Capital growth prospects

Because the home is often the most valuable asset most people own, as you head into the flexibility stage of life, it is important to consider its capital growth prospects. There are two avenues for creating wealth through property, one is rental income and the other is through capital growth which is realised through a sale.

A home can only provide capital growth as a financial return. That is unless you turn it into an investment property. In which case, your long-term planning regarding your mortgage strategy is critical. This is something that most consumers are not aware of. It is a good time to note that properties that grow in value faster, also tend to grow in rental incomes faster. The general rule of thumb as to how your home buying impacts your financial outcomes is as follows: “The more money you invest in your home relative to your overall financial and asset position, the more focus you want to place on the capital growth prospects of the home.” This approach provides for greater wealth creation and more options for you financially as you move into the retirement phase of your life.

It is possible to create significant wealth through downsizing and accessing equity through the sale of your Principal Place of Residence which can be free of capital gains tax. There are also further tax incentives to place the cash from downsizing into Super.

Some people are able to set themselves up for a great and prosperous flexibility stage of life through owning only two properties, as they have significant wealth in the family home, one investment property, superannuation and other non-property investments. In this situation, they may only need to acquire one investment property, meaning they need to plan for downsizing to access a significant cash reserve towards retirement.

Should your next decision be lifestyle based, you should consider where you sit on the Lifestyle Vs Investment scale to assist with determining the location and asset selection. If ticking every box for lifestyle is number 1 and ticking every box as if you were to purchase a great investment property is 10, the question to ask is: where do you want to sit on the scale?

There is no right or wrong answer. What is most important is to contemplate and understand how the choices you make today could impact your future financial position and quality of life in retirement.

These decisions are personal and therefore only you can make them based on your values and goals. Determined and reviewed as part of the Property Planning questions and experience.

Owner occupier appeal is a key driver to capital growth because approximately two thirds of property owners are home-owners. You should strive for a dwelling that would appeal to the vast majority of home-owners in your selected location, if capital growth is a focus for you. The level of demand for a property determines the capital growth, therefore ‘mainstream’ appeal is important.

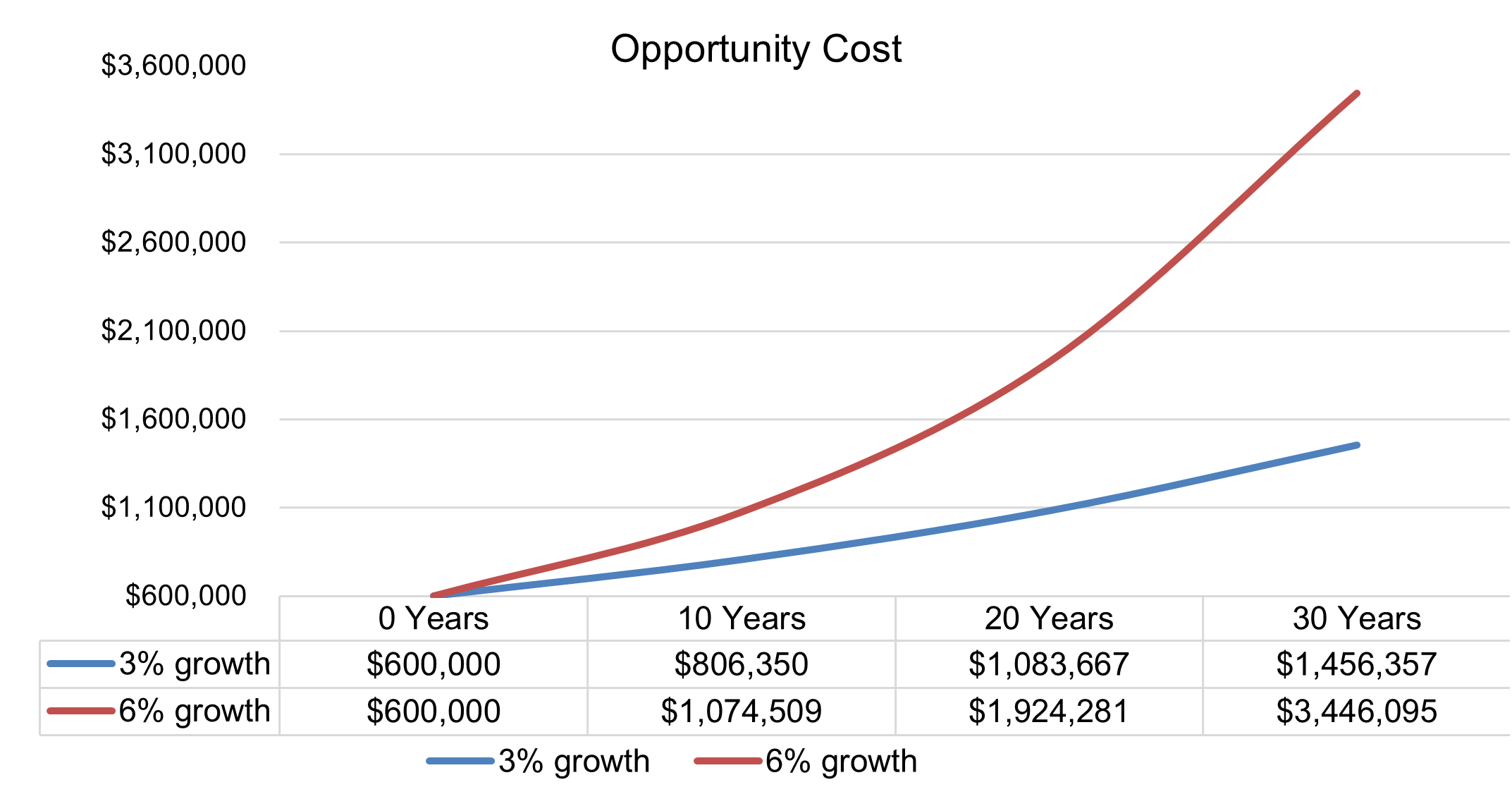

The Power of Compound Capital Growth

Note: property purchase was $500,000 with 6% annual growth

Note: Purchase Price $600,000 @ 6% Capital Growth per annum

| Years | Capital value | Compound growth $ | Compound growth % |

| 10 years: | $1,074,509 | $474,509 | 79% |

| 20 years: | $1,924,281 | $1,324,281 | 221% |

| 30 years: | $3,446,095 | $2,846,095 | 474% |