Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

1. Cash rate rises by 50 basis points, but the sky’s not falling in

The RBA raises the cash rate by 50 basis points to 0.85%, with an expectation that rates will increase by the same amount next month as well. However, this is no reason to panic. The cash rate was at 1.50% pre-covid, so there is still some room to move and the reality is that the cash rate was never meant to be as low as 0.10%. This was an extraordinary measure put in place to tackle the challenges that global pandemic brought.

2. The wage price spiral

The trio discuss the possibility of a wage price spiral caused by high inflation. If wages increase in line with inflation (5-6%), it embeds inflation further and that’s when the probability of job losses is increased, which is a worse outcome than slightly lower wage growth. This is an increased risk if minimum wages are increased, as employment awards and enterprise agreements are raised by the same percentage, effecting a vast amount of wage growth.

3. The current state of the economy

Whilst many home owners may not like the prospect of increasing interest rates, however the economy is a strong position, which is why the cash rate has been increased. As stated by the RBA, the Australian economy is resilient, growing by 0.8 per cent in the March quarter and 3.3 per cent over the year. Australians are well ahead on their mortgage repayments, with a median of 21 months of repayments in savings, even with a 2% rise in mortgage rates, this would only reduce to 19 months. There is an upswing in business investment underway and a large pipeline of construction work to be completed. The terms of trade are at record highs, the lowest unemployment rate in almost 50 years and jab vacancies at high levels.

4. The latest home value index results

The trio discuss the index results for May, which show Sydney and Melbourne on the decline, while Canberra went slightly backwards but a negligible amount. Astoundingly, Adelaide is still going strong with 1.8% increase over May. The market is well and truly slowing down for the other capitals and regions alike. As they say, all good things must come to an end, as we enter a period of 6 to 18 months of excellent buying opportunity.

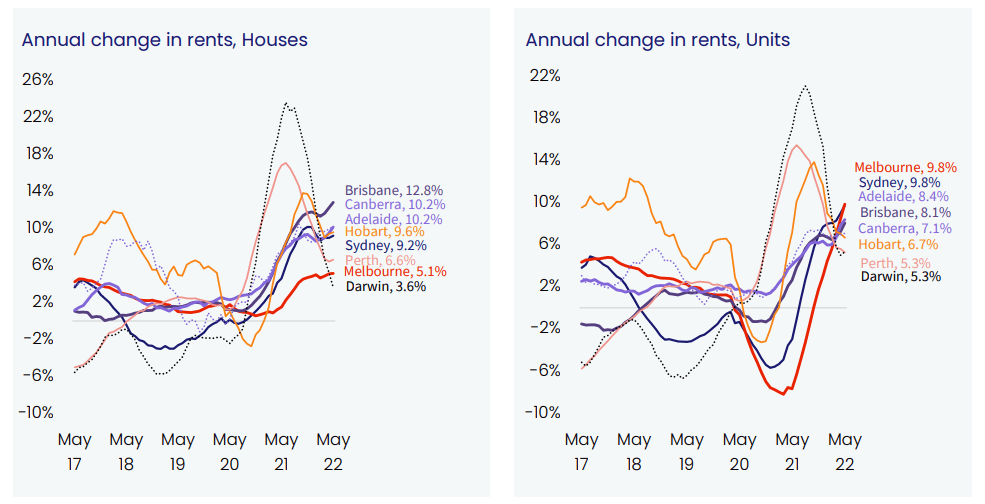

5. Rentals and vacancies

Rental markets continue to remain tight, with each capital city under 2% for vacancy rates. Those are expected to get tighter with the flow of new migrants to Australia. Builders will not be able to pick up the slack and increase supply to meet the demand, with fixed priced contracts in precarious positions as a few major builders go under. Now that prices are flattening, yields are growing even faster, with Melbourne now leading the charge for units, adding on 10% in the last year for asking prices.

6. Listing numbers on the decline

Total listings are down for every capital city and in a change of gear, old listings (listings on the market for longer than 180 days) are increasing. This means that the up-take of the less desirable stock has slowed down for much of the nation, only in Brisbane are buyers still snatching up whatever they can. The upshot is that buyers are taking their time, FOMO has lessened and there is not as much pressure from other competing buyers.

7. Consumer sentiment continues to dive

The house price expectations index, which typically lags behind market movements, is catching up with the market and starting to reduce. The time to buy a dwelling index, which peaked in November 2020, is now the lowest it’s been since the GFC.

8. What do lending indicators tell us about the property market

In April, the amount of finance fell by 6.4%, coming off a big high. The hardest hit were owner occupiers, which fell 7.3% from the previous month with investors showing more resilience with a drop of 4.8%. This move is largely correlated with property values, which have also seen a decline.