Join us on the Property Trio podcast for our latest episode #219: The Role of the Reserve Bank of Australia (RBA), Why they Target Interest Rates & Why we Need Inflation, Just not too much of it!

Dave breaks down the RBA’s mandates: maintaining full employment, ensuring economic prosperity for all Australians and stabilising the currency.

Why is inflation essential, and what are its benefits?

From encouraging spending to facilitating wage growth, we explore the many facets of this economic concept to help you navigate your own personal economy and property decisions.

The trio unpacks the logic behind the RBA’s 2-3% inflation target. What led the RBA to this figure, and how does it positively impact the economy, and why runaway long-term inflation above this level reduces our collective standard of living. All is revealed!

Dave sheds light on the reasons the RBA adjusts the cash rate and the additional measures the RBA has in their monetary policy toolbox to help the economy work better for Australians.

Mike demystifies Quantitative Easing (QE), AKA money printing, outlining its drivers, purpose, outcomes, and even some unintended consequences.

And what of the outcomes of raising rates to reduce inflation? Tune in to find out!

Whether you’re a homeowner, an investor, or just curious about the economy and, most importantly, how to successfully manage your own personal economy, while making property and investment decisions, this episode has something for everyone!

Don’t miss out on these insights and join the discussion with Dave, Mike, and Cate!

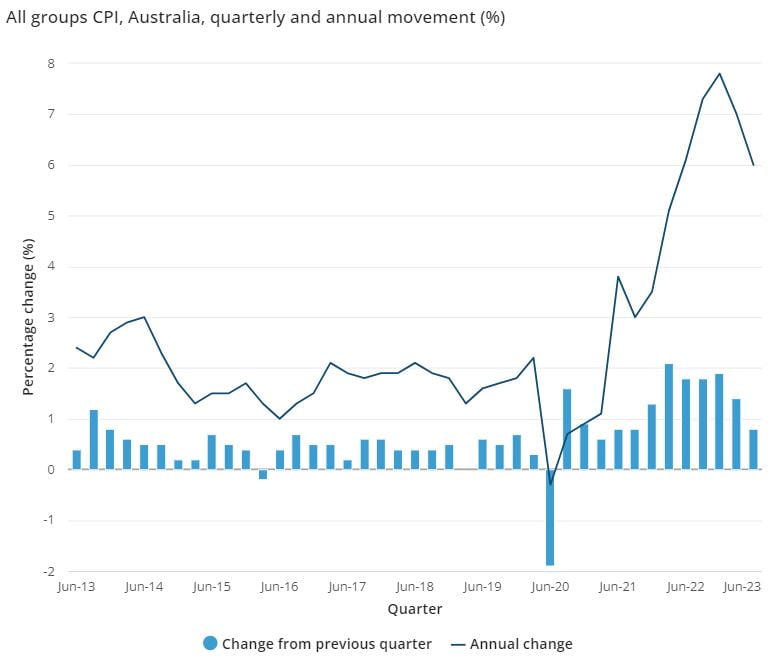

Source: ABS

The Benefits of (Some) Inflation

The Trio unpack why inflation is essential to a healthy economy and the positive impacts of keeping low and steady inflation.

Here’s what we cover:

- Encourages Spending and Investment: Inflation can incentivise consumers and businesses to spend and invest rather than hoard cash. When people anticipate rising prices, they are more likely to make purchases and invest their money in assets or projects that have the potential to generate returns. This increased economic activity can stimulate demand, drive production, and contribute to economic growth.

- Supports Debt Repayment: Inflation can make it easier for borrowers to repay their debts. When there is inflation, the value of money decreases over time. As a result, borrowers can repay their debts with money that has less purchasing power compared to when they initially borrowed. This can provide relief to individuals and businesses burdened with debt obligations.

- Facilitates Wage Adjustments: Inflation can help in wage adjustments and maintaining labor market flexibility. As prices rise, wages tend to adjust to reflect the increased cost of living. This flexibility allows wages to respond to changes in supply and demand conditions in the labor market. It can help ensure that workers’ wages keep pace with the overall price level and maintain their purchasing power.

- Encourages Long-Term Investment: Inflation can incentivise long-term investment over short-term speculation. When inflation erodes the value of cash holdings, investors are more likely to invest in productive assets such as stocks, bonds, or real estate to preserve or grow their wealth. Long-term investments contribute to capital formation and can support economic development and productivity improvements.

- Provides Monetary Policy Flexibility: Inflation allows central banks to use monetary policy tools to manage the economy. By adjusting interest rates, central banks can influence borrowing costs, control money supply, and steer the economy towards desired outcomes such as price stability and sustainable growth. Inflation provides a reference point for central banks to set their policy rates and implement appropriate measures.

The Logic Behind the RBA’s 2-3% Inflation Target

The Trio unpack what led the RBA to this 2-3% figure, and how it positively impacts the economy, and why runaway high long-term inflation reduces our collective standard of living.

A target range of 2-3 percent inflation is often considered a good target for central banks for several reasons:Price Stability: A moderate level of inflation within the target range promotes price stability. Price stability is desirable because it allows consumers and businesses to plan their economic decisions with confidence. When inflation is low and stable, it reduces uncertainty and minimizes the disruptive effects of rapidly changing prices.

- Facilitates Monetary Policy: Inflation within the target range provides central banks with a meaningful reference point for conducting monetary policy. It allows them to set policy rates and implement measures to manage the economy, such as adjusting interest rates and controlling money supply. Having a clear inflation target helps central banks communicate their policy objectives and anchor inflation expectations.

- Avoids Deflationary Pressures: Targeting a positive inflation rate helps to avoid deflation, which is a persistent decline in prices. Deflation can lead to economic stagnation and discourage spending and investment. By setting a positive inflation target, central banks aim to prevent deflationary pressures and maintain a more favorable economic environment.

- Supports Real Income Growth: A target range of 2-3 percent inflation can align with a goal of supporting real income growth. When wages and income increase at a similar or higher rate than inflation, it allows individuals to experience a growth in their purchasing power and maintain or improve their standard of living. It helps ensure that wage growth outpaces the erosion of purchasing power caused by inflation.

- International Consistency: A target range of 2-3 percent is commonly used by central banks in many countries. Having a consistent inflation target across countries can facilitate international trade and investment, as it provides a basis for comparison and stability in economic relations.

The trio ponder these various reasons and apply some relevant examples.