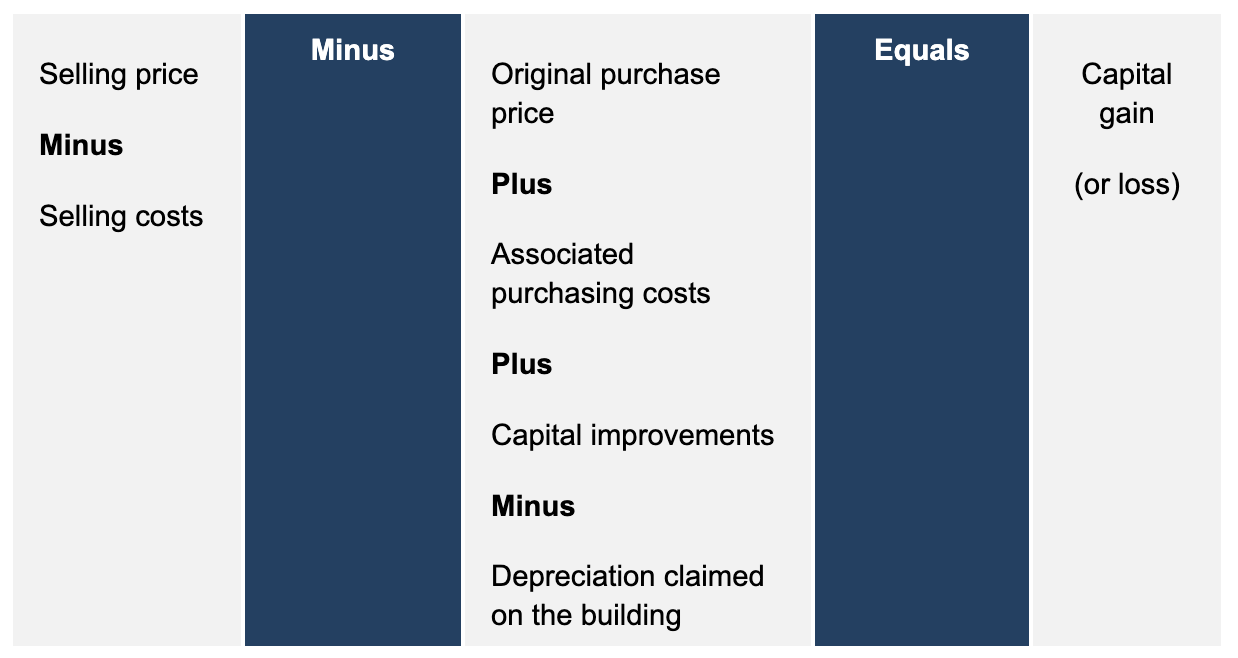

The sale of a property may have CGT implications. CGT is the tax payable on the difference between what it cost you to purchase an asset and the amount you received when you disposed of the asset.

Capital gains general example of calculation

Please note: This table is a general example to calculate your capital gain. It should not be relied on for actual calculations.

A seller may not be liable for some of the costs involved in paying CGT if they fall within any of the following exemption rules provided by the Australian Taxation Office (ATO).

‘Six-month rule’: Under the ‘six-month rule’, the ATO may allow you to hold two primary places of residence. If you dispose of the first dwelling within six months of acquiring the second property, both dwellings may be exempt for the whole period between when you acquire the new one and dispose of the old one.

‘Six-year rule’: If the owner of a Primary Place of Residence chooses to move out of their home and rent it out, a CGT exemption may be available for up to six years after they vacate.

The Property Planner’s fast fact

When could the ‘six year rule’ apply?

The ATO lists some reasons of when this may occur, such as if the owner accepts a job interstate or overseas, is staying with a sick relative long term or is going on an extended holiday.

There is currently no limit to the number of times a property owner can reset the exemption rule so long as each absence is less than six years. If you make this choice, you cannot treat any additional dwelling you own as your main residence for that period.

Principal Place of Residence (PPR)

On a simplistic level, a property that is owned by someone who resides, occupies or lives in the property is exempt from CGT if the purpose of the property is for residential accommodation and it is located on land less than two hectares in size. There are more complexities to consider and we always recommend that you seek advice from a registered tax account on all tax issues. If your property is CGT exclusive, this means that you can keep any profit on the growth in value of the property when you sell. This is one of the advantages of purchasing a home with great capital growth prospects. Subject to the exemptions explained, only one property can be classed as a PPR and, therefore, exempt from CGT at any one time.

Investment property

CGT is payable on any profit from the sale of an investment property. When individuals or small businesses own an asset for more than 12 months, the CGT rate is reduced by 50%. Please note: Stamp duty is added to the cost of purchasing, when calculating the profit.

Important reminder – We are not tax advisers and this document should not be relied upon. Always seek specific tax advice from a trusted tax accountant.

David is the Founder and Managing Director of Property Planning Australia, author of ‘How to Succeed with Property to Create your Ideal Lifestyle’, co-author of ‘Property for Life – Using Property to Plan Your Financial Future’, co-host of the ‘Property Planner, Buyer and Professor Podcast’ and a widely-published media commentator. With more than 20 years of experience, David is passionate about educating others to make informed, and ultimately, more lucrative property investment decisions. David established Property Planning Australia in 2004 – with the vision to educate and empower Australians to make successful property, mortgage strategy and money management decisions. Property Planning Australia’s operations have earned acclaim and national industry awards for its unique fusion of property planning, education, money management, mortgage strategy and risk management. All supported by multi award-winning customer service.