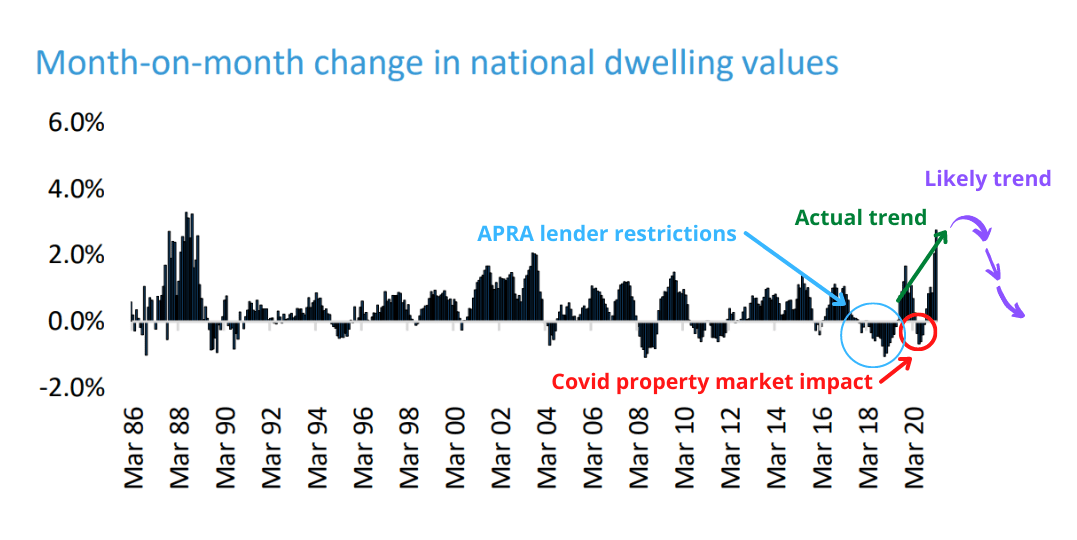

Despite the doomsayers, the Covid induced downturn was one of the shortest of the last 35 years. Looking at the historical monthly movements, it’s clear that negative growth intervals are shorter than upswings. Many have forgotten that only recently we lived through our longest and largest property market retraction on record. This elongated dip lasted for almost 2 years during 2017 to 2019. This was largely driven by three factors:

Despite the doomsayers, the Covid induced downturn was one of the shortest of the last 35 years. Looking at the historical monthly movements, it’s clear that negative growth intervals are shorter than upswings. Many have forgotten that only recently we lived through our longest and largest property market retraction on record. This elongated dip lasted for almost 2 years during 2017 to 2019. This was largely driven by three factors:

- APRA imposed lending restrictions.

- Banks heightened risk aversion from the banking royal commission.

- The risk of negative gearing being abolished if Labor won the election.

This partly explains why we predicted the current recovery in September 2020 as property values have been stagnant for 4 years until late in 2020. During this time personal income growth quadrupled that of property. This is a major reason why the government is likely to ignore any calls for APRA to intervene in the short to mid-term and price rises of 15% to 30% are expected and acceptable.

This serves as a poignant reminder of why a long-term perspective is vital and how our property market can be eternally manipulated by government policy and stimulus.

Providing some much-needed perspective that is often lost in the hurly burly of daily and monthly market movements.

History doesn’t repeat, but it often rhymes!

So, what can we glean from the last 35 years of property data?

- We can see the sky scraper forming with the current market recovery, which started during the final quarter of 2020 prior to the Covid pandemic.

- The latest and tallest monthly return, being March 2021, showing the highest monthly price jump since 1988, with a 2.8% surge in national values. We think this will prove to be the peak of market growth.

- The Covid property market period of retraction was a mere blip in the annals of history. This is despite many ‘experts’ predicting significant drops that the media bought into up to 20% to 30%.

- If you extrapolated a line from the pre-covid peak in March 2020 to the current figures in March 2021, the trajectory would look relatively smooth and would appears as a natural progression of market direction.

- Market falls tend to be shorter than the duration of market recoveries and periods of growth.

In other words, we may consider the current market very frothy. But it is merely a reflection of pent-up inability or desirability to take action during Covid. This inaction has now been made up in a shorter period of time than normal, hence the rapid market movements.

This overall property market median position would have likely happened. But without the brief retraction followed by an extra rapid recovery, therefore the spike would not have been so great.

This provides a great example of the benefits of taking a long-term view when considering any marketplace. By consciously taking in the big picture, we are educated and empowered to make superior decisions for ourselves and in relation to the market.

In the case of property buying, this ensures that our investment, lifestyle and financial decisions match our long-term goals and Property Plan.

This prompts a key question regarding the current market trajectory, namely, how long will this cycle last?

By looking at historical positive growth periods and the trajectory of this market, including our view that it has peaked, we suspect that this rebound has reached its peak. Even with APRA intervention to restrict lending later in 2021 or early 2022, the market will only gradually be pulled back over many months.

This all tells us that this run of positive growth (as opposed to the level of growth currently occurring) is likely to last at least into the first half of 2022.