Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

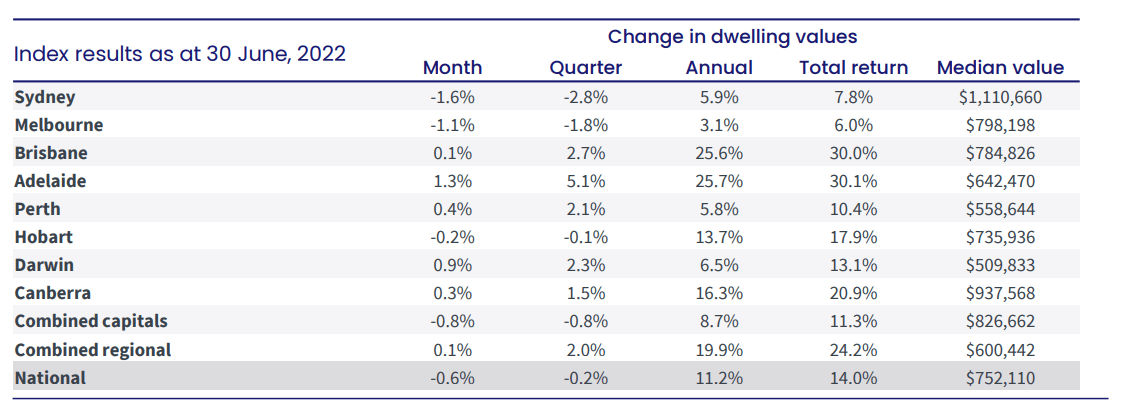

- Markets across Australia dip further over June

For capital cities already in retraction, the rate of decline has increased over June, while those still experiencing value growth have seen a definitive slow-down in the rate of price increases. Sydney in particular has made the headlines, with a median dwelling price drop of 1.6% over June, the largest monthly fall since 1989. The trio discuss the fact that these circumstances are not unusual after a period of rapid price growth.

- Upper quartile feeling the pinch

As is typical of rising and falling markets, the upper quartile is leading the price declines and feeling the pinch more than the lower quartile. This has a significant impact on median values, as statistically, the bigger numbers are removed from the data pool. However, it’s important to note that quality property is still in high demand, particularly if it sits within the median price range and buyers should not expect a bargain. A key example is entry level family homes where there is simply not enough stock to cover the demand.

- How capital cities have fared over the last 40 years

Cate shares some interesting data collected from the REIA showing annual value growth for each capital city since 1980. Whilst a 1% differential in annual growth compounded over 40 years will make a significant difference to the end result, it’s important to remember that there are many facets to consider when investing, such as vacancy rates, insurances, maintenance costs and rental returns. Although one capital city may have performed better than another over the long-term, price points are significant and could mean that it’s better to purchase a high-quality asset in a lower performing city vs a low-quality asset in a high-performing city.

- Market cycle trends

The trio discuss the trends in market peaks, which cities were the first to move and how these moves correlate with population size for the corresponding cities.

- Taking a critical eye to data and median values

The trio discuss data and differences between the nation’s data houses: REIA, ABS and CoreLogic. As an interesting note, Brisbane is gaining on Melbourne in median values for all dwellings, but a closer look at the data shows that it’s not all that it seems…

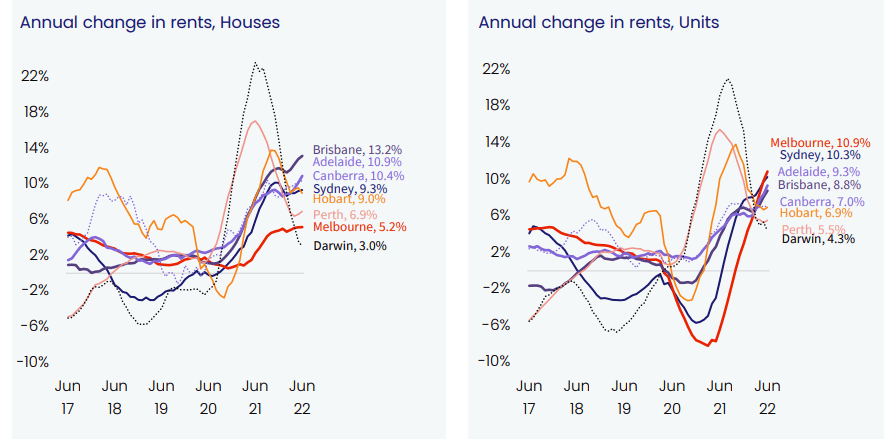

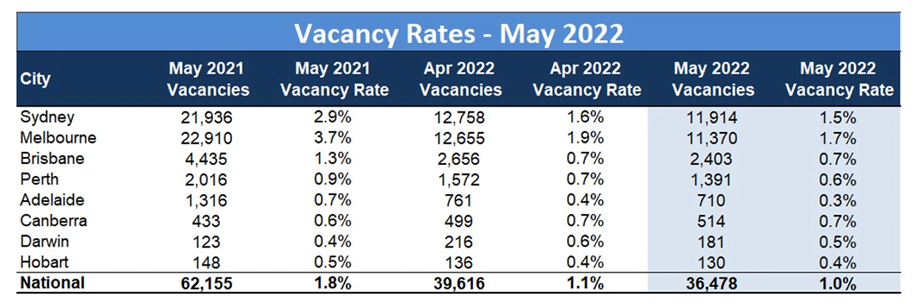

- Rollercoaster rents

The trio discuss the case of Darwin which has had large swings in annualised rents over the last year, resembling one of the scariest roller coasters in the theme park. Melbourne units lead the charge for rental increases, which suggests that people are migrating back to the city and a supply-side issue could be brewing. To add to the pressure cooker, vacancy rates tighten further across most capitals. How will this impact the property market and who are the buyers likely to jump into the fray? Stay tuned to find out.

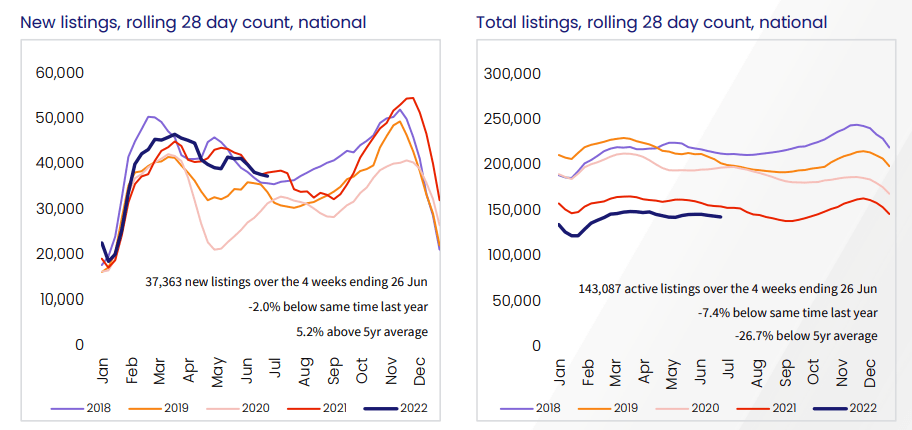

- Listings follow the annual trend and dwelling sales return to normalcy

Following the usual seasonal winter trajectory, listings have dropped in Melbourne, Sydney, Adelaide and Canberra. The trio discuss the curious case of Hobart, which has seen a very large increase in listings year on year. Although being a smaller city, it doesn’t take many transactions to register some serious numbers. In terms of dwelling sales, the figures are tracking back towards the 5-year average, after a spike in activity last year following an uptake in lifestyle decisions that were put on hold during covid.

- Consumer sentiment bodes well for inflation

The trio discuss the latest data on consumer sentiment, which shows a reluctance on the part of consumers to buy major household items. This indicates that the RBA 125 basis point rate movement is taking effect and consumers are now watching the hip-pocket and cutting back on spending. Could this also be attributed to the increased cost of living though? The time to buy a dwelling index has reached a new low post the GFC and the trio discuss an increasing chasm in sentiment between male and female purchasers.

- Will the RBA oversteer the ship again on inflation?

David explains why the Australian economy is particularly sensitive to interest rate changes, compared with other countries. This means that any rate changes are likely to have a big and fast impact, as is already showing in the consumer sentiment data, with willingness to spend dropping significantly. Ideally the RBA will not raise rates more than 0.25% next month or even, dare we say it, take a break. The trio discuss a significant hurdle and structural weakness with inflation data, it is simply too old! By the time the RBA knows what’s happening with inflation, it’s too late.

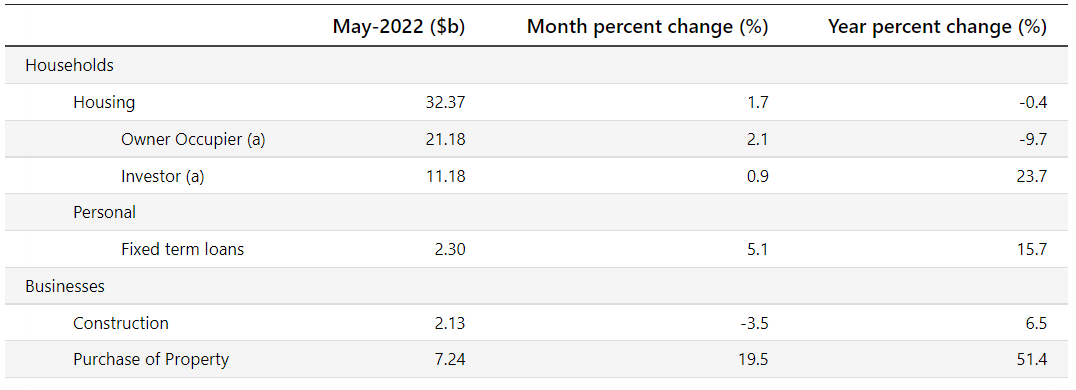

- Lending indicators and the three-year bond yield

Not much has changed over May, although we expect to see a shift towards investors in the coming months as home purchasers elect to wait and see. The three-year bond yield peaked on 20th of June and has started to drop slightly since, which indicates that the market is starting to draw back predictions on how high rates will rise.