Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through

#3. Mixing emotion with pragmatism when it comes to investing

What are some of the mistakes?

- Imagining themselves in it – this starts when a buyer walks through a property and starts giving feedback on things that they don’t quite like. You don’t want to write things off due to personal taste. If it’s easy to update or remove, then you can ignore it.

- Thinking about it as a future ‘maybe’ home for them (or their kids) – that’s a difficult thing to navigate because you’re trying to get more than one benefit out of the property and then lifestyle considerations come into place. Stick with the numbers and look at the capital growth potential or the development potential. What’s important is the bones of the property, the location and the street – that cannot be changed.

- Being too nice about the tenant’s rent – this is not the right way to look at things commercially. As an investor, it’s good to let them get a bit of a discount if you like your tenants and they are a good tenant, but not let it slip way below market rent.

- Amenities that are important for tenants are different – seek amenities that appeal to renters, close to hospitals (lots of jobs) or universities

- Familiarity – you want to buy an investment down the road, you know the area, you can keep an eye on it.

Causes of emotional decision making:

- Fear – You could lose money, buy a lemon, pay too much, miss out on an asset you were emotionally invested in, owe heaps of money. The list is endless.

- Holding out for the unicorn

- You are sick and tired of pounding the pavement

- Time pressure – where you feel the stress of a ticking clock

- Lease is expiring

- You’ve just sold your home

- You’re having a baby

- Kids are starting school

- You don’t like the agent = don’t let a bad agent get between you and a good house.

- Pleasing third parties – we all want to make our parents happy, but some decisions belong to you.

How can you detach yourself to make better decisions?

- Planning and preparation, this one’s a no-brainer.

- Aligning your purchase with your goals.

- Thinking of the property as a product – if it’s an investment you’re looking for, you are running a business. If it’s a home, you need clear criteria, and cross check your must haves with what has recently sold as a feasibility analysis.

- Get a buyer’s agent.

#4. Low ball offers and a quest for a bargain (instead of a quality property)

- The bargains are usually the most compromised properties. Yes, it’s heavily discounted but you still have some issues to deal with. It could be challenging to sell, rent out and may not deliver the value growth that you are hoping for.

- Challenging tenants make owning property a real headache. A quality property attracts quality tenants.

- Buying the worst property on the worst street.

- If it’s a good asset, pay a good price and hold onto it – you will never miss out.

Bargain hunter attitude and actions

- Annoying the agents and becoming that “unrealistic” buyer on their CRM – if you’re doing that for a long period of time, taking up the agents time, annoying vendors with low ball offers – CRM will flag buyers who are difficult to work with.

- Burning the vendor so badly that they won’t come back to the negotiation table – if you put forward an offer which is offensive to a vendor, if they are not pragmatic, they may cut the buyer out altogether. Challenge the vendor for sure, but don’t offend.

- Missing out altogether because of being priced out of the market – now you’re looking at a higher price or different suburb because of your budget, you will regret.

#5. Being impatient with time

What are some of the things that can go wrong?

- Buying on a knee jerk reaction

- Not being satisfied with performance over a short period of time and choosing to sell

- You can spend a lot of money jumping in an out of property

- Lots of anxiousness and stress

What could cause regret?

- Reversing a decision is really costly – lost opportunity, especially duds that have underperformed. People not spending the time getting contract reviewed, researching the area.

Property is a get rich slow scheme

- If you don’t have time on your side, you need to do scenario analysis – worst that could happen, best case scenario, what’s most likely to happen

- Don’t go from Zero to Hero if you’ve never developed.

- Risk = reward. If you want to take lower risks, you need to wait a long time to get the reward.

#6. Counting cents instead of dollars

This can lead us to making bad decisions. Some examples include:

- Selling because of a tax issue/burden, but overplaying the size of the tax issue/burden – could be land tax conversation. Is the tax too great for you to sustain? You need to run the numbers.

- Getting stressed about maintenance costs – you only need one thing to go wrong which is a big ticket item to make you feel disenchanted with your property.

- Scrimping with property managers – rates vary a little, but there are some that are very good that you may need to pay a little extra.

- Annoying a tenant when not seeing to real issues. Causing further deterioration when ignoring small issues that are worsening. Give your tenant a pat on the back for letting you know – water ingress or leaks.

- Band aid repairs – repeat issues, handyman’s revisiting.

#7. DIY’ing the things that they shouldn’t

- Works are tax deductible – what is your time better spent doing?

- Trade work – having a crack and then realising half way through that you can’t do it. That can be difficult if you need to sell a property because your ran out of cash.

- Jack of all trades, master of none – get better at what you’re great at, and pay for the things that you’re not great at.

- Non-permitted work – trade sign offs, you need plumbing sign off and water certificates. You can create something that looks magical but hard to sell because it’s done without permits.

- Property management / Selling their own property – it can be a much harder and clunkier process and often ends in tears.

Gold Nuggets

Peter Koulizos – The Property Professor’s Golden nugget: analysis paralisys happens if you’re overthinking or looking for a bargain, but in the end never buying anything. Generally the price increases over the last two years would take five years. Do your research, there are no unicorns, buy the right property, in the right street, in the right suburb and just hold on and enjoy the ride

Cate Bakos – The Property Buyer’s Golden nugget: If a property is a bargain because it is challenging, it could change desirability from a lenders point of view – fire, flood, stripped – may not be accepted as normal residential security and the bank may not take it. They could apply a different loan to value ratio or loan product to it. Now you’ve signed a contract for something that could cost a lot more than you thought

Market Updates

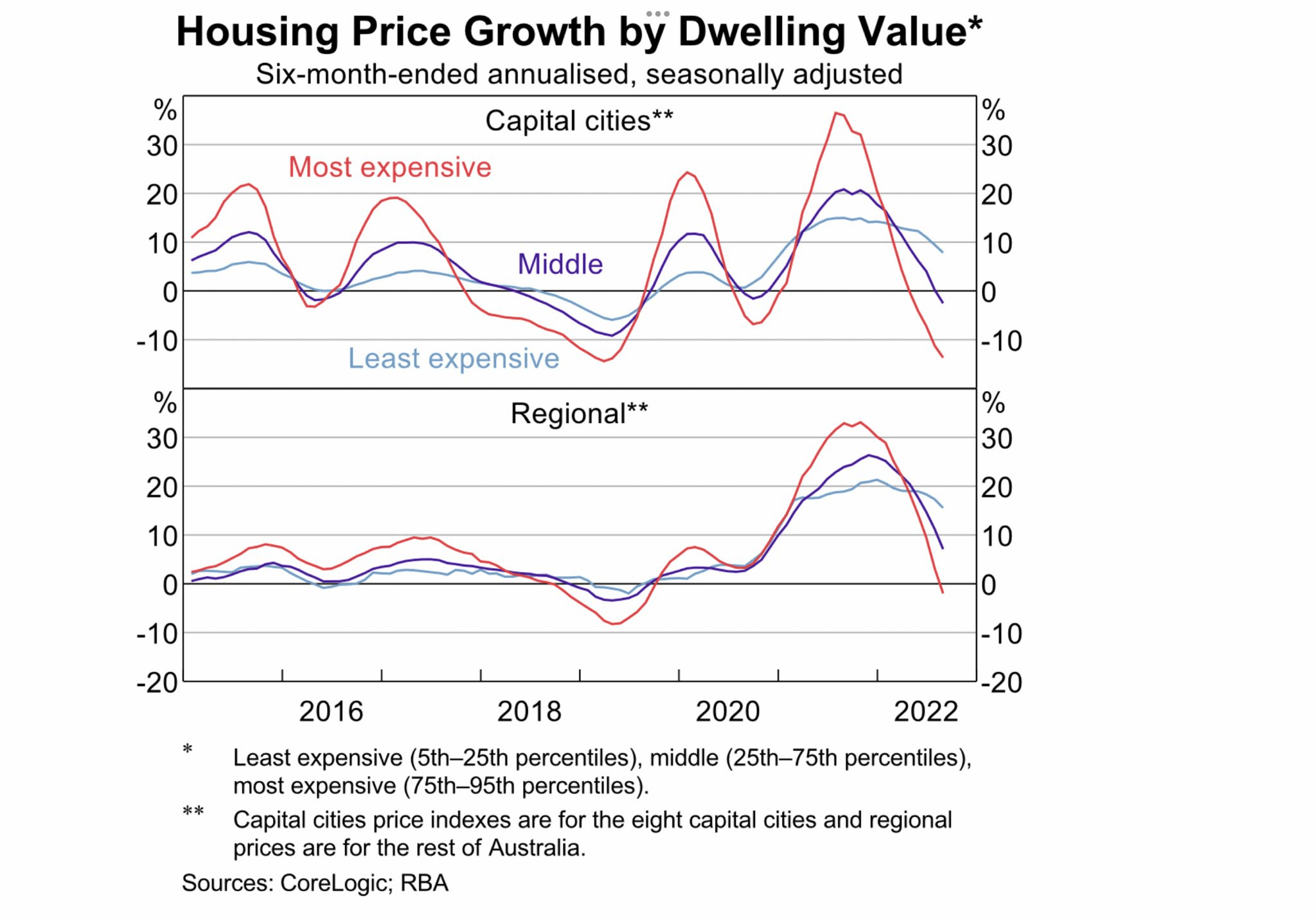

- How the different sectors of the market react to price movements

Pete shares with you how the most expensive, middle and lowest sectors of the market in both capitals and regional centres react to market movements. Check out our show notes for an interesting graph that shows it all.

2. The lure of off-markets

Cate shares a conversation that she had with an agent who is very experienced about her take on off-market properties. While 95% of them are disappointing, there is the odd gem to be found. Tune in to find out how you can capitalise on these opportunities. n.

3. The Property Planner updates his predictions for the next RBA rate movement

Due to further inflationary developments in the US, money markets have changed their predictions for the next rate increase to be 50 basis points, rather than 25.