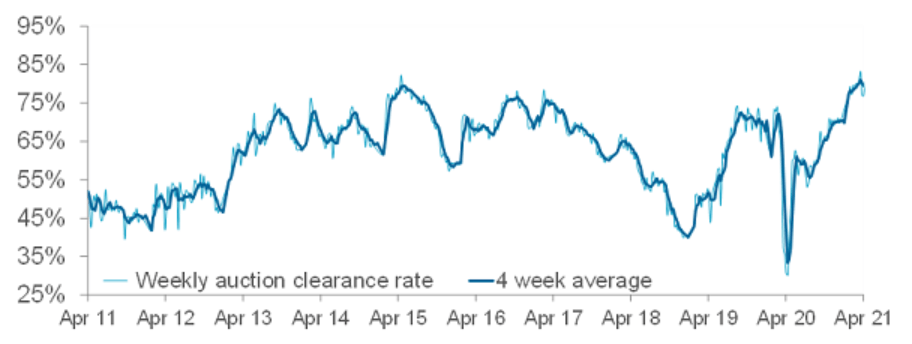

CoreLogic’s Quarterly Auction figures show Australia’s combined capitals clearance rate averaged above 80% for the entire first quarter of 2021. This may never have happened before given CoreLogic tells us this has only occurred once for weekly results since 2008, let alone average across a quarter.

CoreLogic’s Quarterly Auction figures show Australia’s combined capitals clearance rate averaged above 80% for the entire first quarter of 2021. This may never have happened before given CoreLogic tells us this has only occurred once for weekly results since 2008, let alone average across a quarter.

For context, the early 2020 market pre-Covid was strong in Melbourne and Sydney, who had each recovered by 10%, and so was the end of last year for the final quarter, yet the average clearance rate over those periods was a mere 62.5% and 69.4% respectively.

Note – we didn’t include the middle quarters of 2020, as they were the peak ‘sky falling in’ Covid period (except for those who had the foresight to buy when others are fearful).

This market is showing signs of what we are dubbing the ‘Rubber Band Effect’ as property buyers and consumers were held back from buying property and spending money for 6 months. Now after receiving financial stimulus, saving to record levels and having the lowest interest rates ever, buyers are vaulting back into the market at a speed never seen before.

Is it any surprise the market has literally sprung back?

Check out the CoreLogic report here.

If you’d like to discuss your property plans or mortgage strategy, please get in touch with us here.