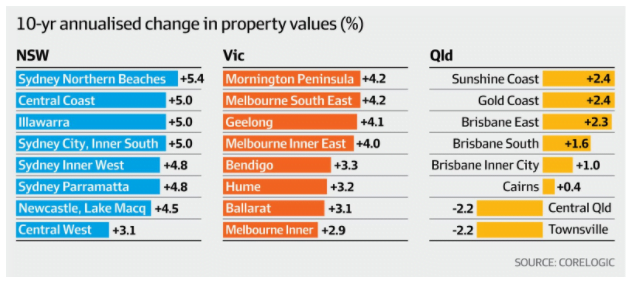

CoreLogic has released data on property values over the last 10 years and regional locations make up a chunk of the top performers, spurred on by the ‘working from home’ and ‘escape from lockdown’ phenomenon. Resulting in near 7% growth across regions in 2020, against 2% for capital cities, although the timing of this data release after the regional spurt will have impacted the results. The big question – is this a long-term structural change?

CoreLogic has released data on property values over the last 10 years and regional locations make up a chunk of the top performers, spurred on by the ‘working from home’ and ‘escape from lockdown’ phenomenon. Resulting in near 7% growth across regions in 2020, against 2% for capital cities, although the timing of this data release after the regional spurt will have impacted the results. The big question – is this a long-term structural change?We think the most sought-after capital cities (Sydney, Melbourne & Brisbane) will continue to have the edge over top regional locations in the next 10 years plus, but the gap has narrowed.

For those unable to purchase in a major city, the benefits of purchasing well located property in a commutable, or ‘special’ seaside regional city or town has been enhanced.

However, until the majority of the workforce is based at home for 4 or 5 days a week, cities will outperform due to superior job, education and social opportunities. Humans are social creatures and this is unlikely to change until the advent of singularity, or regular pandemics and climate events. None of which is high on anyone’s wish list.

Until then, land values will rise more rapidly, as will rents in superior city locations.