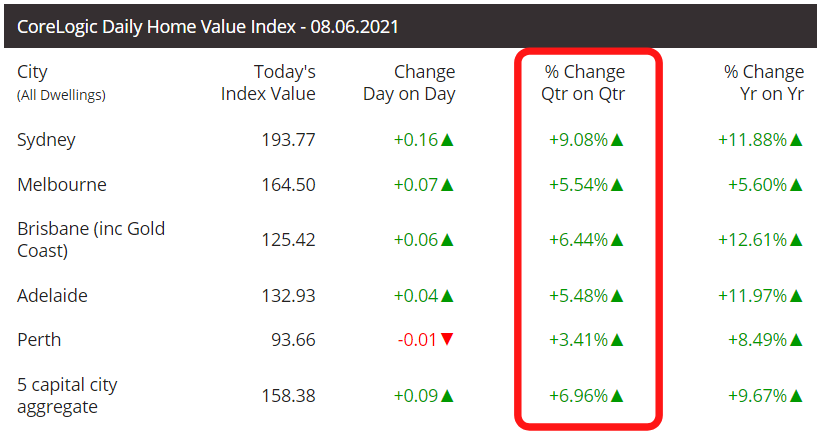

The Sydney property market is the hottest of the 5 major capital cities, reflected in CoreLogic data showing growth reaching 9.08% in the last 3 months alone. That’s a growth rate in excess of 36% pa.

The Sydney property market is the hottest of the 5 major capital cities, reflected in CoreLogic data showing growth reaching 9.08% in the last 3 months alone. That’s a growth rate in excess of 36% pa.

Sydney’s negative and weaker months of June to October 2020 will soon fall off the 12-month numbers. These months saw negative growth up to –0.90% before the rebound. They will simultaneously be replaced by the current growth trend – a double whammy for the headline annual growth rate which will jump rapidly from 11.2% over the last 12 months to 15%, and possibly above 20%, sparking significant chatter about affordability.

As Sydney is the largest property market in the country, this will have a disproportionate impact on the national growth rate, causing a media and political frenzy during August, September and beyond.

The Labor party will attack the LNP on housing affordability, which will play well leading into the election. Combined with investor numbers growing faster than home buyers as is currently happening, it’s becoming increasingly likely that APRA will move to curb investment lending at the end of 2021 or early 2022.

It will be a difficult balancing act for the government to manage property prices, whilst continuing to drive the economic recovery prior to the election.