Welcome to the Property Planner’s Monthly Market Update, your comprehensive resource for the latest insights and trends in the real estate and economic landscape!

Stay informed and ahead of the curve with our expert analysis, helping you make well-informed decisions in the ever-evolving property market.

Melbourne Market Recovery Rolling On!

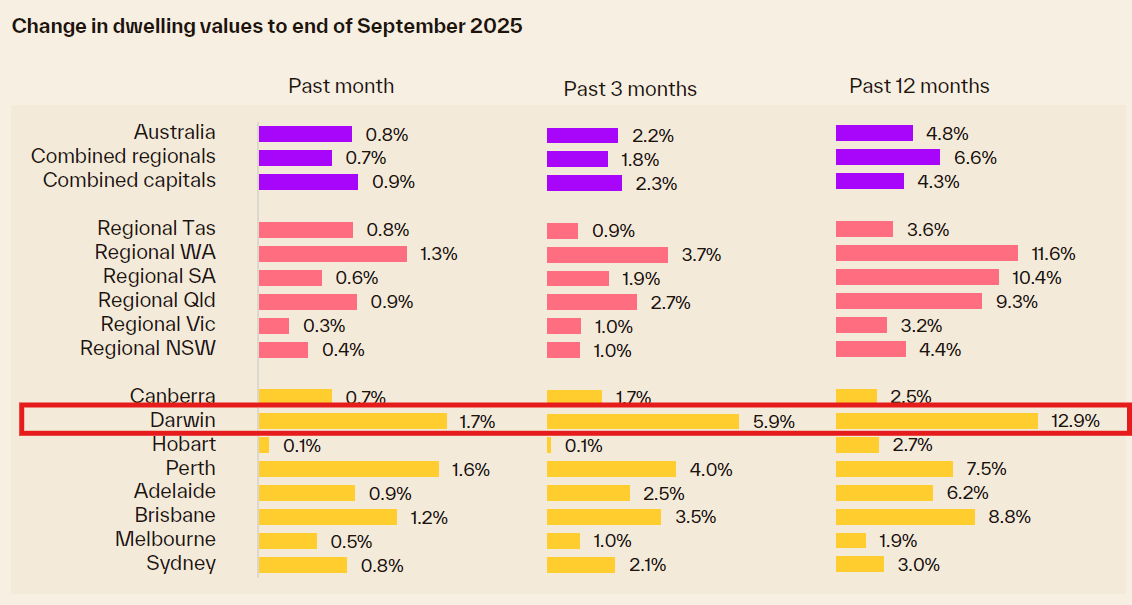

The recovery in Melbourne continues, with another month of steady growth — values rose 0.5% in September.

Since the first rate cut back in February, Melbourne values have been rising consistently between 0.3% and 0.5% each month according to Cotality (formerly CoreLogic).

Interestingly, the unit market outpaced houses in September, with units up 0.6% and houses rising 0.5%.

Now that the AFL season is in the books, attention turns to October to see whether more listings come to market.

As of the end of August, the number of homes for sale was still 15.4% below this time last year, suggesting further upward pressure on prices due to limited supply.

It appears many Melburnians are holding off listing their homes for sale until values recover further.

Source: Cotality

Darwin Property Market on Fire in September!

Darwin is leading the pack this month, recording an impressive 1.7% growth in September alone.

Back in May, we predicted Darwin would be one of 2025’s standout markets

We even unpacked the trends driving its strength in our podcast episode #308

Over the past year, values have climbed a strong 12.9%.

It’s houses that are driving the market, with house values surging 2.0%, while units gained 0.9% in September.

With the number of homes for sale sitting 53% lower than the 5-year average, demand is pushing prices higher and keeping momentum strong.

Click here for more insights on Darwin.

Source: Cotality

Perth Property Market Powers Ahead!

Perth has been building momentum since March, and September delivered its strongest growth of 2025 so far.

Perth property values jumped 1.6%, second only to Darwin’s 1.7% rise, as the city continues to show resilience with steady price growth since interest rates began to decline.

With the number of homes for sale sitting 45% below the 5-year average, demand is keeping competition high.

Both segments are performing strongly, with houses up 1.6% and units up 1.5% last month.

Source: Cotality

Brisbane Property Market Holding Strong!

Brisbane values grew by a solid 1.2% in September, matching August’s result for another month of solid gains.

It was units leading the way, rising 1.7%, while houses still posted healthy growth of 1.1%.

Like Perth, Melbourne and Darwin, supply remains tight.

The number of homes for sale in September was 31% lower than the 5-year average, keeping competition high among buyers.

Source: Cotality

Homebuyer Sentiment Rises in Victoria

Melbourne’s property scene is starting to shine again and momentum is building.

In October, homebuyer sentiment in Victoria for the ‘time to buy a dwelling’ index led the pack with a reading of 108, showing more optimism than in NSW (98), Queensland (86) or WA (87).

Victorians are now the most optimistic buyers in the country, believing it’s a good time to enter the market.

And as we know, sentiment drives markets.

Melbourne’s recovery has been gathering pace since the first rate cut back in February, and all signs point to an even stronger run in 2026 as confidence builds and conditions improve.

With one or two more rate reductions expected and the expansion of the First Home Guarantee Scheme on October 1, now open to a wider pool of buyers, momentum is set to accelerate further in all cities.

As we predicted at the start of this year, 2026 is shaping up to be the year that home prices take off.

Source: Westpac-Melbourne Institute

Rents

The national Rental Index climbed 0.5% in September (seasonally adjusted), taking the quarterly increase to 1.4% — the fastest pace since June last year.

Among the capitals, Darwin led with a 2.9% quarterly rise, followed by Hobart (+1.9%) and Perth (+1.7%). Melbourne (+0.8%) and Adelaide (+0.4%) saw the smallest gains.

The tough news for renters — supply remains tight. Over the four weeks to September 28, rental listings were around 25% below the five-year average.

With rents carrying heavy weight in the CPI, this renewed upswing could add pressure to inflation in the months ahead.

Source: Cotality

Reach Out to Us

If you would like to discuss your next steps, property plans, and mortgage strategy, get in touch with us today. Our team of experts is here to guide you through the complexities of the market and help you achieve your property goals.