From our extensive experience in property there are seven elements which, when considered together, are more likely to lead to investment success. We call these the ‘Seven principles for property success’. These criteria are covered extensively in your Property Plan and are summarised below for your reference.

- Goal-setting and a long term ‘property’ plan

Setting goals is fundamental to long-term success. Goal-setting keeps you motivated and ensures you maintain focus and allocate your time and resources efficiently and effectively. Equally important, is having a long-term view. You are then able to make short-term decisions and set goals that are aligned with your long-term vision. Sounds obvious, right? Well, unfortunately too few investors seem to be doing it in the property sector.

If you do not have short and long-term goals in place – goals that you regularly review with your Property Planning team – then your property decisions may become costly.

- Mortgage strategy

A mortgage strategy sets the foundation for growing your wealth and managing risk. It is also fundamental to supporting your Property Plan. We will work with you, including meeting annually, to implement and maintain the right mortgage strategy to support your Property Plan.

- Money management

Successful money management is intrinsically linked with your mortgage strategy and property investment success. Careful and disciplined money management requires saving a set percentage of your income every month, ideally paid into an offset account.

In today’s economy, most Australians will earn between $4 million and $5 million during their working lives. It is almost impossible to compete with that earning capacity through property investment alone. Your remuneration will almost certainly be the key to funding your investing. Your remuneration has the additional benefit of adding to your superannuation to assist with funding retirement. A combination of wise property decisions, mortgage strategy and disciplined money management can help you create your ideal lifestyle.

- Risk management

A defence strategy for risk management includes money, tax and considering economic risks which are outside of your control (such as regulatory and market risk) and also those personal/behavioural risks which you can control (such as your tolerance for risk). While you need to take on some level of risk to enter the property market, having a clear understanding of a full suite of risks and appropriate risk management strategies is important.

To help you make your next property decision and then implement your overarching Property Plan, it is critical that first you are aware of, understand the impact of, and plan for potential risks. This will increase the chances of preventing or at least adequately addressing any serious financial concerns you face without the need to sell a quality property asset quickly and unnecessarily.

The most common property regrets people have in life are:

- selling property that could have been held on to

- not buying property when they could have

- purchasing an underperforming property

- purchasing the wrong property which you end up needing to sell.

Successful money management, mortgage strategy and sound property education are fundamental to your Risk Management strategy.

Prevention is always better than needing a cure. There are many methods at your disposal to prevent being in the position where a bank is forced to sell your property to recoup their funds.

- Time in the market (the power of compounding)

The power of compounding can work for you when you purchase quality property and hold it for as long as possible, while also saving more than you spend to minimise interest payable. ‘Timing the market’ is achievable, but very difficult – especially if you are not an expert in economic analysis. As such, to minimise mistakes and harness compound growth we recommend that you adopt the ‘buy and hold strategy’. This is more achievable by having your long-term goals in place as early in life as possible. The graph highlights the power of compound growth. Note that in the first 10 years the figure has not doubled, yet after 20 years it has tripled, and after 30 years it is more than five times the original value.

Table 7 – The power of compound capital growth. This example is $500,000 with 6% annual growth.

Notice the compounding jump in value over time:

Value – $909,698 – 10 years $409,698 increase in value

Value – $1,655,102 – 20 years $745,404 increase in value

Value – $3,011,288 – 30 years $1,356,186 increase in value

By efficiently growing the gap between total assets and debt, AND income versus expenses, the sooner you will move yourself into the flexibility stage of life. Minimising mistakes is important.

- Quality over quantity

As you know, Property Planning Australia’s philosophy is that you only need to own two-to-five quality properties (including your home) to retire wealthier than the vast majority. As such, you should focus on quality over quantity and making each property decision as ‘right’ as possible.

Please note, however, to purchase a property you need to be willing to pay more than anyone else and it will be competitive when attempting to secure quality real estate.

- Holding quality property

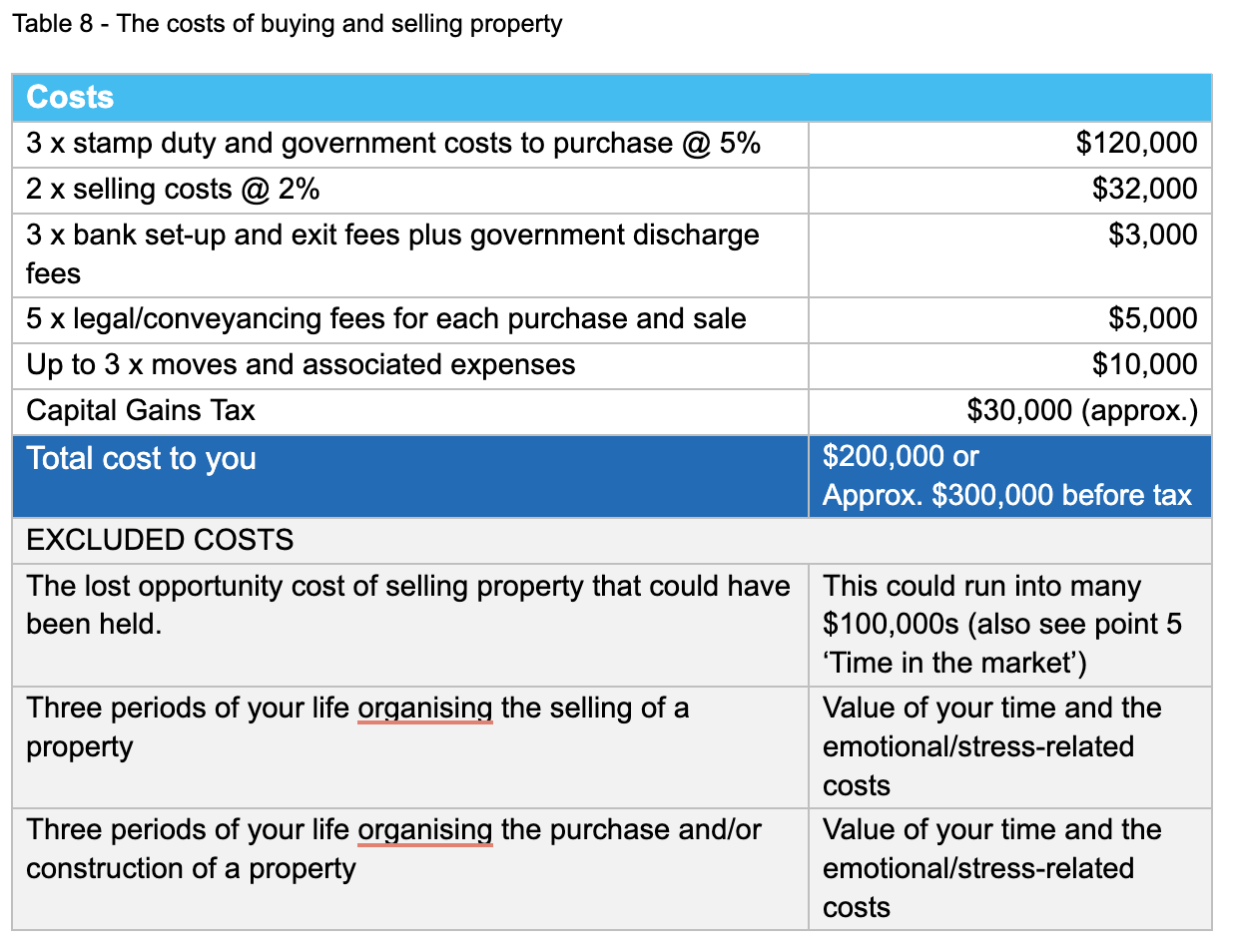

Your money management and mortgage strategies play a vital role in enabling you to maximise your ability to hold any properties you accumulate. Ideally, the only time you will sell quality real estate is to improve your lifestyle, for example: upgrading to your long-term home or downsizing. Otherwise, the risk to you is increased and unnecessary costs. The Table below provides an example of the direct and indirect costs associated with buying three and selling two properties.