Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

1. Heat in the market is dissipating

Anecdotally, we’re seeing some behaviours such as vendors holding out for better prices that are not always being achieved, supporting the fact that the heat is coming out of the market to some degree. As touched on during recent Podcasts, we don’t expect prices to be growing at quite the same rate of knots as the first four months of this year across most part of Australia.

2. Smaller capital cities have been the outperformers of the last 12 months

The latest property index results for April from CoreLogic reveal that Adelaide, Hobart, Darwin and Canberra have outperformed Sydney, Melbourne and Brisbane over the last year. We know that the larger capital cities took the biggest hit during the covid-downturn due to lockdowns and halting of international travel. It’s worth noting that while Darwin and Perth are doing well, they are still behind their peak medians reached in 2014 and still have far to go. And many of the regions around our nation have also outperformed the two biggest cities, but Sydney in particular is making up ground rapidly and we expect these numbers to evolve over the next three to six months.

3. What tales are the vacancy rates telling?

Looking at the vacancy rates for Melbourne and Sydney, you’d think that they are in dire straits. What’s increasingly evident is that the markets of the largest capitals are operating at two speeds and there is a large disparity between vacancies for houses versus units. Much of the higher vacancy rate will be due to medium to high density apartments and student accommodation. This is another example of why you need to dig beneath the data, as it can’t always be taken at face value, and generalising data can hide important detail.

4. The swinging pendulum – investors vs home buyers

Investor mortgage numbers have recorded anincrease, suggesting that the pendulum could be swinging back towards an investor market. First home buyers are starting to reduce, as prices get more unaffordable for new entrants to the property market. This latter point is one of the drivers for government initiatives that have been announced in our most recent federal budget.

5. Property incentives from the budget announcement

The trio talk through the 4 key property market incentives and schemes announced in the federal budget, including their merits, insights gleaned and likely impact on the property market. They include:

- New Home Guarantee (increase demand and price) – additional 10,000 places allowing first home buyers to build a new home or buy a newly built home on as little as 5% deposit, with the government acting as guarantor on the loan, freeing the buyer from lender’s mortgage insurance.

- First Home Super Saver Scheme (increase demand and prices): first home buyers will be able to release up to $50,000 as part of voluntary contributions under this scheme (increased from $30,000).

- Family Home Guarantee (increase demand and prices) – a scheme allowing for 10,000 single parents over the next 4 years to purchase a home with a deposit of just 2%, with the government providing a guarantee of 18%.

- Downsizer Super Scheme (Increase supply) – allowing those age 60 and above to contribute $300,000 into super when selling the family home. This will not only bolster retirement savings, but also free up critical housing stock.

6. RBA reiterates its commitment to maintaining a low cash rate

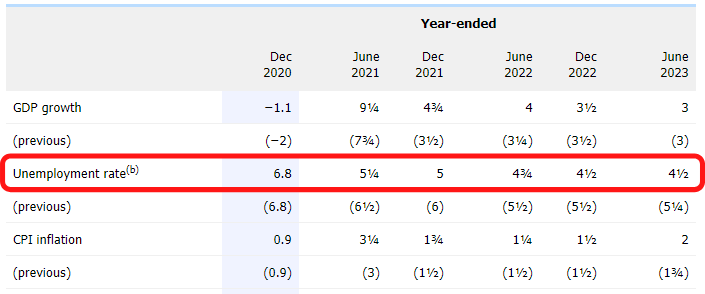

The RBA have consistently communicated since mid 2020 that rates will remain low until inflation hits the target band and remains there for a sustainable period. The target band for inflation is between 2% and 3%. For inflation to reach this level, the Reserve Bank believes we require wage growth to be 3% to 4%. It’s becoming increasingly evident that unemployment needs to drop down to the low 4%’s, or perhaps even the high 3% from the current 5.6% for this kind of wage growth and inflation to occur. If this level is reached, it is unlikely to happen until 2023 or 2024. Hence the central case is that interest rates will remain nailed to the floor until then. For context, unemployment has not been at 4% since August 2008. As you can see below, the current forecast from the RBA is for unemployment to reach below 5% by the end of next year.

7. APRA intervention

APRA has made it clear it has no mandate to control house prices, but it will need to act if risks are growing on the balance sheets of regulated banks,or if they feel that there are financial stability concerns. They are also conscious not to be as heavy handed with macro prudential measures as they were in 2017-2019 with Sydney prices retracting by 15%, and Melbourne by 12%. For perspective, these are the biggest price drops on record. This is why any measures implemented will be designed to softly flatten the market, rather than decimate it.

8. Non-banklenders, the next target of APRA?

Non-bank lenders are often more lenient in their borrowing capacity assessment, allowing borrowers access to more money than a major bank would allow on most occasions. The differential can be quite significant. For this reason and the fact that the government targeted non-bank lenders as part of their policy to repeal responsible lending laws, non-bank lenders could be part of the next target for APRA if concern builds over the risks of non-bank lending policies and practices. The Property Planner explains the policy differences between bank and non-bank lenders and why you can regularly access more credit using a non-bank lender. And why you shouldn’t let a few percentage points in interest rates get in the way of your property strategy.

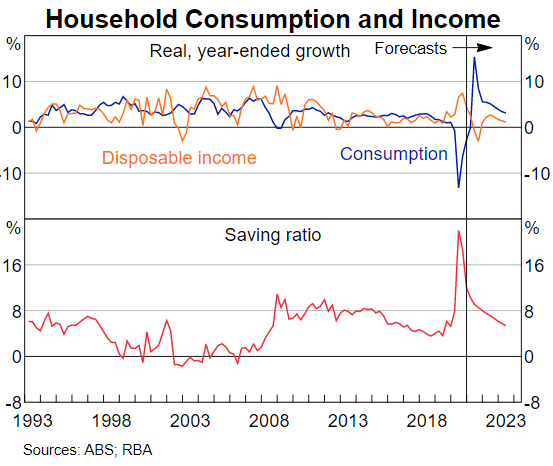

9. Australian’s on the spend – a consumer driven recovery

The household savings ratio had spiked to a historic high of 19 per cent during the pandemic. But as households emerged from lockdown the rate of savings fell quick smart to 12 per cent in the December quarter. We certainly all enjoyed being able to get out and about and spend on holidays, social activities, material goods and of course, housing. This savings rate is expected to fall to 8 per cent by the end of the year. This is exactly what the government wants to see, as consumer spending creates jobs which drives the economy.

\

10. Property market sentiment is shifting

The ‘Time to Buy a Dwelling Index’, which is one of the indexes feeding into the Westpac Melbourne Institute Consumer Sentiment index has decreased from 116.4 in March to 107.2 in April. It is now 18.8% below its recent peak in November 2020 of 132. Some buyers are discouraged by the recent surge in prices and implications for affordability, however the index is still above 100 which means the majority still believe now is a good time buy. The lowering of this index is reflected by the heat in the market is dissipating. Despite this, we expect the property market to continue to see price growth at a reduced pace right into the first half of 2022.

Resources

- Family home guarantee

- First Home Loan deposit scheme (New Home Guarantee) – nhfic

- Preparing for auction #2 (#78)

- The winner’s curse and how to avoid it (#75)

- The Seven secret steps to buying a house (#74)

- Property Planning your next purchase – critical considerations and why modelling financial outcomes is vital to success (#73)

- Goal setting fundamentals for property success (#67)

- Why your Mortgage Strategy is more important than your interest rate! (#9 )

- How to succeed with Property and Create your Ideal Lifestyle

- Mortgage Strategy 101 – YouTube video series.

Gold Nuggets

David Johnston- The Property Planner’s Golden nugget: for people who are waiting for interest rates to rise to get into the property market, for this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. That isn’t going to happen until 2024 at the earliest (the RBA believes). Make your property decisions based on your own personal economy and not what’s happening in the external economy. APRA has made it clear it has no mandate to control house prices, but it will need to act if risks are growing on the balance sheets of regulated banks or there are financial stability concerns. That could be in 6 months or so, but they want to flatten it, not decimate it.

Cate Bakos – The Property Buyer’s Golden nugget: the impact of sentiment and how it can be dangerous, if we look at what everyone else is doing and we follow suit. That can be very dangerous at times. Listening to interview about guys who invested crypto currency called Doge, it’s experienced phenomenal growth. They anticipated Doge coin would have a run and Elon Musk referenced it, he made a remark that wasn’t so supportive and it dropped 28% immediately. Sometimes our market can be quite fickle and we need to ask more questions.