Selling a property to buy your home

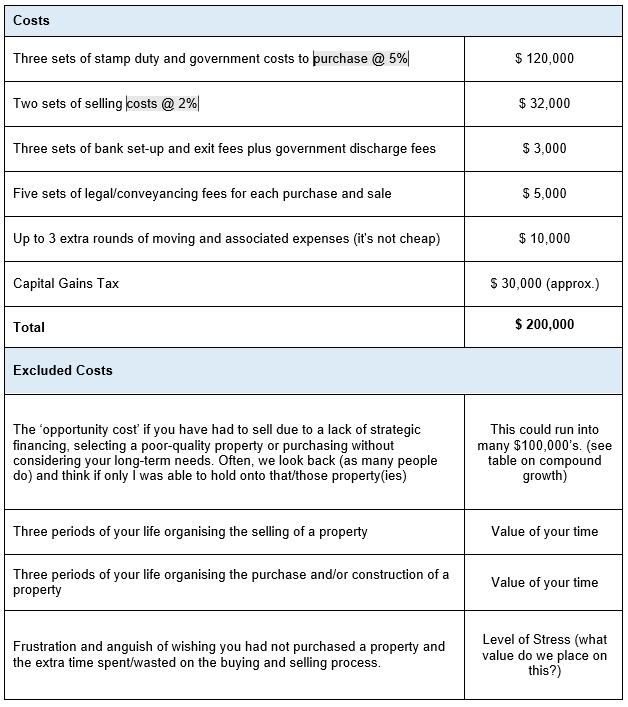

Selling property is one of the killers of financial wealth and prosperity for many Australians due to the high transactional costs.

You should consider whether your existing home will maintain the equivalent rate of capital growth as your possible future long-term home.

If this is unlikely, this makes your investment property selection(s) all the more important.

Alternatively, it could be a motivation to shorten the time frame until you purchase your long-term home to minimise the possibility that your long-term home will become out of reach.

One advantage of selling your existing home to facilitate the purchase of your long-term home is that your home can be capital gains tax free given it is your Principal Place of Residence.

If you sold first, you could make more of an informed decision once the proceeds of sale figure is finalised prior to purchasing and your preferred level of savings buffer and cash flow commitment is clear.

David is the Founder and Managing Director of Property Planning Australia, author of ‘How to Succeed with Property to Create your Ideal Lifestyle’, co-author of ‘Property for Life – Using Property to Plan Your Financial Future’, co-host of the ‘Property Planner, Buyer and Professor Podcast’ and a widely-published media commentator. With more than 20 years of experience, David is passionate about educating others to make informed, and ultimately, more lucrative property investment decisions. David established Property Planning Australia in 2004 – with the vision to educate and empower Australians to make successful property, mortgage strategy and money management decisions. Property Planning Australia’s operations have earned acclaim and national industry awards for its unique fusion of property planning, education, money management, mortgage strategy and risk management. All supported by multi award-winning customer service.