Dave’s market update is a special one – he has been in the mortgage industry for over twenty years and his mortgage intel is always exciting. One lender has re-introduced negative gearing into their serviceability calculator. This essentially means that “shading” on rental incomes enables heightened borrowing capacity for investors. While it’s just one lender… these situations often mean more will follow.

What could this mean for investors who are building a property portfolio? Tune in to hear Dave’s coal face observations and thoughts on why this is happening.

Cate’s market update relates to civil and infrastructure works. From a planning point of view, home owners and investors should be mindful of the impact of these works. From compulsory acquisition to road widening to zoning changes, buyers should look into these changes and consider the impact to their purchasing plans.

Following on from Episode 194, the trio uncover the common triggers for upgrader/family home buyer discord.

What are some of the triggers for upgraders/family home buyers when it comes to upsetting a relationship?

From provisioning cashflow to enable parents to stay at home with young children to managing thoughtful discussions about retirement plans, Dave sheds light on the benefit of having buffers and a strategy to navigate some of these often-treacherous waters.

“Going in with your eyes open” is a popular mantra Dave adopts when helping his clients navigate big decisions like these.

The trio discuss some of the other tricky aspects, including;

– identifying the need for living in a show-home vs enjoying a simpler life

– debt comfort level misalignment

– investing vs nesting

– location preference disharmony

Cate reminds the listeners that having a mutually shared spot on the Venn diagram is essential to overcome couple’s different preferences and clashing risk profiles.

Dave raises an interesting point about the relationship between financial focus and personality traits. Not all people are financially literate and many have to be taught about the difference between good debt/bad debt, and the merit of having financial goals.

What are some of the triggers for investor couples when it comes to upsetting a relationship?

Pete uses a great example to illustrate the importance of remaining unemotional and pragmatic decision when it comes to investment property selection. And his two ‘fundamentals’ questions highlight just how pragmatic the Property Professor’s approach is: “Is it in a good location, and does it have a good land component?”

To support Pete’s philosophy, Cate’s favourite saying for her investor clients is; “You don’t have to love it, in fact you don’t even have to like it, but I want you to be proud of it.” This extends to those who also confuse investment with holiday homes and future use potential.

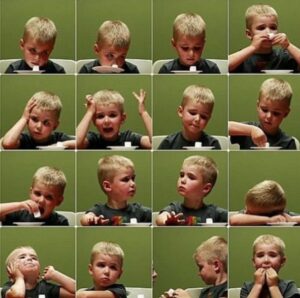

Sacrificing family home dreams is another common source of upset, as is impatience. Dave’s example about the kids who were offered one marshmellow immediately, versus those who were rewarded with two marshmellows if they could wait for five minutes had the trio chuckling. Property investing really is a long game and it does require sacrifices at the start.

The trio also chat about misalignment of preferences for asset classes, and bad previous experiences with property investing tarnishing enthusiasm.

Cate Bakos, the ‘Property Buyer’s Gold Nugget: Cate shares some good tips based on personal experience. To get yourself in the best position to present to a financial advisor, Cate recommends couples take the time to understand each other’s positions on wealth creation and debt aversion, and she encourages couples to be prepared to talk to each other about their sensitivities.

David Johnston, the ‘Property Planner’s Gold Nugget: Dave notes that the crucial conversations are the hardest ones to have, but to push past the discomfort, remain open-minded, and to chat consistently is critical for couples who want to be on the same page when it comes to property and finance.