Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

1. SA council takes matters into its own hands

Pete shares the measures that the Karoonda East Murray Council in SA are trialing to grow their population. Kudos to them! Rather than waiting for the federal or state governments to come to the party, they are implementing some great initiatives themselves.

2. How long does it take each capital city to double in value?

Pete shares with our listeners his research for each capital city, starting from March 2022 and working backwards, to distill how long it has taken for property values to double in each capital city. The winner may be a surprise, however the trio warn that some of the performances can be unpredictable. Trying to pick the next hot location is fraught with danger and our listeners are better off sticking to the tried and true principles of selecting quality investments.

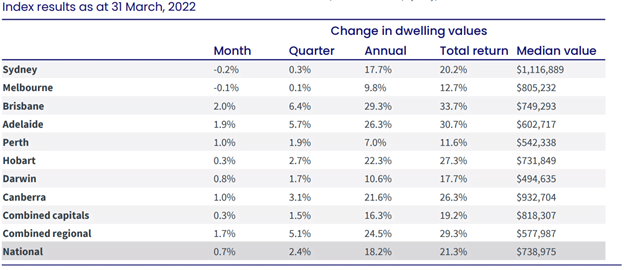

3. Sydney and Melbourne flatlining while Brisbane and Adelaide continue to shine

The trio take our listeners through the highlights in the March home value index results and the reasons behind the numbers. Plus, not all the numbers can be relied upon. Hobart is such a small market that there may be some anomalies skewing the results.

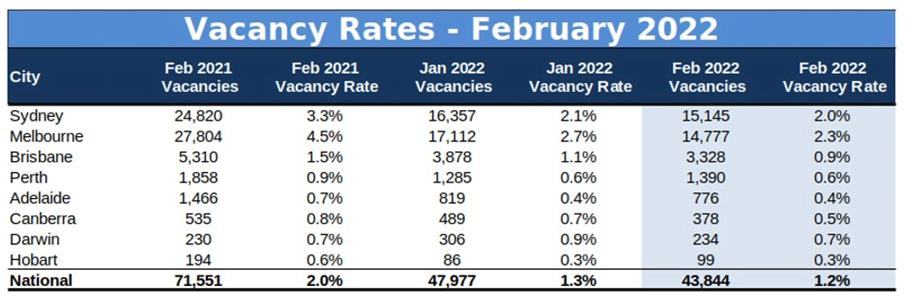

4. Rents turning the tide

For the first time in a long time, national rents are outgrowing housing values. Which also means that yields are increasing, particularly in Melbourne and Sydney which have each had a small degree of negative capital growth. Interestingly, it appears that there is a flock back towards units and inner city living. Sydney now records the strongest lift in unit rents with Melbourne not far behind. How the opening up of borders will impact this further is a story that is still unfolding. Vacancies have also dropped to a fresh 16-year low, putting immense pressure on rental markets.

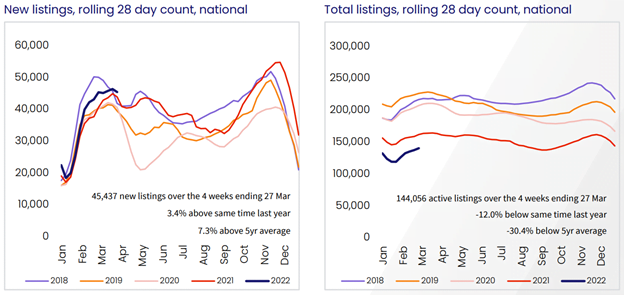

5. How do current listings compare with the 5 year average?

Nationally, “total” listings are 30% below the 5 year average. The trio have been saying for months now that there is a deep correlation between the level of listings and capital growth. An example is Brisbane and Adelaide, both of which have experienced the strongest capital growth outcomes in March and also have total listing numbers that remain 40% below the 5 year average. The story is similar for regions, as there are 22% less sales in combined regional areas for this current year so far.

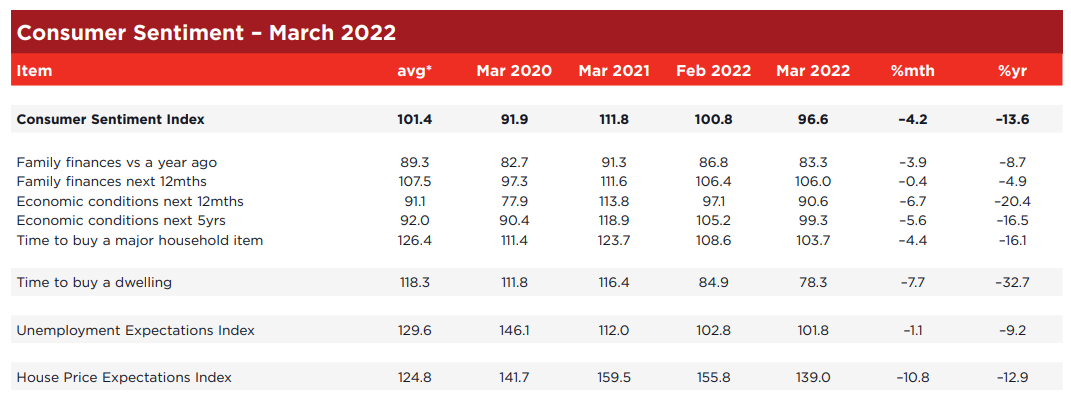

6. Consumer sentiment takes a dive

The house price expectations index has fallen by 10.8% to 139 points. This index tends to lag behind actual market movements and the writing has been on the wall in 2022 that growth in the housing market is well and truly slowing down, (for most states). Interestingly, the time to buy a dwelling index has also dropped to 78.3 points, after hovering in the low 80’s to high 90’s since July 2021. This index is now at its lowest level since February 2008, during the GFC and well below levels seen in the 2017-18 housing market decline. This is not a good harbinger for what’s to come, as this index tends to be a forward indicator. The trio discuss the reasons behind the drop in sentiment.

7. Turning the tables on fixed rates

With fixed rates on the rise due to increasing bond yields and swap rates, lenders have started to compete on variable rates. Now that the tide is turning, many variable rates are lower than the fixed rate offering. Pre-covid, this status quo was the norm and it was the RBA measures which drove fixed rates to the lowest they’d ever been.

8. Investors back at equilibrium

Latest ABS figures for February show that investors now make up 33% of new lending, which is in line with the historical split between owner occupiers and investors. First time buyers have declined to 22% of new owner occupied lending over the last year, which was expected as government initiatives came to a close. However, total borrower numbers are up on previous years and we do need to keep this in perspective when we consider percentages.

9. RBA bites back – the forecast for interest rates

The trio discuss the likelihood of a cash rate rise by the RBA and how soon they each believe it will happen. Although in some argy-bargy between the RBA and economists, the RBA has stated that it will be raising the cash rate based on evidence, not on forecasts… watch this space.

10. Federal election jitters

A warning to our listeners, the next few months of data may not be a good indicator of what’s to come, as many prospective purchasers will sit on their hands until there is certainty around an election date and more clarity on policies to see through the haze. Often the 2 months prior to an election can produce some unreliable data points when it comes to trend-spotting. After all, sentiment counts for a lot, even if it’s short-term.