Listen and subscribe

Apple  Android

Android

In this week’s episode, Dave, Cate and Pete take you through:

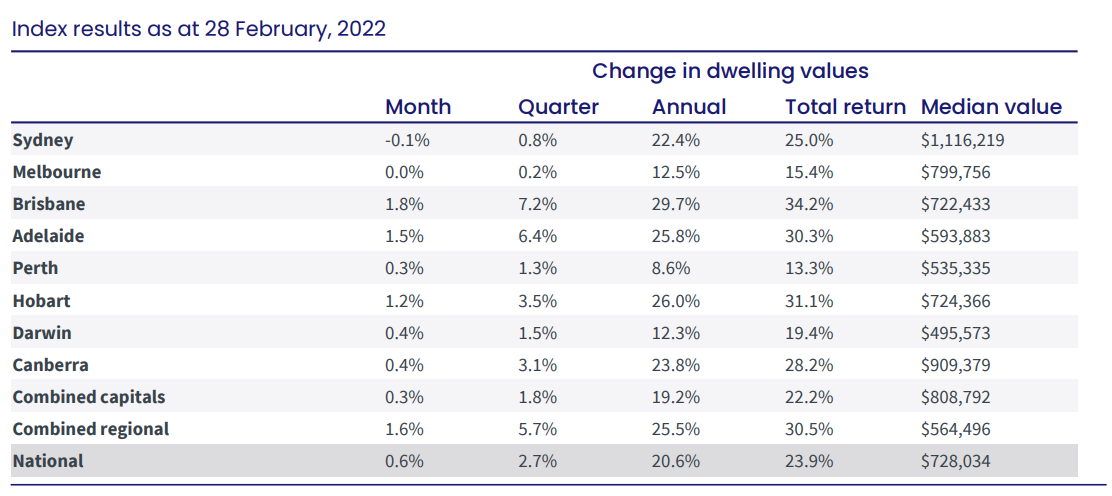

1. Declining rate of growth for housing values is proving to be the long-term trend

While housing values are generally rising, the pace of growth in the national index has trended downwards since April 2021. This is not to say that housing values are going backwards, they are still increasing but have lost steam. Housing values increased 0.6% nationally over the month of February, although the effects on each state have varied greatly. Brisbane continues to perform strongly with 1.8% growth over the month and 29.7% over the year, which could well be a record for the city. However the floods in Brisbane are likely to dampen the property market, at least for the short term.

2. Is the property market at an inflection point?

With recent events in Ukraine, speculation over rising interest rates, combined with inflation pressures and yields increasing for the first time, we may very well be at a turning point in the property market. …Or are we? Media and speculation count for only so much and we have navigated global challenges before and fared better than predicted.

3. Regions continue to perform strongly

Total return for combined regions is at a whopping 30.5%! ‘Combined regions’ is a very vague term and there will be some regions that perform more strongly than others, with annual growth and yields topping this figure. According to CoreLogic, Regional SA is actually the best performing regional market over the last 3 months, which is probably very closely tied to the fact that proportionally it has the lowest number of total listings of any regional area or capital city in the country.

The trio ponder why investment in Adelaide’s regions lag behind the nation’s eastern states, among other data findings. Stay tuned for next week when Pete to shares his research and insights in his market update, where he will try to determine why regional towns in SA such as Victor Harbor are so much cheaper than regional towns in Victoria, such as Portsea.

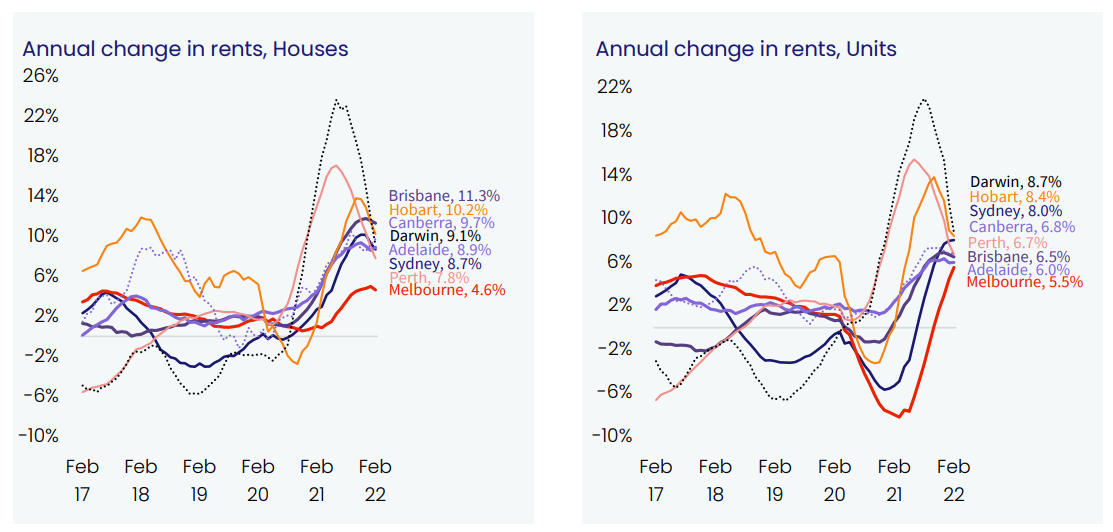

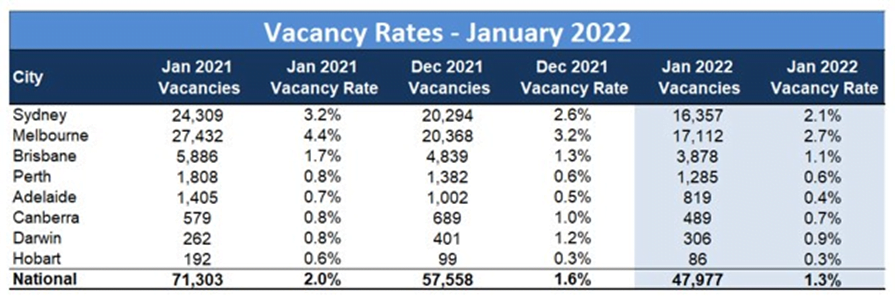

4. Rents and vacancy rates will be the story of the year

Cate shares her insights on the rental market in Ballarat, (as one example of a vibrant and changing regional city), and why rents have tightened again in this market. With the opening up of international boarders, vacancy rates are expected to be put under more pressure for capital city and university towns that will see an influx of international students. Vacancy rates are under 1% in every capital city except Melbourne, Sydney and Brisbane, although these cities have seen a significant reduction in vacancies over the last month.

5. Rental yields on the rise?

Average rental yield in Melbourne and Sydney is as low as it’s ever been. But this is likely to be the bottom of the curve. Melbourne unit growth has now recovered and Melbourne is largely on par with other capital cities in terms of annual change in rents. Increases of 20% in yields with the arrival of a new tenant is not uncommon, where previously landlords would be lucky to see a $10 per week increase in rent. As yields come down in Brisbane and Adelaide due to the stellar capital growth, this may bring investors back to Melbourne and Sydney. But are the Victorian landlord reforms with heightened landlord obligations turning investors away? And Victoria isn’t the only state to roll out rental reforms. We are watching this space…

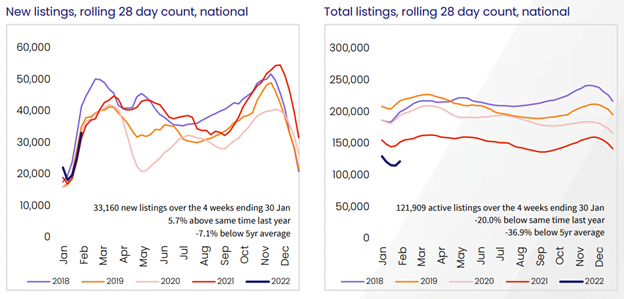

6. How listings impact housing value growth

The clear picture from the data that we’re studying is that Brisbane, Adelaide, Hobart and combined regions continue to exhibit recent monthly growth of over 1%, while the other capitals are recording less than 0.5% growth. It is no coincidence that they have also seen the biggest annual reduction in total property advertised for sale. We come back to economics 101 to reiterate that price is often a function of demand vs supply, and supply is continuing to be very low for these locations.

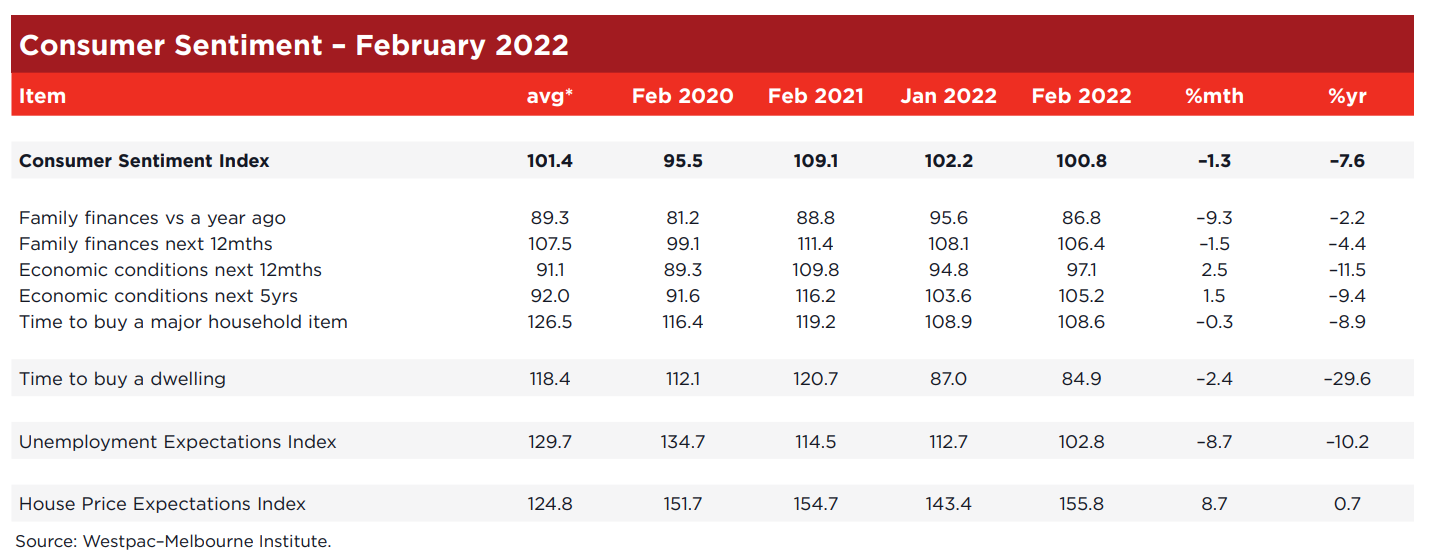

7. Insights from consumer sentiment and the impact on supply

The house price expectations index has risen again over 150, but this indicator seems to lag behind what’s actually occurring in the market. The time to buy a dwelling index is expected to pick up as people start to feel that it’s a good time to purchase, and this may coincide with signs that growth wanes. The trio discuss the connection between consumer sentiment and supply. If values are increasing, then why aren’t more people putting their homes up for sale?

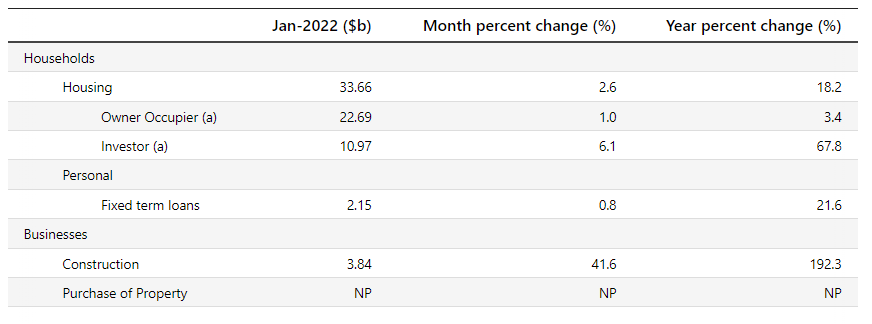

8. Lending indicators and risks for those looking to purchase

Owner occupiers contributed to an uplift over November and December but is this an ongoing trend? On the ground, the number of purchases and pre-approvals is declining. A major concern for anyone looking to purchase is that borrowing capacities are reducing, with increases to fixed rates and assessment rates. Dave shares a real client example of how borrowing capacity for a client has been impacted over the last two months.

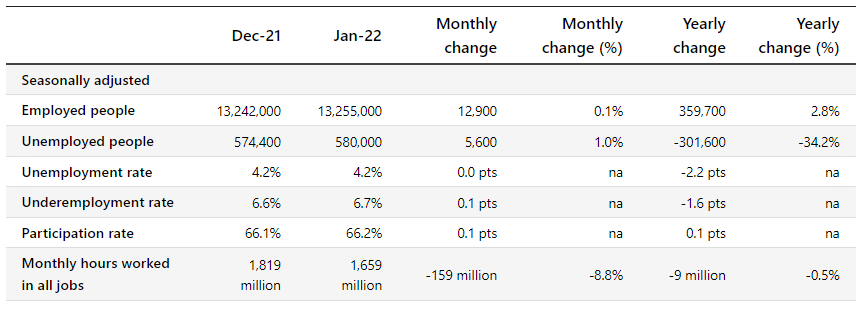

9. The latest unemployment stats with a pinch of salt

Nationally, unemployment did not change from December 2021 to January 2022, remaining at 4.2%. However, the city of Adelaide, (which was under 4% for unemployment in December) has now jumped to 4.8%. It is inconceivable that unemployment would fluctuate so much in a month, which does indicate that perhaps the data is not so reliable for our smaller states.

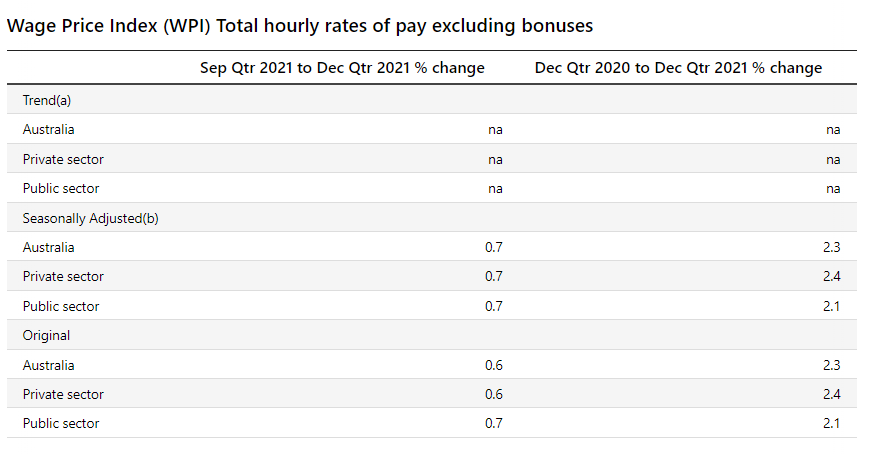

10. Wage growth, GDP and government stimulus

The trio share a brief update on what’s happening in the world with regards to wage growth, and why our regulator wouldn’t poke a stick at GDP and government stimulus to make it easier for first time buyers to get into the market.