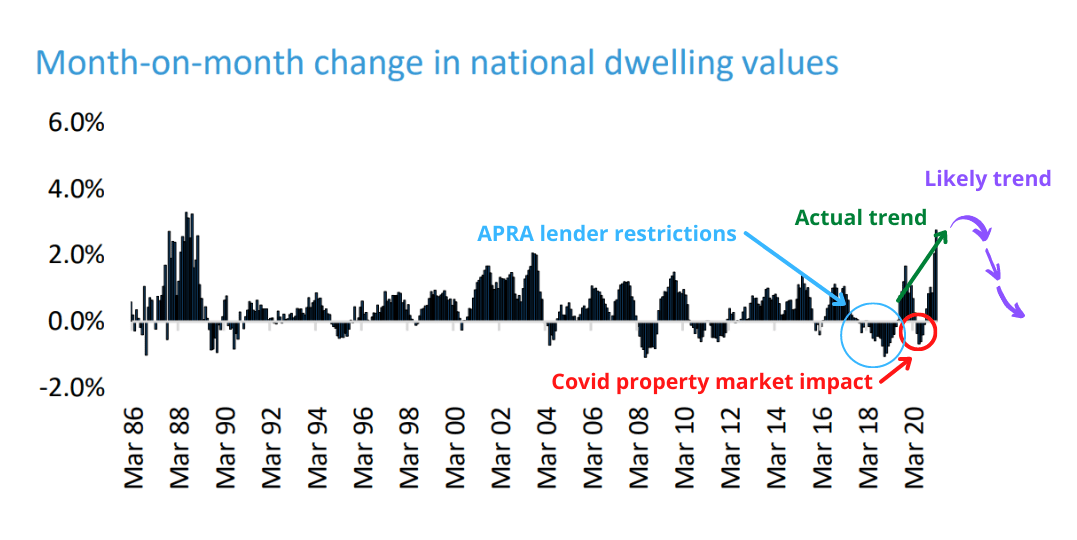

Covid property dip a blip in property history

Despite the doomsayers, the Covid induced downturn was one of the shortest of the last 35 years. Looking at the historical monthly movements, it’s clear that…

New Zealand abolishes negative gearing

In a shock move, the Ardern led NZ government last week announced the repeal of negative gearing. Taking effect from today…

Navigating a successful property purchase in a hyper competitive environment

Given the hyper competitiveness of the current property market, the Property Planner, Buyer and Professor podcast team have recorded a video to help you navigate a successful property purchase…

Why the property market was not impacted by Covid

This week’s correspondence from the treasurer Josh Frydenberg included some juicy insights around why the property market was not severely impacted due to Covid…

How to keep your first property as an investment and why most home owner’s don’t do it

In an ideal world, we all would keep our first property or current home when we upgrade. Unfortunately, most people are not able to achieve this outcome because…

Are fixed-rate home loans below 2% too good to be true?

Now might just be the best time in history to fix your loan! Find out why